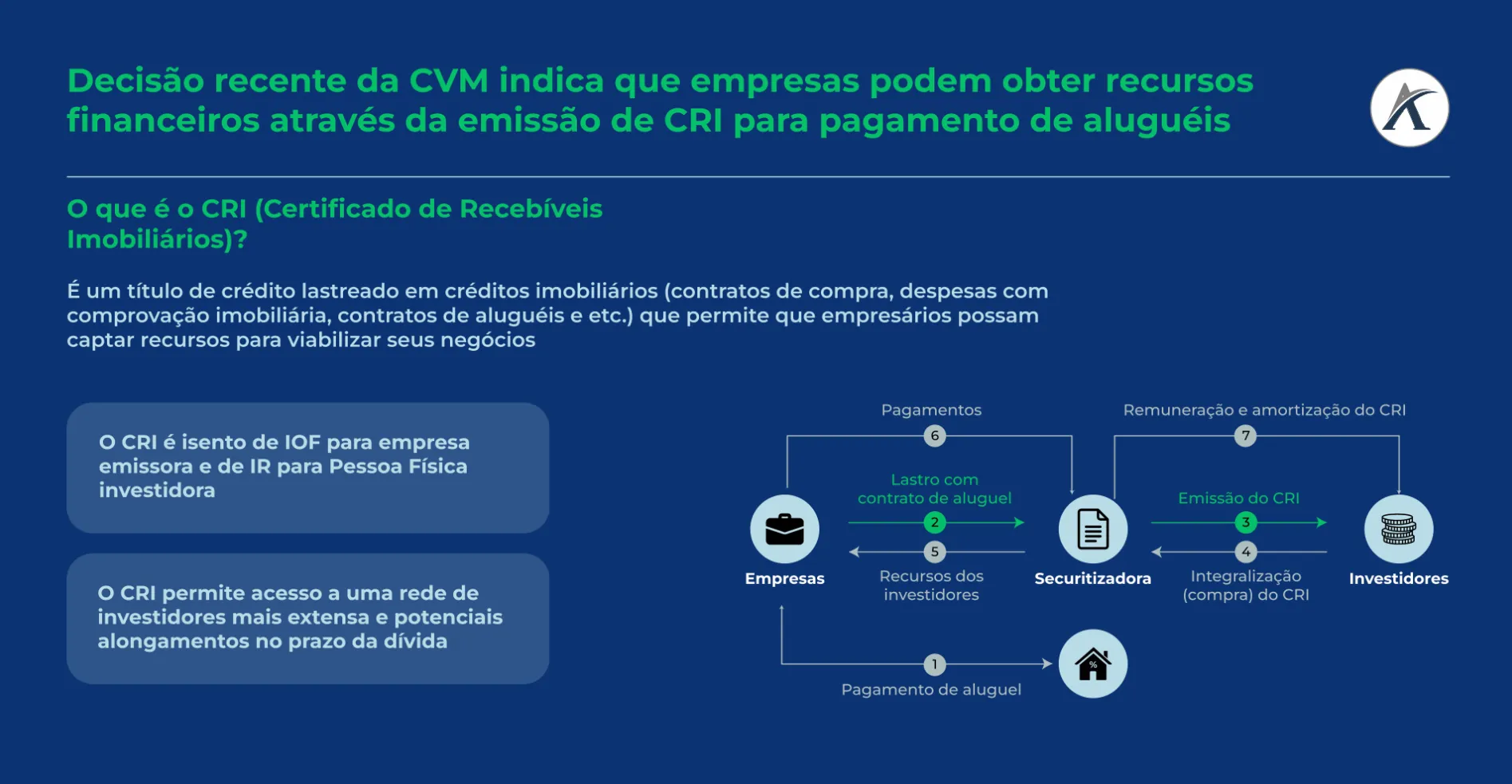

The instrument is known for its tax benefits, as individual investors do not pay Income Tax (IR) on their earnings, and companies do not pay Financial Transaction Tax (IOF) on the issued value of the security. Furthermore, other advantages over bonds include increased investor options, as it is a highly attractive security, and payment terms can often be longer than other types of funding.

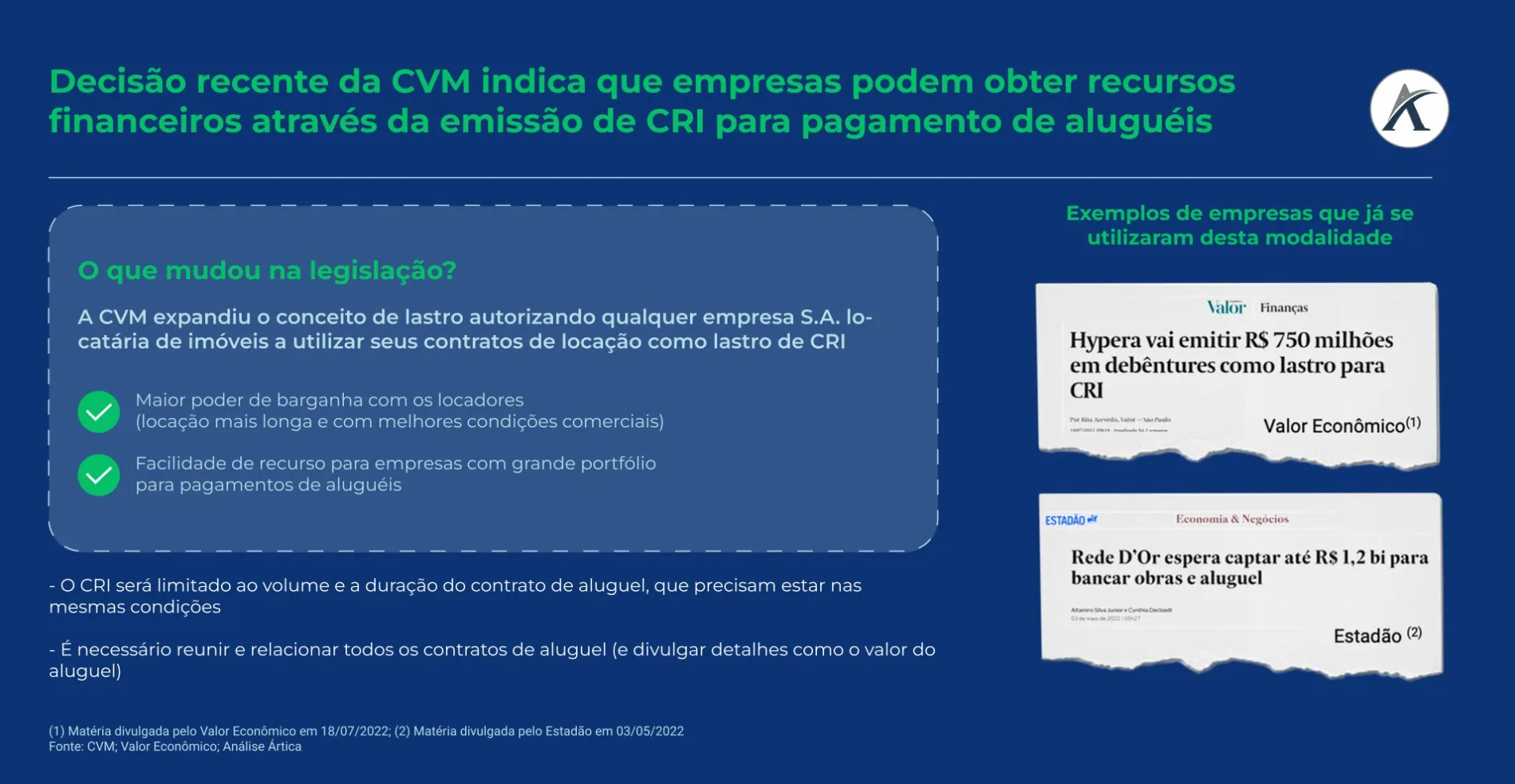

Recently, the CVM was questioned about the use of funds raised via CRI to pay rental expenses and was in favor of the decision in February 2022.

With this decision, the commission authorizes companies, regardless of their sector, that are tenants of properties to issue a CRI (Real Estate Investment Certificate) with funds earmarked for payment of their lease agreements. The decision corroborates the instrument's flexibility milestones and increases companies' access to the capital markets.

Some practical examples of beneficiaries of this authorization are companies that operate through real estate leasing, such as factories, logistics warehouses, and stores, which are authorized to use their rental contract as a form of financial capture, as long as the criteria established by the regulatory body are respected.