David and Goliath in the financial market

Dear investors,

Today, the workings of the financial market in Brazil are still unclear to most individual investors. For example, have you ever wondered how large brokerage firms make money, even though they offer free services to individuals, and what the implications of this business model are for investors?

One of the main sources of revenue for brokerages is charging commercial commissions on investment funds available on their platform, which commonly reach 50% of all fees paid by investors to fund managers throughout the entire investment period.

This business model has two significant implications. The first is that brokerage advisors, who serve clients for free, have an incentive to recommend the products that pay the highest commissions, not necessarily the best ones for each client. The second implication is that the compensation of managers, who effectively work to improve investment profitability, is cut in half. The rest goes to the brokerages, which provide the convenience of a good app and the ability to centralize investments in a single account, but do nothing to improve the return on invested capital. It's as if the packaging cost the same as the product inside.

As a result of this structure, managers seek to offset the reduced fees by increasing the fund's capital under management. However, this creates a burden for investors, as the larger the fund, the more difficult it is to achieve excellent returns. This will be the topic of today's letter.

Smaller funds, higher returns

The fact that small funds have higher average returns than large funds is well known in the financial market. Although the topic is rarely discussed, several studies and articles prove this point.¹

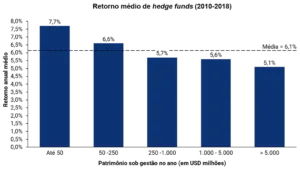

Aurum, a property management company funds of funds (funds specialized in selecting and investing in shares of other funds), analyzed the returns of hedge funds between 2010 and 2018. At the beginning of the period, there were approximately 1,700 funds with USD 1.7 trillion under management, and at the end of the period, there were 3,800 funds with USD 3.2 trillion under management. They found a clear correlation between fund size and profitability: while "micro" funds (less than USD 50 million under management) had an average return of 7.7% per year, "mega" funds (more than USD 5 billion under management) had an average return of 5.1% per year. The difference is greater than it seems: USD 100,000 invested in "mega" funds would become USD 156,000 at the end of the nine years, while the same investment in "micro" funds would reach USD 195,000, a final value 25% higher.

Source: Aurum Research Limited

The result is the same in Brazil

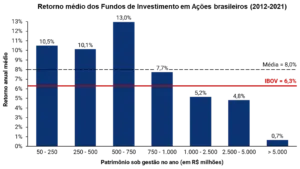

To verify whether this difference in returns also applied to equity funds operating in the Brazilian market, we collected data from 1,049 investment funds listed on the CVM with net assets of R$50 million or more for the period 2012 to 2021 and compared the average return across different size ranges. The results were similar. There was no return erosion up to the R$750 million range, but the average return begins to decline after that. While funds smaller than R$750 million had an average return of 10.61%, those larger than R$5 billion had a return of 0.66%. In other words, R$ 100 thousand invested in large funds would become R$ 107 thousand over these 10 years, while the same investment, in small funds, would reach R$ 274 thousand, leading to a final value 157% higher.

Source: CVM, Arctic analysis

Why does this happen?

Huge deals are quite rare. For example, in Brazil, we have 366 listed companies², of which 253 are worth less than R$$ 5 billion, 95 are worth between R$$ 5 and R$50 billion, and only 18 are worth more than R$$ 50 billion. Similarly, there are fewer investment opportunities in which it is possible to invest billions of reais, due to the company's size or the liquidity of its shares on the market, than opportunities to invest tens or a few hundred million.

At the same time, fund managers typically only invest time analyzing opportunities that allow for a minimum investment. The larger the fund, the higher the minimum investment required, and the greater the number of stocks that fail this filter and are ignored. A fund that only invested in stocks with a market cap above R$5 billion would analyze only 113 stocks on the Brazilian stock exchange, disregarding the other 253, which represent 69% of the potential opportunities.

As a result, large funds compete with each other for the limited number of investment opportunities that can absorb large amounts of capital. This fierce competition among professional investors makes it more difficult for large asymmetries to emerge between the price and intrinsic value of each asset.

Consequently, the chance of these funds having very high returns ends up being lower.

In contrast, there's far less competition for small opportunities, and in some cases, the competition comes from non-professional investors, who are more likely to make mistakes and misprice the stock they're analyzing. Thus, it's easier to find small caps (stocks with low liquidity, usually from smaller companies) that are undervalued in the market and, in addition, small caps tend to have higher returns than large caps in the long term³, as they tend to have greater growth potential and more agile and efficient management structures. Funds that can invest in these types of companies have an advantage in seeking higher returns.

Our plans

We're quite realistic about the fact that our investment strategy wouldn't yield the same results if we had billions under management. The threshold at which we have a good chance of continuing to achieve our profitability target isn't precise, but we know it's somewhere between R$500 million and R$1 billion. Given this, we made two decisions.

The first is that, when we begin to have difficulty finding good investments due to the fund's size, we intend to close it to new investors. In addition to investing most of our personal wealth in Ártica Long Term FIA, it also includes significant capital from several friends and family members. Therefore, both through professional ethics and personal relationships, we are deeply committed to maximizing this capital in the best possible way.

The second decision was not to distribute Ártica Long Term FIA through platforms. We preferred to raise funds directly and avoid the "packaging cost," thus ensuring that the fees paid by our investors are allocated to the management structure, which is what generates returns. The impact of this is quite significant: we were able to maintain the same structure with half the assets under management that would be necessary if we had paid distribution fees.

Furthermore, we enjoy getting to know and maintaining close contact with our investors. Direct fundraising brings the added benefit of allowing us to continue this practice. We have strived to be increasingly transparent about our investment philosophy and market vision: we have begun to lives on the topics of the monthly letters (every first Wednesday of the month at 7:00 pm) and also presentations of quarterly results, in exclusive online meetings for our investors.

If you have any suggestions on what else we could do to improve communication with you, please send us an email at investimentos@articainvest.com.br We'd love to hear new ideas!

¹ Gao, Chao; Haight, Tim and Yin, Chengdong, Size, Age, and the Performance Life Cycle of Hedge Funds (September 2018); Chen, Joseph S. and Hong, Harrison G. and Huang, Ming and Kubik, Jeffrey D., Does Fund Size Erode Mutual Fund Performance? The Role of Liquidity and Organization (May 1, 2004)

² B3 data as of July 30, 2022, excluding listed companies that do not have traded shares.

³ We published a letter about investments in small caps in September 2021, which is available at the link https://artica.capital/cartas/investimento-em-small-caps/