The corporate debt segment distributed in the capital market was associated with large companies and publicly traded companies.

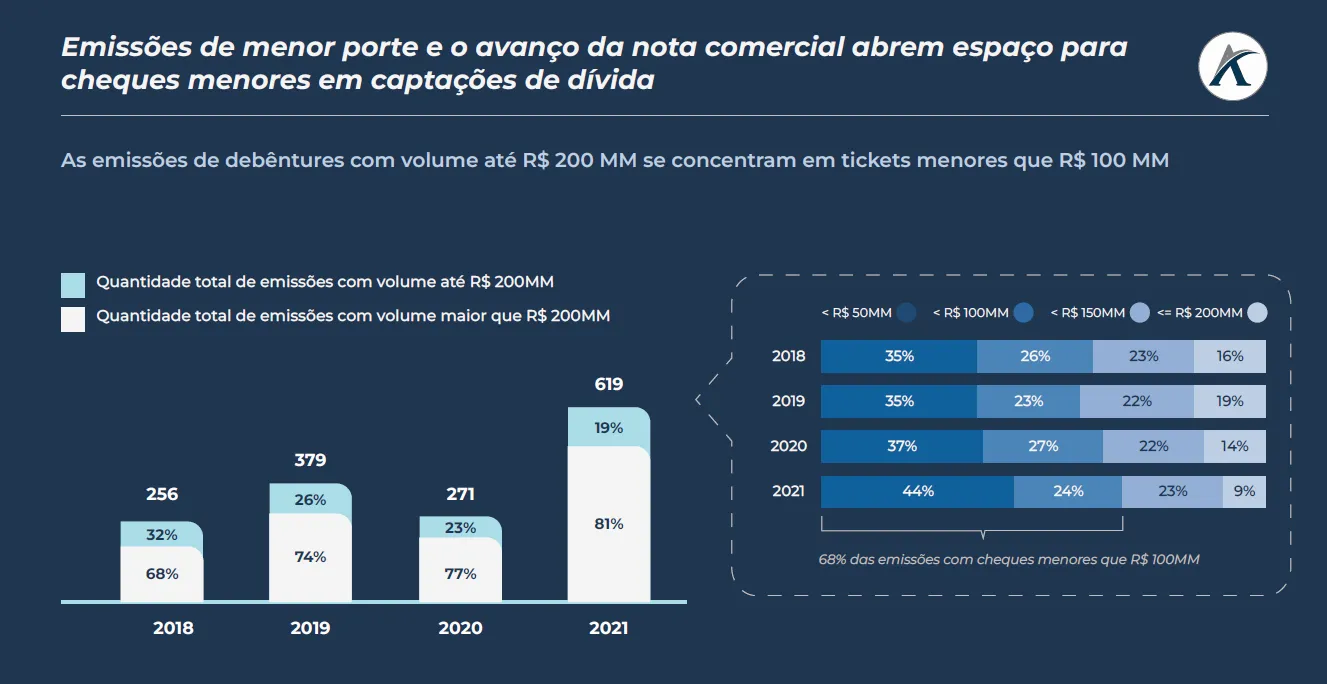

Although large-scale issuances remain the most representative segment of debenture issuances (a recurring debt instrument distributed to the market), accounting for almost 80% of total issuances in 2021, issuances of up to R$ 200 MM have been gradually increasing in volume. There is room in the market for issuers aiming to raise smaller volumes.

This movement is in line with regulatory changes, such as the creation of a specific law for market offerings of Commercial Notes, which reinforced the potential of the Middle Market in this type of financial raising.

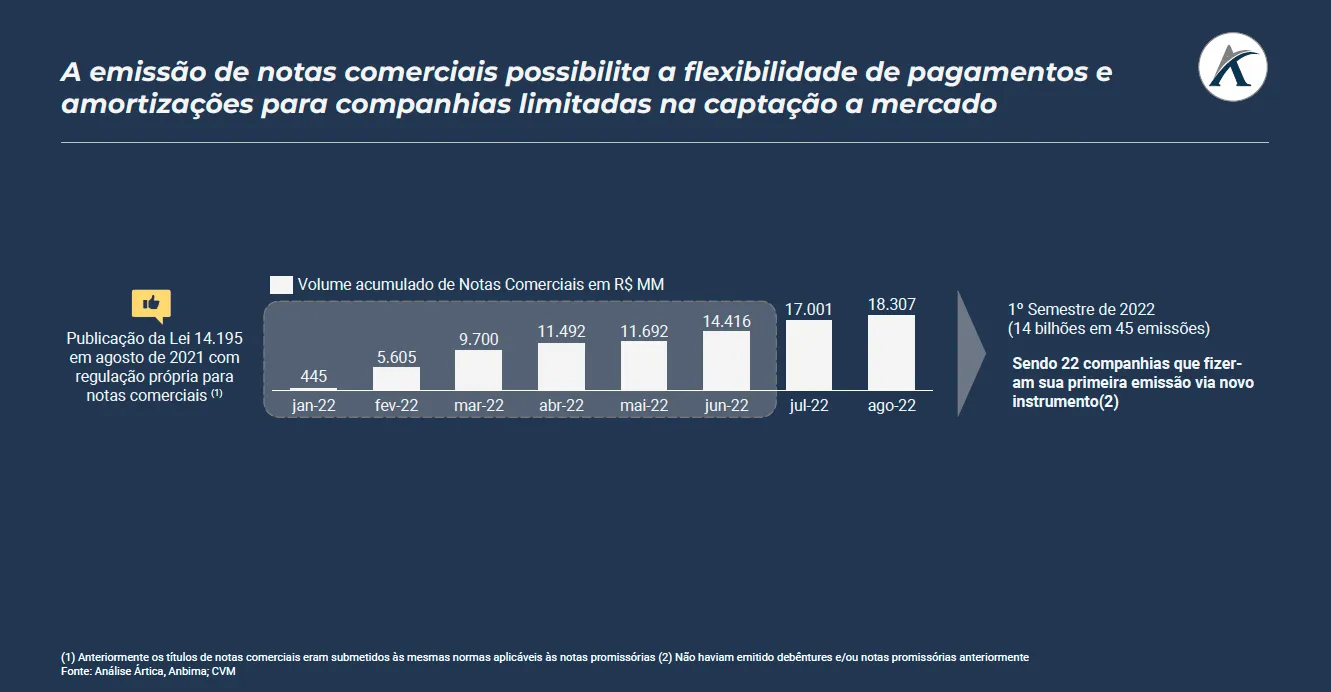

In 2021, the publication of Law 14,195, which regulates Commercial Notes, introduced more flexible amortization and interest payment rules for limited companies, which previously accessed the market following the Promissory Note guidelines.

This change led to the creation of a R$ 14 BI market in the year to date 2022 (January to July), with 22 companies making their first access to the capital market through this financial instrument, that is, companies that had not previously issued debentures and/or promissory notes.

The movement of emissions with smaller volumes tends to increase more and more in the coming years with the exponential need for investments and support of the process by market regulators.