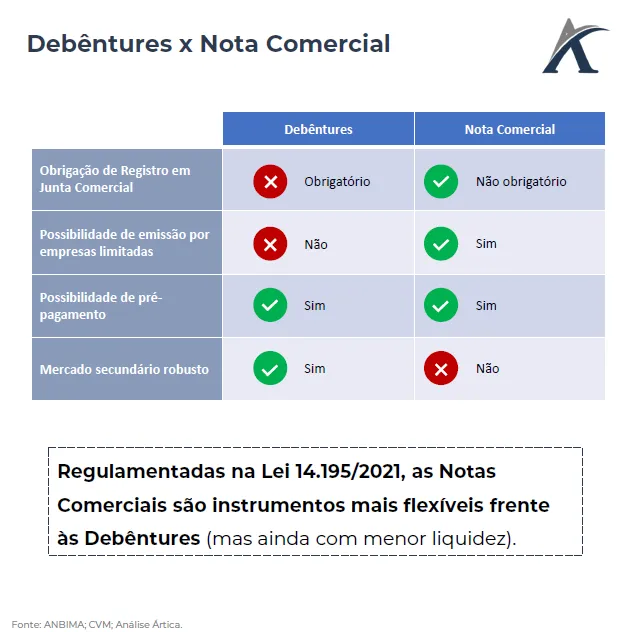

Carrying out your first debt issuance on the market can be challenging. Structuring an instrument requires compliance with specific regulations, and the distribution process can be complex because the company is not yet known to the market—often increasing costs in terms of fees and collateral requirements. Other instruments are restricted to companies with a certain level of governance—such as debentures, which can only be issued by public limited companies.

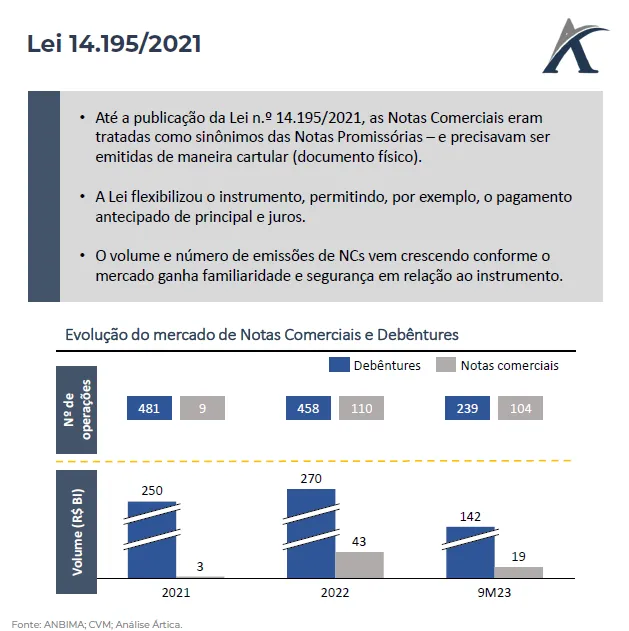

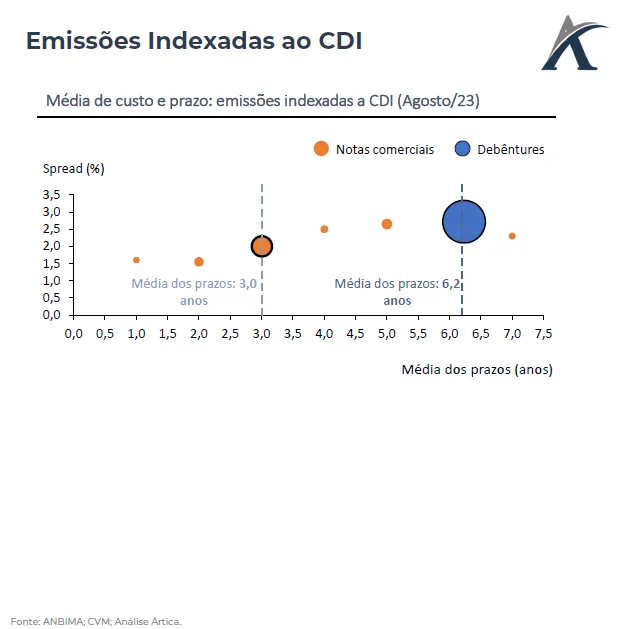

With these challenges in mind, public and private institutions have worked together to develop the private credit market and facilitate access to it for companies. One such example is the specific regulation of Commercial Notes, enacted in 2021. Since then, the volume of Commercial Note issuances has grown, and the instrument has proven to be a viable option for companies entering the capital markets. This way, companies can prepare for the next steps in governance—such as becoming a public limited company to enable the issuance of debentures and access to more liquid markets—without missing out on fundraising opportunities at attractive costs and terms.