Some financial managers are faced with the need to find viable alternatives to raise funds without increasing their company's financial leverage. Strategies used to obtain financing or new money without directly affecting financial covenants allow companies to access capital without significantly increasing their debt.

Covenants are contractual clauses that establish financial restrictions and limits to protect creditors and ensure the company's financial health. These covenants may include requirements related to net debt, leverage ratios, interest coverage, and others.

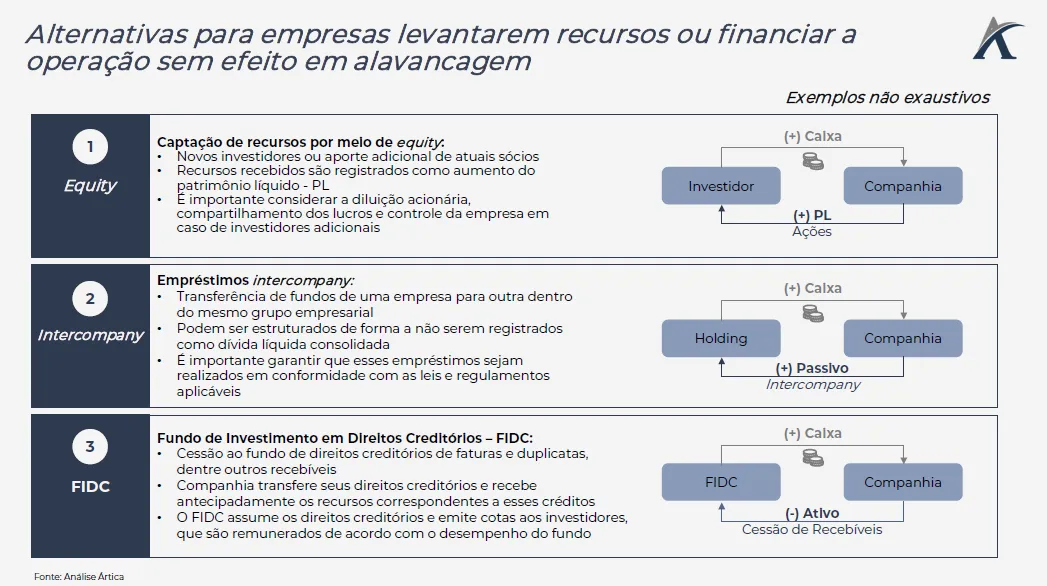

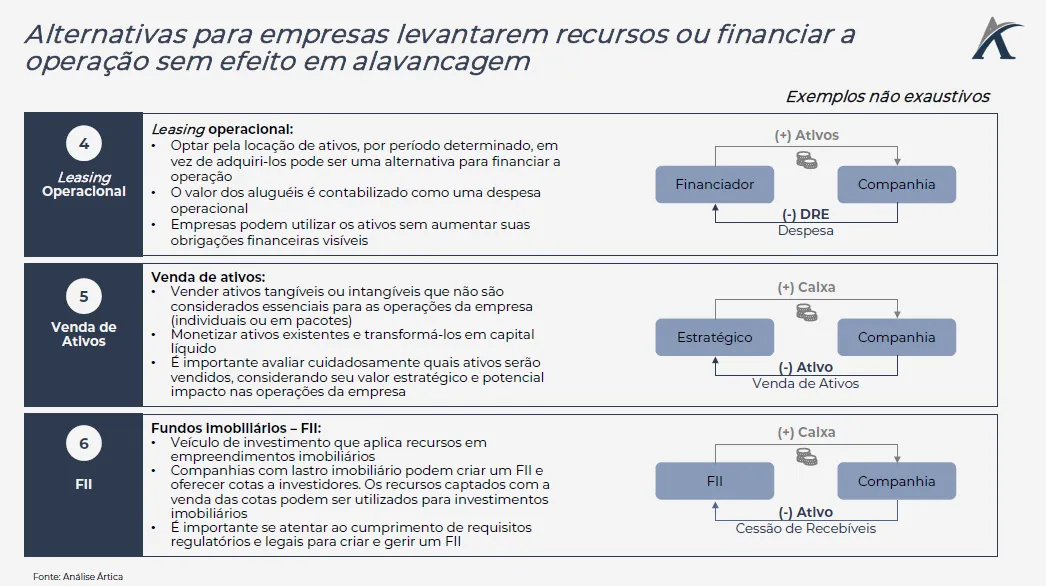

Therefore, there are funding options for companies concerned about complying with financial covenants or wishing to preserve their capacity for additional debt. The most commonly used strategies are equity, alternative debt instruments (FIDC, FII, operational leasing), intercompany fundraising, and asset sales.

Companies across a variety of sectors can access the capital they need to drive growth and finance projects without directly compromising their debt ratio. However, it's important to note that while raising capital doesn't directly impact financial leverage, it's important to consider the company's ability to meet its obligations and generate cash.