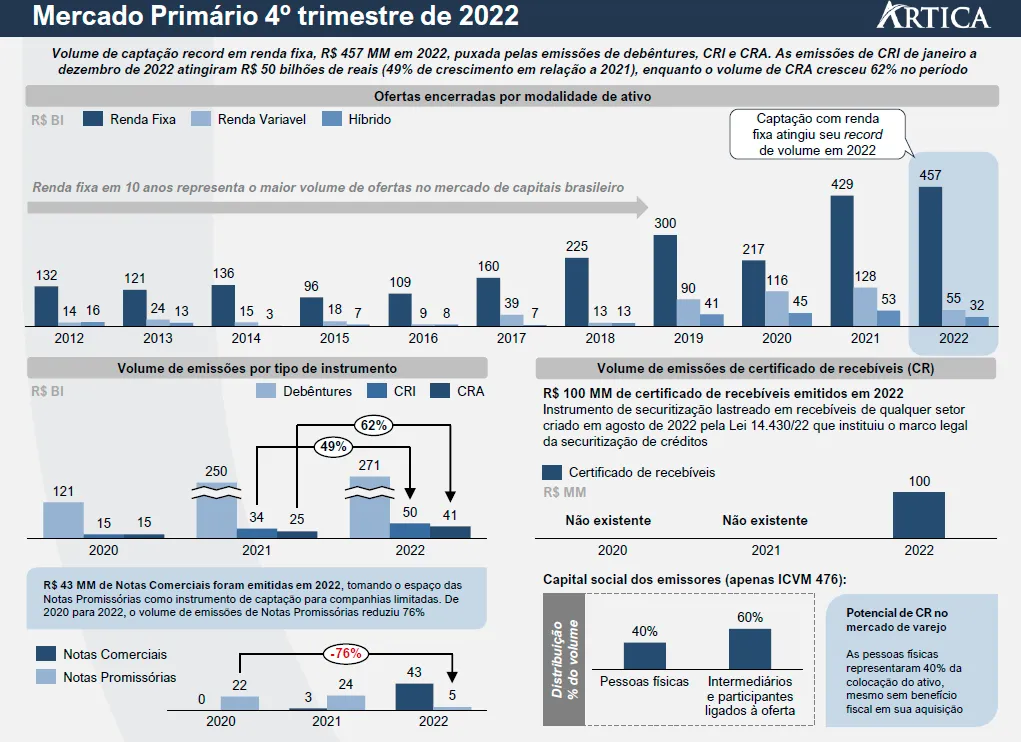

2022 was marked by a record fundraising volume in the history of fixed income, totaling R$457 billion, driven by the largest offering of debentures, CRIs (Real Estate Receivables Certificates), and CRAs (Agribusiness Receivables Certificates) in the capital markets. From January to December 2022, CRI issuances reached R$50 billion, representing a 49% increase compared to the same period in 2021. CRA issuances grew by 62% in the year, reaching a total issuance volume of R$41 billion.

Contrary to the increased supply observed in the primary private credit market, in 2022, there was a net outflow of R$163 billion in investment funds, with net withdrawals also recorded in fixed income funds.

Following monitoring of the private credit market, Ártica's Capital Solutions department prepared a brief report on the accumulated results for 2022. Check it out: