Most CEOs recognize that business creation is critical to success. McKinsey's annual New Business Study shows that executives expect new products, services, and businesses to generate nearly 30% of their revenue by 2027.

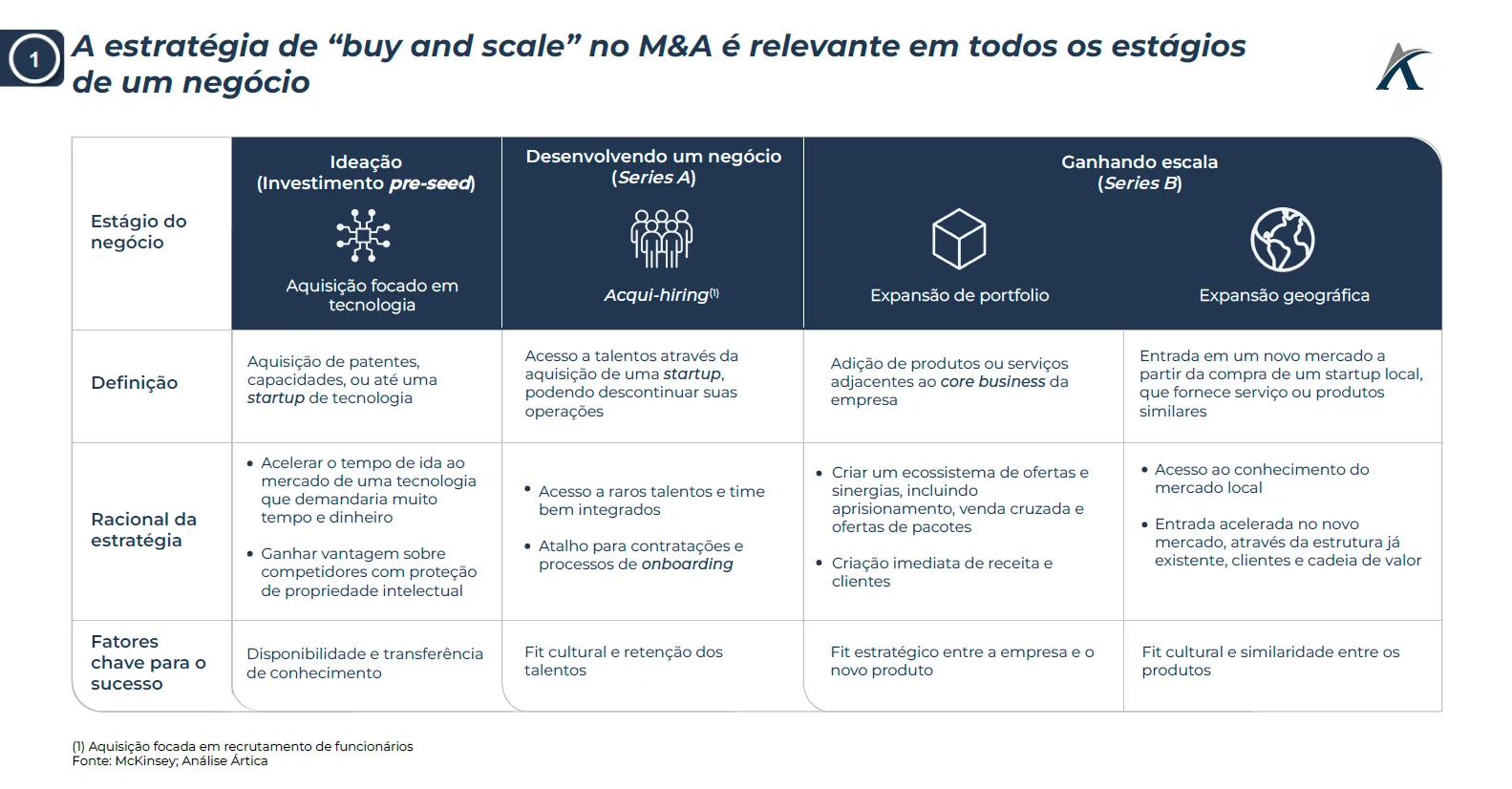

An article published by McKinsey, "Buy and Scale: How incumbents can use M&A to grow their business," shows how large companies can learn from digital disruptors in the M&A process. The latter adopt a strategy completely opposite to their more traditional competitors. Instead of focusing on one or two acquisitions to capture cost synergies and leverage their economies of scale, disruptors make a series of acquisitions to increase their growth (buy and scale). This strategy has proven successful, as companies that make more than five acquisitions grow at twice the rate of companies that are more selective when it comes to M&A.

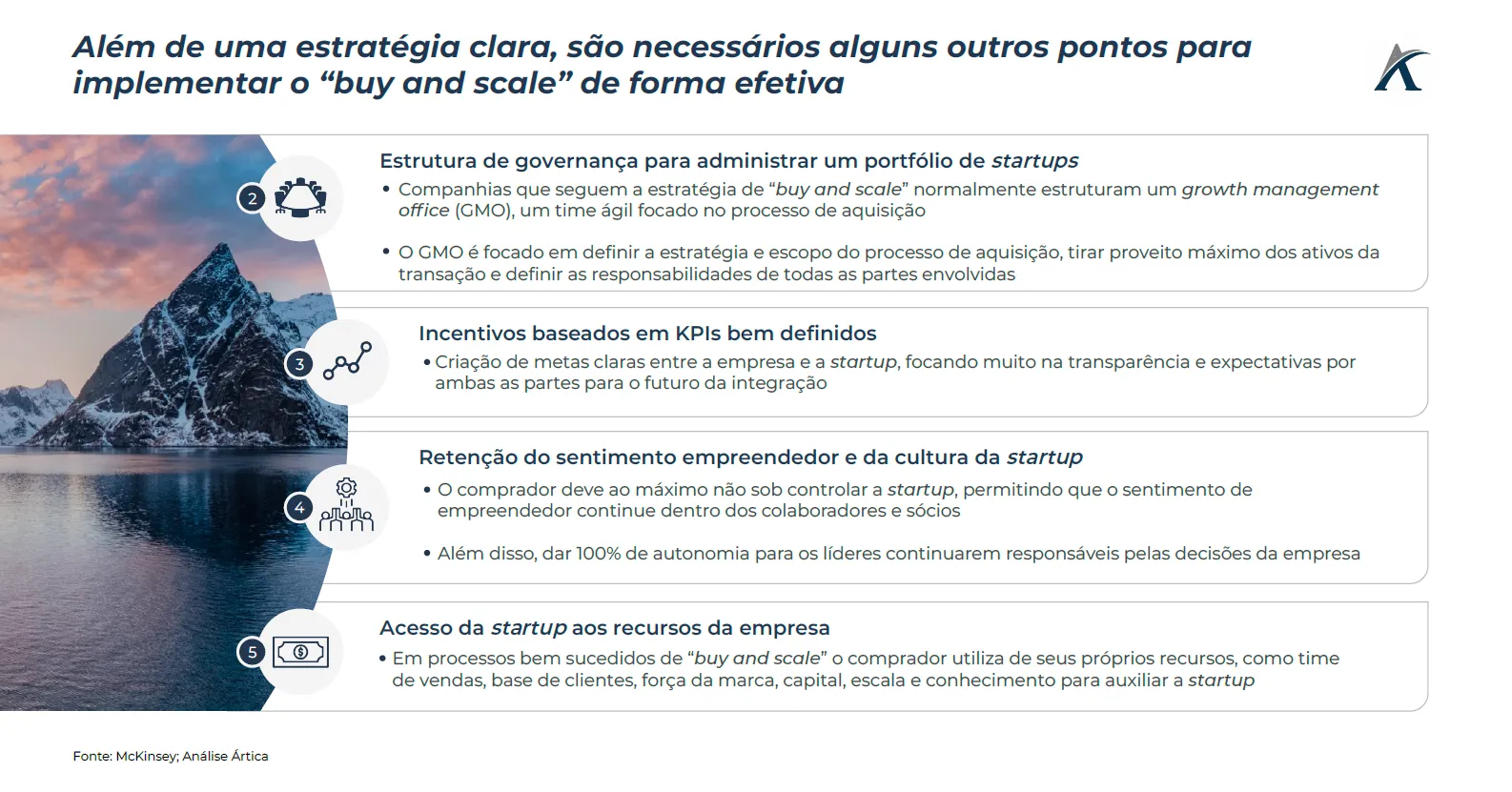

To help companies implement their “buy and scale” strategy, McKinsey recommends 5 points to follow:

- A wide range of M&A objectives based on a clear strategy

- Governance framework for managing a portfolio of startups

- Incentives based on well-defined KPIs

- Retaining entrepreneurial sentiment and start-up culture

- Start-up access to company resources

With the proper implementation of these 5 points, companies can use M&A as an arm of innovation and new business creation, generating competitive advantages and enabling growth beyond organic growth.

Veja o artigo original da Mckinsey.