Dear investors,

10 years ago, on June 27, 2013, we formed an investment club called Arcadia, with initial capital of R$ 126 thousand. At the time, the objective was to join efforts to better manage our investments in the stock exchange, since we all worked with investment banking and our free time was insufficient for each one to take care of their investments separately.

The strategy worked. We started to have good results, we increased our investments and we also received contributions from some friends and family. At the end of 2014, we had R$ 6 million under management, still minuscule compared to investment funds. With the high return and some new contributions, at the end of 2018, we reached R$ 46 million of capital under management, already enough for us to decide to found a professional management company and transform the club into an investment fund. This is the story of how Ártica Asset Management came about and how Clube Arcadia became the current Ártica Long Term FIA, which completed 10 years of history last week.

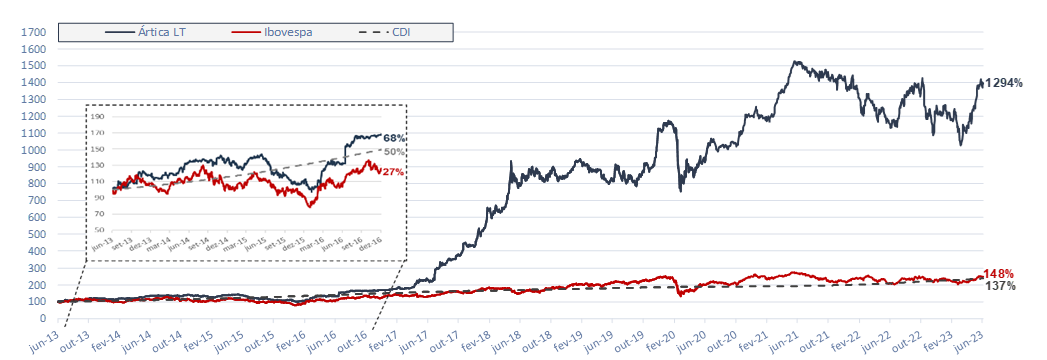

We closed our first decade of investment with an accumulated return of 1,294% up to 06/30/2023, corresponding to an average annual return of 30% per year.

History of the value of Ártica Long Term FIA shares [1]

In this letter, we are going to tell you about some episodes and learnings that our manager had along the way and that helped us to consolidate the investment philosophy that we follow today.

Investment theses mature in a non-linear way

unite

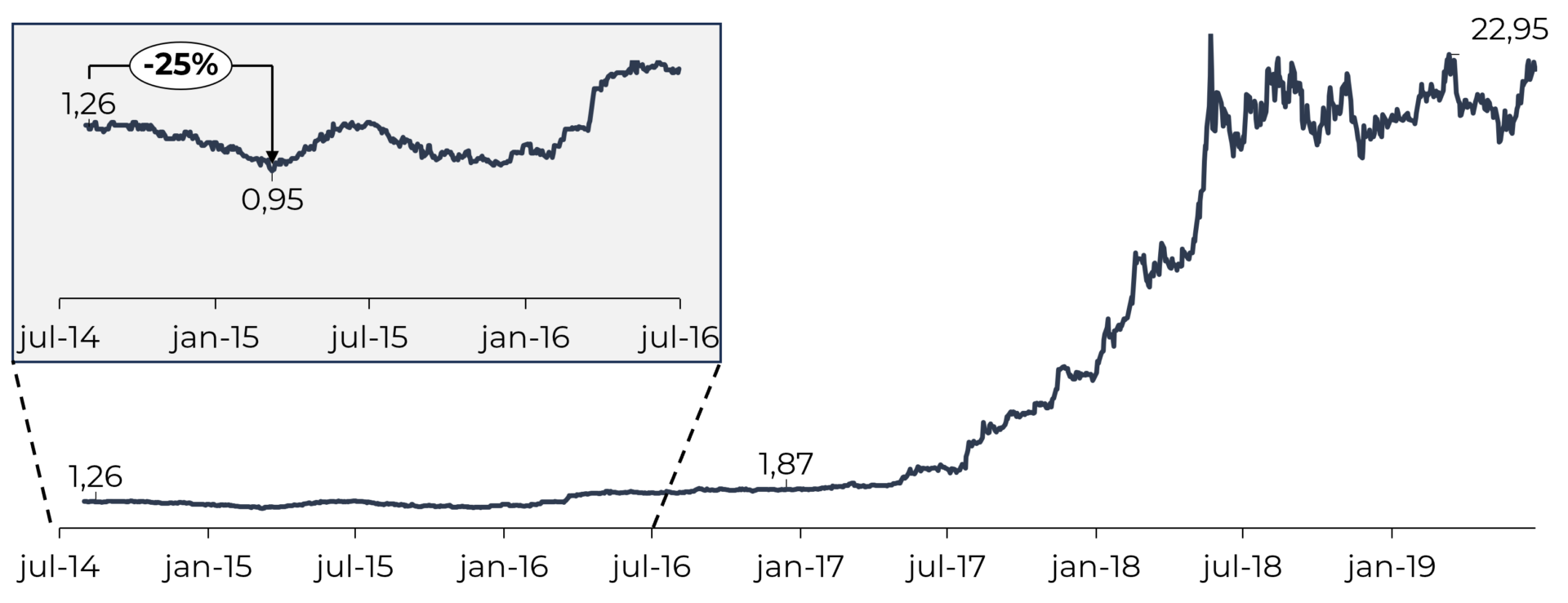

In 2013, Unipar's only asset was 50% from Carbocloro, a manufacturer of chlorine and soda. That year, Unipar announced the purchase of the other 50% from Carbocloro and the acquisition price caught our attention. The asset purchased was exactly the same asset that Unipar already had, but it paid for the second half of Carbocloro around 25% more than what Unipar was worth on the stock exchange. That is, either Unipar had paid dearly for the acquisition or its share was devalued on the stock exchange. With that, we deepened the analyzes to estimate the real value of Carbocloro and realized that Unipar, now owner of 100% of Carbocloro, was worth at least twice its price traded on the stock exchange.

In August 2014, we started to buy Unipar shares. Six months later, the share price had dropped by 25% (vs. IBOV's 12% drop in the period). With all the discomfort that a fall of this magnitude generates, even more so in a recently purchased position with a good margin of safety, we carried out a detailed review of the thesis. The result of this review was counterintuitive.

Carbocloro's operations continued to do very well, even better than our initial expectations. The drop in share prices seemed more related to macro factors (2015 was the year of the crisis related to Dilma's impeachment) than to the performance of the company itself. In this scenario, we decided to buy more shares.

Our belief in Unipar's value was not shared by the market for a long time. The stock only started to rise at a more expressive pace from the second half of 2017 onwards. That is, we held the stock sideways for 3 years before seeing the thesis really proved correct and Unipar's price rising rapidly the following year . We sold our entire position in 2019 after 5 years as shareholders. During this period, we received almost the same amount in dividends as we had paid for the shares, so the sale was practically pure profit and generated a return of around 20x the invested capital. The price expansion during the period in which we were shareholders is illustrated in the graph below.

Price history* for UNIP6

This case illustrates well the fact that the market is far from perfectly pricing the value of listed companies. Unipar's price volatility during this period was much greater than the volatility of its operating results. Another lesson that remains is the importance of being patient. If we had been frustrated with the first years without expressive appreciation and sold the position, we would have stopped earning several million reais for our investors. This investment case is detailed in our July 2020 letter.

After our sale, the stock went sideways for about a year and a half and rose again until it surpassed R$ 100. Even with the 20x return on investment in Unipar, until today we still feel some remorse for not having bought this stock again. stock, which we knew so well, and took advantage of the second wave of appreciation. It's part of the fate of investors to ruminate over calculations of the extra returns they could have earned if they had made a few different decisions over their lifetime.

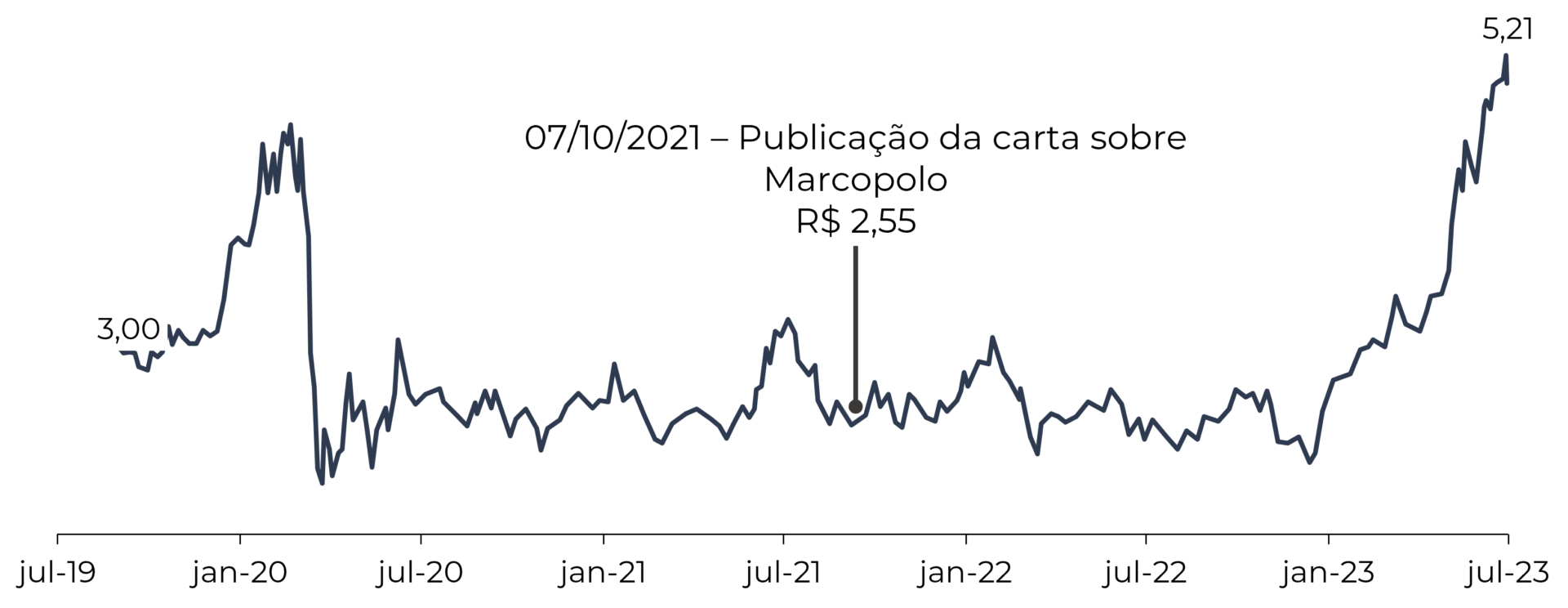

Marcopolo

A more recent case that we still have in our portfolio illustrates the same point. In 2019, we started to buy shares in Marcopolo, the leading manufacturer of bus bodies in Brazil. In summary, the rationale of the thesis is that the Brazilian bus fleet is much older than the age of equilibrium implicit in the history of the last 25 years. As bus changes are technical decisions (when the bus starts to cost maintenance and cause excessive stops due to mechanical problems, it is time to change it), it was expected that a wave of higher sales volumes would come until the age of fleet returns to its normal level.

The path over the years has been tortuous. The first months after our purchases were positive, the price rose by around 50%, until the pandemic hit and the stock dropped to 35% below our purchase price. We reviewed our accounts and the penalty appeared to be excessive, so we bought more Marcopolo shares.

Being honest, at the time we thought the pandemic would last less time (who didn't think throw the first stone). For those who are curious, the vision we had about the covid crisis at the time is in the April 2020 letter. In any case, the advantage of a thesis supported by the fact that the bus fleet is old is that the passage of time can only make it even older, so we increased investments in Marcopolo until we reached a position of around 6x greater than what we had before the pandemic.

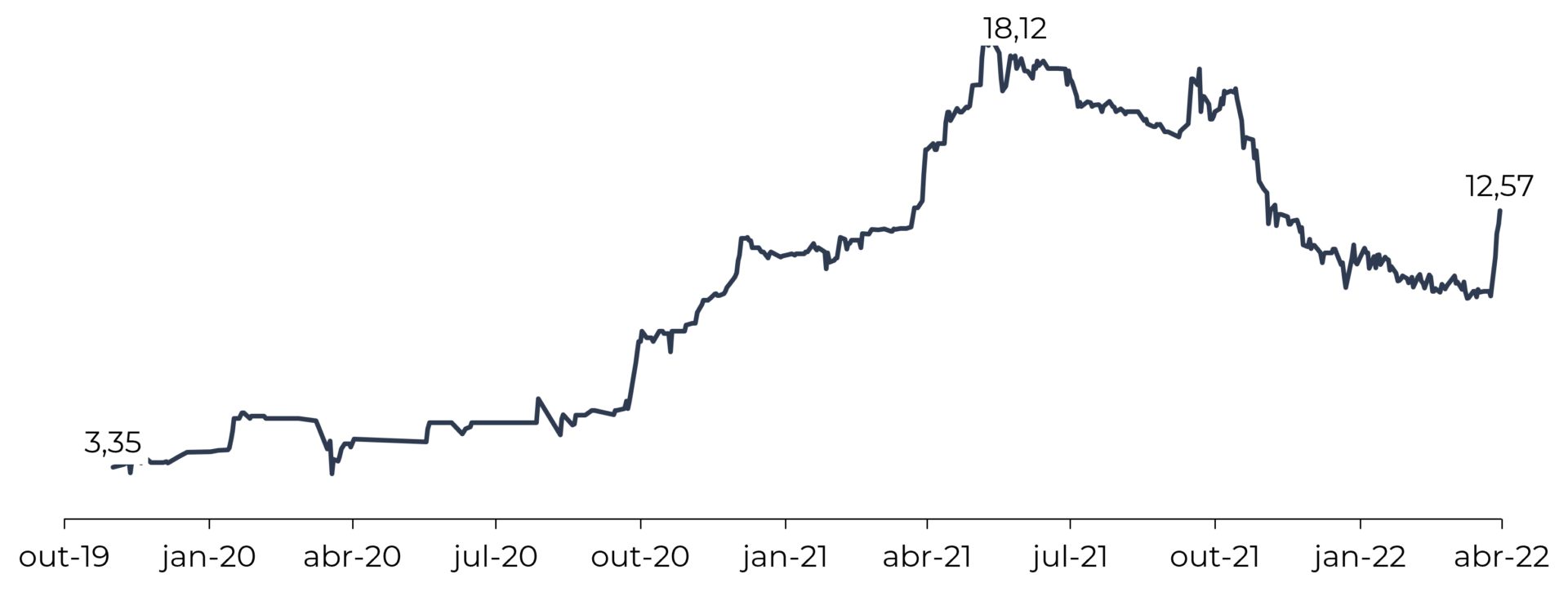

Today, that investment has already proven to be quite profitable, as seen in the share price chart below. The thesis is described in more detail, including our rationale for increasing the position amid the pandemic, in the October 2021 letter.

Price history* of POMO4

Good returns do not depend on buying and selling all the time

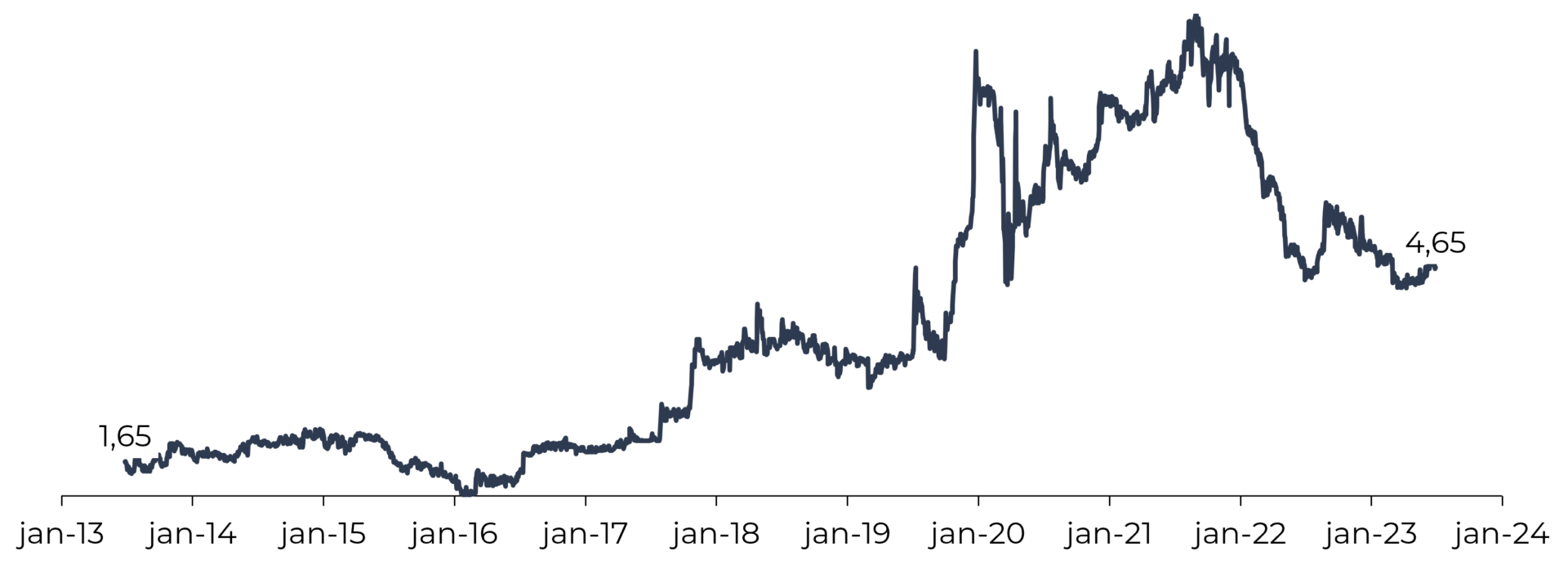

Another case of successful investment, but with a very different profile, was in Whirpool, the company that manufactures home appliances for Brastemp, Consul and Kitchen Aid in Brazil. Despite the fact that the company earns ~R$ 11 billion per year, it is hardly heard of in the Brazilian market because its stock is very little liquid (today the trading volume is ~R$ 40 thousand per day). The lack of liquidity has historical reasons.

The B3-listed company is a subsidiary of Whilrpool Corp, one of the global leaders in home appliances, listed on the New York Stock Exchange and with annual revenues of ~USD 20 billion. The parent company tried to delist its Brazilian subsidiary twice: the first in 2000, which reduced the share's free-float to 5%, and in 2016, which reduced the free-float even further, to the current 2%.

This was our first investment thesis. We bought the first shares in 2013 and increased our position in the company over the years. In the second attempt to go private, we were already shareholders and we organized a minority group to negotiate what we understood to be a fair price for the offer. Negotiating the price with the company's executives was unsuccessful, but we managed to prevent the company from going private at too low a price and maintained our portfolio investment.

Due to the lack of liquidity, the company is despised on the stock exchange and it is unlikely that we will see huge increases in the price of its shares, but its business is excellent, with very relevant competitive advantages, and it generates excellent dividends. We have had the stock in our portfolio for 10 years, we took advantage of downturns to increase investment over time and today we have an internal rate of return of 14% pa since the beginning, even with the stock currently at a very low price level.

WHRL4 Price History*

The exchange also offers unusual opportunities

Buying shares in a good company at attractive prices and waiting for time to generate good returns is the most traditional investment formula, but not every opportunity fits into this category. In 2019, the case of Companhia Energética de Brasília (CEB), a state-owned company controlled by the Federal District government, caught our attention. At the time, the company's biggest asset was an electricity distributor (CEB-D), which had a loss-making operation and risk of losing its concession because the regulation of the electricity sector requires operators to maintain minimum indicators of financial health. Far from what we would classify as “a good company”.

However, there were plans to privatize CEB-D and, in that case, it could prove to be a valuable asset as the Brazilian electricity sector has a successful track record in privatizing state-owned companies (Equatorial and Energisa, for example, managed to generate enormous value to its shareholders by acquiring state-owned companies and making them more efficient). We decided to analyze the situation in detail.

In summary, we concluded that there were two very different scenarios for the future of an eventual investment. If CEB-D were privatized, the likely return was around 150%. If the privatization did not happen, the risk was that the company would lose around 50% of its stock market value at the time. That is, if the probability of privatization was greater than 25%, the expected value of the investment was positive. We followed the case until it seemed to us that the probability of privatization success was quite high and we started to buy CEB shares in November 2019.

As the thesis risk was relevant, we started with a small investment and, as the privatization process became more certain, we bought more until we had around 10% of the fund invested in CEB.

The privatization of CEB-D was completed in March 2021, for an acquisition price greater than we had considered. After that, the market was still slow to properly evaluate the share price. For months, CEB's stock market value was below the cash position it would have after receiving payment for the sale of CEB-D. As a result, we maintained our investment for another year and sold it in 2022, with an accumulated return of 5x the invested capital. More details about this investment were described in our January 2021 letter.

CEBR6 Price History*

Not every thesis will be successful, it takes constant attention and flexibility to change your mind

As not everything is rosy, we'll tell you about our worst investment, which was in Restoque (currently changed its name to Veste), the clothing manufacturer and retailer that owns the brands Le Lis Blanc, Dudalina and a few others.

The company had a history full of problems after acquiring Dudalina from its founders, partly due to frustrated strategies, partly due to conflicts between its main shareholders. However, the action seemed very cheap, the conflicts between the partners seemed to be resolved and the business recovery plan presented by its executives was reasonable. We followed the company for some time and, after 3 quarters in a row of indicators improving, we understood that the recovery plan was starting to bear fruit and this would be a turning point for the business. If the plan's implementation was successful, the upside potential was enormous. We started buying shares in the middle of the 3rd quarter of 2018.

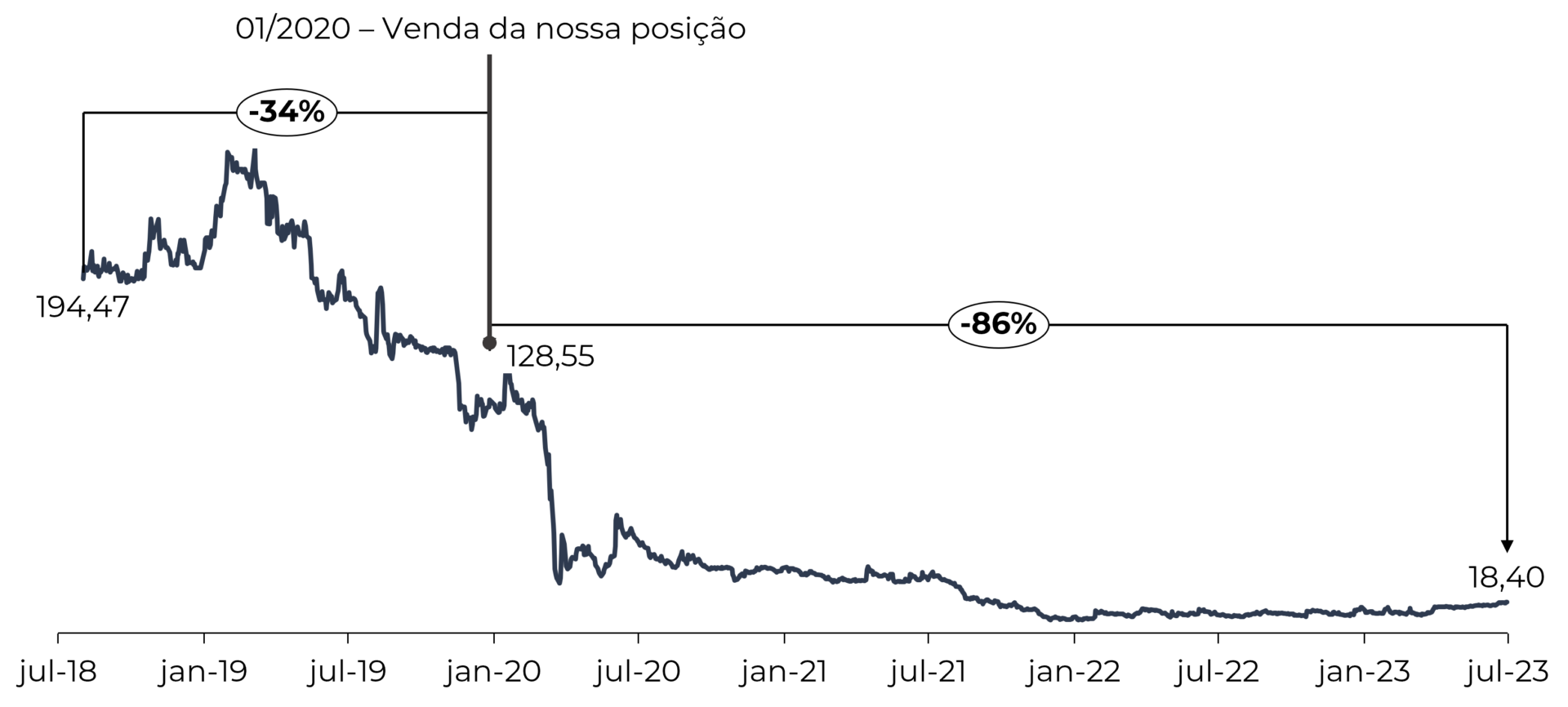

In the following 2 quarters, operating indicators deteriorated again. As operational restructurings are always complex, we gave the company and the executive team the benefit of the doubt and remain invested. After 5 quarters of poor results, at the beginning of 2020 we decided to liquidate our position and we had a loss of around 30% of the amount invested.

Price history* of LLIS3

The only consolation is that the decision to exit was the right one, as after we sold the stock continued to fall to a fraction of its historical value. Recently the company had to go through a capital restructuring.

It was our first major loss case and we make a point of remembering it from time to time, to contemplate the irrefutable proof that even carefully crafted theses can be dead wrong and keep alive the fear that makes us diligent and willing to change our minds.

The profile of the investor base is important for the good performance of the fund

As you can see, even successful theses have had their “exciting” periods. In these moments, the biggest risk an investor runs is to despair, leaving rationality aside and starting to make decisions based on psychological factors. In addition to the natural pressure that investment bumps generate, fund managers are under an extra element of pressure: demands from their investor base. In that respect, we feel privileged.

Until today, our attraction of new investors is atypical. While most managers decide to make their investment funds available on brokerage platforms, which allow anyone to invest without much information beyond the historical return of the fund, we decided to keep Ártica Long Term FIA out of these platforms and adopted practices that ensure greater alignment of expectations.

We explain to interested people what our strategy is, the results it should generate and what part of their capital is suitable for investing in this way. In short, we seek to maximize the fund's absolute return over long terms, in excess of 5 years. We are subject to periods of volatility along the way (although the volatility of the Ártica LT is very similar to that of the IBOV itself), as we tend to take advantage of moments of market stress to make purchases and are willing to wait several years to sell, while the investment thesis is reasonable. Therefore, it is only appropriate to invest with us a portion of capital that they can leave invested for a few years, ideally with flexible terms to be able to withdraw at a good moment in the market.

Although it seems like an obvious procedure, few managers follow this path because it reduces funding and, therefore, the manager's own remuneration (at least in the short term). However, we prefer to grow slowly and with firm steps than seek shortcuts to attract investors with a profile that is incompatible with our investment style.

The great benefit is that today we have an extremely differentiated investor base aligned with our philosophy. The best proof of this is to compare the evolution of assets under management of Ártica LT throughout the 2022 downturn with what happened to other equity funds. While most funds suffered waves of redemptions due to the months of decline, some losing more than half of their assets under management, we received a substantial volume of new contributions, which allowed us to take advantage of depressed prices and expand our portfolio of investments. In addition, around 90% of our investors never made any withdrawals, even though they went through difficult periods with us.

Having the support of our investors to do what we truly believe will bring the best long-term return, even when it requires psychologically uncomfortable decisions, is a rare privilege. For this reason, we extend our most sincere thanks to everyone who has entrusted their capital to us over all these years. We will continue to strive every day to bring you, in the years to come, a return as good as the one we had in our first decade.

*Prices shown in the charts are adjusted for dividends, and any groupings or stock splits in the period.

On the 05/07th we will do a live via YouTube commenting on this month's letter. sign up clicking here.[1] Ártica Long Term started on 06/27/2013 as an “investment club” and, on 09/27/2019 was transformed into an “equity investment fund”.