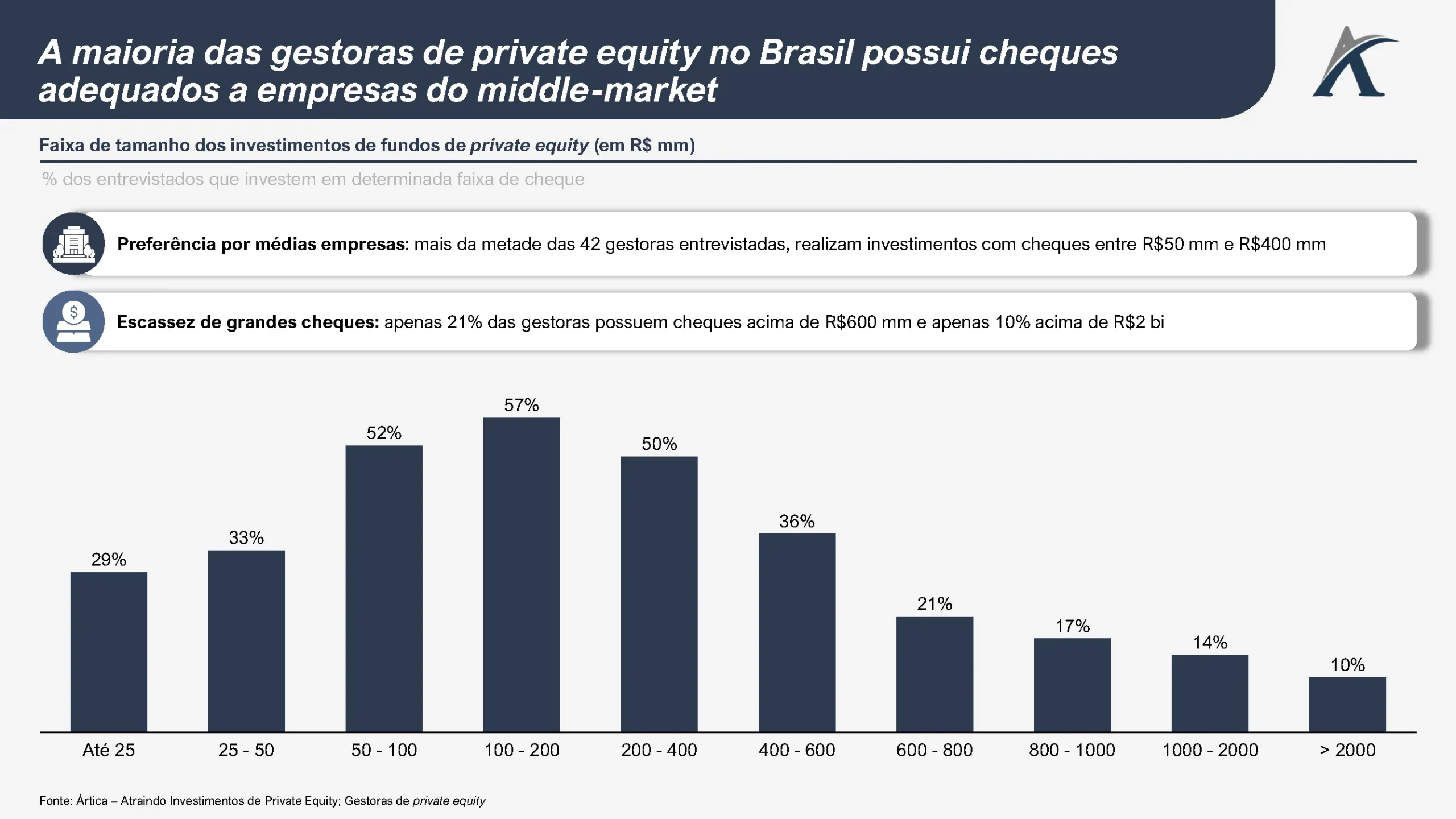

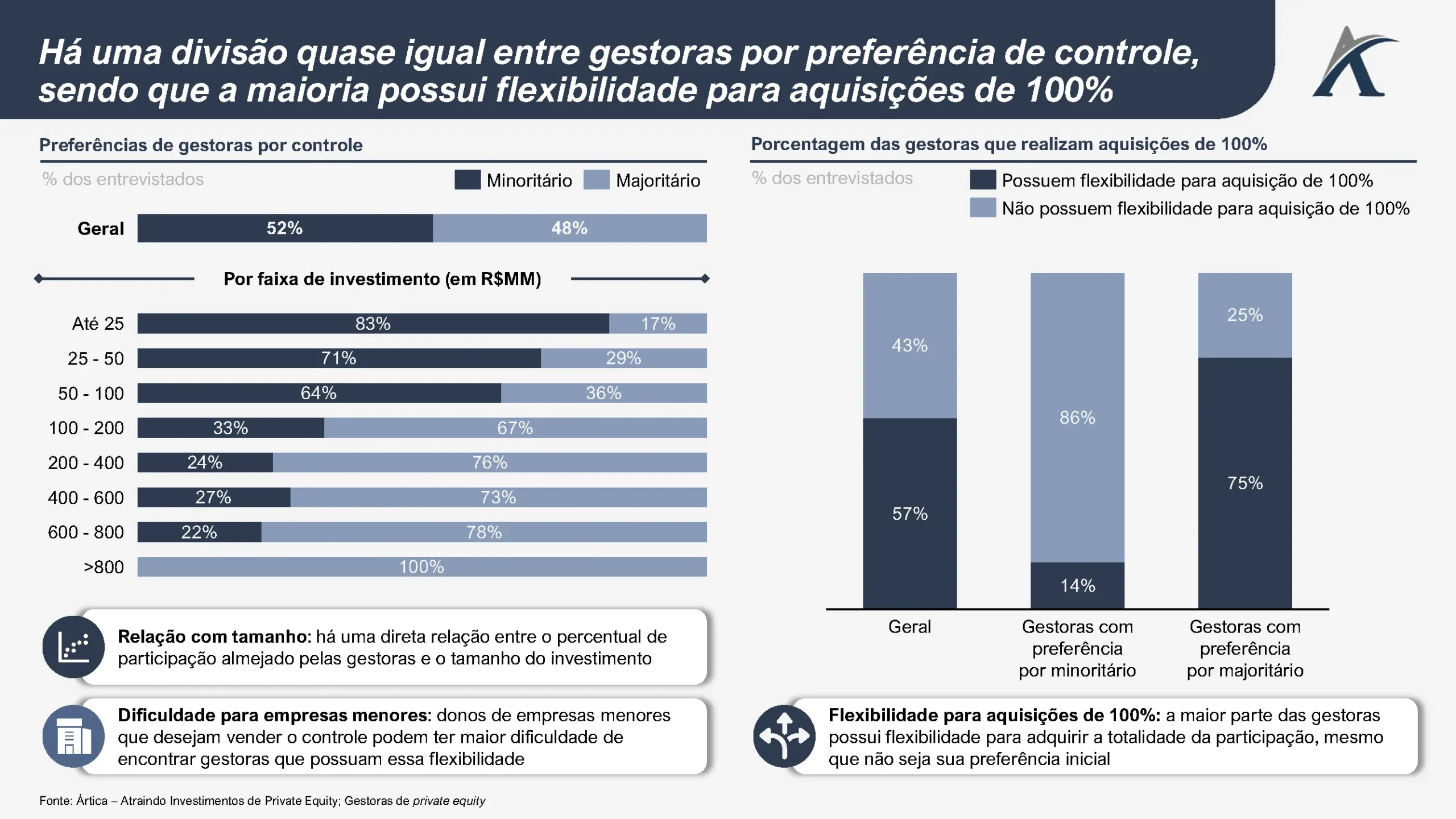

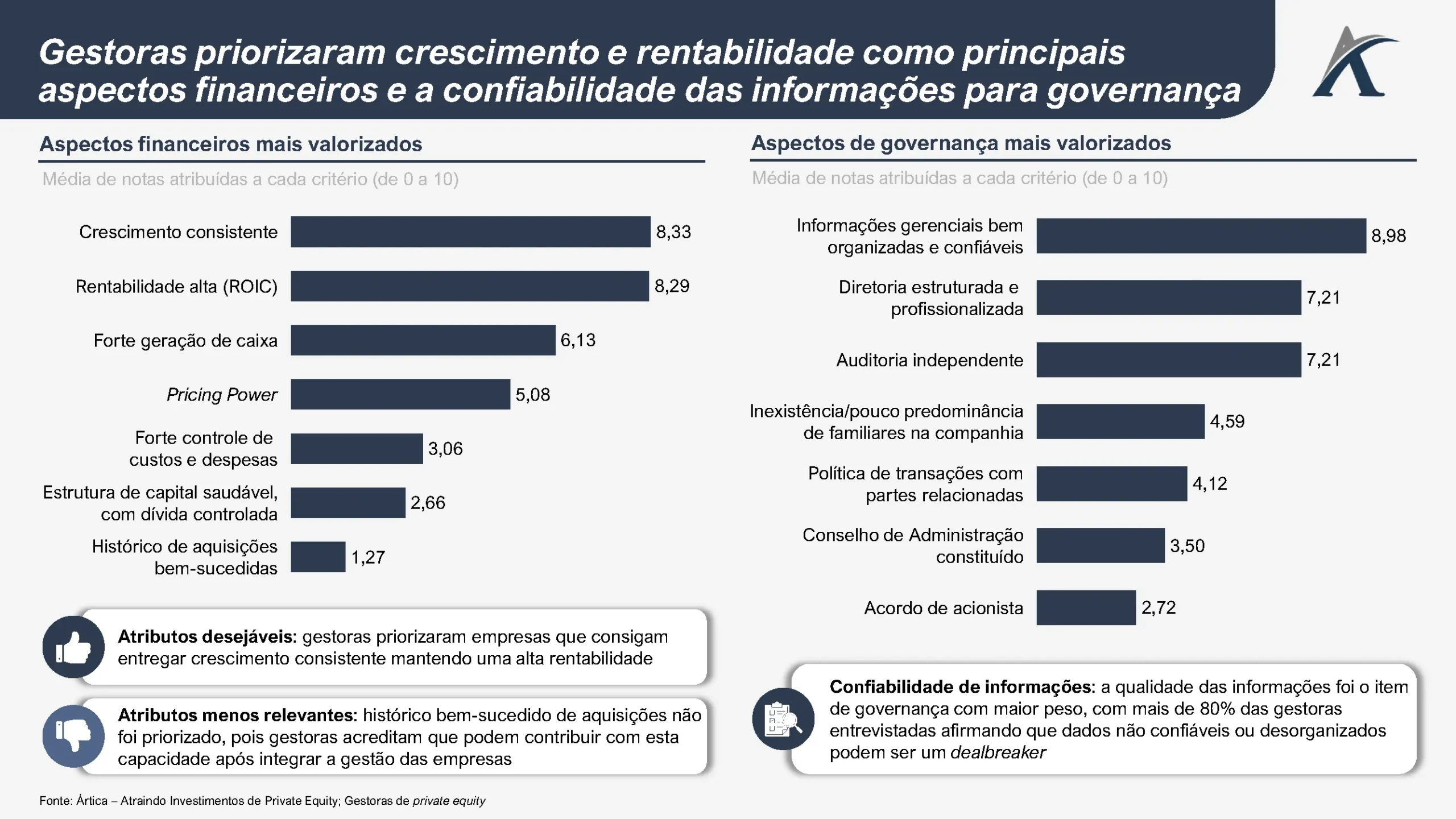

Ártica conducted a study with Private Equity managers to map their investment preferences. The study included 42 managers, representing 45% of those operating at the time of the survey, totaling R$105 billion in invested capital, equivalent to 58% of the total estimated by the industry in Brazil.

Below, we highlight the managers' characteristics regarding the checks issued, their preference for majority/minority investments, and their financial indicators. Governance metrics are also observed, as well as their preference for sectors of interest, restrictions on companies with government ties, and their level of interference in the management of invested companies. Read the full material at: https://lnkd.in/djz4CSgQ