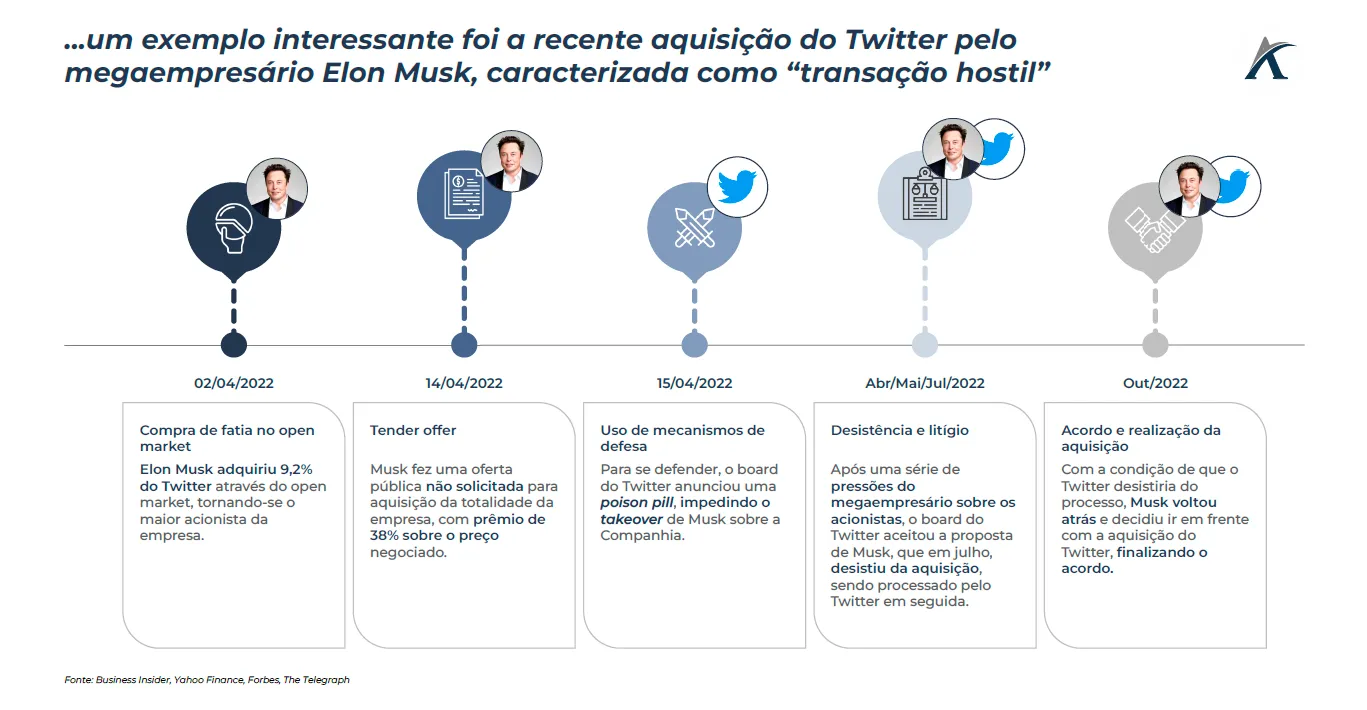

Elon Musk's acquisition of Twitter began in April and was only completed in October 2022. During this period, the company and the entrepreneur engaged in a series of disputes: Musk quietly became the company's largest shareholder; then announced the full acquisition; withdrew; was sued; and finally, reversed his withdrawal and completed the transaction. Processes like this, characterized by the attempted forced acquisition of control of a publicly traded company, are called a hostile takeover.

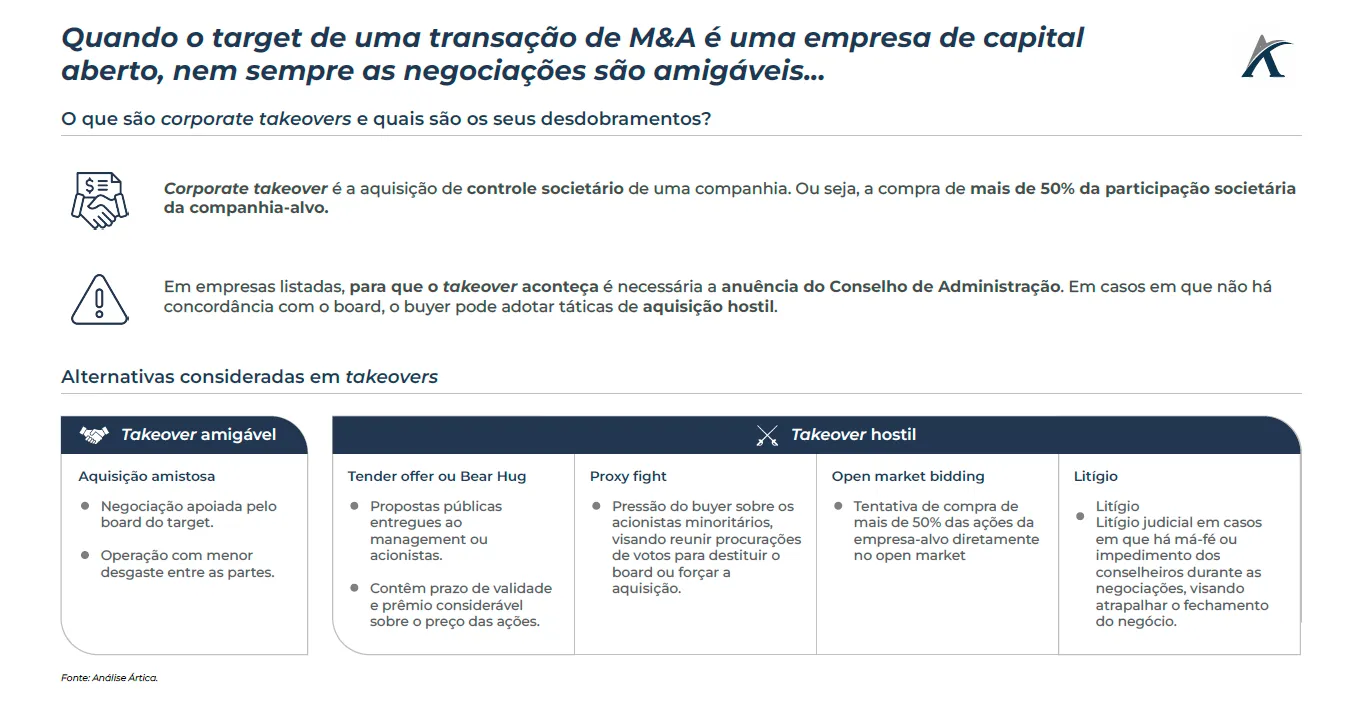

In hostile takeovers, the target company's management and/or Board of Directors are typically not interested in selling control of the company, and the buyer begins to seek other ways to complete the transaction rather than a friendly takeover.

Among the most commonly used tactics, a tender offer is a public proposal to acquire a company at a premium over the share price, delivered to shareholders with a defined validity period. When a tender offer is made, minority shareholders, although they do not have decision-making rights, begin to pressure and influence management to accept or reject the proposal.

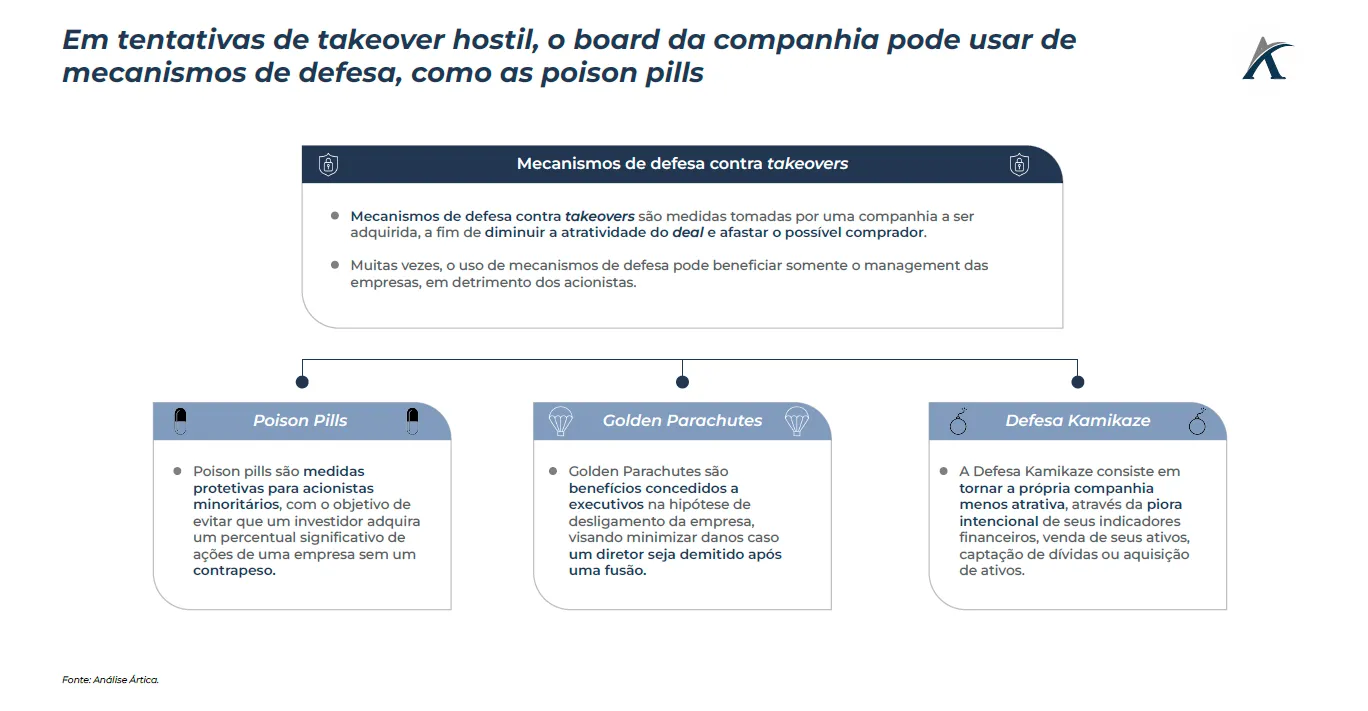

Despite this, in hostile takeover attempts, target companies can use well-known defense mechanisms. In the lawsuit between Twitter and Elon Musk, the company, seeking to prevent the entrepreneur from acquiring a stake exceeding 15%, activated a poison pill, which would have given other shareholders the right to purchase additional shares at a discount to the market price, diluting Musk's stake.