Countries committed to carbon neutrality targets represent 90% of global GDP. Although some of the solutions to meet this commitment are already commercially viable, the path to becoming carbon neutral will be long: it is estimated that achieving carbon neutrality in the next 30 years will require investments of around US$$ 150 trillion.

Pressure on companies to reduce their emissions comes from both sides: on the one hand, the public sector acts by establishing greenhouse gas generation limits and the possibility of a "carbon tax"; on the other, the private sector increases its demands on ESG issues when investing in companies.

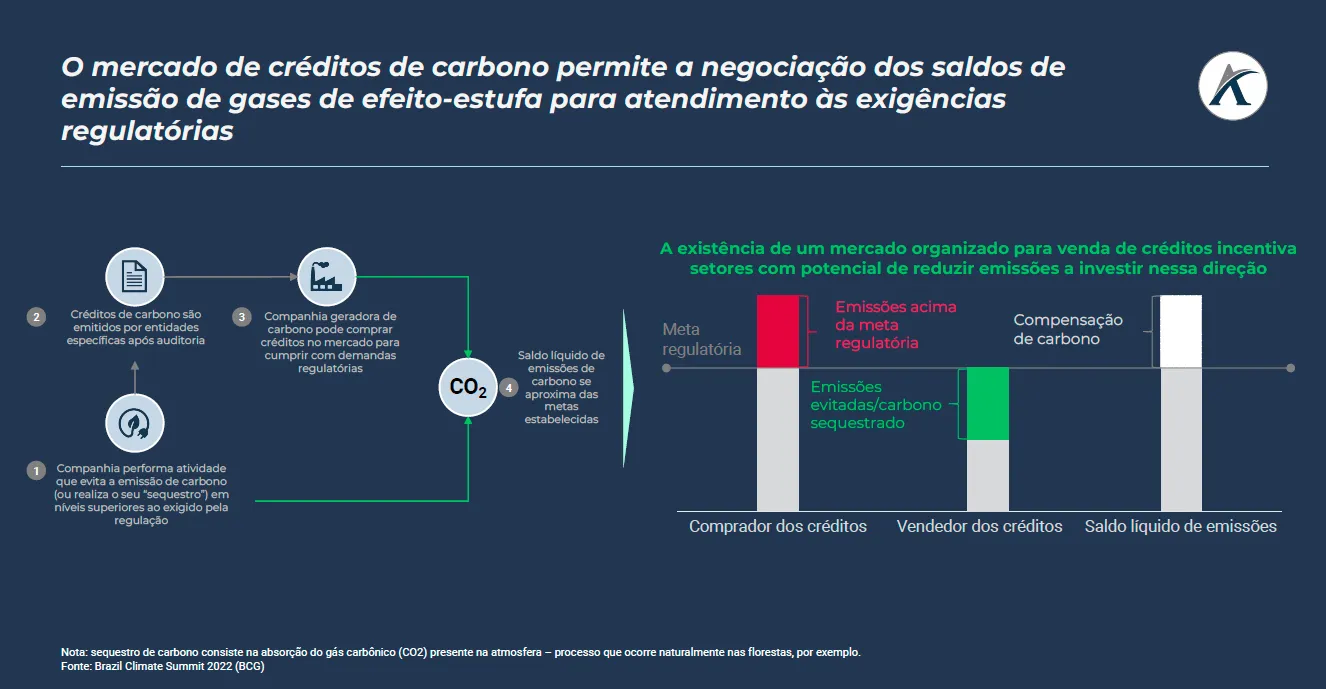

With some sectors finding it easier than others to reduce their emissions, the carbon credit market is advancing as a solution and a means of collection for many of them: on the one hand, we have highly carbon-generating sectors that struggle to meet regulatory targets and investor demands; on the other, we have sectors that can easily reduce their emissions or even sequester carbon from the atmosphere.

The credit market allows these two ends to meet, encouraging those capable of reducing their emissions to spend the necessary resources and then benefit from the sales of the generated credits.