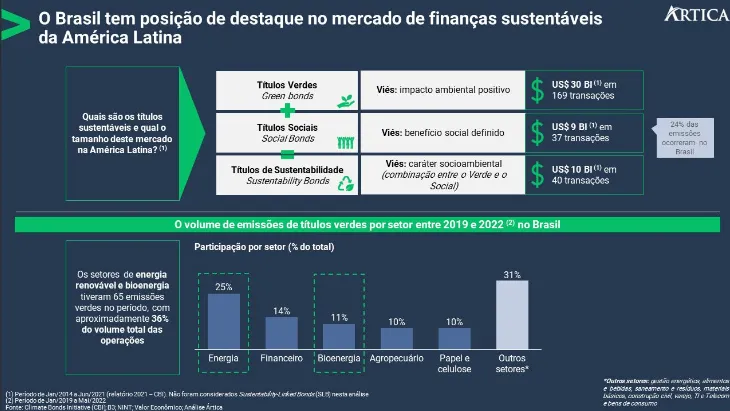

The sustainable finance market in Brazil has accumulated US$$12 BI in social and sustainable green bonds issued since 2015, within a universe of US$$49 BI in Latin America, according to the report released by the Climate Bonds Initiative (CBI) in 2021.

The country is emerging as a destination of interest for financial investments, with projects aimed at creating a positive socio-environmental impact in Latin America.

Bonds can be issued by companies, governments, and multilateral entities, providing an opportunity to expand fundraising with a green, social, or even a mix of both.

Fundraising can also be linked to ESG targets and KPIs that enable a gradual reduction in interest rates, through so-called "Sustainability-Linked Bonds" (SLB). The Brazilian market managed to classify US$1.5 billion (US$1.4 billion) into this SLB category, totaling US$1.5 billion (US$1.4 billion) in sustainable finance.

It is not yet possible to observe a reduction in the interest rate of these issues, when compared to traditional bonds, but the appeal of investors to increasingly seek operations that observe this positive impact is quite evident.