Among the challenges inherent to a company's growth, employees are central and essential. To encourage and retain these professionals, many companies have adopted LTI (Long-Term Incentive) compensation models. One of the most well-known models in this modality is the structuring of stock option plans.

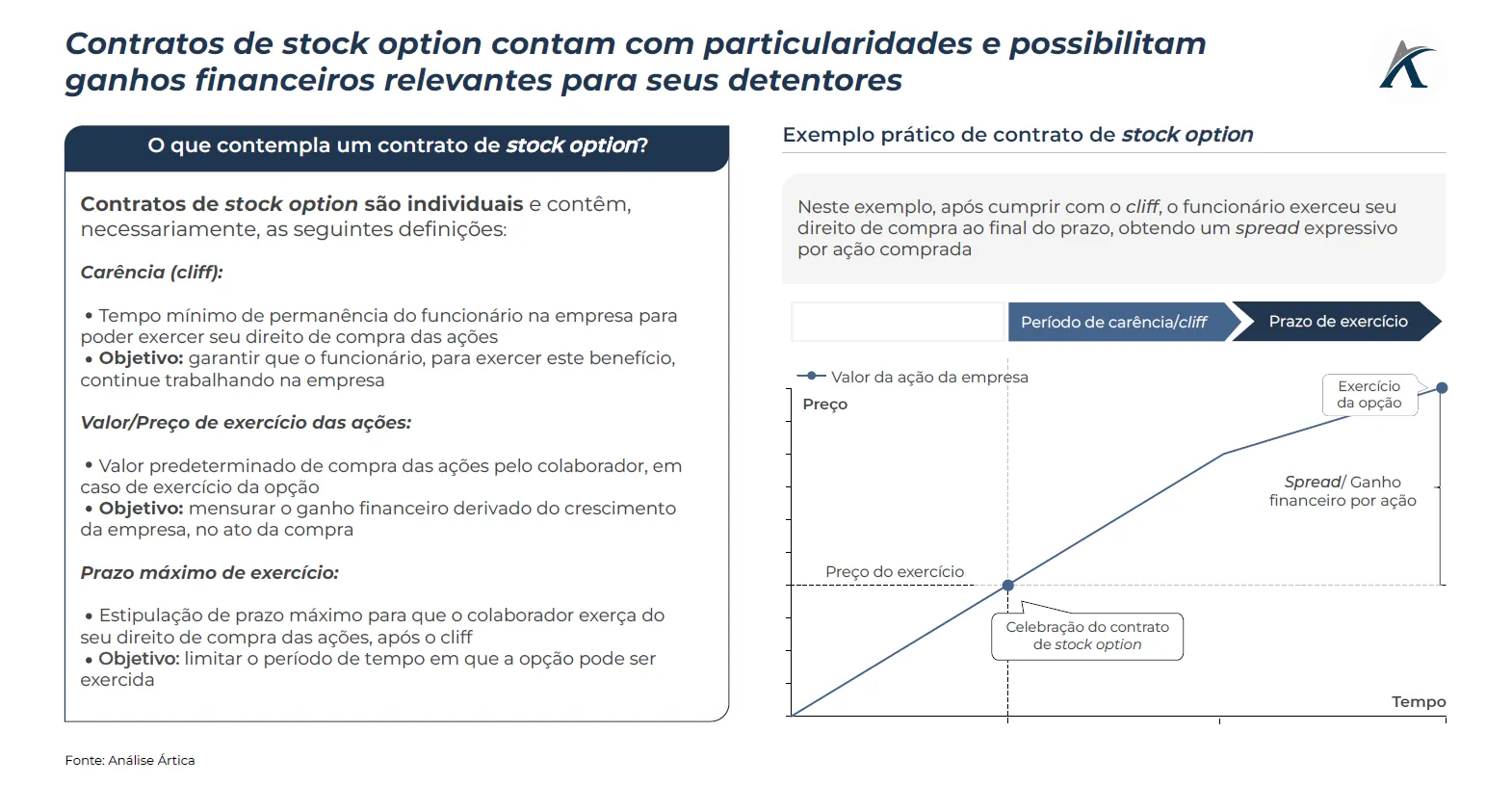

In this incentive model, the selected employee receives the right to purchase company shares at a price below market value for a specified period. In other words, as the company grows and its market value increases over time, the employee can purchase company shares at a previously set strike price, prior to appreciation. In stock option contracts, the following definitions are essential:

•Grace period (or cliff), which is the minimum period of time an employee must remain in office to exercise their options;

•Share value, which is the price set for purchase when exercising the option in the future; and

• Maximum term, which is the deadline for the employee to exercise their right to purchase shares after the grace period/cliff

The objective of this model, broadly speaking, is to align the interests of a company's partners and employees, fostering a sense of ownership and encouraging employees to maintain their highest level of performance. Furthermore, the model is beneficial for companies because it doesn't require capital outlays to incentivize employees (like other incentive models, such as financial bonuses) and helps maintain and retain key employees.

In the context of startups, this approach is even more attractive, as the potential for share appreciation is greater than that of traditional companies, and the lack of cash disbursement is significant for the company, given potential difficulties in raising funds in low liquidity scenarios. According to Atlantico's "Digital Transformation in Latin America 2021" report, in 2021, 6% to 10% of the shareholder base of Latin American unicorns was already committed to stock options.