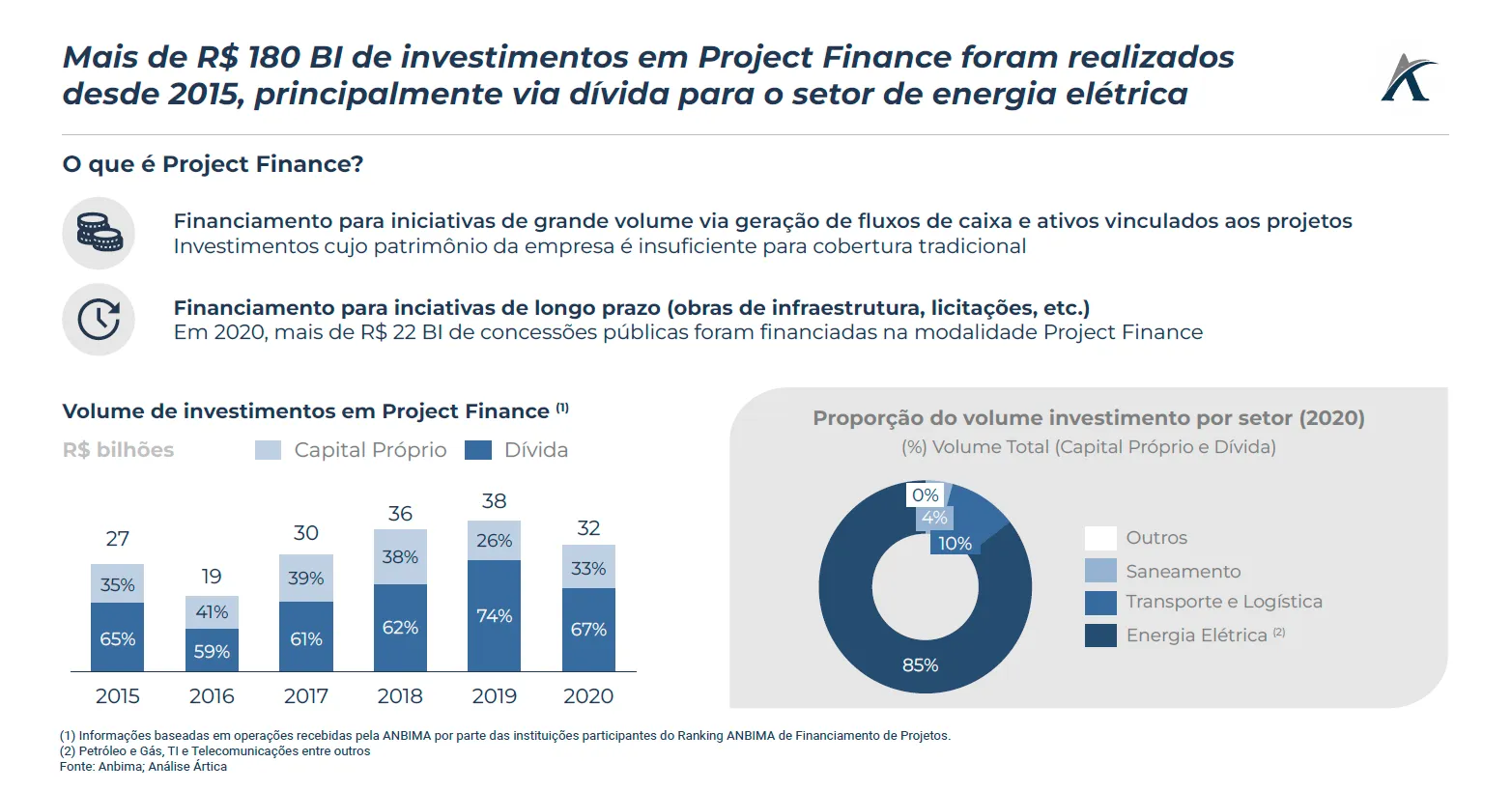

Investments in infrastructure, sanitation, power generation park construction, and public concessions in various sectors typically require a greater allocation of resources than the traditional equity raising potential of the company interested in the project. At this point, the entrepreneur can opt for a structured source of leverage through Project Finance.

Debt project financing is a way to allocate large amounts of resources to long-term initiatives. Project finance is particularly attractive for financial structuring that aims to promote greater leverage in the early stages of investment, separating project risks from shareholder risks. To this end, it is possible to use third-party capital through financial engineering that contractually supports the lender with the cash flows to be generated by the initiative, while also serving as collateral with the receivables and assets linked to the project itself.

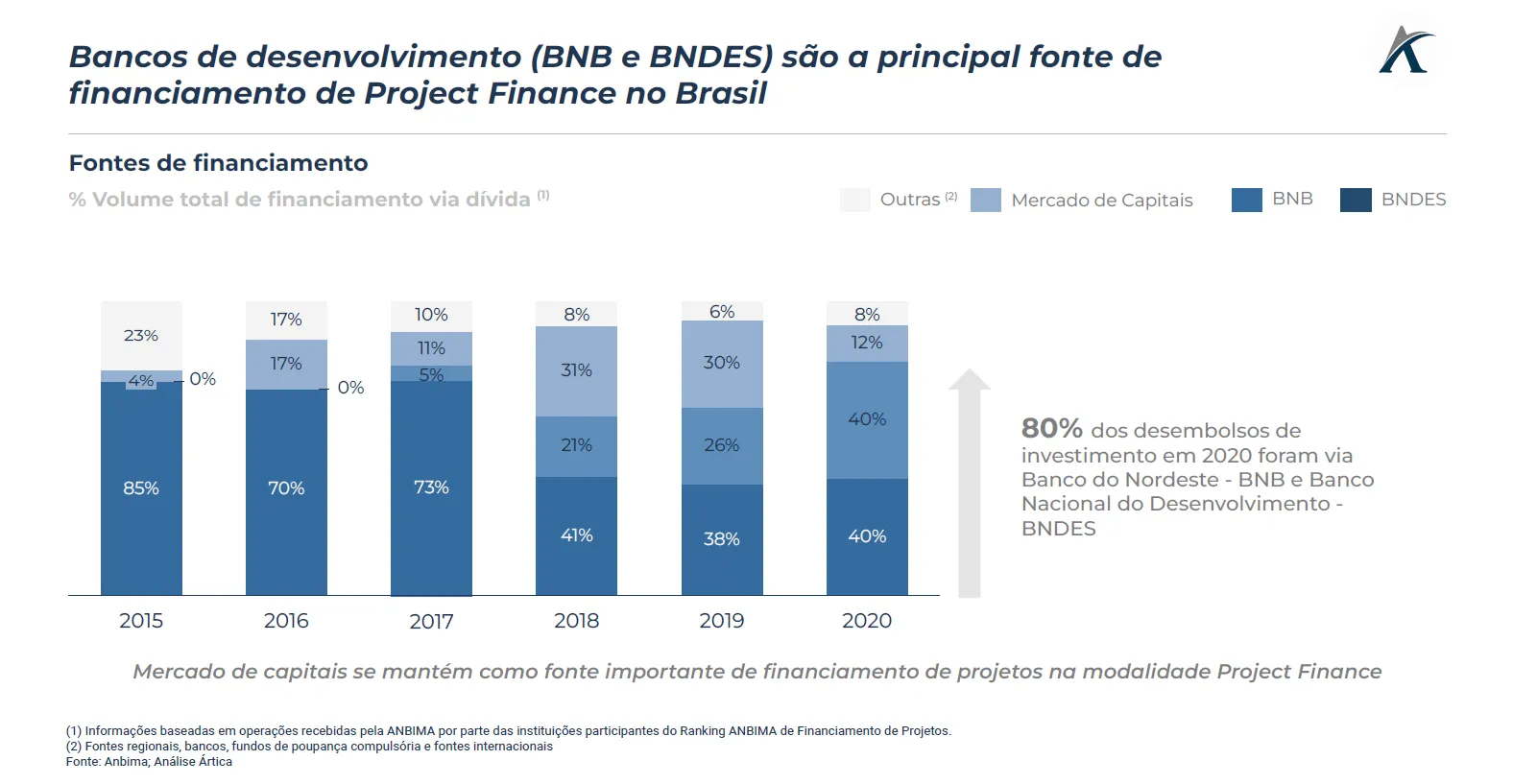

According to ANBIMA's monitoring, development banks are the main source of financing for this type of project in Brazil. In 2020, BNB and BNDES together accounted for 80% of financing. However, despite the increase in public investment in these initiatives, the capital market remains an important funding alternative for companies seeking resources to begin implementing long-term projects.