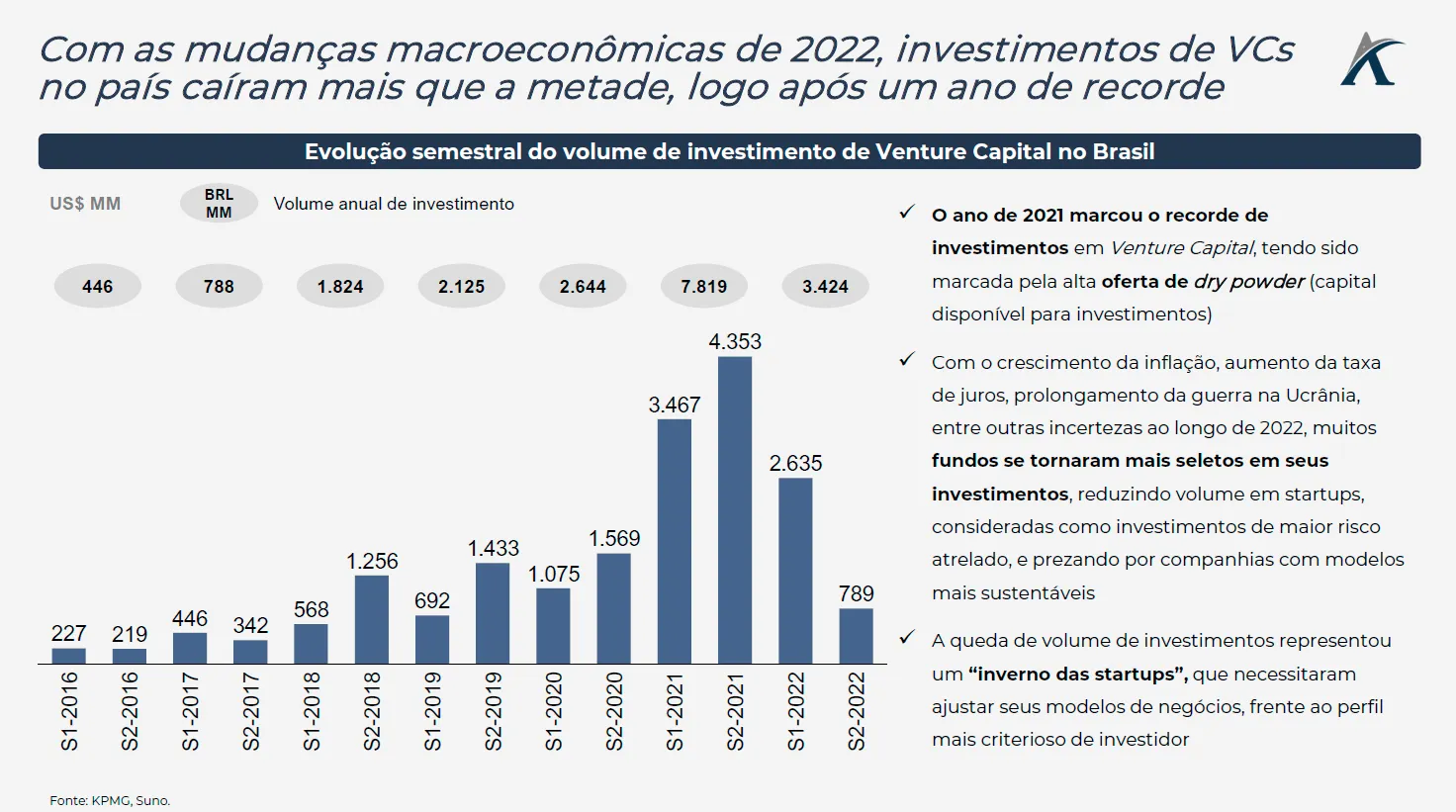

2021 was a record year for venture capital investment, reaching US$7.8 billion in Brazil. The large supply of dry powder (capital available for investment) generated by the low international interest rate scenario and the buoyant IPO market boosted investment rounds in startups, particularly those focused on technology, which were insufficient to meet the increased appetite of funds and were able to take advantage of favorable conditions for raising funds at high valuations.

With the shifting macroeconomic paradigm, marked by rising interest rates, the prolonged war in Ukraine, concerns about a global recession, and the country's elections at the end of the year, venture capital investment levels fell by more than half in 2022, reaching US$1.4 billion. Investors changed their investment profile and reduced capital allocated to startups, which are considered higher risk.

The "startup winter" represented a period of significant reduction in fundraising rounds, with startups adapting to new market conditions and the new investor profile, which prioritizes sustainable cash generation models over the high growth of the previous year.

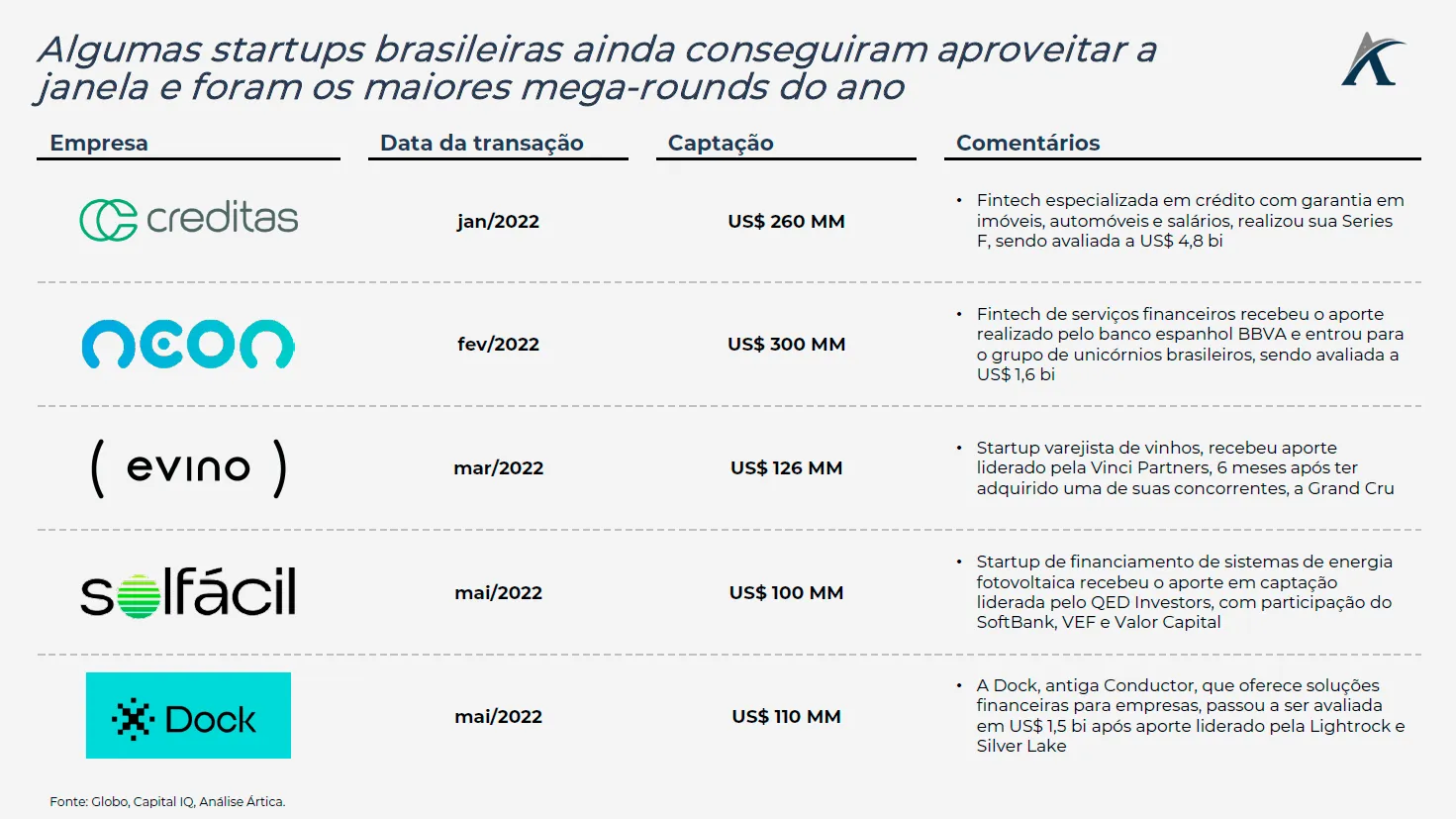

Despite the drop in investment volume in 2022, some startups still managed to take advantage of the end of the window of opportunity in the first half of the year, participating in fundraising rounds exceeding US$100 million, known as “mega-rounds”.

In today's bulletin, we present in more detail the evolution of venture capital investments that resulted in the "startup winter" and what the largest "mega-rounds" of 2022 were.