The current global macroeconomic climate, with high inflation and interest rates, has led to widespread discounts on publicly traded shares. By the end of July 2022, the NASDAQ and STOXX Europe 600 indexes, which focus on technology stocks in the US and Europe, reported declines of 21.7% and 10.3% for the year, respectively.

This scenario of discounts has fueled a series of take-private transactions, primarily by private equity funds. Take-private is the term used when a private entity, such as a fund, purchases a company listed on the stock exchange, resulting in its shares being delisted and becoming a private entity.

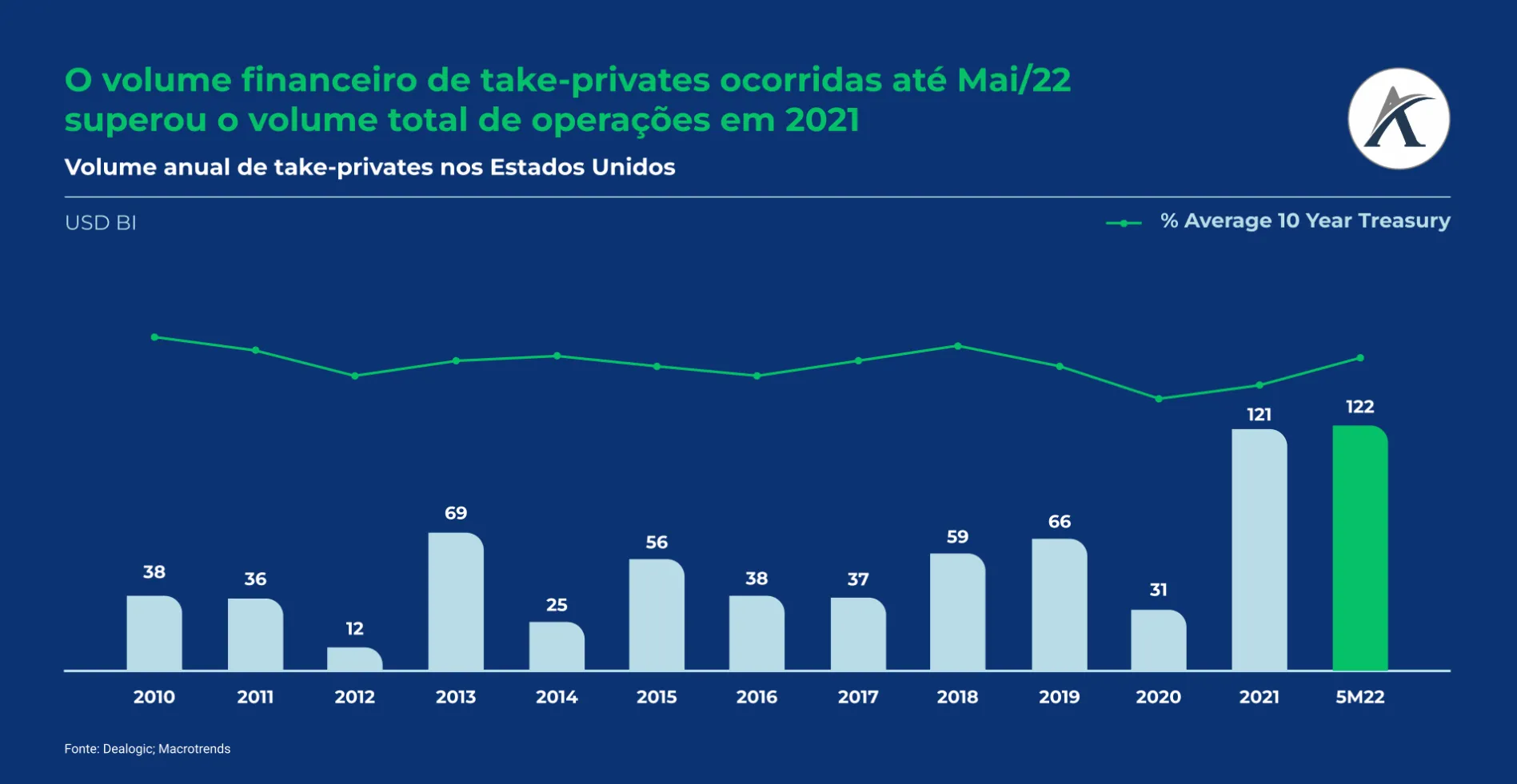

2022 has been a record year for these transactions. In the first half of the year alone, the financial volume of take-private transactions carried out by PE funds worldwide reached US$226.5 billion, representing an increase of US$391 billion compared to the same period last year. In Europe, delisting transactions on stock exchanges involving private equity funds reached US$78 billion, practically double the volume for the same period last year.

Private equity funds reached a record high in fundraising in 2021, totaling US$1,400,000. With their cash positions flush, they found good buying opportunities in the public markets, especially in technology companies that received steep valuation discounts.