Dear investors,

In this memo, we share with you an unorthodox arbitrage investment that we carried between 2018 and 2019 and it generated great results for us. It is a good example of using risk-return asymmetry in favor of the investor.

The operation consisted of the purchase of Bradespar shares accompanied by the sale of Vale shares.

Bradespar is a holding public company founded by the controlling block of the Bradesco Group with the objective of investing in assets traded on the stock exchange and diversifying the Group's capital.

After the sale of its entire stake in CPFL Energia in December 2017, Bradespar now has Vale as the only investment in its portfolio, a company in which it has been a partner since its privatization. Thus, Bradespar became, in practice, a means of indirectly investing in Vale.

As is common in similar cases (observed in Gerdau – Metalúrgica Gerdau, Itaú Unibanco – Itaúsa, Iguatemi – Jereissati Participações, among others), Bradespar is quoted at a discount to its NAV [1] – ie, it is worth less than the market value of its stake in Vale. This discount is called a discount holding and exists due to the fact that the intermediary vehicle – the holding – add an additional layer of uncertainty to the asset, as it can apply the proceeds from its investment (dividends, interest on equity and share sales on the market) at its discretion, and may even allocate it to activities that are not profitable, destroying value for its shareholders.

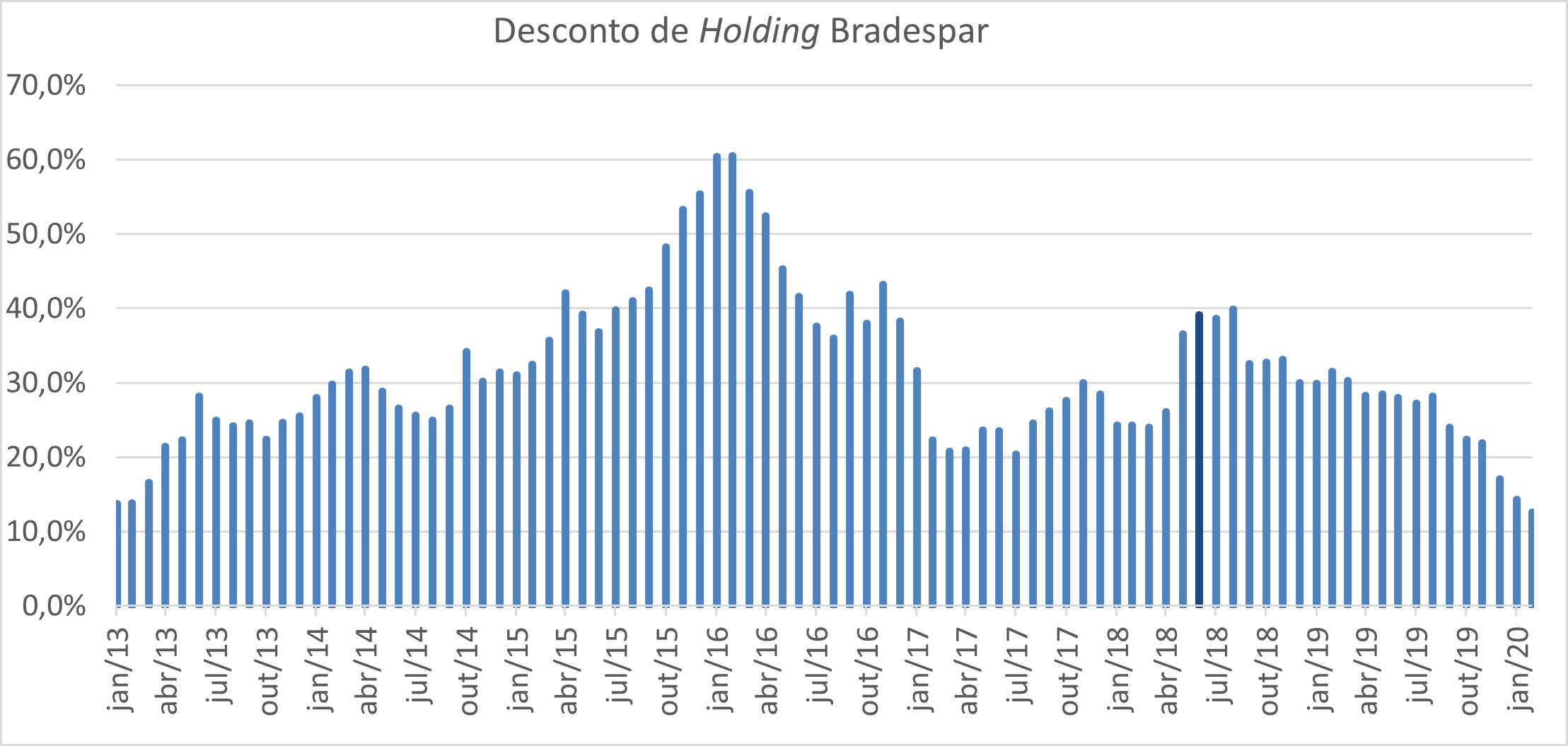

In general, the discount holding observed in similar cases oscillates around 20% of the NAV, which, historically, is possible to observe in Bradespar[2]

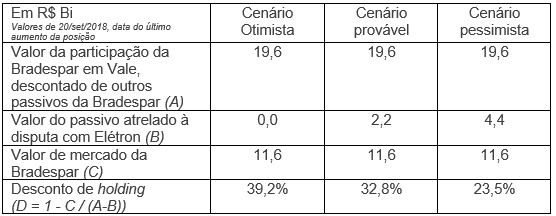

In 2018, there was a movement to increase the discount of holding due to a legal dispute brought by Elétron, a company of the Opportunity Group (owned by businessman Daniel Dantas). The dispute was already 11 years old and concerned a lawsuit filed by Elétron against Bradespar and Litel. In May 2018, the court approved an expert report that stipulated compensation for Elétron in the amount of R$ 4.4 billion, of which Bradespar would be responsible for half of this amount.

The news caused Bradespar's holding discount to increase considerably (the discount reached 40%, as shown in the chart above). In our view, the increase was exaggerated: even assuming a scenario that Bradespar would pay 100% of the contingency, that is, R$ 4.4 Bi, the adjusted discount would still be 23.5%, above the historical average of 20%. For us, this would be the worst possible scenario.

To capture this opportunity, our investment should be positioned based on the discount of holding of Bradespar, capturing the value in the return of the discount to historical levels. The way we found to structure this operation was via a long shorts[3]: we stay long in Bradespar (BRAP4) and shorts in Vale (VALE3), so that losses generated by the appreciation of VALE3 would be offset by gains from the appreciation of BRAP4 and that only the relative oscillation between the price of BRAP4 and VALE3 would affect our investment – an important point, since we did not want to bet on the direction of the movement of these shares (which prevented, for example, a capital loss for Arcadia after the Brumadinho accident, when Vale's shares fell more than 24% in just one day).

The fact of being a long shorts gave the investment an interesting feature as it did not require large amounts of resources, as we used the amount obtained from the sale of VALE3 to buy BRAP4. That is, it was not necessary to withdraw funds from other assets, or even cash, to invest in the thesis.

We set up the operation between June and September 2018, when the discount holding fluctuated around 39% until we reached the maximum limit allowed by the Arcadia regulations.

Since then, Bradespar, Litel and Elétron have ratified an agreement where they agreed to a total compensation of R$ 2.8 Bi, well below the initial R$ 4.4 Bi, divided equally between Bradespar and Litel (R$ 1.4 Bi each).

Litel tried to charge Bradespar in court for the reimbursement of the R$ 1.4 Bi paid by it, but recently, in December 2019, the court decision was released that said claim was denied.

This news reflected positively on the discount, which dropped from the level of 39% to the current level of 13% (in February 2020). The drop in the discount generated a great result for Arcadia – total return of 91.2%[4] on capital employed, which represents an annualized return of 47.7% until February 2020.

The question that remains is the following: what would happen if the discount holding increase instead of decreasing? Although “on paper” the operation could have a negative result, in practice it was just a matter of time for the discount to decrease, as the market tends to correct significant shifts in value over time. And we had enough time to wait because as we bought Bradespar “cheap”, the dividends received for the position long were greater than the cost of maintaining the position shorts – that is, effectively we were being paid to wait and make money!

The case described above illustrates an alternative way of obtaining a differentiated return combined with a very reduced risk exposure. This type of investment serves as an important portfolio complement and becomes even more interesting in times of bull market, when it becomes increasingly difficult to find good stocks at reasonable prices on the stock exchange.

To make investments like this, it is necessary to be aware of the opportunities that the market offers, and to exercise the same common sense skills and analytical capacity that are naturally required for more traditional investments in stocks.

[1]NAV: Net Asset Value. Indicates the market value of assets minus the market value of liabilities. [2]The peak of the discount holding observed in the graph (between 2013 and 2016) occurred when due to the approach of the end of Vale's Shareholders' Agreement, which would expire in 2017. However, the Agreement was renewed and returned to levels close to 201TP3Q in 2017 [3]long: Investing in a stock (earnings occur when the stock appreciates); Shorts: Betting against the stock (gains occur when the stock depreciates). Strategies long shorts are used for investments where the thesis is the relative change in the value of assets, not their absolute change. [4] Until 02/28/2020