The fact that small funds have higher average returns than large funds is well known in the financial market.

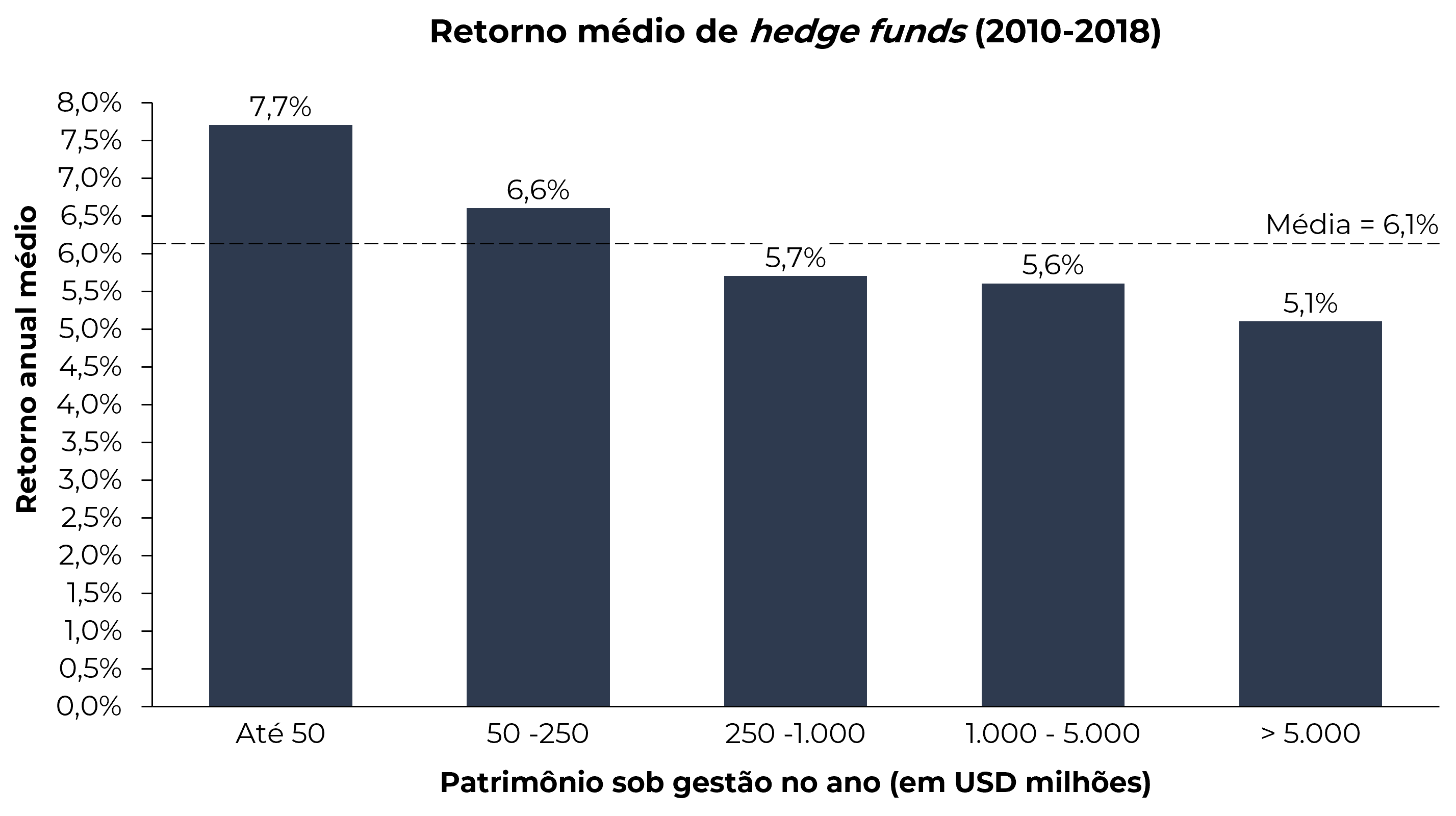

An American manager of funds of funds analyzed the returns of hedge funds between 2010 and 2018. At the beginning of the period, there were around 1,700 funds that accumulated USD 1.7 trillion under management, and at the end of the period there were 3,800 funds with USD 3 .2 trillion under management. They found a clear correlation between fund size and profitability: while “micro” funds (less than USD 50 million under management) had an average return of 7.7% per year, “mega” funds (more than USD 5 billion under management ) had an average return of 5.1% per year. The difference is greater than it seems: USD 100,000 invested in “mega” funds would become USD 156,000 at the end of the 9 years, while the same investment in “micro” funds would reach USD 195,000, a final value 25% higher.

This occurs because large funds compete with each other for the limited number of investment opportunities that can absorb large volumes of capital. This fierce competition among professional investors makes it more difficult for large asymmetries to arise between the price and intrinsic value of each asset.

Consequently, the chance of these funds having very high returns ends up being smaller.