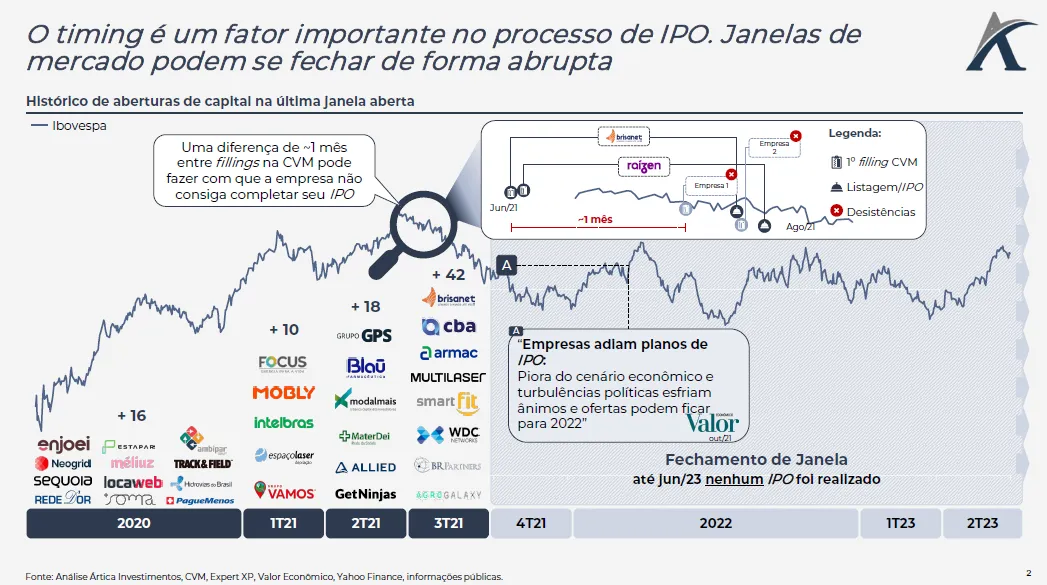

Do you know why no IPOs have been launched since the last quarter of 2021? This is due to what we call the "closing window."

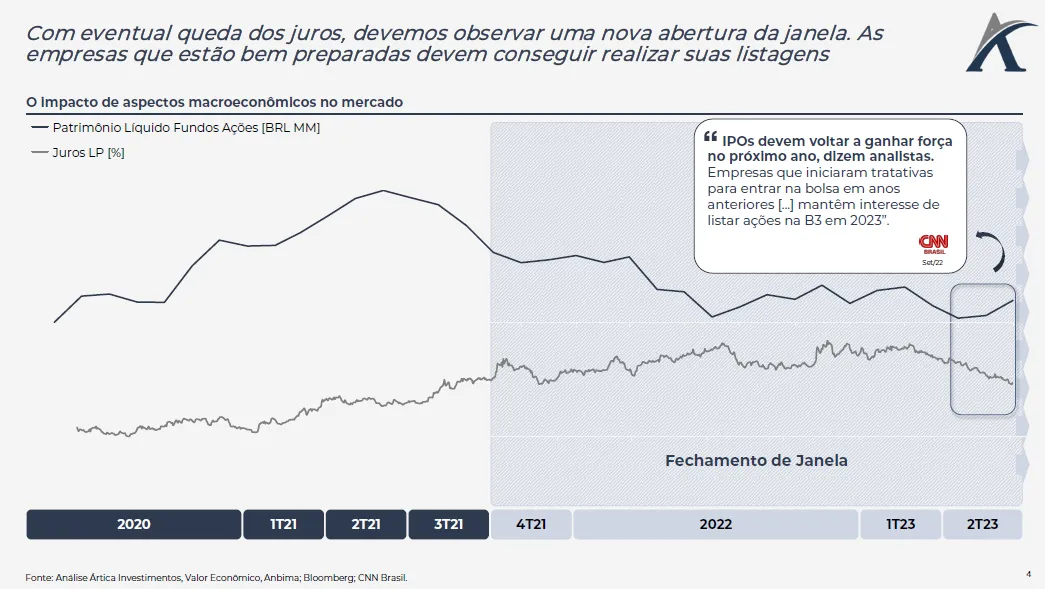

Listing windows are favorable periods for equity offerings, marked by strong investor appetite for variable-income assets. They are determined by various macroeconomic factors, such as interest rate changes, economic growth, and political crises, resulting in a volatile and unpredictable nature.

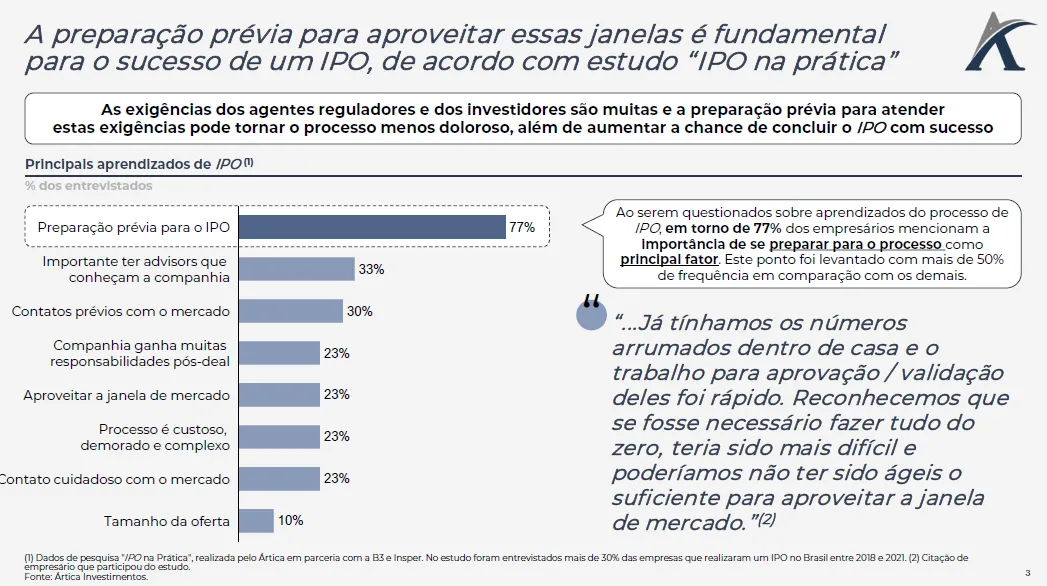

Listing windows can open or close abruptly and with limited predictability. Therefore, companies' advance preparation is crucial to capitalize on the window as quickly as possible and achieve successful listing. This process is extensive and meticulous, involving several regulatory and organizational aspects.

In today's pill, we seek to demonstrate the phenomenon of closing the last listing window and the importance of prior preparation to successfully price an IPO.

Furthermore, with the prospect of a reduction in interest rates in 2H23 and the increase in the number of follow-ons, market analysts are already predicting a new window opening in 2024. Although it may seem distant, companies seeking an IPO need to be vigilant.

To learn more about IPOs, access our study in partnership with B3 and with the Insper “IPO in Practice: Lessons Learned by Entrepreneurs Who Went Through the Process” in: https://lnkd.in/db5s9gFk.