The first half of 2022 saw important regulatory moves in the Brazilian capital market:

CVM decision indicating that companies can raise funds via CRI to be used for rent payments;

Senate approval of the New Legal Framework for securitization that extends the Receivables Certificate (CR) to various sectors and creates the Insurance Risk Letter (LRS);

Advancement of CVM resolution 160, which unifies public offerings and revokes instructions 476 and 400 used in market raisings to date.

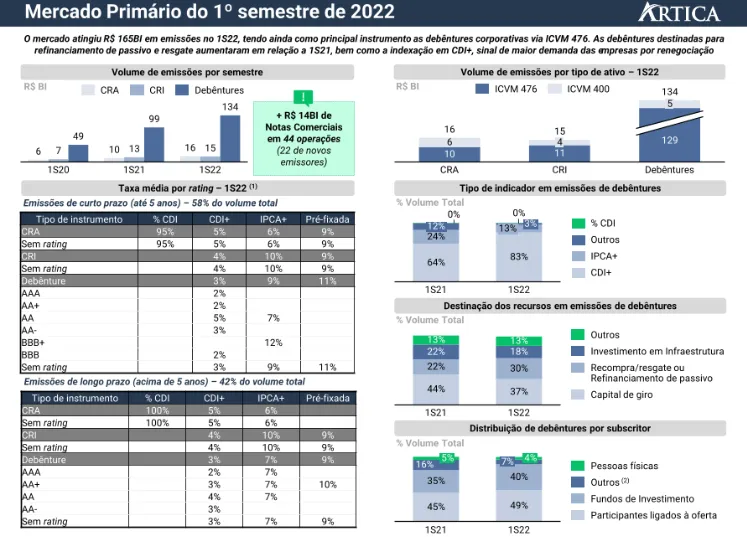

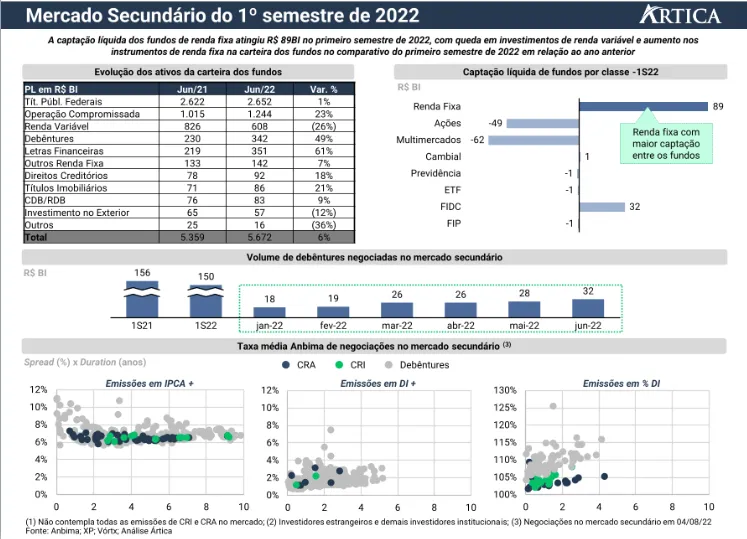

In this context, following monitoring of the private credit market, Ártica's Capital Solutions department prepared a brief report on the first half of the year. Check it out.