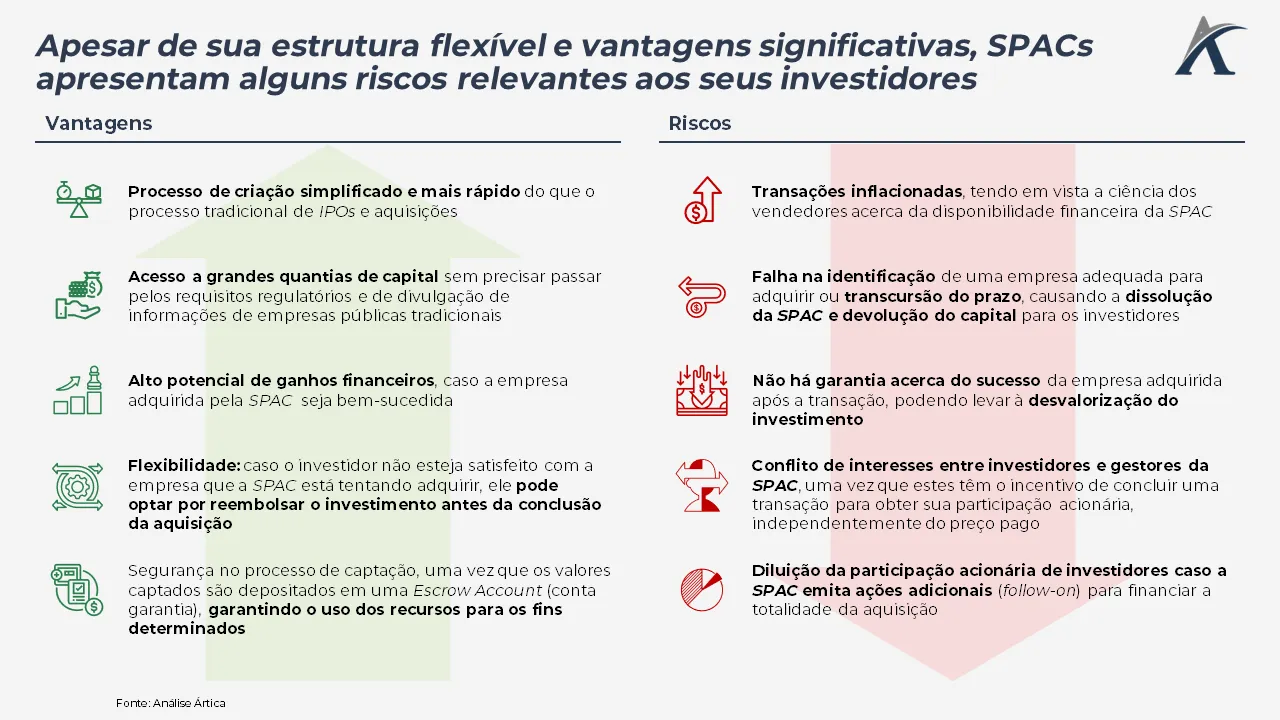

SPACs (Special Purpose Acquisition Companies) have no product, sales, or results. Their basic premise is investor trust in the managers, much like an investment fund.

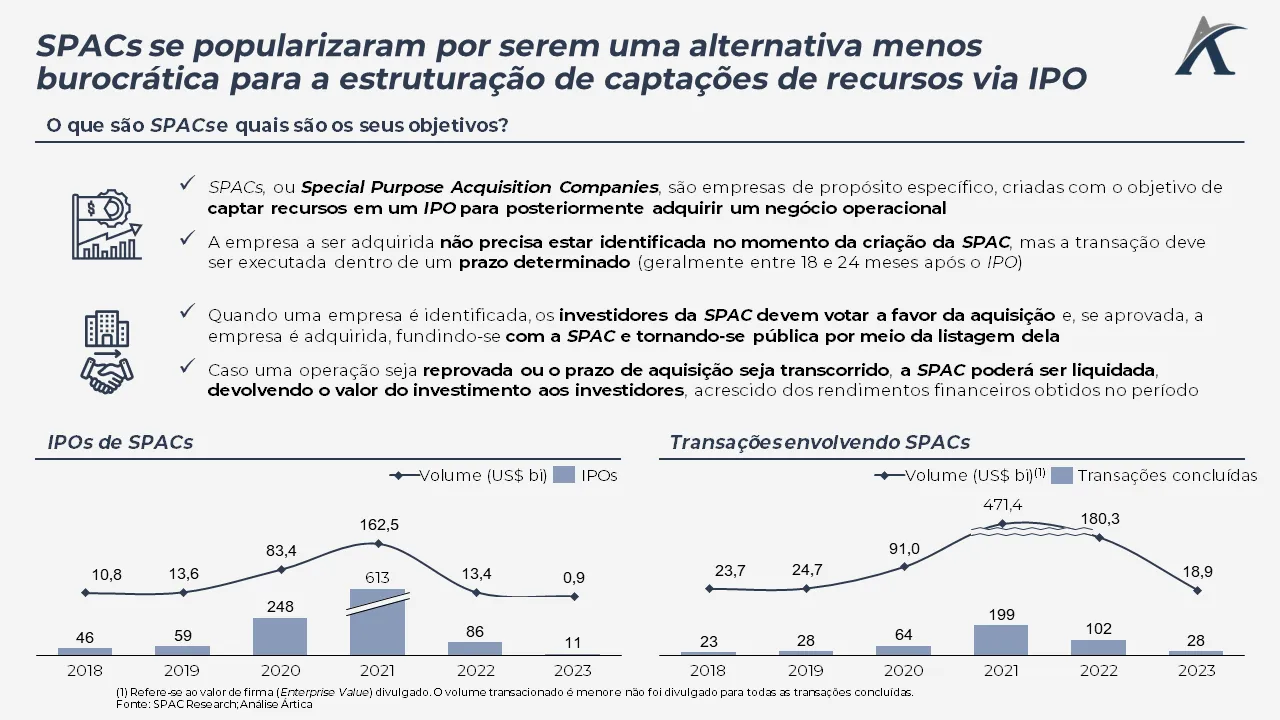

Also known as "blank check" IPOs, SPACs are special purpose companies created to raise funds for the future acquisition of another operating-stage company. In other words, a SPAC functions as an investment vehicle, raising funds through an IPO and taking the acquired company public, without the need for the traditional IPO process.

Typically, when creating SPACs, managers already intend to target small- to medium-sized companies in specific sectors with high growth potential. Following their IPO, SPACs maintain their funds in low-risk financial investments in Escrow Accounts and have a two-year term to acquire a company. They must liquidate the company and return the proceeds to investors in the event of a failed acquisition, plus the proceeds from the investments.

With the recent global rise in interest rates and rising inflation, the pace of SPACs emerging has slowed, and many SPACs have not even been able to complete a transaction, leading to the liquidation of these companies and the return of billions of dollars to investors.

Learn more about SPACs in today's pill: