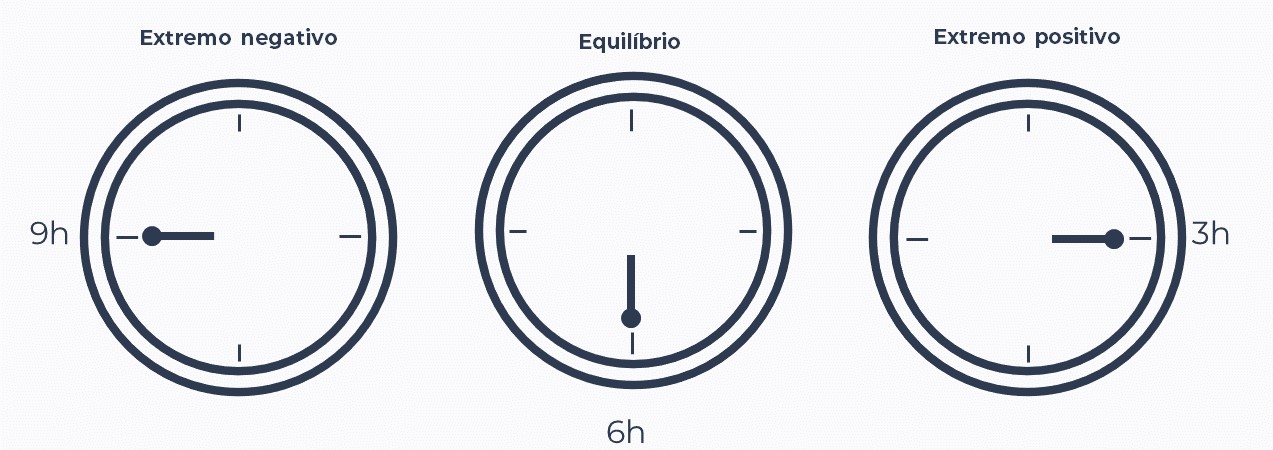

Dear investors, In a memo written in 1991 by Howard Marks, the famous fundamentalist investor at the head of Oaktree Capital Management, the movement of a pendulum is used as an analogy to describe the dynamics of market fluctuations. This pendulum movement idea would be revisited several times by him (in other memos and in the books The Most Important Thing and Mastering the Market Cycle) and pointed out as one of the most fundamental concepts to understand the behavior of markets. At the negative extreme, when the general sentiment is pessimistic and prices reach their historic lows, it is as if the pendulum were at the 9 o'clock position on a clock. At the opposite extreme, when the climate is one of generalized optimism and it seems that nothing can go wrong, it is as if the pendulum were at the 3 o'clock position on the clock. The low point at 6 am is where price levels would have to remain if markets were always rational and measured. However, in the same way as the pendulum, the market spends less time at 6 am than in the lateral zones, with prices above or below what the most weighted evaluations point out. It seems counterintuitive to say that a market made up of intelligent and qualified investors spends most of the time with distorted notions about the real value of assets, but rationality in markets is like the force of gravity acting on the pendulum. She always acts to bring her to the break-even point at 6:00. However, under the influence of an external force, this static equilibrium becomes dynamic: the pendulum oscillates around its equilibrium point, but does not stop there. In the market, the external force that disturbs static equilibrium and creates this pendular dynamic is the nature of human psychology.