Dear investors,

Wilson Sons is an investment that we have had in our portfolio since the end of 2018 and, currently, it is a very relevant position in the fund. We decided to share it because it is a good example of our investment philosophy: for more than 2 years the share price “walked sideways”, while operationally the company delivered good results, even with the crisis.

The company is traded in the form of BDR[1] on the stock exchange and, for this reason, ends up being little covered by most investors. This situation changed in May 2021, when the company announced its intention to convert the BDRs into shares and start to be listed in B3's new market segment. This simple move drew attention to the stock, which contributed to the company's appreciation of 24.8% since the day of the announcement.[2].

Below, we detail our investment process in the company, from joining the position to our current investment view.

Our investment:

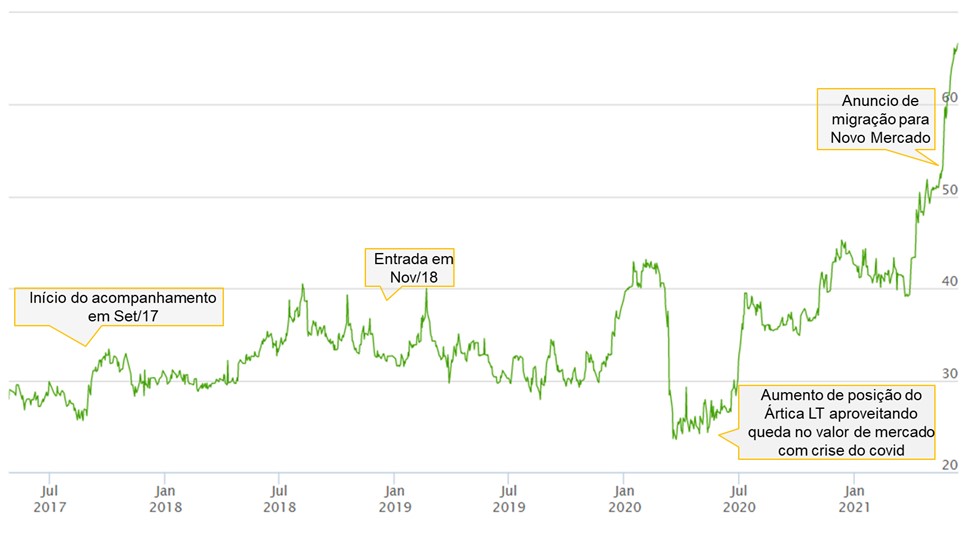

Our relationship with Wilson Sons is relatively old. We started analyzing the company in mid-2017 and we had a very positive initial impression, but there were some doubts in the thesis and so we decided to just follow it up at first.

The main doubts at the time related to the potentially challenging competitive environment in its tugboat segment, and a potential discontinuity of its tecon business in case of non-renewal of its concessions.

After more than a year of monitoring, we became increasingly comfortable with the risk factors that initially concerned us, and we decided to start investing in November 2018. There were factors that could benefit the company in the medium term (return of the economy; expectation of lower levels of capex in the following years, allowing for greater distribution of cash; gains obtained from operational improvements), but what most called our attention at Wilson Sons was that we saw the investment as not being risky. Both from the business point of view, which has stable and recurring results, and no risk of disruption, as well as from the point of view of valuation, which seemed quite discounted to us (in particular, what called our attention was the fact that the company had invested more than USD 1.0 billion in its operations in the previous 10 years, an amount that was higher than its market value at the time).

For two years after the initial purchase, the investment in Wilson Sons was average with the stock “walking sideways”, even with the company delivering good operating results. We took advantage of this period to continuously increase our investment position.

In 2021, discipline and patience were rewarded. Since we started investing in Wilson Sons, the share has appreciated by 100%, which generated an IRR[3] annualized amount of 37% for our fund.

Graph 1 – Price per share of WSON33 and main milestones of the investment

As we have already said in other letters, it is not enough to find good companies, the challenge is to invest in them at the right price. And at Wilson Sons, we believe we have found a great combination of both factors.

Company overview:

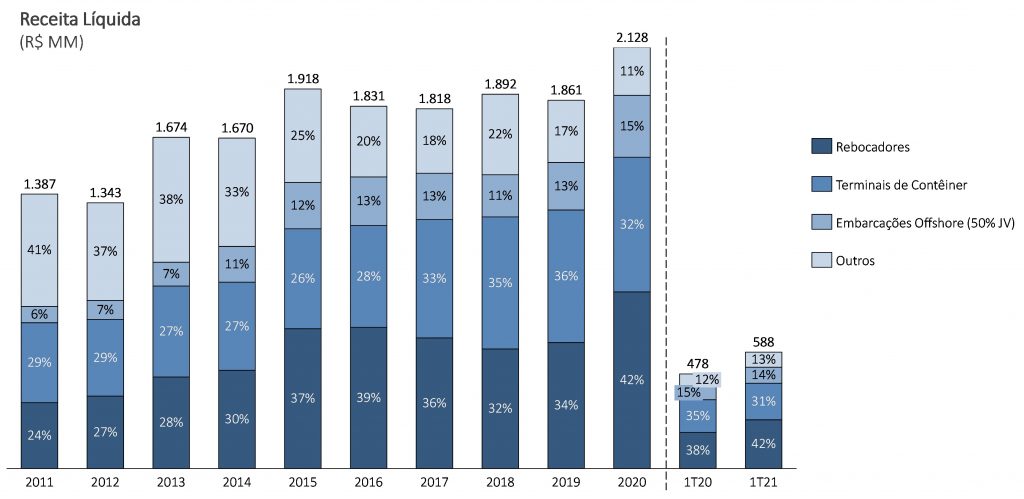

Wilson Sons is a company with more than 180 years of existence that operates in the port and maritime services sector. As a curiosity, it is the oldest company listed on the stock exchange (even older than Banco do Brasil)! The company operates in 7 different segments: (1) maritime towage, (2) container terminal (tecon), (3) offshore support vessels, (4) offshore support bases, (5) logistics centers, (6) agency maritime and (7) shipyards.

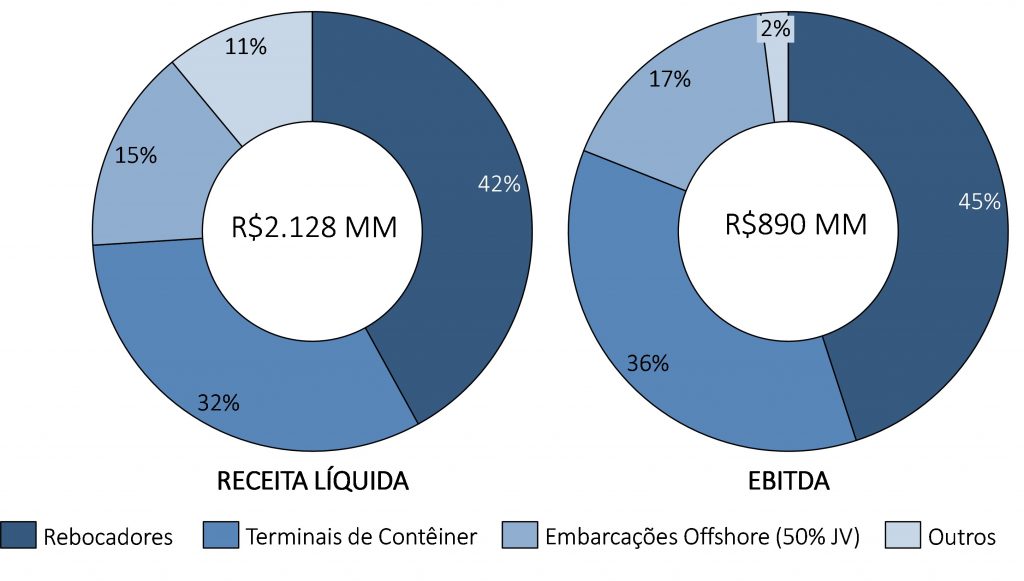

The first three are the most important segments for the company, as evidenced by the graph below:

Graph 2 – Net revenue and EBITDA by business unit (1TP3Q, in 2020)

-

- Tugboats (42% from 2020 revenue, and 45% from EBITDA):

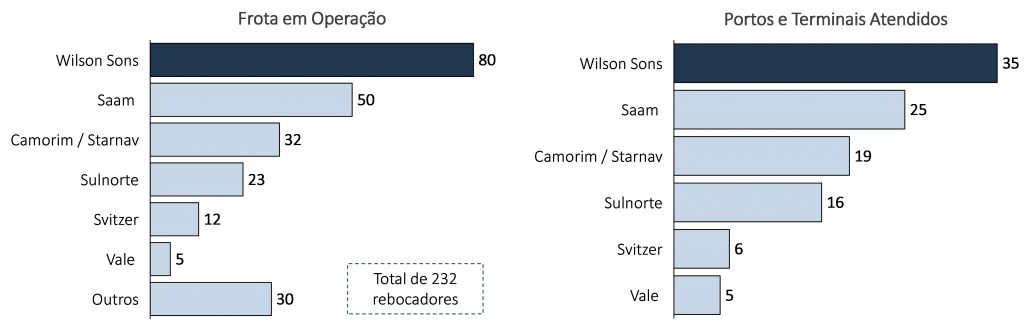

Tugboats are small vessels with high static traction power used to aid in the mooring and unberthing of large vessels in port terminals. Hiring tugboats is mandatory on the part of the companies responsible for berthing (owners), and the service is monitored and regulated by the Brazilian Navy.

Wilson Sons is the Brazilian leader in this market, with 80 ships in operation and operations in all major Brazilian ports (35 ports). In terms of number of maneuvers, the market share from the company revolves around 40-50%.

Graph 3 - Towage market in Brazil (#, in Mar/2021)

- Tecon (32% from 2020 revenue, and 36% from EBITDA):

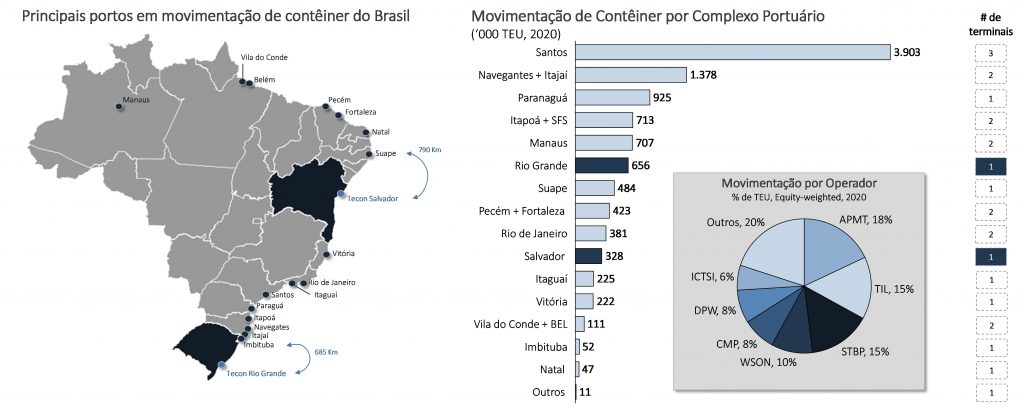

Wilson Sons is the operator of two container terminals (Tecons) in Brazil: Rio Grande (Rio Grande do Sul) and Salvador (Bahia). Containers are widely used to transport goods such as plastics and resins, agricultural products, pulp and paper, among others.

Both Wilson Sons terminals are among the most important in the country:

Graph 4 – Main container ports in the country, and handling by port

- Offshore vessels (15% from 2020 revenue, and 17% from EBITDA):

Wilson Sons owns 23 offshore support vessels through its subsidiary WSUT (a JV with a stake of 50% from Wilson Sons and 50% from the Chilean group Ultramar). Such vessels are used to support oil exploration and production operations, especially for Petrobras.

The contracting of such vessels is carried out through contracts lasting approximately 2 years.

Investment Thesis:

Our investment thesis in the company is based on 3 pillars:

- Privileged market positioning in the main operating segments (tugs and tecons):

As previously mentioned, Wilson Sons is the Brazilian leader in the tug market, with 40-50% of Market Share. This leadership position gives the company important competitive advantages, such as: greater coverage of ports, allowing shipowners to rely on a single supplier for all the stops they operate in the country; operations center that monitors all the company's tugboats 24/7, which enables greater safety and operational efficiency (fuel savings); own shipyard that is used to carry out the construction and maintenance of its own ships.

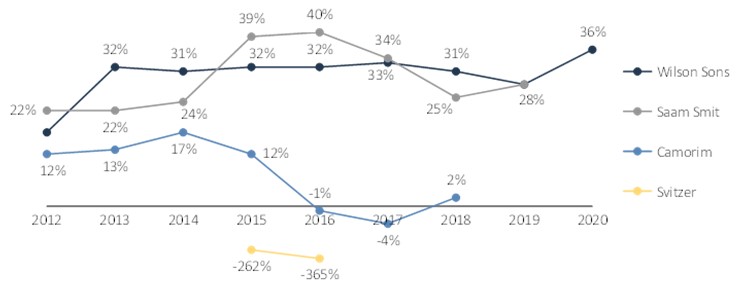

The result of these differentials is that the company has a higher level of profitability than its competitors:

Graph 5 – Wilson Sons EBIT margin comparison (tugboats) with competitors

In the Tecons segment, the company operates the only container terminals in its states (Rio Grande do Sul and Bahia). In both cases, the nearest terminals are at least 700 km away, which gives the operation a captive market and geographic monopoly characteristics. The result is very high profitability, with ROE close to 30% in this segment.

There is additional comfort with the operation due to the following facts: (1) concessions are long-term (Rio Grande expires in 2047, Salvador in 2050), and (2) there is no competing terminal project announced (even if there were, new projects terminals take years to build).

- Company well positioned to capture foreign trade expansion, which should be accelerated with economic recovery

Even with the crisis we went through in the last decade, the flow of trade continued on a growth trajectory, despite having been at a much slower pace than in the previous decade, which benefited from a better economic scenario. In both periods, transport via containers grew at a faster pace than the flow of general trade:

Graph 6 – Trade flow growth in Brazil vs. GDP growth

| % Annual growth | Period 1 (2002-2010) | Period 2 (2010-2020) |

| GDP | 4,0% | 0,2% |

| Goods transported in ports (MM ton) | 6,0% | 3,2% |

| Goods transported in ports via container (MM TEU) | 11,5% | 3,7% |

The data above show two facts: (1) even with a decade of zero economic growth, the trade flow proved its resilience by growing at a reasonable pace of 3.2% per year (3.7% for containers); (2) with stronger economic growth, an even more significant level of growth for the trade flow is expected.

Also weighing in favor of this trend is the growth of the cabotage modal, which is the transport of cargo by sea within the country. This modal has already been growing at a rate of 11% per year in the last decade and should have its growth accelerated with BR do Mar, which is a project of the Ministry of Infrastructure that aims to stimulate cabotage in the country.

This increased trade flow should benefit both Wilson Sons' tecon and tug operations.

Added to this fact, the company has made strong investments in the last decade. In recent years, such investments were mainly focused on renewing and expanding its fleet of tugboats, and expanding the cargo handling capacity at the tecons. These investments put the company in a privileged position to capture another industry trend, which is the increase in the average size of ships that dock on the Brazilian coast. To support larger ships, Wilson Sons stands out for having powerful tugboats and terminals with adequate infrastructure (especially the draft of the port).

Finally, it is worth mentioning that the company's offshore operations support segment has been greatly affected since 2015 with the crisis in the O&G sector in Brazil, which led to a drastic reduction in vessel utilization levels, impacting both volume and contract price. With the progress in pre-salt development (up to 18 new platforms are expected by 2024), expectations for the sector are once again positive, which should benefit the company's performance in this segment in the medium term.

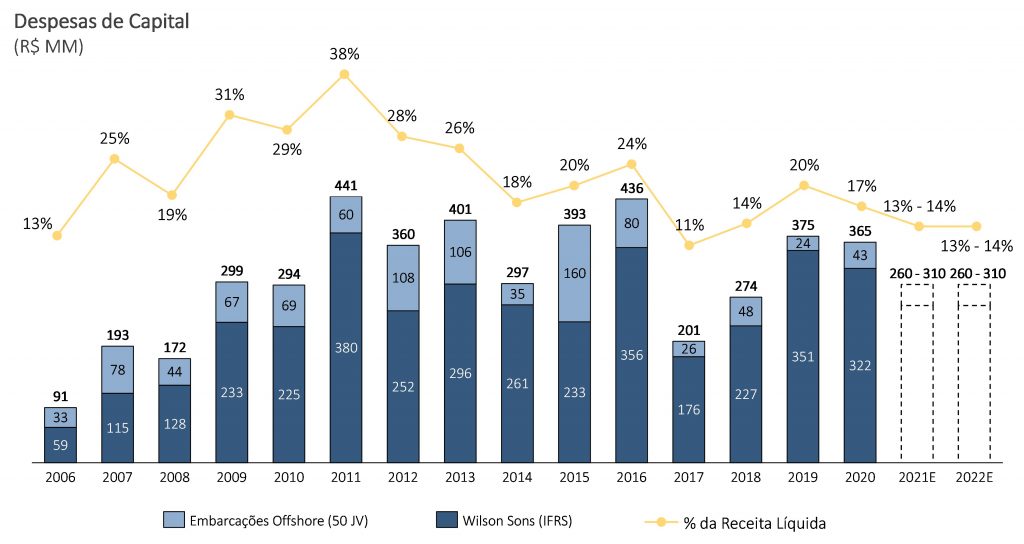

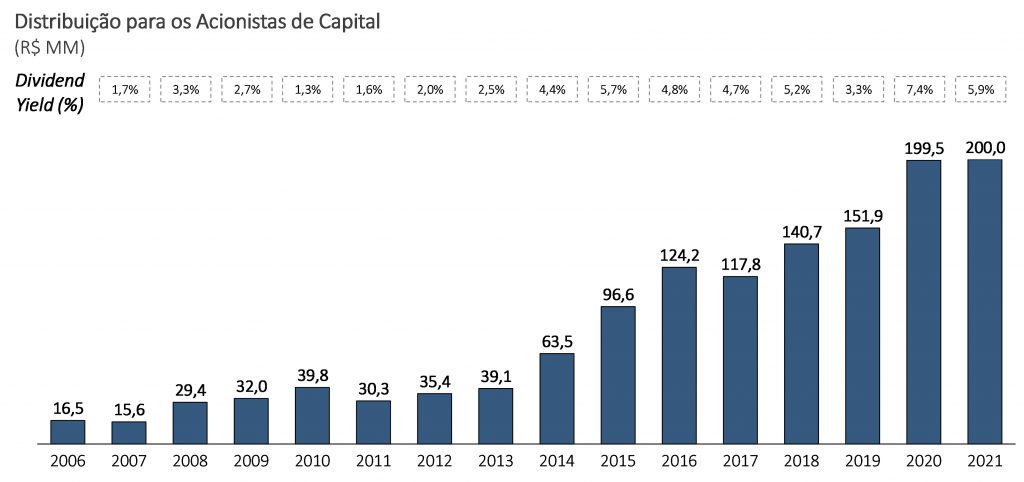

- Lower level of investments (after a long period of high investments), will allow for greater cash generation in the coming years

As previously mentioned, Wilson Sons has made significant investments over the last decade. The highlight is the expansion at tecon in Salvador, which was completed in March 2021 and led to a capacity increase of 110%. Now, especially in the tecons operation, the company has plenty of room to grow without the need for new investments for several years and can allow for an increase in dividends.

Graph 7 - Capex and historical dividends

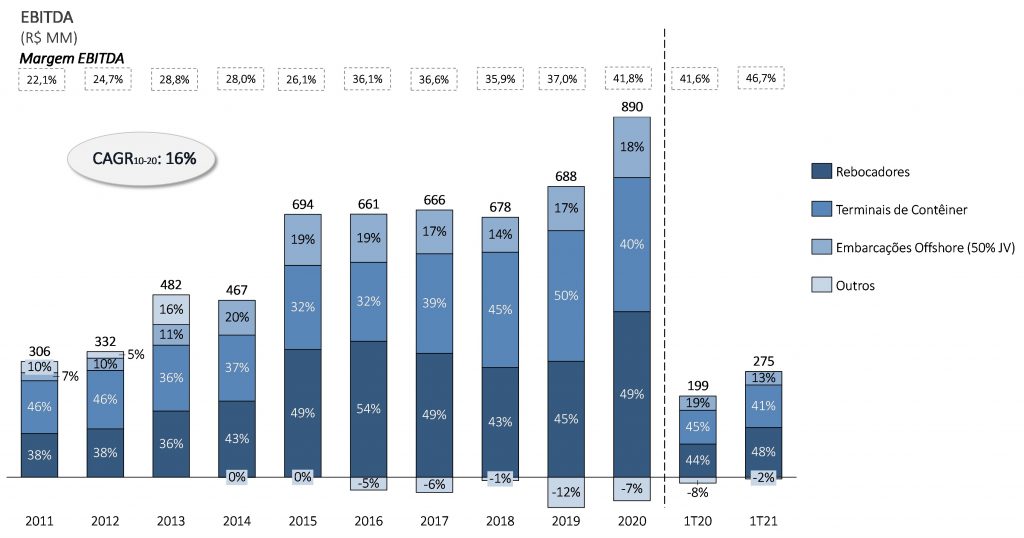

It is worth noting that, even with the crisis we have been through in the last decade, Wilson Sons proved to be very resilient by growing its results at a rate of 16% per year from 2011 to 2020. During this period, the company implemented operational improvements and benefited from an increase in the dollar (many of the company's segments have dollarized revenue):

Graph 8 – Historical Net Revenue and EBITDA

Valuation:

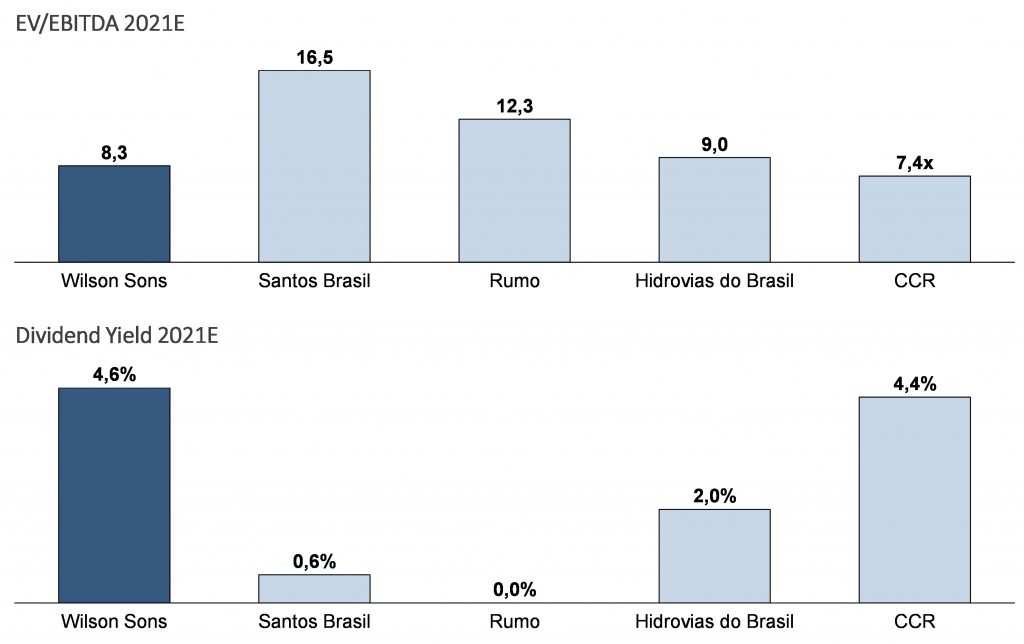

As for the valuation, our estimates are that, under conservative scenarios, the company seems quite discounted, even considering the recent rise in share prices.

We estimate that the company is trading at around 12-14x its cash generation baseline, which looks very attractive. Combined with the good growth prospects that may occur without the need for large investments, we believe this is a great opportunity.

In comparative terms, the table below shows that Wilson Sons is still the cheapest company in the sector:

Graph 9 - Comparison of multiples[4]

[1] BDR (Brazilian Depositary Receipt) are stock certificates for companies headquartered abroad. It works similarly to a common action

[2] From announcement on 5/23/21 to closing price on 6/14/21

[3] IRR: Internal rate of return. It is a metric that represents the annualized return for the fund.

[4] Reference date of 06/11/2021