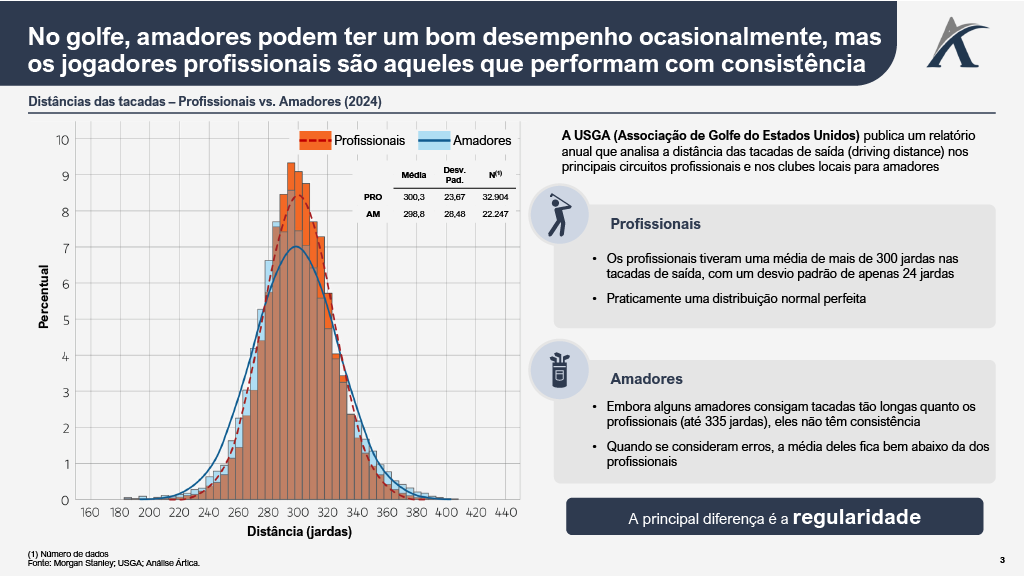

In golf, as in investing, consistency is what separates amateurs from professionals.

Data shows that even amateur golfers can occasionally hit shots comparable to those of professionals. But the difference lies in consistency: while professionals deliver solid performance with low deviation, amateurs frequently mix hits and misses.

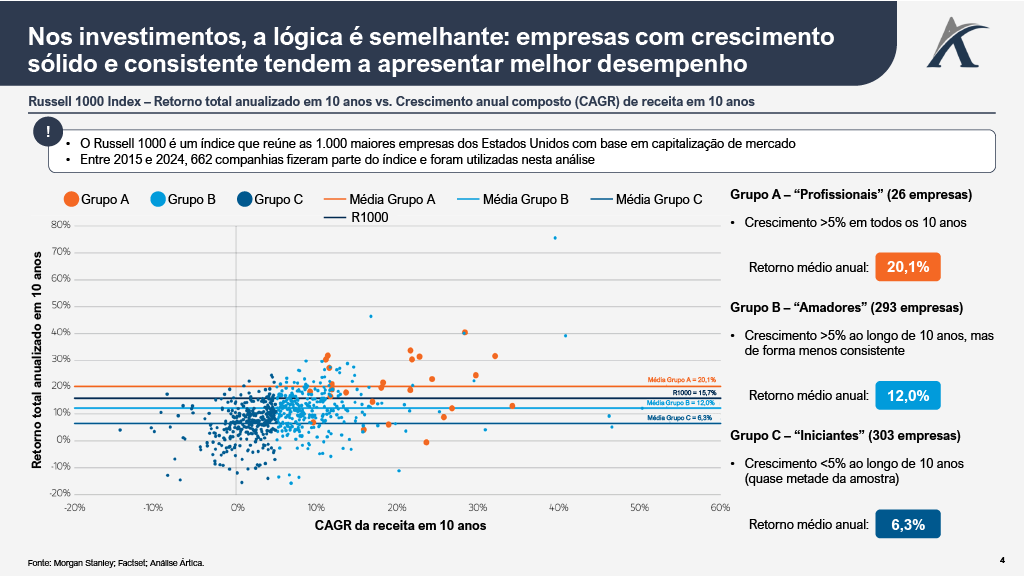

The logic is similar in the world of investments.

Analyzing more than 600 companies in the Russell 1000 index between 2015 and 2024, it was observed that those with consistent revenue growth (CAGR > 5% over the 10 years) delivered significantly superior returns. Companies with uneven trajectories or inconsistent growth, however, lagged behind.

The winning strategy is clear: seek businesses that grow in a solid, sustainable, and profitable way.

Just like in golf, the key is consistency, not sporadic moments of brilliance.

Based on the Morgan Stanley article “What Can Golf Teach Us About Investment Returns?”