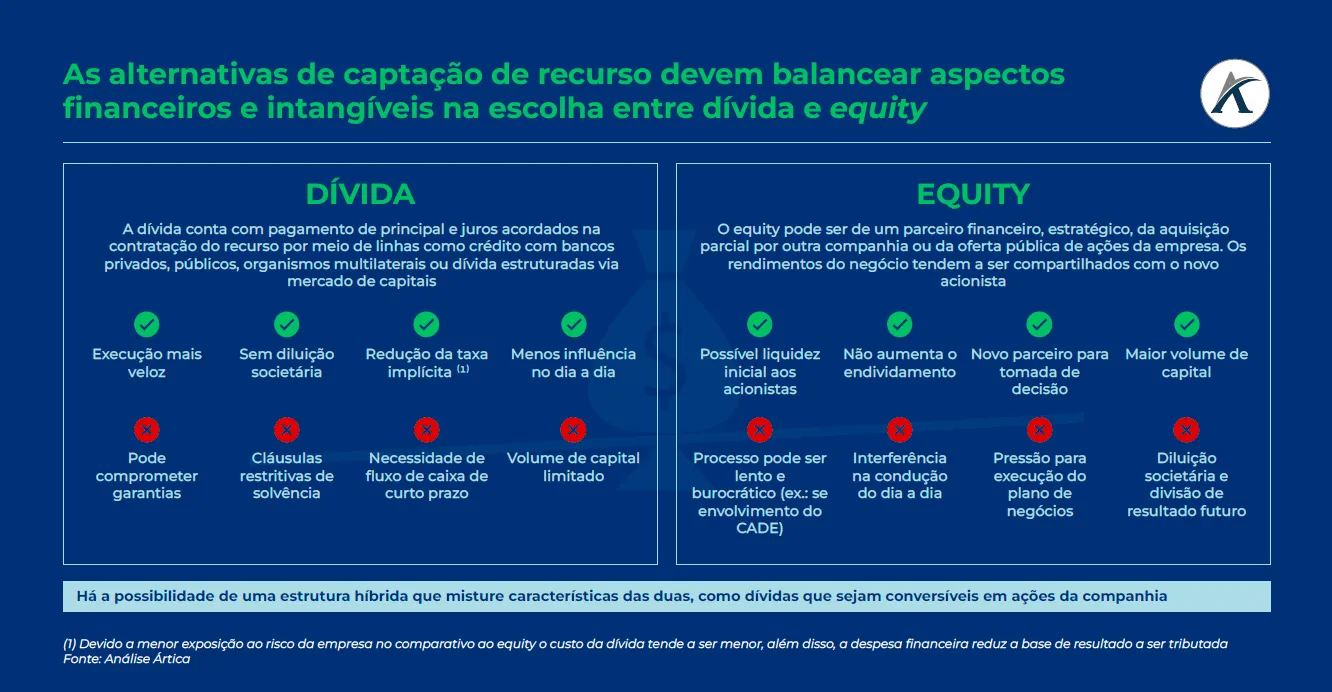

Every entrepreneur has at some point considered the alternatives available for raising funds for their business, whether to expand their operations, invest in new projects, or raise working capital. The question of whether to invest through equity or debt is common in the corporate world, and the decision between these alternatives is complex because it involves managing factors such as timeframe, liquidity, volume, capital structure, and other intangible strategic aspects.

The alternatives are not mutually exclusive, and the best capital structure will depend on the individual assessment. For example, a debt with third parties may provide capital that requires less influence over the company's day-to-day operations, as it analyzes and prioritizes the payment capacity of the contracted transaction.

This can be positive if the current shareholder doesn't want to face external pressure on their strategic business decisions or doesn't want to share in future results. However, in some cases, the acquisition of a stake in the company by an experienced player can boost the growth levers of the business model and generate value in its day-to-day operations.

Therefore, analyzing the advantages and disadvantages of fundraising alternatives is essential for decision-making. Furthermore, there is no single answer to decision-making and it varies depending on the company's current situation and the market in which it operates. We recommend that shareholders and executives continually review their business plan and the most efficient capital structure for their company's current situation.