About Ártica Long Term FIA

In our investment fund, Ártica Long Term FIA, we have a team of professionals dedicated to management.

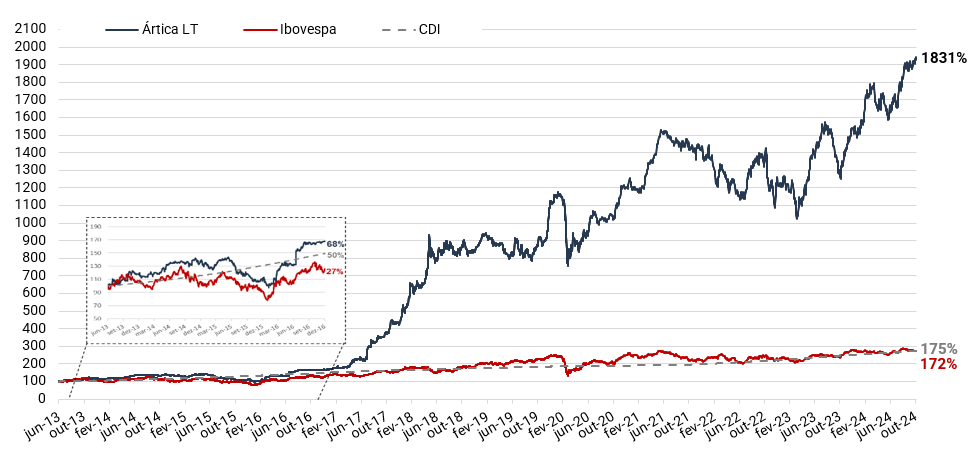

We all invest a significant portion of our personal assets in this fund, which reinforces our commitment to taking care of it with maximum discipline and responsibility, continuing the investment strategy that resulted in an average return of almost 30% per year since the creation of this investment vehicle, in June 2013, until October 2024.

Our Principles

SAFETY MARGIN

We believe that requiring a margin of safety in the purchase price is the most efficient way to reduce risk.

DISCIPLINE AND PATIENCE

We maintain a high analytical rigor and exercise patience, waiting for exceptional opportunities to arise.

LONG-TERM PERSPECTIVES

We develop investment theses with a horizon spanning years. We do not seek to predict short-term stock market fluctuations.

FOCUS ON STRONG COMPANIES

Our focus is on identifying companies with clear and sustainable competitive advantages that contribute to their profitability and resilience.

Profitability

(1) Ártica LT started on 06/27/2013 as an “investment club” and, on 09/27/2019, it was transformed into a “stock investment fund”. Profitability presented from the beginning on 06/27/2013 until 10/31/2024.

(2) The profitability presented is adjusted as it considers the reinvestment of dividends, interest on equity or other income arising from financial assets that are part of the Fund's portfolio passed directly to the shareholder, which was permitted by law until 2015. The practice avoided the charging 15% taxes on the value of the dividends, but it meant that the dividends received were not incorporated into the value of the Ártica shares.

Where to invest

*Available on demand

We want to meet you!

Here at Ártica, we value a close and transparent relationship with our investors. To this end, we hold restricted quarterly results meetings, in addition to having an IR team always available for any questions.

If you are our investor and are interested in participating, simply register by clicking the button below:

Technical Features

ANBIMA classification

Free Actions

Manager

Artica Long Term FIA

Administrator / Custodian

BTG Pactual

Minimum investment

R$ 20 thousand

Additional investment

R$ 1.0 thousand

Global rate

2% aa

Performance fee

20% on what to exceed the Ibovespa, with watermark

Application quotas

D+1 (business day)

Redemption quotas

D + 89 (calendar days)

Financial settlement

D + 1 (after subscription)

Taxation (IR)

15% of gain, on redemption (without share eaters)

Target Audience

Qualified Investors

Documents

Compliance

All rights reserved.

Sign up for our newsletter