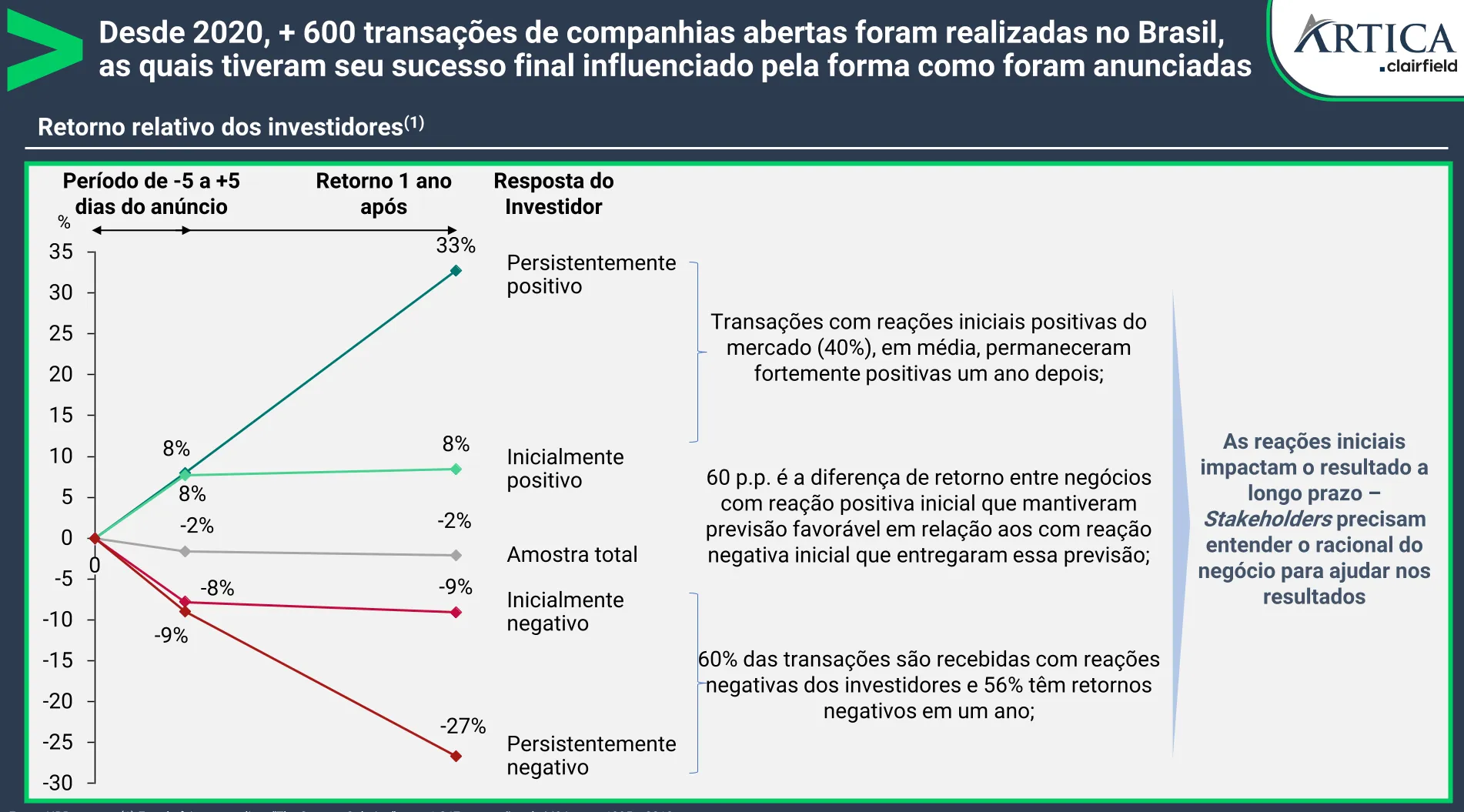

M&A processes typically involve efforts from both parties until their conclusion, but this effort doesn't end there. In the last two years alone, over 600 publicly traded companies have been completed in Brazil, making it crucial to understand that the way a deal is announced to the market plays a significant role in the success of transactions after the event.

A Harvard Business Review (HBR) study was conducted to observe how investors reacted to transactions between 1995 and 2018 at short intervals after the day of the announcement, and how the company's shares performed over the year following the end of the transaction, in relation to other shares in the same sector.

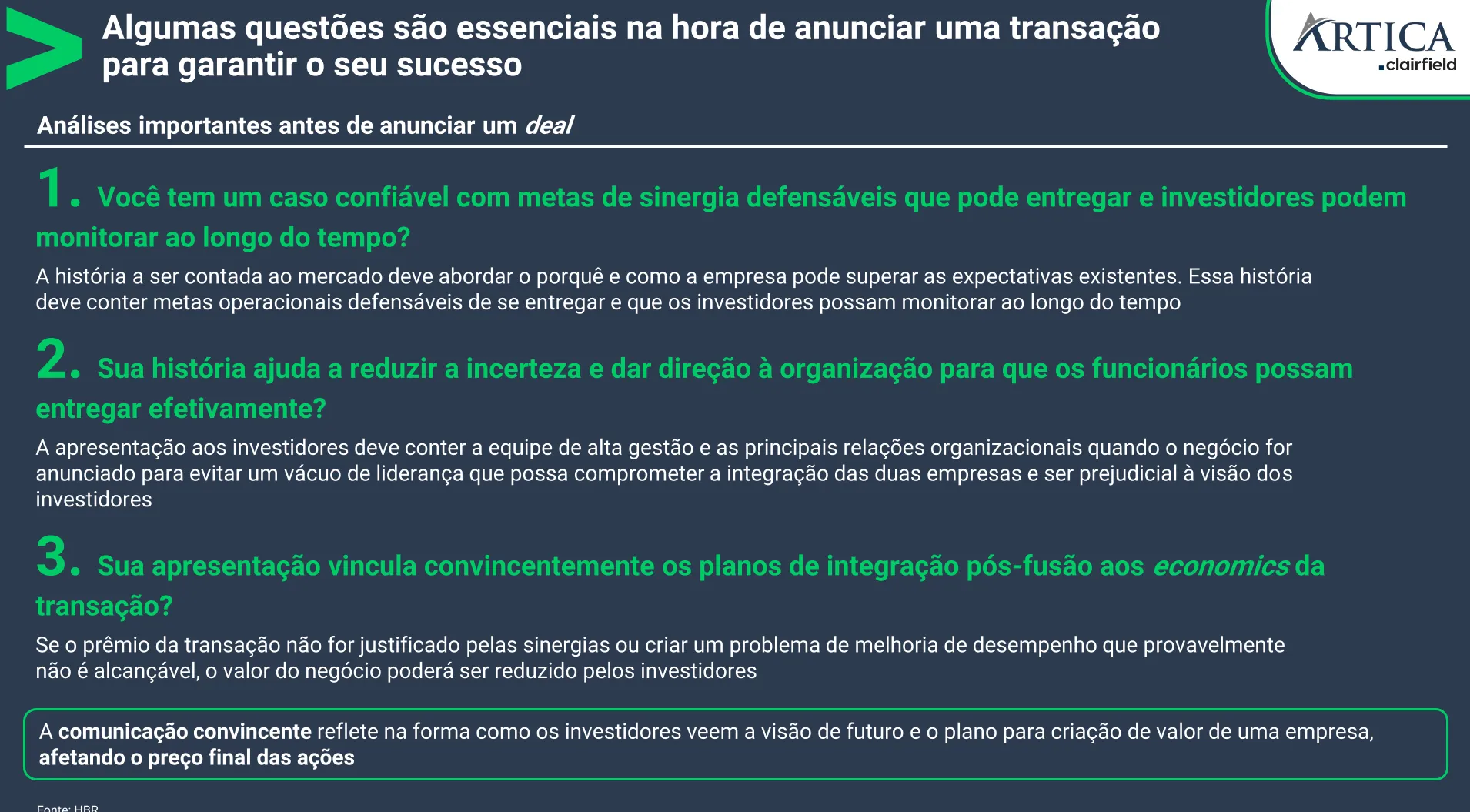

Through this study, we noted that the initial reactions that impact share prices after the transaction announcement often reflect long-term consequences. Buyers need to inform investors about the deal's rationale so they understand why and how additional value will be created in the future, thus maintaining their appeal to current investors (in addition to attracting new ones). They must also ensure the market understands the long-term objective of their move.

To ensure the correct way to communicate with investors, we have outlined in the post below some essential points on how to correctly communicate with the investor base when announcing a transaction.

Study link: https://lnkd.in/gsE3JvpM.