One of the largest recent M&As in Brazil was Carrefour's acquisition of Grupo Big, a transaction that resulted in Advent exiting in one of the most successful turnarounds in recent years. In three years, the fund achieved a return of ~4x, driven by an intense restructuring process within the group that controls brands such as Sam's Club and Maxxi, demonstrating the potential gains this type of transaction can generate.

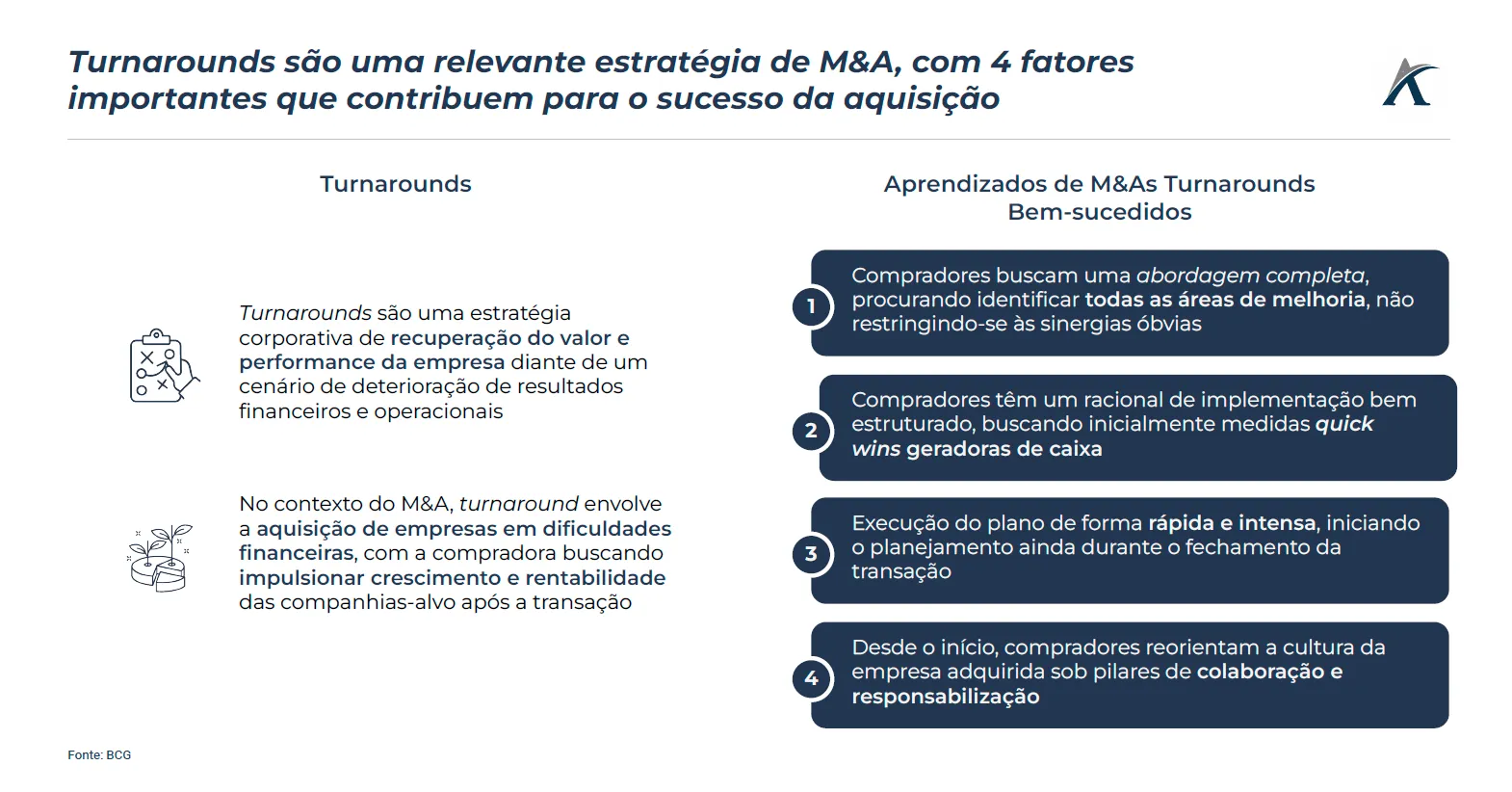

M&A turnarounds are one of the acquisition categories that have become prevalent, especially in times of crisis. This type of transaction involves the acquisition of companies in financial and/or operational difficulties, followed by a corporate strategy restructuring process led by the acquiring company. Because of this, the transaction risks are higher than usual, but a well-executed turnaround can result in significant returns for the acquiring company.

Today's guide highlights four factors that can boost the chances of a successful turnaround, also providing examples of iconic M&As that involved restructuring the acquired companies and generated positive results.