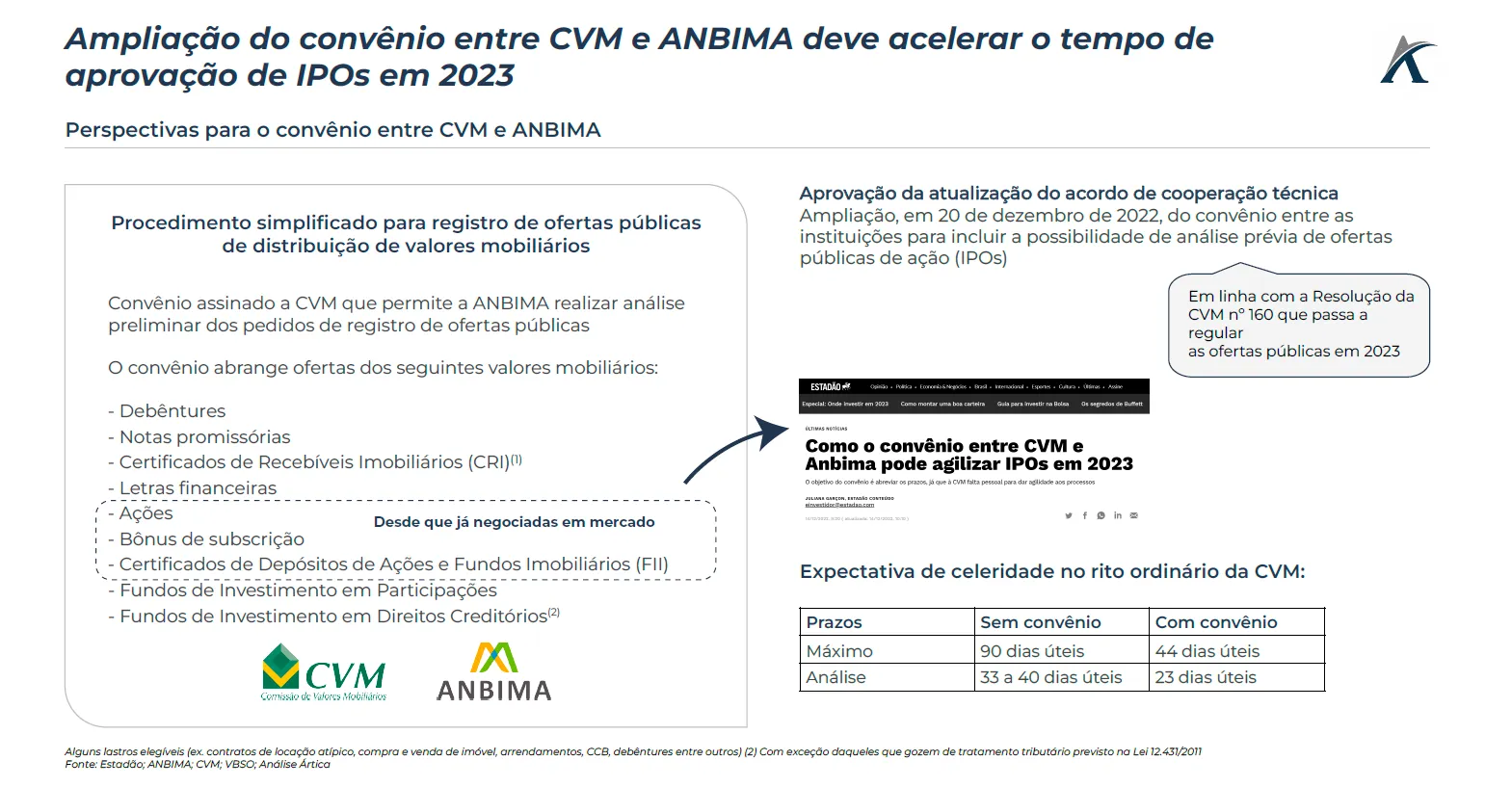

Since 2008, the Brazilian Securities and Exchange Commission (CVM) has had an agreement with ANBIMA (Brazilian Association of Capital Market Entities) that allows the entity to conduct a preliminary analysis of public offering registration requests, thus reducing the evaluation time that was previously concentrated solely at the CVM. The agreement has undergone several amendments to include more securities and improve the analysis process.

After the publication of CVM Instruction No. 160, on July 13, 2022 (ICVM 160), the need to include the offer became evident

public offering (IPO) in the agreement between the institutions. ICVM 160, which comes into effect in January 2023, provides for the expansion of

partnership by establishing the possibility of prior analysis of the registration request by entities associated with other securities distributed on the market that were not included in the technical cooperation agreement of the entities until now.

On December 20, 2022, CVM approved the expansion of the agreement with ANBIMA with the aim of promoting agility in

public offering registration process. Therefore, the market expects the agreement to speed up the approval time for IPOs in

2023 by including ANBIMA support in the analysis of this type of registration.