Dear investors,

In the last 4 months, the IBOV has risen by around 20%. As a result, it is natural to question whether there are still good investment opportunities on the stock exchange or whether the market has already adjusted to something close to what should be the normal price level.

Before addressing this question, let's go back over the last few years of the stock exchange's history, from the pandemic to the present day, which form the necessary backdrop for making considerations about what the future may hold for us.

The shock of the pandemic

In 2019 and early 2020, the interest rate was quite low (4.5% at the end of 2019 and 2.0% at the end of 2020) and finding cheap stocks on the stock exchange was an arduous prospecting activity. When the pandemic began to take on large proportions, at the end of February 2020, the IBOV fell by around 40% in a month's time, reflecting the fear and uncertainty that surrounded global markets in the face of an atypical threat and with very difficult consequences to quantify.

Surprisingly, after this drop, the stock rose more than 75% by the end of 2020, surpassed its pre-pandemic peak and continued to rise until June 2021, when the IBOV reached 130,000 points, almost double compared to the low of 67 thousand points achieved in March 2020.

This vertiginous recovery, in part, was motivated by the ability that the world has shown to adapt to the health restrictions imposed by the pandemic and continue with a reasonably productive economy. However, two other factors played an important role in this bullish cycle.

The first, and most striking, were massive government actions to stimulate the economy, both in Brazil and in the rest of the world, through the distribution of subsidies and expansionist monetary policies. This is how the SELIC reached 2%, and this is how the seeds of the inflation problem for the following years were planted.

The second factor was a wave of market enthusiasm with this low interest rate scenario and with some sectors that were driven by the sudden change in consumption patterns caused by restrictions (eg: technology and e-commerce) and a narrative that from then there would be a “new normal” in which interest rates would remain low and these businesses would remain thriving. The theory took a while to fall apart.

In all the enthusiasm of the time, the facts were ignored that no expansionary monetary policy is sustainable for long and that the restrictions imposed during the pandemic period could only have had a negative economic impact. Production stoppages, changes in production methods and extra health protection measures had enormous costs, without any positive counterpart. As of July 2021, these factors began to weigh in and the stock market's bull cycle was interrupted.

The hangover and the war

In the second half of 2021, reality knocked on the door. Inflation increased, caused by the monetary policy adopted during the pandemic and, to combat it, BACEN started the interest rate hike. In a year and a half (Mar/21 to Aug/22), interest rose from 2.0% to 13.75%. In parallel, the thesis of the “new normal” lost strength, as the world gravitated back to the “old normal” after the lifting of health restrictions.

As if that were not enough, in February 2022 the war between Russia and Ukraine began, in which a large part of the West ended up getting politically involved and acting through economic sanctions. The main impact was on commodity markets where Russia was a major supplier. The sanctions caused a negative supply shock and caused prices to rise rapidly, worsening the global inflation problem.

Brazil did not suffer so much from the war between Russia and Ukraine, as it is far from the center of the conflict, both geographically and politically, and because it is an economy that exports commodities, which benefited from the cycle of high prices. However, we suffered a lot from the BACEN monetary tightening policy used to combat inflation. High interest rates, maintained for a long period, had a strong contractionary effect on our economy, suppressing consumption and weighing on the balance sheet of several companies that leveraged during the period of low interest rates.

In addition to this effect on the real economy, high interest rates caused a massive reallocation of capital between asset classes. With the opportunity to invest 13.75% per year “risk-free” and a macroeconomic scenario full of uncertainties, a large number of Brazilian investors redeemed their capital from equity funds and multimarket funds, transferring it to fixed income. Naturally, this movement heavily penalized the prices of listed shares.

This is the very brief summary of the downturn we went through between June 2021 and March 2023, a period in which the IBOV dropped from 130 thousand to around 100 thousand points (-23%). Let's now go to the most recent facts, which caused the upward movement in the stock market from April of this year onwards.

Stock market recovery

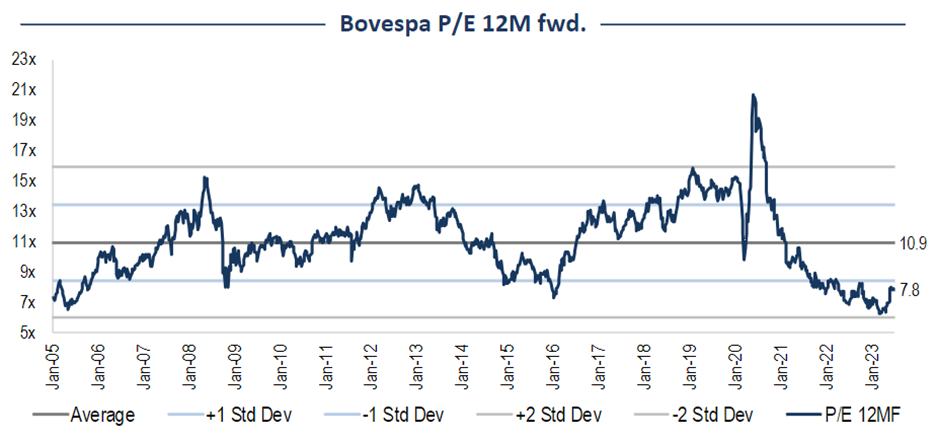

The fall in interest rates itself had been expected for some time, but the exact moment of its onset and the speed of the fall were still uncertain. As the BACEN started to signal that it would start to reduce the rate, the market began to react by reallocating capital to the exchange. Greater clarity as to BACEN's intention was the trigger for the recent rise in the stock exchange, but undoubtedly helped by the fact that the stock exchange was very cheap at the time, with valuation multiples close to 2 standard deviations below the mean.

Source: BTG Pactual

Note that, even after the recent rise, valuation multiples remain 1 standard deviation below the mean. Despite being a generalist metric, it makes the point clear that we are far from an overheated market state. There are two other factors that corroborate the view that it is likely that we are facing the beginning of a new, longer bull cycle in the stock market.

The first is that the effect of the drop in interest rates on the real economy only happens some time after the rate is already lower, since the effectively lower cost of credit is what will reheat demand and only after months of stronger demand will the result generated will appear in the financial statements of the companies. Therefore, today we are still looking at weak financial results, pressured by the effect of the contractionary monetary policy and, as much as the market tries to anticipate the improvement based on the expectation of a drop in interest rates, the recent history always has a strong anchoring effect on the projections. As the economy recovers, it is likely that several businesses will show better results than those considered today.

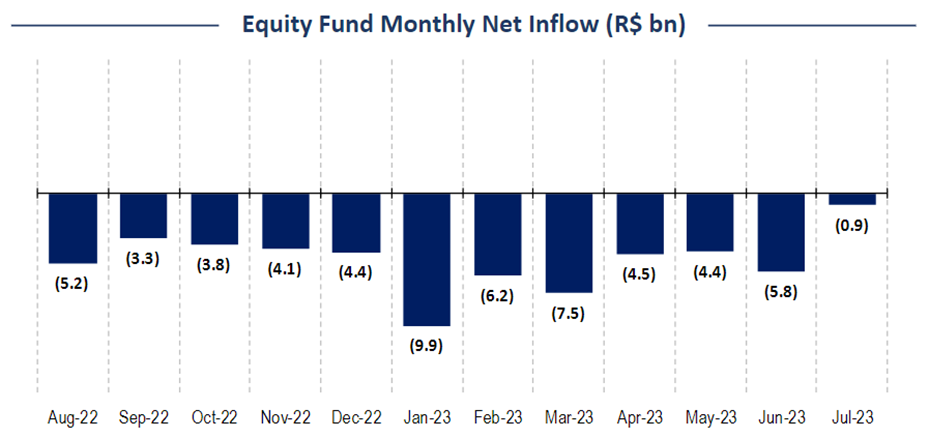

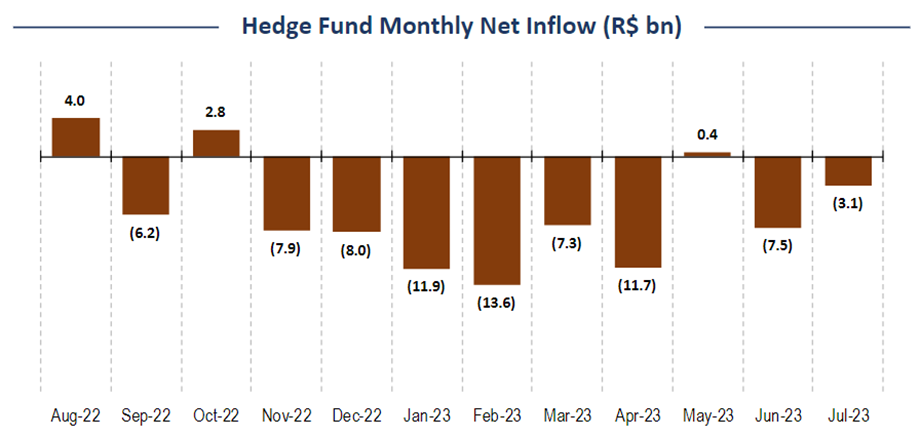

The second factor is related to the reallocation of capital back to the stock exchange, which should take place over the coming semesters and reverse the massive movement of redemptions of equity funds and multimarket funds that we saw in 2022 and in the 1st half of 2023. This movement hasn't even started, as funds have still been negative in recent months.

Source: BTG Pactual

Certainly some investors are already anticipating and reallocating capital back to the stock exchange, but most of the market will probably keep their investments in fixed income while interest rates are high, only looking to reallocate it after the effective drop. That is, there are still many potential buyers of shares to drive a new cycle of rising prices.

Positive options

In addition to the expected drop in interest rates and the positive flow of capital to the stock market that should be generated by it, there are other more uncertain elements that could be sources of future positive surprises.

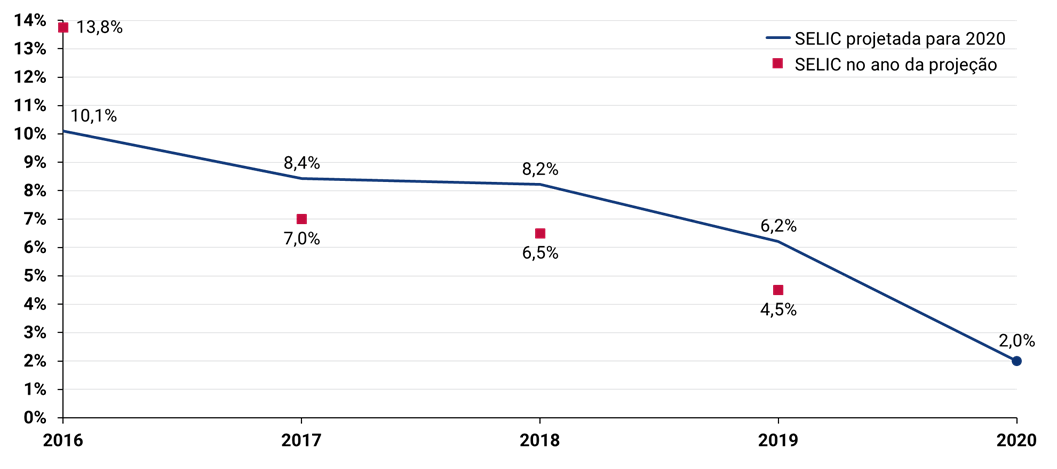

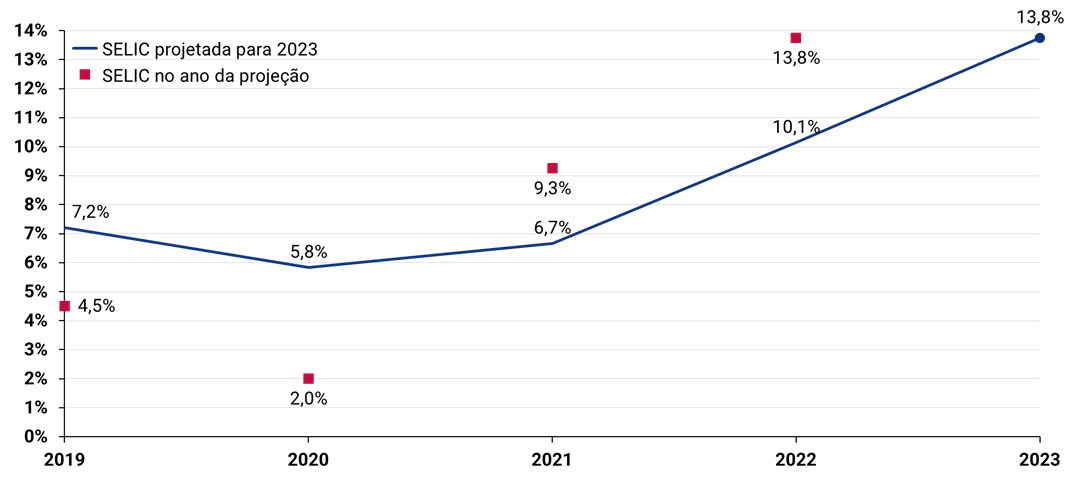

One of them is the fact that market interest projections are generally anchored by the interest rate value at the time the projection is made, as can be seen in the evolution of projections compiled in BACEN's Market Expectations System. Below we bring the history of projections for two years in which the SELIC rate was at its extremes: 2020 and 2023.

History of projections for the SELIC rate in 2020

History of projections for the SELIC rate in 2023

Source: BACEN – Market Expectations System

Thus, there is a certain chance that the long-term interest rate projected by the market today is overestimated, as it was forecast while the rate is high. If realized interest rates turn out to be lower than projected, there will be a positive impact on stock prices.

We also expect the approval of the tax reform, which would greatly simplify the Brazilian tax system, standardize the rates paid by different economic activities and, thus, could bring productivity gains to the national economy. Although it is difficult to quantify the impact of the possible reform, it is very likely to be positive. In May 2023 we wrote about this reform. Although some terms of the proposal have changed since then, the main concepts we explored still remain.

Brazil can still benefit from the trend of decentralization of production chains, which are currently very concentrated in Asia, a theme that gained evidence after the problems of supply interruptions amid the lockdowns and the war between Russia and Ukraine, and by global efforts to decarbonization of the economy, leveraging the clean energy matrix that we have in our country. We talk more about these trends in more detail in November 2022 letter.

Perspectives for the stock market

Even after the recent rise, which started from a price base resulting from difficult years for the stock market, the stock market still seems cheap, with interesting opportunities in well-selected companies. Added to this, the less contractionary monetary policy that the BACEN announced that it will adopt from now on will also contribute to the recovery of Brazilian companies and, consequently, the share prices of listed companies. Finally, today we see more positive factors than major threats to the Brazilian economy and we believe that it is likely that we are at the beginning of a new upward trend in the stock market. There will certainly be periods of price declines, as is natural in equity markets, but we are optimistic for the longer term.

In any case, there is always the work of separating the wheat from the chaff. Not every listed company is cheap, and it's important to maintain the discipline of spotting high-quality businesses and only buying shares at prices that offer a comfortable safety margin. In the current scenario, we were able to identify excellent opportunities and our capital under management is almost entirely invested in companies that we believe have excellent prospects for the coming years.