Despite the uncertainties in the global economic landscape, key indicators point to a possible recession in the short to medium term. The actions of major central banks to combat post-COVID inflation have limited access to capital for companies of all sizes and sectors.

Therefore, companies must make decisions that optimize their operations and ensure financial strength to weather a period of expected instability. Studies by Harvard Business Review and JP Morgan present key measures companies can take to navigate these periods.

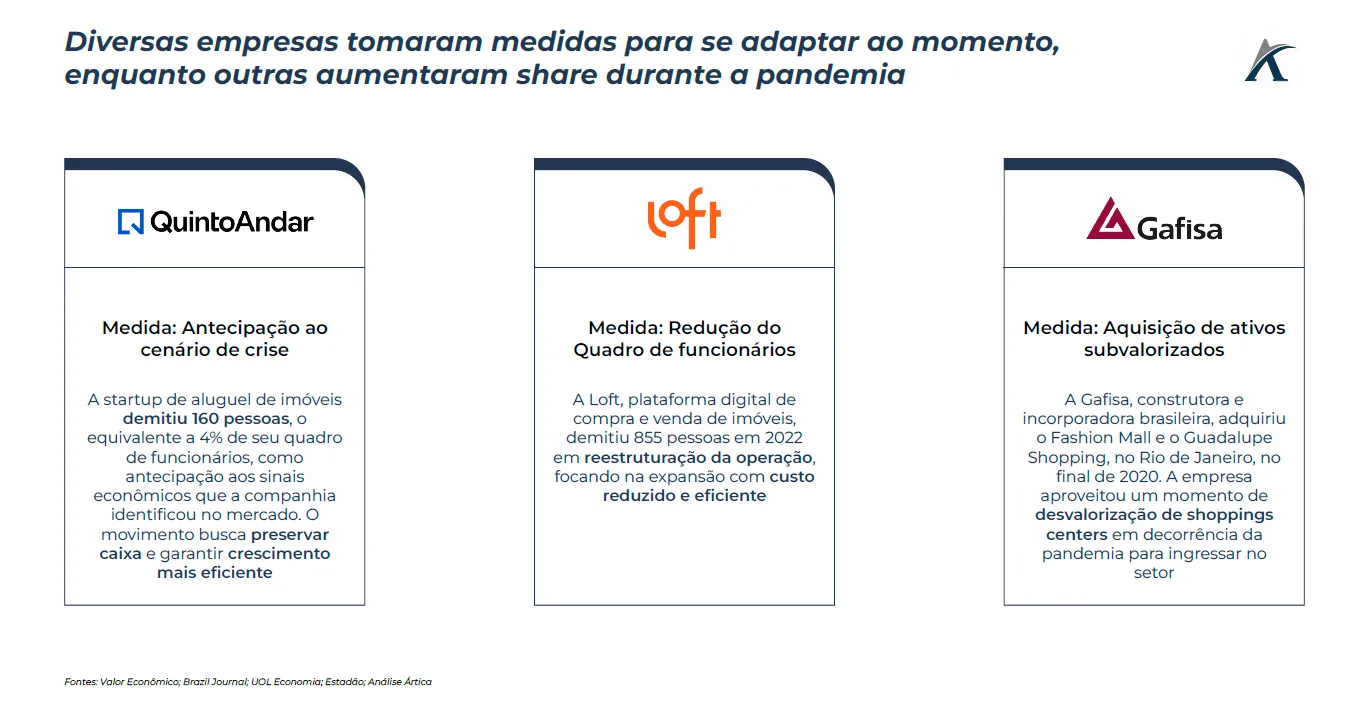

Companies must anticipate potential scenarios, taking strategic measures to preserve their cash flow and ensure a solid balance sheet during times of crisis. Often, the primary measure companies take is layoffs.

In situations where the company has a favorable financial position, it is possible to conduct M&As that leverage undervalued assets and increase its market share. This was evident in 2020, when sectors directly affected by the pandemic underwent consolidation through a large-scale merger and acquisition movement.

Finally, investors and shareholders must be satisfied with the company's performance. During times of crisis, private equity and venture capital firms tend to invest less, and therefore, only companies with strong performance will remain in their portfolios.