Dear investors,

On August 30th, Warren Buffett turned 90. To celebrate the date, we decided to bring an analysis of one of his most iconic investments: the purchase of a relevant stake in CocaCola, during the 80's.

This is one of cases that we present in our training program for new members of our team: “If you went back in time and valued Coca-Cola in 1988, would you buy the stock?” In this letter, we are going to try to summarize the main insights we got from this training.

We start with a quiz. A well-regarded business magazine once published the following statement:

“Several times every year an investor looks at Coca-Cola's track record with deep respect, but comes to the sad conclusion that he is already looking too late (to invest).”

Fortune Magazine

In what year was this judgment published? The correct answer is at the bottom of the next page.3:

a-) 1938

b-) 1944

c-) 1957

d-) 1968

e-) 1979

f-) 1986

Investment context:

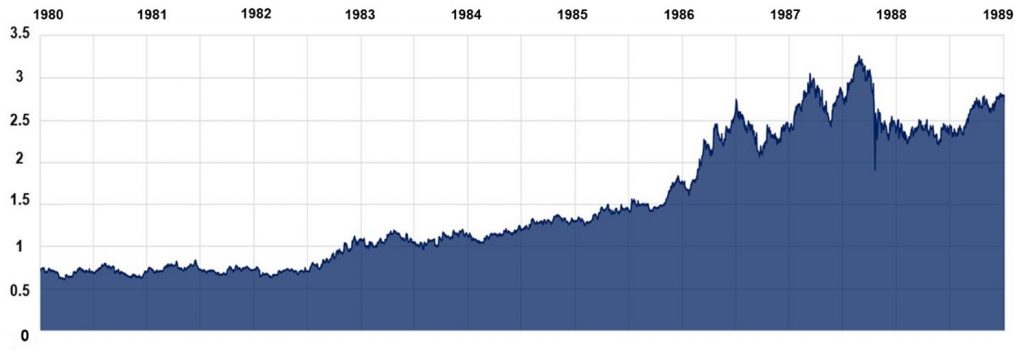

• In 1988, Buffett started buying Coca-Cola stock. Many analysts were skeptical, as the stock had been rising for several years and was trading at all-time highs (the stock's price has more than tripled in the decade, and that's not counting dividends).

Graph 1 – Coca-Cola share price (1980-1988)

- The stock looked expensive. She traded with a price/earnings multiple1 of 15-19x at a time when the long-term interest rate was 9% per annum.

- Even so, Buffett bought 7% of Coca-Cola shares, which represented an investment of USD 1.02B. It was a significant amount and represented 21% of Berkshire Hathaway's equity2 in season!

What Buffett saw in the company:

In his 1988 annual letter, Buffett commented on his investment in Coca-Cola for the first time:

“In 1988 we made significant purchases in (…) Coca-Cola. We expect to maintain these actions for a long time.. In truth, when we have a piece of a great business, with great management, our preferred investment time is forever. We are the opposite of those who are in a hurry to sell and book profits when companies are doing well, but who hang around exhaustively with companies that disappoint. Peter Lynch aptly compares this behavior to "cutting the flowers and watering the weeds."

We continue to focus our investments on a few companies that we try to understand well. These are just a few businesses in which we have strong long-term convictions. So when we find a deal like that, we want to participate in a meaningful way. We agree with Mae West “too much of a good thing can be wonderful.”.

Warren Buffett, 1988 Letter from Berkshire Hathaway

1 P/L (Price / Earnings) is a multiple widely used in the financial market. It measures a company's market value relative to its annual net income. As a rule, the higher the multiple, the more “expensive” the company tends to be. 2 Berkshire Hathaway is the holding of Buffett's investments.

3 Citation was published in 1938.

In 1989, he also praised the work CEO Roberto Goizueta was doing to return the company to a growth trajectory after a period of stagnation during the 1970s.

Based on statements by Buffett and Munger at the time and later, we understand that he based his investment decision on three main factors:

1. Potential growth in per capita consumption:

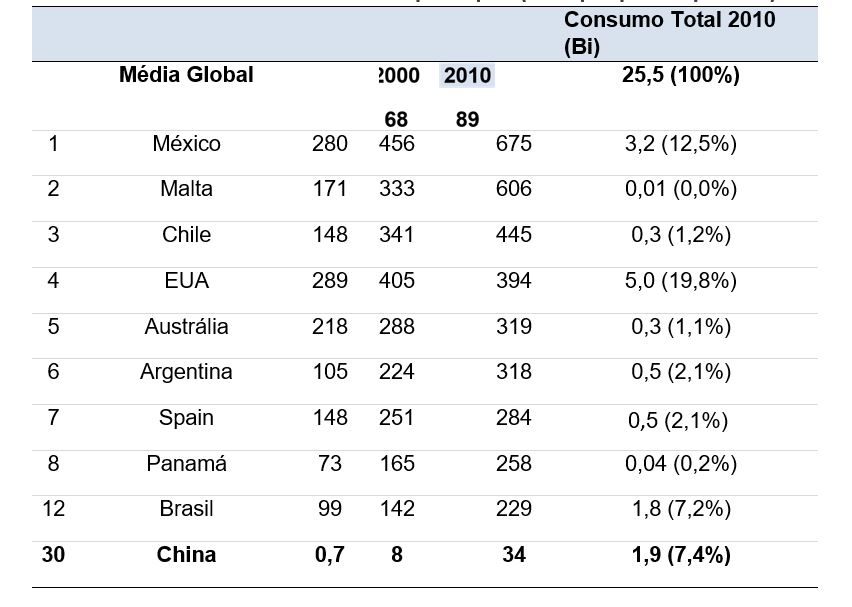

In 1988, Coca-Cola was already a strong brand worldwide, it was the global leader with 45% of the market share soft drink global company and operated in more than 160 countries. In 1990, the global average consumption of Coca-Cola was already 43 cans per person per year. With that presence already strong, how would the company grow?

Despite the strong presence, the penetration of the brand varied greatly in each country. As shown in the graph below, while the average US consumption was 289 cans per capita in 1990 (nearly 7 times the global average), in China that figure was a measly 0.7.

There was clearly plenty of room for growth. Even with already very high consumption in the US and limited potential growth (in fact, consumption dropped between 2000 and 2010), there was plenty of room to increase volumes abroad.

China, in particular, had very low penetration and presented a huge opportunity for growth given its population of 1.3 billion people. In fact, per capita consumption grew 49x between 1990 and 2010, and today it is one of CocaCola's main markets.

Graph 2 - Coca-Cola consumption per capita (cans per person per year)

2. Pricing power:

One of the characteristics that make Coca-Cola such a great business is its power to consistently raise prices above inflation. Coca-Cola has a brand-loyal customer base and a relatively inexpensive product, which allows the company to constantly raise prices without breaking the consumer's pocket. Today, for example, a 350 ml can of Coca-Cola costs around R$ 2.50. If the company raises prices to 2.70 (an increase of 8%, twice the inflation in one year), few people will stop consuming the product.

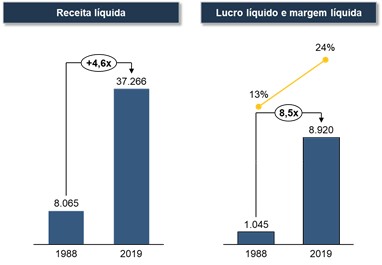

In addition to protection in inflationary environments, pricing power also allows for growth and margin gains, when the company's revenue grows at a faster pace than its costs.

Evidence of this is the fact that, between 1988-2019, Coca-Cola's revenue grew 4.6x while the company's net income grew 8.5x (net margin increased from 13% to 24%).

Graph 3 - Coca-Cola's revenue and net profit growth (in USD MM)

3. New profitable investments:

As mentioned in the previous letter, in addition to growing, it is important to have good profitability in order to actually generate shareholder value. In that regard, Coca-Cola did very well. ROE[1] average company in the 1980s (before Buffett's investment) was 25% pa and showed a growth trend that continued throughout the 1990s.

But why is this important?

The importance of high ROE is that the company was able to grow without compromising its capital too much or having to go into debt. In fact, the soft drink business requires little capital, the main investment that the company makes every year is in marketing, investments that strengthen the brand and increase the company's competitive advantages. This trait allowed Coca-Cola to grow before and after Buffett's investment while paying generous dividends to its shareholders – historically, the company pays between 75-80% of generated profits back to shareholders in the form of dividends or share repurchase.

The result:

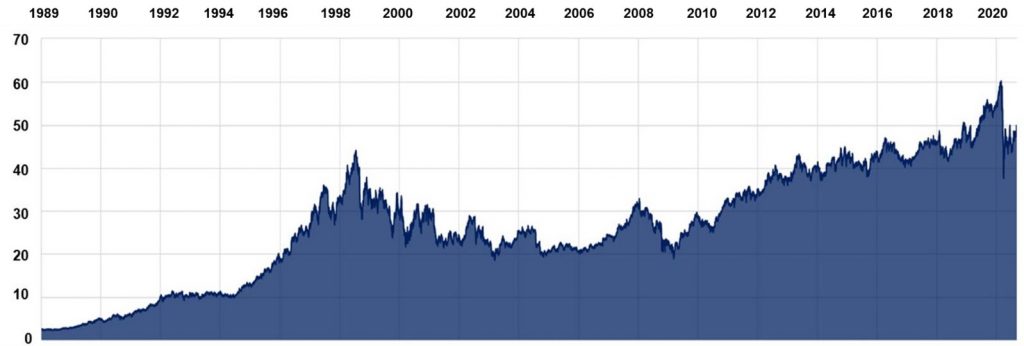

In the first 10 years of Buffett's investment in Coca-Cola, the stock performed spectacularly, returning 14x on invested capital, equivalent to an annual gain of 30% pa (considering dividend reinvestment).

However, with the change of management following the death of CEO Roberto Goizueta in 1997 and, more recently, with trends in healthy eating, the company's stock has not performed as well as it used to. Even so, from the end of 1988 to August 2020, Coca-Cola shares appreciated 36x, which represented an annual growth of 12% pa, after considering dividend reinvestment. Considering the USD 1.30 Bi[2] initial investments that Buffett invested in the company in 1988, Coca-Cola has guaranteed a profit of almost USD 30.0 Bi for the investor over the last 30 years.

Graph 4 – Coca-Cola share price, unadjusted for dividends (1989-2020)

A constant question is why Buffett didn't sell his shares when the company peaked in 1998 and looked expensive at the time. There are three main reasons:

- The first is the capital gains taxes that Buffett would pay if he sold shares in the company. Considering the huge appreciation of the stock, the taxes paid would be almost USD

-

- Another reason is that the volume of investment was too large. Buffett's stake in CocaCola was valued at USD 13.4B in 1998, which made the task of looking for new investments as good as Coca-Cola quite challenging.

-

- Added to the previous points, Coca-Cola has always been an excellent dividend payer. Since at least 1988, Coca-Cola has paid quarterly and increasing dividends every year. This characteristic allowed Buffett to receive USD 8.4 Bi in Coca-Cola dividends alone. Currently, its position earns USD 656 MM per year.

Even with a lower return over the last 20 years, Coca-Cola generated a profit of USD 16.1B for Berkshire Hathaway between 1998-2019 (USD 8.7B with share appreciation and USD 7.3B in dividends ) – earnings greater than the USD 13.4 billion invested in the company in 1998, which highlights the importance of focusing on the long term.

Buffett still considers Coke a "great deal," but he admits that criticism of sugary soft drinks is a threat to the company.

The company has expanded into other beverage categories (such as coffees, teas and juices) to continue growing, but these categories don't generate the same high margins that its core product does. Even so, Coca-Cola is still a giant and has the best beverage distribution system in the world, which should help the company expand into these new product categories.

[1] ROE (return on equity) is calculated by dividing net income by a company's equity. ROE is a measure of a company's financial performance as it indicates how well the company uses its resources to generate profit for the shareholder. The higher the earnings for a given amount of equity, the higher the company's ROE.

[2] Berkshire Hathaway invested USD 1.024B between 1988-89 and added USD 0.275B to the investment in 1994, which represents a total investment of USD 1.299B. Buffett never sells a single share of Coca-Cola.