According to a recent study by Accenture, 751% of Private Equity leaders say investments have become more complex over the past five years, while 831% agree that the current approach to due diligence has significant room for improvement.

The consultancy identified three critical factors that transform current due diligence into a more dynamic and value-generating process:

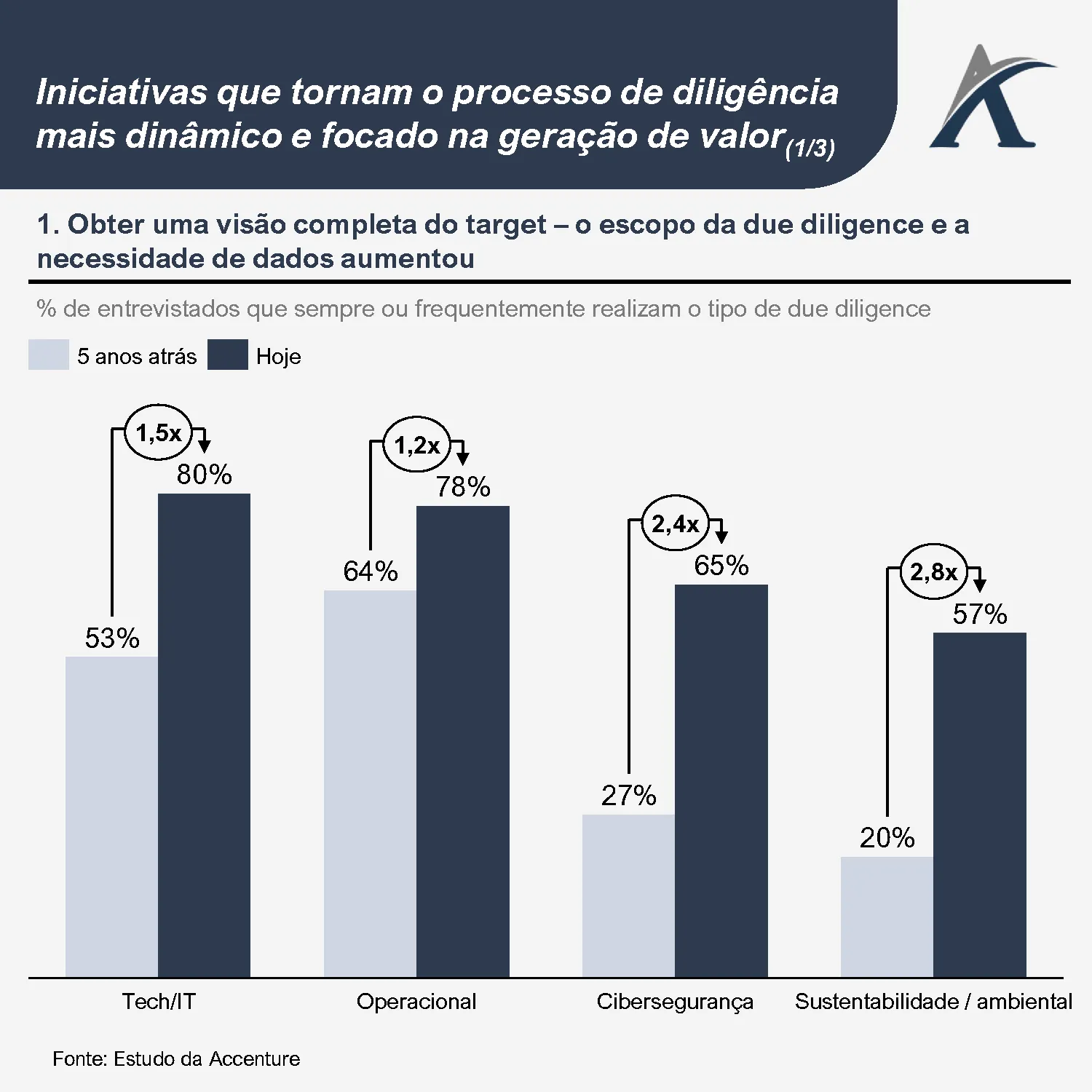

1. Get a complete overview of the company to be acquired:

Discovering gaps in target companies' capabilities, processes, or technology is a common challenge, highlighted by 40% of Accenture's respondents. Connecting insights before the negotiation strengthens the value creation plan and justifies higher offers.

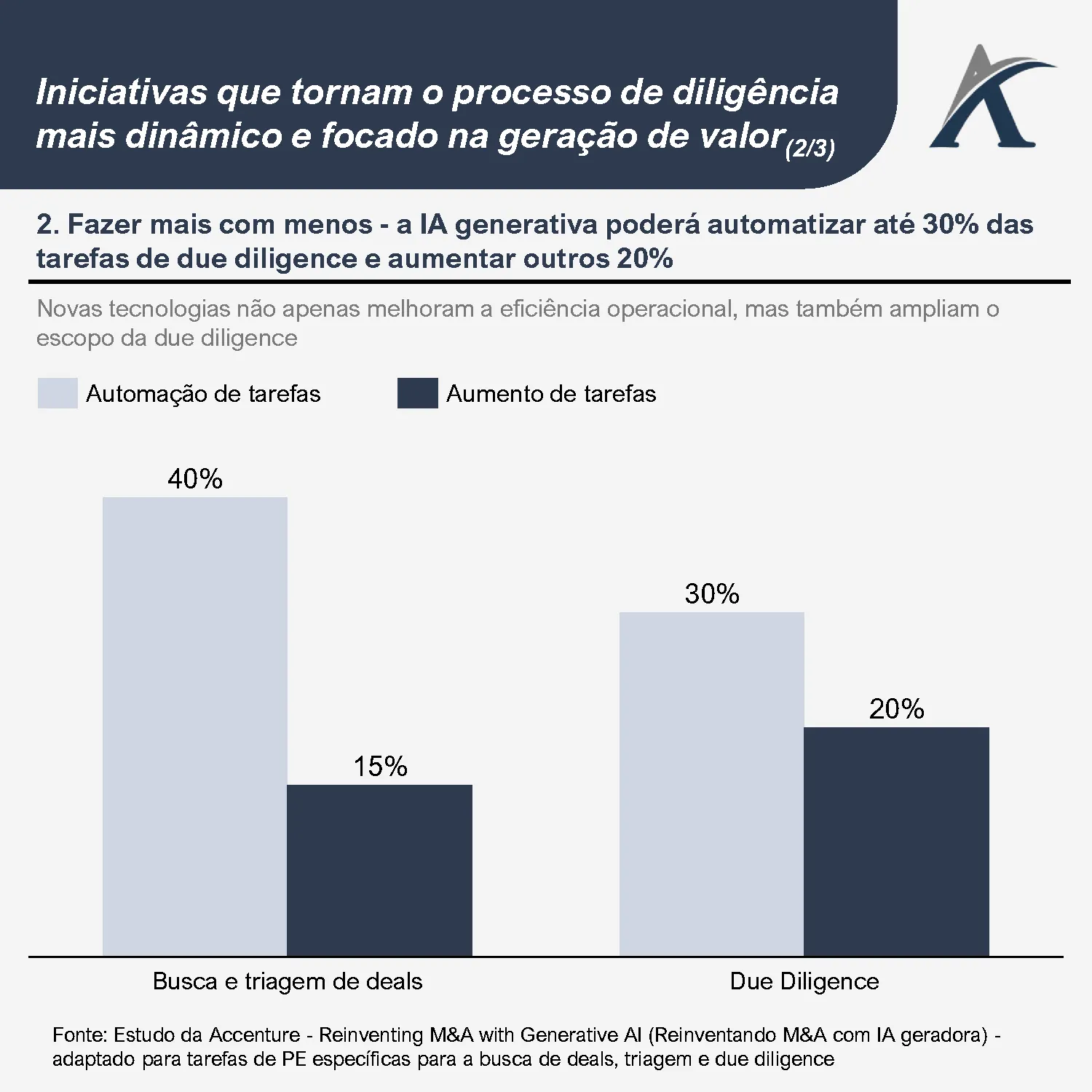

2. Do more with less

Companies that use technology for target screening and due diligence gain agility and depth in their analyses. Nearly 621% of leaders believe that tools like data analytics and AI will fundamentally transform these processes.

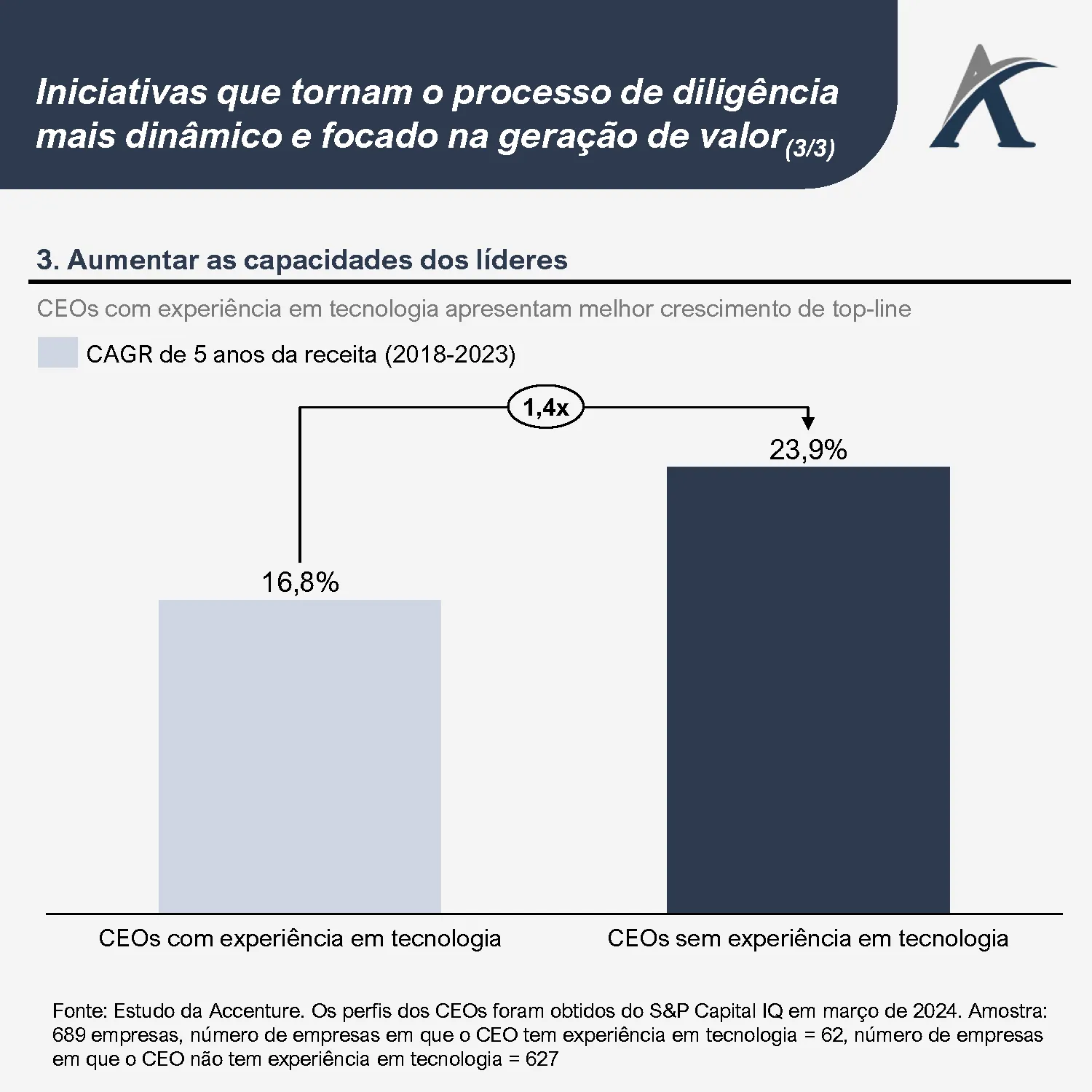

3. Increase the capabilities of leaders

Leadership capability gaps in portfolio companies have become a critical obstacle to value creation, cited by 47% of leaders. With disruptive technological advances, CEOs with technology backgrounds are better equipped to manage change. According to Accenture, these leaders generated a revenue CAGR of 23.9% over five years, 1.4x higher than CEOs without this experience.

Read the full Accenture article: It's time to rethink private equity due diligence.