Stocks or Fixed Income: the Brazilian investor's dilemma

Dear investors,

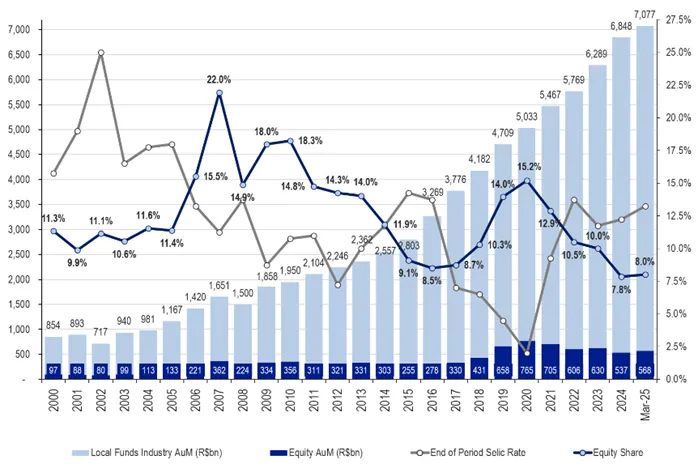

The Brazilian stock market has been losing space in the portfolios of local investment funds since 2021. Today, 8.0% of the total capital managed by funds is invested in variable income, very close to the lowest level in 25 years (7.8% at the end of December 2024) and well below the average of 12.7%.

Local equity fund allocations (R$1T4T billion)

Source: BTG Pactual – Brazil: Follow the money, May 13th 2025.

The main reasons for the low allocation are in the newspapers almost daily: concern about the fiscal deficit, the growing debt of the Brazilian government, and sky-high interest rates, which encourage the current Brazilian investor's motto: why take risks in the stock market in this scenario and with the CDI so high?

This motto is reinforced by recent history: from January 2021 to May 2025, the IBOV (Brazilian Institute of Bovespa) yielded ~17%, while the CDI (Brazilian Deposit Certificate) yielded ~55%. Coupled with the fact that equity investment decisions are always more complex than simply investing in post-fixed securities and observing the steady growth of your wealth, it's fair to question why it would make sense to invest in the stock market in Brazil right now. Meanwhile, Ártica's funds are almost entirely allocated to stocks, so we're expected to have an answer.

Our first point is that stock market investments are not destined to the IBOV's return. There is much more room to obtain additional returns through asset selection on the stock market than in fixed income. Investors in Ártica Long Term FIA returned 74% (1.35x the CDI) in the period in question, even with the tide against stocks. The broader reasons to invest in stocks now are that companies are structurally biased to yield more than credit investments, and the best way to seek good returns is to buy when there is low capital allocation in the stock market, as this is precisely when capital is undervalued. Let's explore these points.

The average return of companies must exceed the CDI

The original sources of economic value are natural resources and human time spent on something that has immediate (services) or future (consumable products, capital goods, and technology) utility. Since there are infinite ways to organize the use of both, and attempts to do so centrally have been notoriously unsuccessful, the main advantage of the modern capitalist system is to create incentives for the constant and decentralized pursuit of the best possible organization through a self-calibrating price system: the well-known mechanism of price determination by the balance between supply and demand.

The classic example of how productive activity is organized based on this price mechanism is that any good will be produced more soon after demand for it increases, because the emergence of demand above available supply will cause a price rise, which will incentivize the creation of additional supply capacity to restore equilibrium. The same logic works in reverse, and the optimization of capital use follows the same principle, from a slightly altered perspective: when demand for something rises, the price rise causes the capital allocated to create additional supply capacity to expect higher returns, so there is an incentive to allocate more capital for this purpose until supply and demand are rebalanced and the previously existing return premium disappears.

Fundamentally, credit isn't necessary to solve the capital allocation problem. All investments could be made directly in companies, and each investor would directly bear the risk of the economic activities they decide to encourage by providing their capital. The benefit of the credit mechanism is to provide greater capital mobility in the economy. Instead of deeply understanding a sector's expected returns and deciding to invest in it indefinitely, given that selling shares in a privately held company is a complex process, it's possible to outsource much of the problem to someone who already understands the sector that requires capital and has a planned allocation plan in mind. The owner of the capital makes a loan under much simpler terms: a predetermined rate of return and payment schedule, and a collateral structure to reinforce the borrower's commitment.

The benefit to the lender is clear. For the entrepreneur, it only makes sense to borrow if the agreed interest rate is considerably lower than the expected return on the capital, since the risk is disproportionately on their side. Naturally, in many cases, borrowers make mistakes and end up worse off than their lenders, but if this negative outcome becomes too common, entrepreneurs will begin to borrow less capital, credit investment opportunities will become scarcer than the capital available to be loaned, and lenders will have to reduce their required interest rates to stimulate interest in new credit operations in the market. In other words, the interest rate also follows the logic of prices. The surplus between the average return on investment in companies and the average interest on loans is necessary to keep the credit system functional, just as it is necessary to make a profit on the sale of a product to ensure its continued supply.

This logic doesn't necessarily hold true all the time. Just as imbalances between supply and demand can cause periods of significant price increases or decreases, seasons of poor business performance due to unpredictable factors can frustrate entrepreneurs' expectations and leave creditors in a better position. However, in the long term, it is unsustainable for the profitability of credit investments to remain higher than the profitability of businesses, as this would mean that entrepreneurs, those truly responsible for creating real economic value, would accept less than chronically passive rentiers, even when faced with the possibility of simply ceasing to lead businesses and becoming just another creditor.

A quick aside: the average interest rate on corporate loans is always higher than the CDI, which is in effect for very short-term credit transactions between banks, which have very low risk. Therefore, the average return on businesses in general is expected to be considerably above the CDI over long periods.

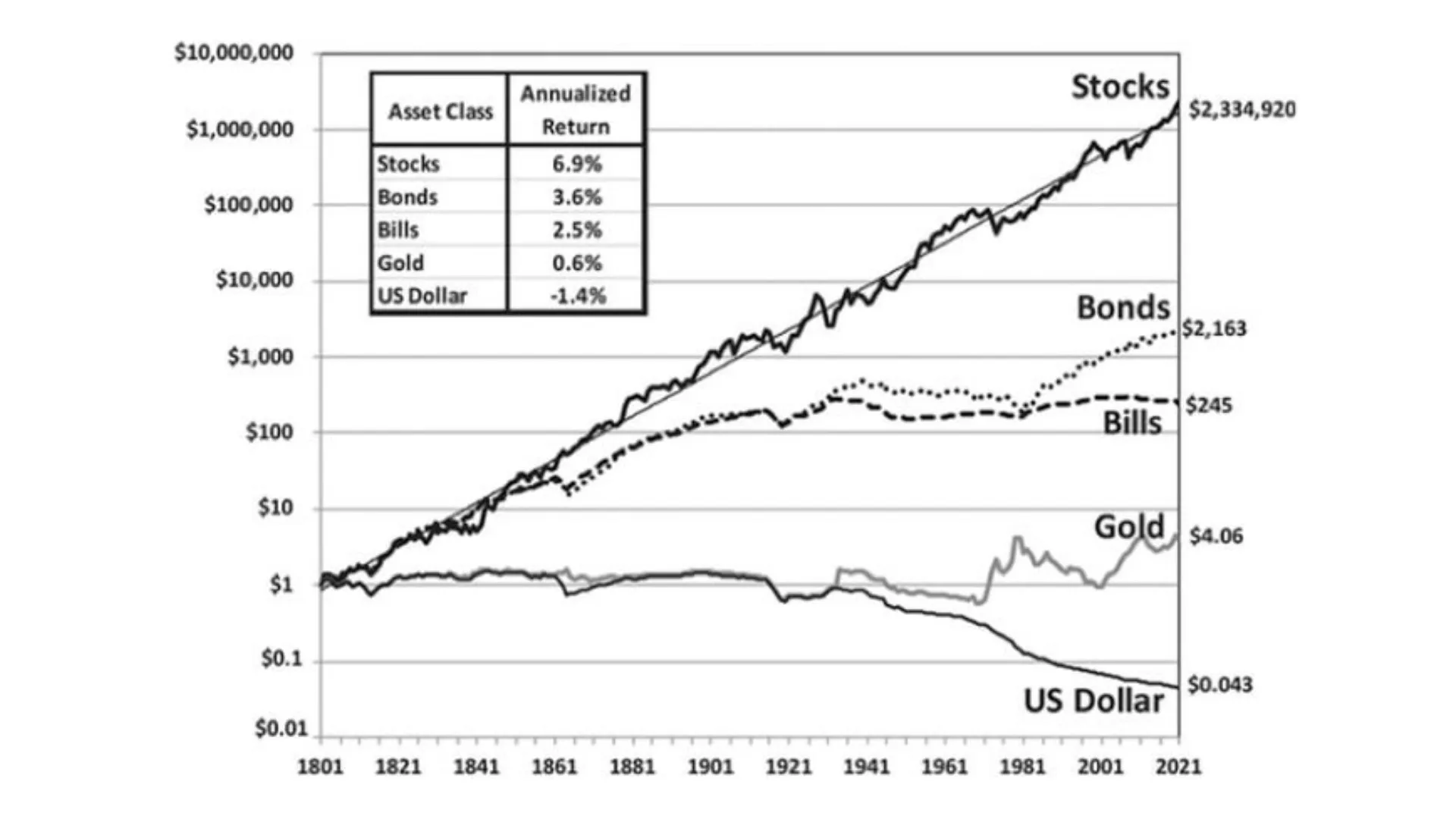

If the theoretical argument isn't enough, the most comprehensive empirical data comes from the very long-term study by Jeremy Siegel, who analyzed fixed-income and equity returns in the American market over more than 200 years and summarized the results in this famous graph, originally published in his book "Stocks for the Long Run."

Note: real returns, above inflation

There is also anecdotal evidence: have you ever heard of large fortunes created through investments in CDB, LCI, LCA, and the like?

When is it time to buy?

Despite the conclusion that being a partner in companies tends to be more profitable than being a creditor in the long term, the equity market is remarkably cyclical, and the purchase price of shares significantly impacts the return obtained. The best way to ensure an attractive purchase price for investment is a well-known process: i) qualitatively analyze how the company's business operates; ii) estimate the cash flow generated by the business in the coming years; iii) calculate the intrinsic value of the stock by discounting the estimated cash flow at your target rate of return; and iv) only buy when the price is considerably below your estimated intrinsic value (the good old-fashioned margin of safety). It's not a highly complex task, but it does require some time. However, there are simple and quick ways to check for signs that it might be a good time to look for undervalued stocks.

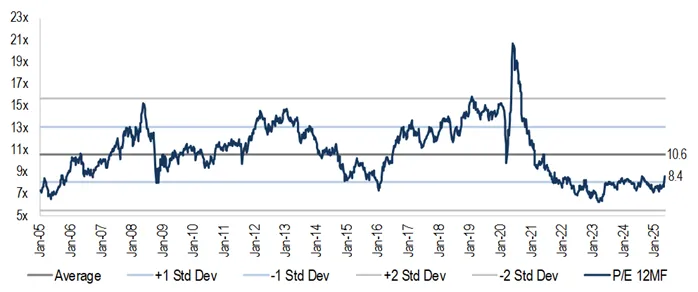

One such approach is to monitor the evolution of the stock market's average valuation multiples. Although simplistic, the indicator provides a general idea of how current prices compare to their "normal" values. Several investment banks regularly publish this index, which is currently ~21% below its average over the past 20 years.

Average Price/Earnings Multiple* on the Brazilian stock exchange

*Considers estimated profit for the next 12 months

Source: BTG Pactual – Brazil Strategy Monitor, May 23rd 2025

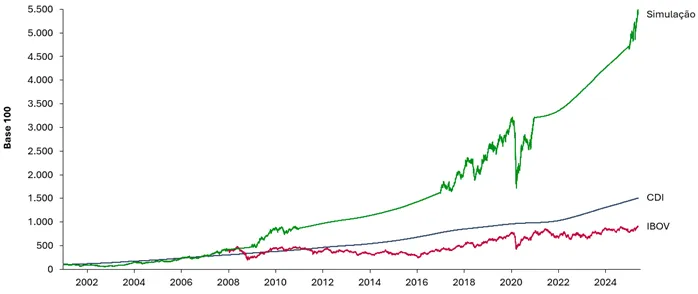

Another approach is the one we mentioned at the beginning: checking the allocation level of Brazilian stock market funds, because when it's low, it's usually a good time to buy. This statement isn't immediately obvious, since most of the capital invested in the Brazilian fund industry comes from professional investors, and it's implied that they would be making mistakes along with the other categories (foreign investors and individuals). To test whether this statement is true, let's simulate the return of a simple strategy: investing in IBOV when the allocation level of Brazilian stock market funds is at minimum levels (and begins to rise) and in CDI when it is at maximum levels (and begins to fall). The investment periods in each index and the returns obtained in this simulated strategy are illustrated below.

Investment in IBOV and CDI according to local equity fund allocations

Simulated strategy return

The interpretation of these facts that seems most fair to us is that local investors, like everyone else, exhibit procyclical behavior: as the stock market generates good returns, they gain confidence and increase their allocation to the stock market; when stocks begin to decline, they become frustrated and migrate to fixed income. This is how the markets' pendulum-like behavior is generated, which, despite being a well-known phenomenon, inevitably continues to repeat itself.

The trap is largely psychological. Most people, professionals or not, are insecure when faced with uncertainty and seek reassurance in the behavior of those around them. It's a good strategy in many life situations. If you see a crowd running, it's advisable to run in the same direction and only then ask why. In investing, it's advisable to develop your own analyses and draw your own conclusions, regardless of what the majority thinks. The conviction to act in the opposite direction comes from diligent analytical work and a pinch of faith in the ancient Latin proverb: fortis fortuna adiuvat – fortune favors the brave!