Artica Long Term FIA

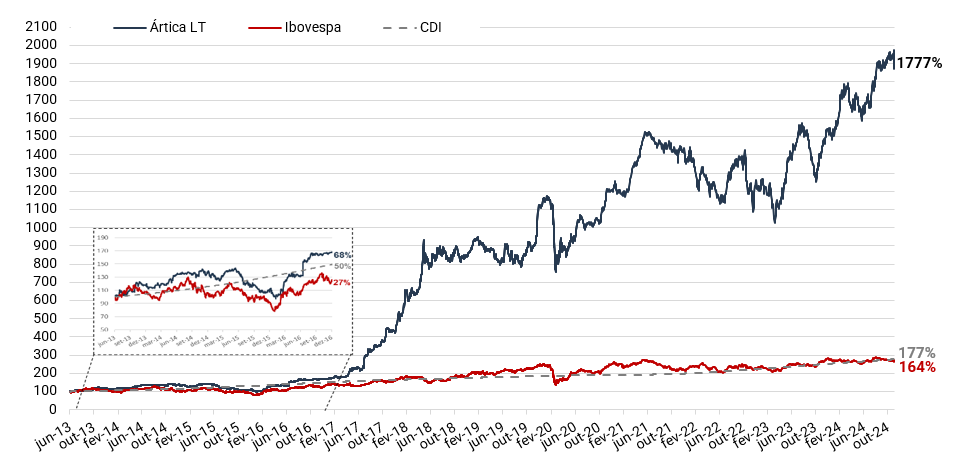

The Ártica LT is our oldest vehicle, with more than 11 years of history and an average accumulated return of approximately 30% per year.

Through a fundamentalist philosophy, we seek to invest in shares of Brazilian and foreign companies that we consider to be of quality, and that are at a significant discount to what we estimate to be their intrinsic value. We tend to concentrate the fund on the best ideas, with the 5 largest positions having a significant share of the fund's assets, and usually with less than 15 invested companies.

A significant portion of the partners' and management team's assets are concentrated in our funds, which reinforces our commitment to taking care of them with the utmost discipline and responsibility.

Profitability

(1) Ártica LT started on 06/27/2013 as an “investment club” and, on 09/27/2019, it was transformed into a “stock investment fund”. Profitability presented from the beginning on 06/27/2013 until 11/30/2024.

(2) The profitability presented is adjusted as it considers the reinvestment of dividends, interest on equity or other income arising from financial assets that are part of the Fund's portfolio passed directly to the shareholder, which was permitted by law until 2015. The practice avoided the charging 15% taxes on the value of the dividends, but it meant that the dividends received were not incorporated into the value of the Ártica shares.

Where to invest

*Available on demand

Results meeting

At Ártica, we value proximity and transparency with our shareholders. To this end, we hold quarterly results meetings, exclusively for our investors.

If you invest in any of our funds and are interested in participating, simply register by clicking the button below:

Technical Features

Quota Class

Single Class

CNPJ of the Fund

18.302.338/0001-63

Target Audience

Qualified Investors

ANBIMA classification

Free Actions

Manager

Arctic Management

Administrator / Custodian

BTG Pactual

Minimum investment

R$ 20 thousand

Additional investment

R$ 1.0 thousand

Global rate

2% aa

Performance fee

20% on what to exceed the Ibovespa, with watermark

Application quotas

D+1 (business day)

Redemption quotas

D + 89 (calendar days)

Financial settlement

D + 1 (after subscription)

Taxation (IR)

15% of gain, on redemption (without share eaters)

Arctic Long Term FIA Documents

All rights reserved.

Sign up for our newsletter