As the end of the year approaches, we will provide an overview of the global M&A market in 2022, as well as some perspectives for 2023.

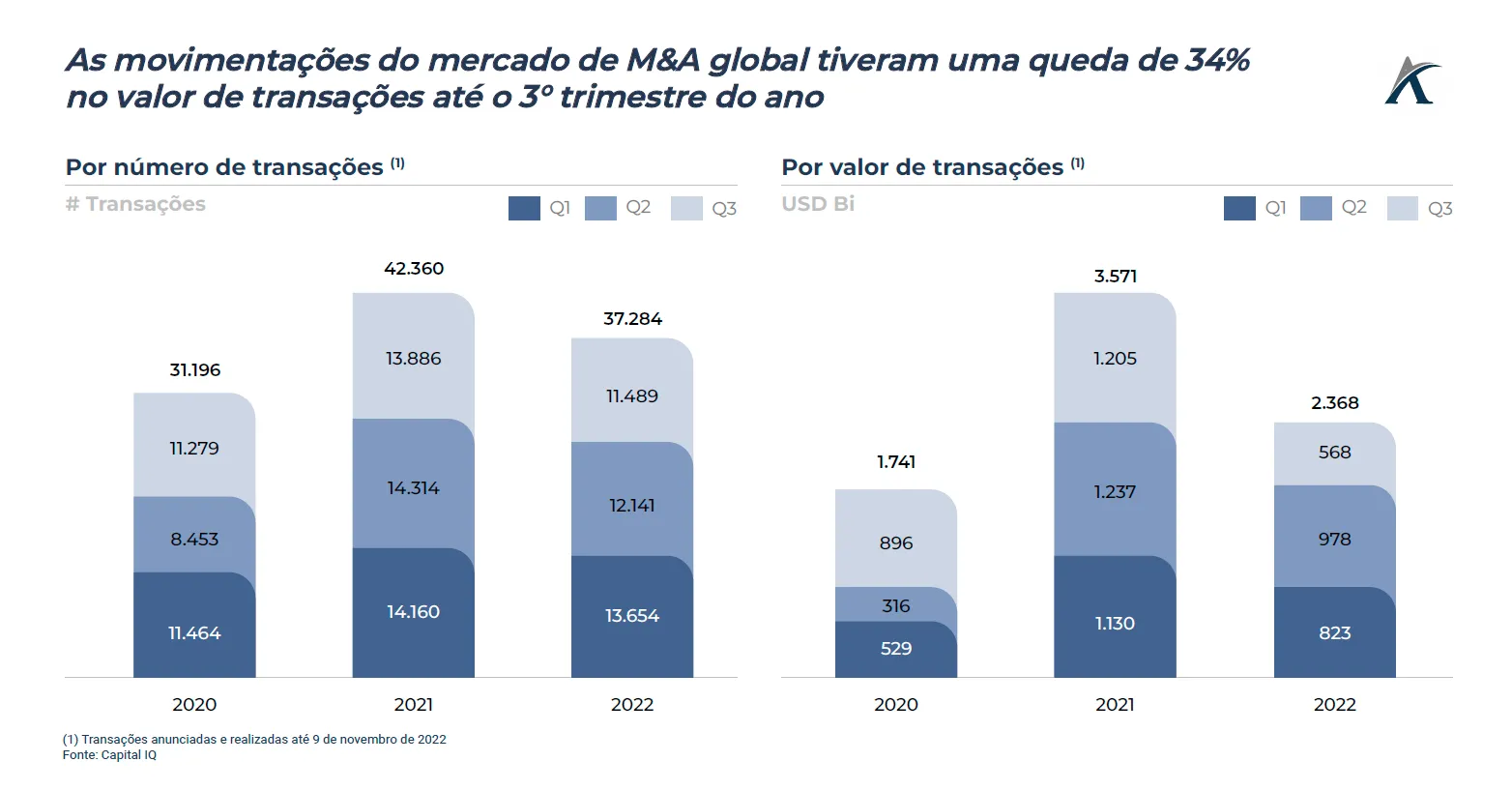

Even though the year isn't over yet, it's already possible to get a good overview of the market based on the last three quarters, when M&A activity showed a decrease in both the aggregate value of transactions and the number of announced deals. The value of announced transactions through the end of the third half of 2022 decreased by 34% compared to the same period in 2021. Regarding the number of deals, this figure fell by 12%, going from 42,360 transactions to 37,284. According to S&P, this M&A slowdown is related to three main factors: i. Global inflation and its indirect effects on deal financing; ii. Market volatility; iii. The war in Ukraine.

Still, some high-value transactions were announced, the two most notable being in the communications and technology sectors, with Microsoft acquiring Activision/Blizzard and VMware being acquired by Broadcom. The combined value of the two transactions exceeds $150 billion.

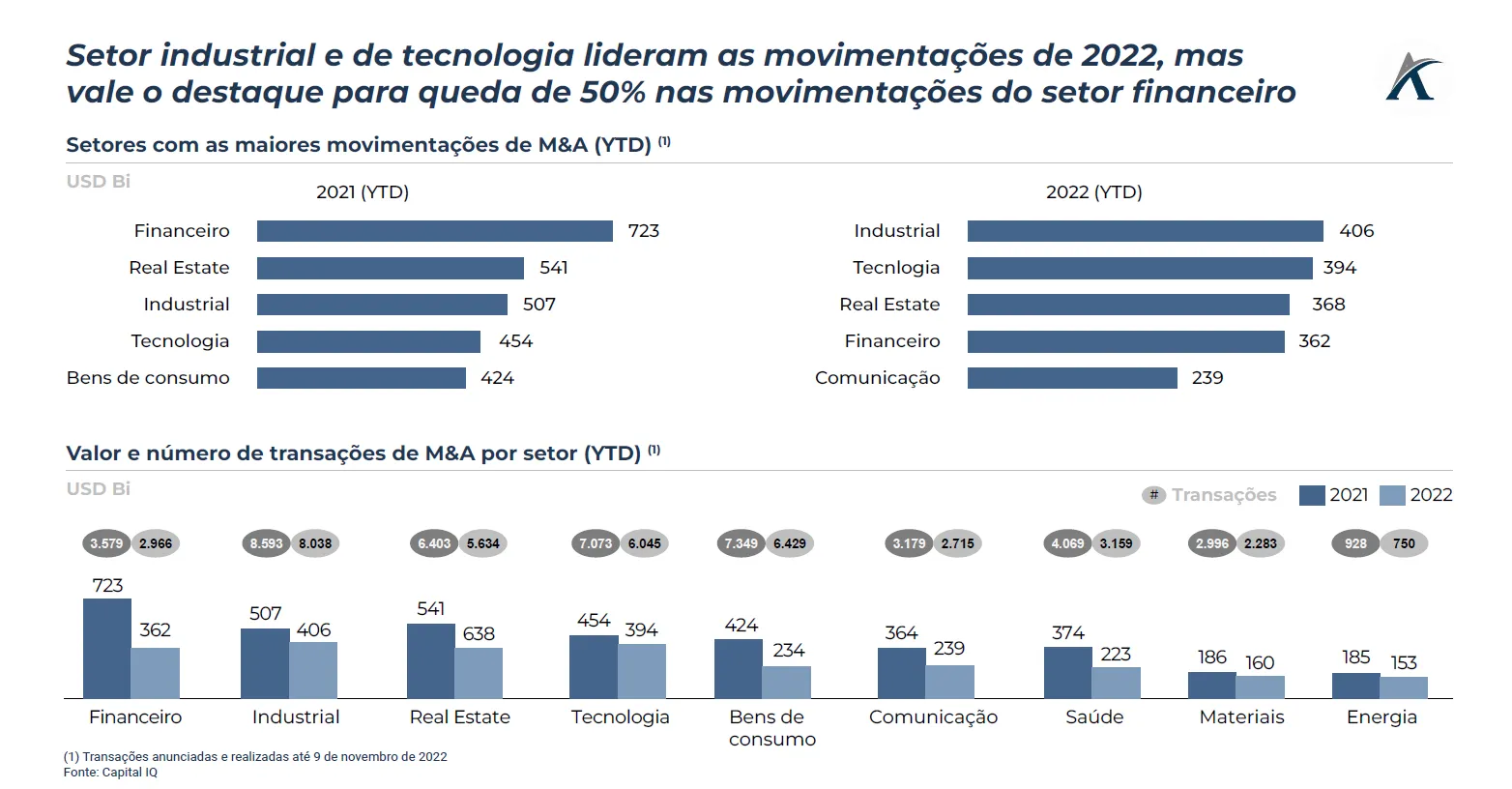

Regarding the sectors of the economy, the Industrial and Technology sectors are the two that led in added value, but it is worth highlighting the drop of more than 50% in the financial sector in both aspects, with a total of USD 362 billion this year compared to USD 723 billion in the same period of 2021.

Finally, expectations for 2023, also according to S&P, indicate that the decline in M&A activity in 2022 will not show a turnaround in the short term. The combination of high interest rates and lower valuations on companies' equity tends to make it more difficult for key stakeholders to execute deals. Rising interest rates increase the cost of acquiring financing, forcing players such as private equity firms to withdraw from the acquisition spotlight. Lower valuations also lead companies to refrain from issuing new shares, making M&A financing more difficult. Furthermore, the forecast decline in global economic activity creates a less favorable environment for growth, leading to a lack of confidence among executives, a key factor in executing new deals. All of this leads to a scenario without high expectations for the M&A sector.