Publications

Pills of content

Check out our latest reviews published on the blog

Latest publications

-

Read more

Read moreDo you know what angel investment is?

A term often used in startup ventures is angel investing. This refers to a type of…

-

Read more

Read moreBowie Bonds and the Securitization of Music Royalties

Receivables securitization is a widely used instrument in the financial market to anticipate the receipt of cash flows.…

-

Read more

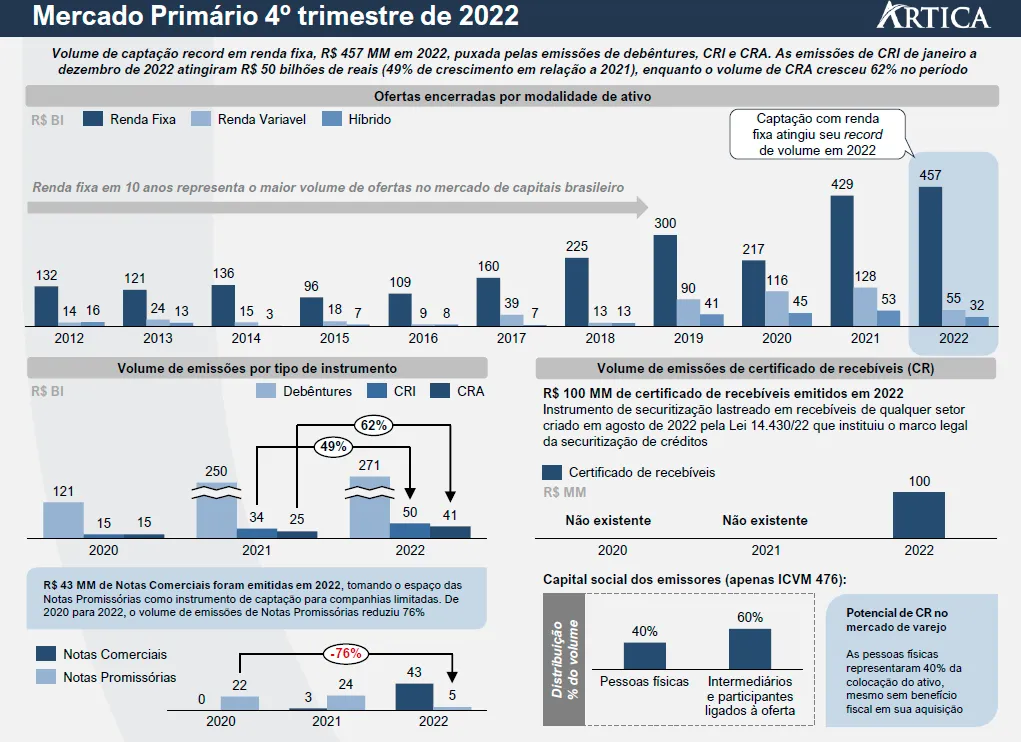

Read moreQuarterly report on the private credit market

The year 2022 was marked by a record volume of funding in the history of fixed income, with a total of R$…

-

Read more

Read moreDo you know what Joint Ventures are?

One of the largest IPOs of the last opening window was that of energy generator and distributor Raízen, raising R$1,000,000.

-

Read more

Read moreGlobal financial market scandals and their repercussions

In recent weeks, the Americanas (AMER3) case has moved the market with the revelation of accounting inconsistencies that could have…

-

Read more

Read moreHave you ever heard of so-called blue bonds?

ESG practices have been gaining momentum globally in the corporate market and have established themselves as an important factor in investors' decision-making processes.…

-

Read more

Read moreM&A Cases in Series and Films

We're used to reading about mergers and acquisitions on specialized economics and business websites. However, in series…

-

Read more

Read moreWhat does JP Morgan's acquisition of Frank have in common with the decline of AMER3 and FTX?

A JP Morgan acquisition of US$175 million ended up in Delaware courts after the bank discovered that…

-

Read more

Read moreBuy and scale strategy for M&A

Most CEOs recognize that business creation is critical to success. Annual study of new businesses…

-

Read more

Read moreDo you know what stock options are?

Among the challenges inherent to a company's growth, employees are central and essential. To encourage and retain these…

-

Read more

Read moreExpansion of the agreement between CVM and Anbima could speed up IPOs in 2023

Since 2008, CVM (Brazilian Securities and Exchange Commission) has had an agreement with ANBIMA (Brazilian Association of Securities Market Entities).

-

Read more

Read moreHow can companies prepare for a recession?

Despite the uncertainties surrounding the global economic landscape, key indicators point to a possible recession in the short to medium term. The…