In addition to companies' internal motivations and capabilities, conducting an IPO (Initial Public Offering) is highly sensitive to external factors. Factors such as inflation, high interest rates, and market uncertainty and volatility have a significant impact on IPO windows, hindering their opening.

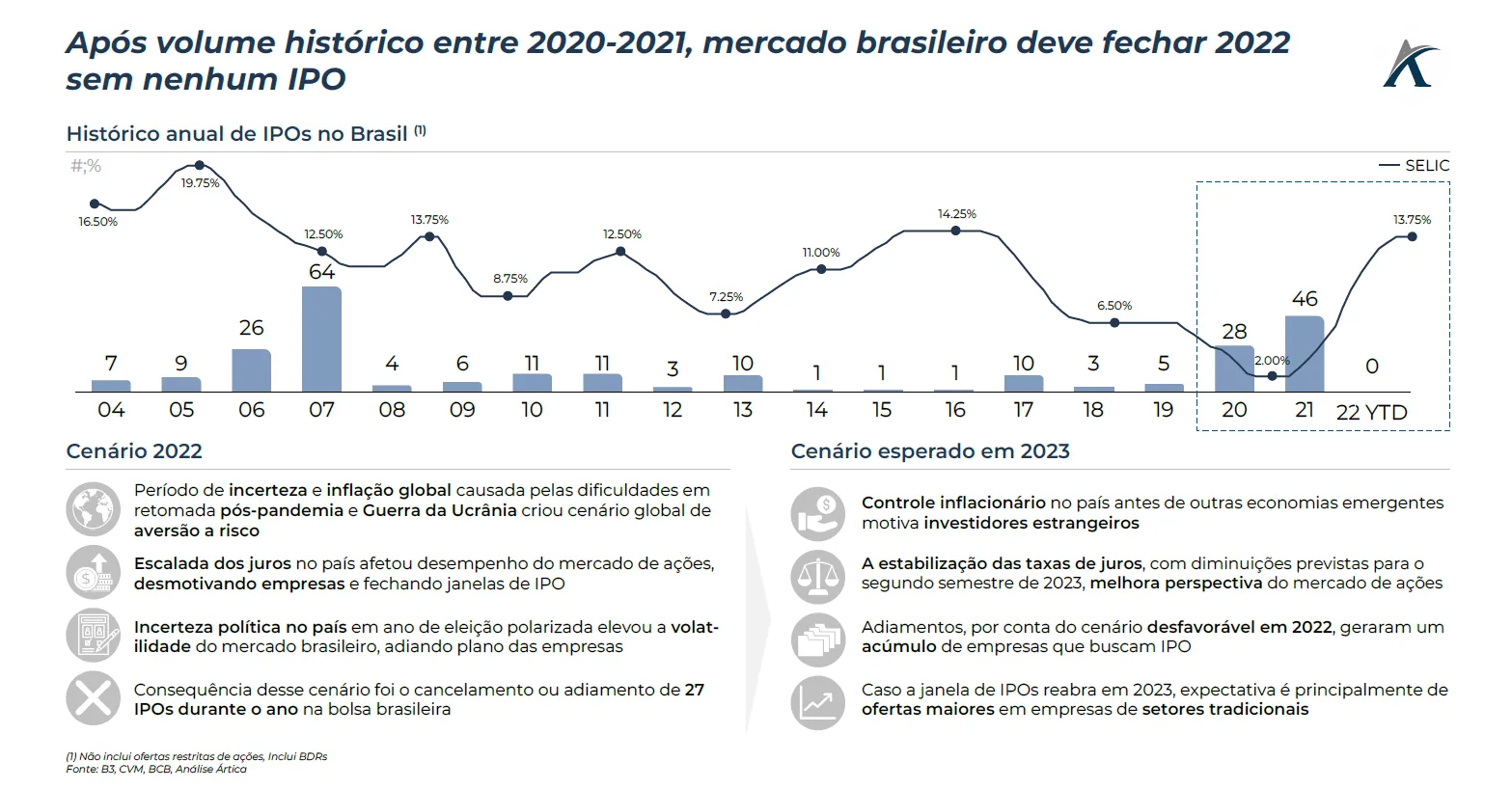

In Brazil, after a busy period with more than 70 transactions between 2020 and 2021, there have been no new offerings in 2022 due to the destabilization of the capital markets during the year. This situation was generated by global uncertainties arising from the post-pandemic recovery and the war in Ukraine, coupled with rising interest rates in the country and political polarization in an election year. As a result, 27 companies have already withdrawn or postponed their offerings during the year.

However, the country's inflation control and the expectation of a decline in interest rates starting in the second half of the year are indicative of economic recovery and provide better future visibility. These are necessary conditions for the opening of IPO windows, but uncertainty remains regarding the consolidation of this scenario. Therefore, if the window reopens in 2023, larger offerings are expected in companies in traditional sectors, targeting larger and foreign investors.