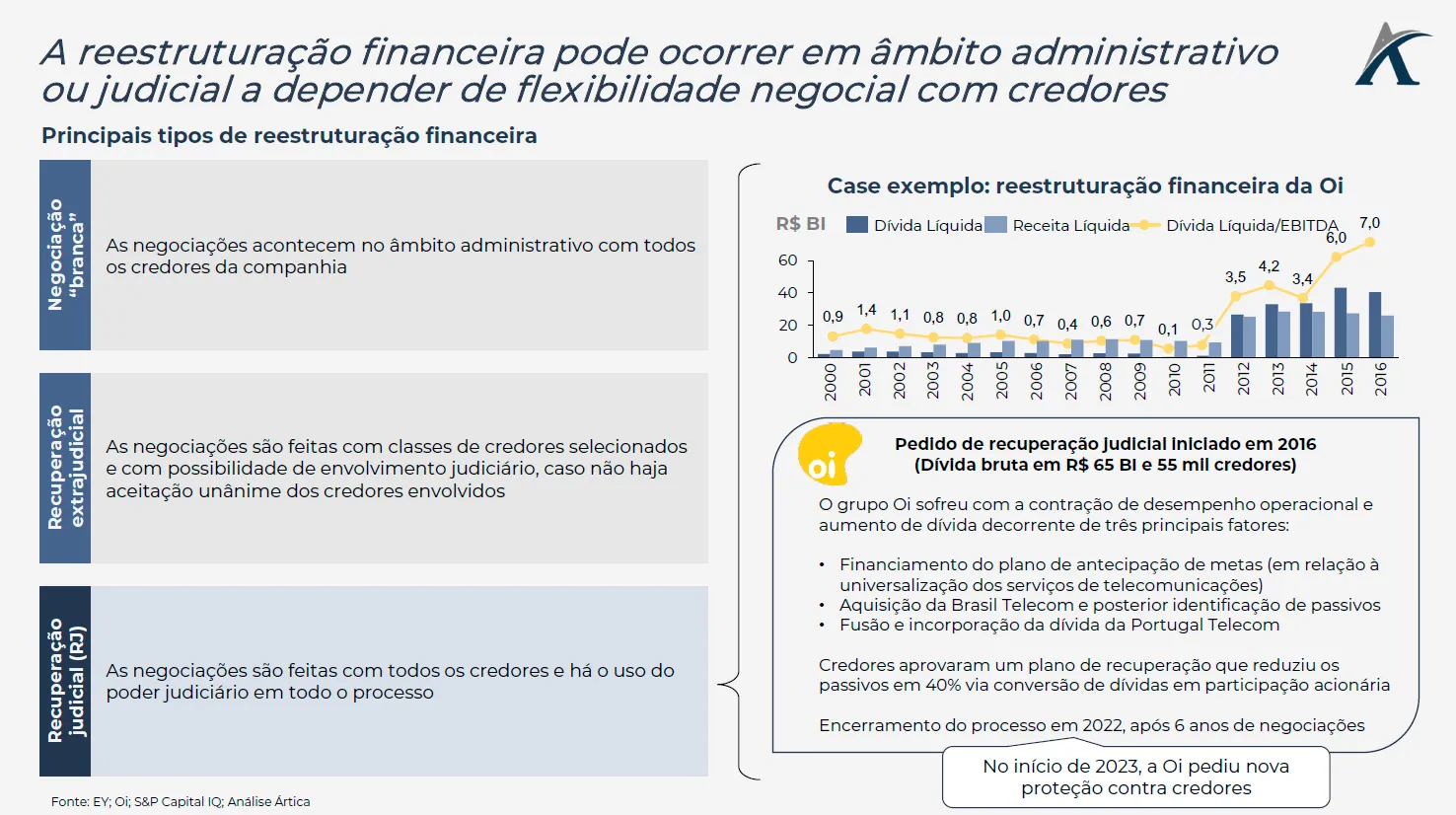

Judicial Reorganization (RJ) is a recurring topic in the corporate market. In Brazil, the standout recovery case was the financial restructuring of the Oi Group, which lasted six years. The company filed for RJ in 2016, due to the contraction of its operations due to declining revenue in previous years and rapidly increasing debt. Oi reached the mark of R$65 billion in gross debt with over 55,000 creditors.

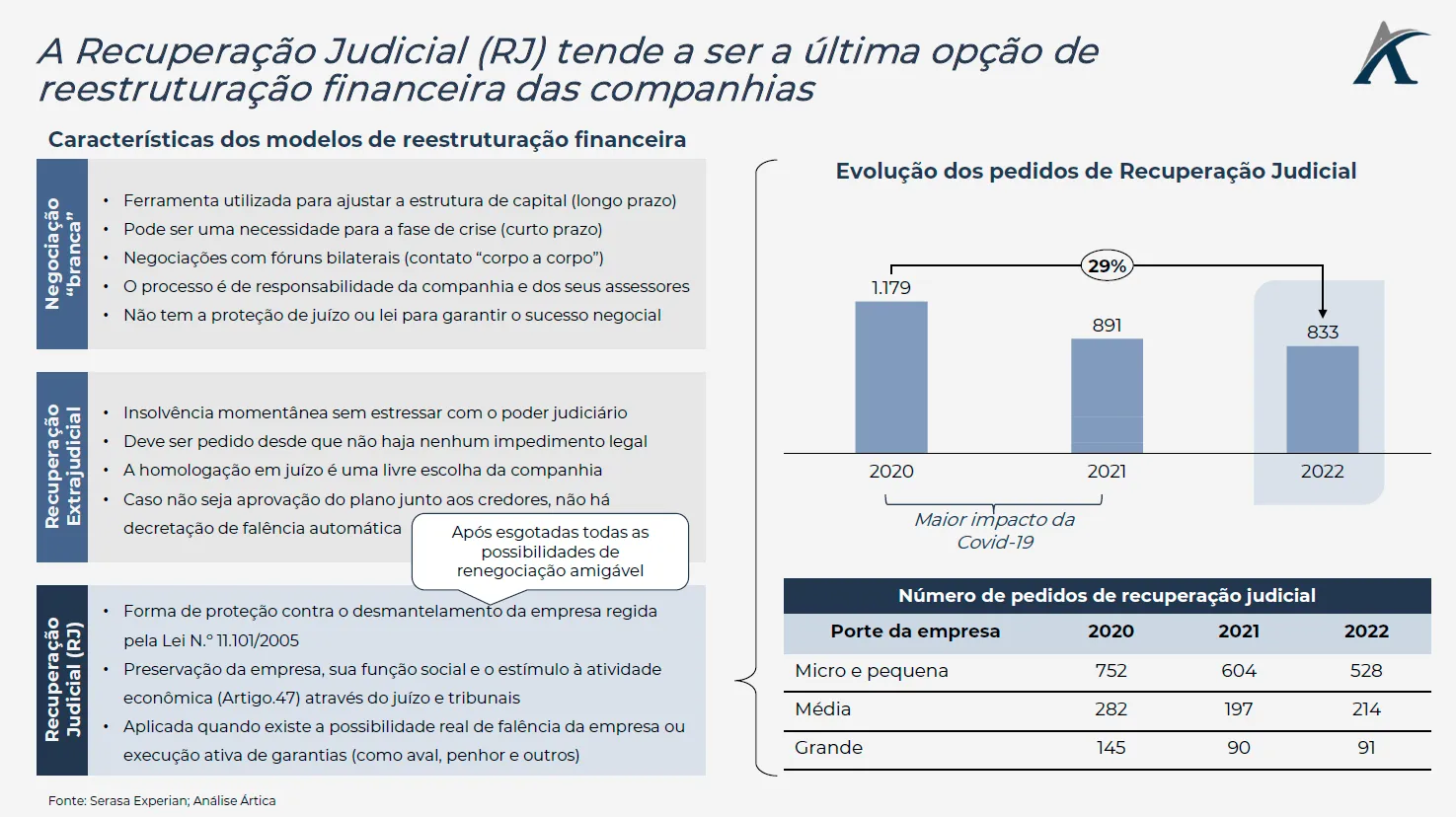

When addressing the topic of corporate financial restructuring, it's important to take a step back from the topic of judicial recovery, as this option tends to be a last resort for companies struggling with liquidity and negotiations with creditors. A good manager needs to keep in mind that readjusting liabilities for business sustainability can occur at the administrative level before legal support is sought, and manage the best alternative for each negotiation process.

This financial restructuring can be divided into three main paths: white-collar negotiation, out-of-court reorganization, and judicial reorganization. The options differ in the negotiation method and also in aspects such as cash flow protection, costs involved, and partner attrition.