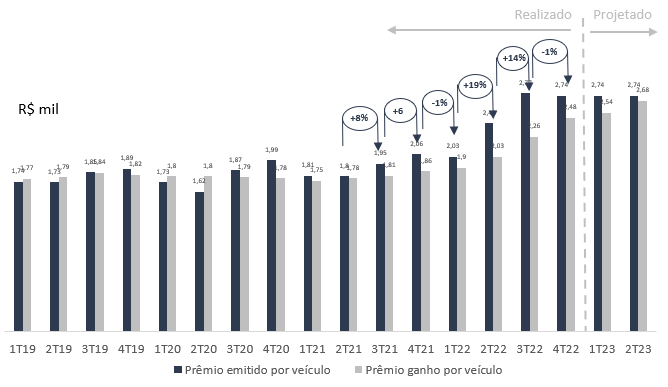

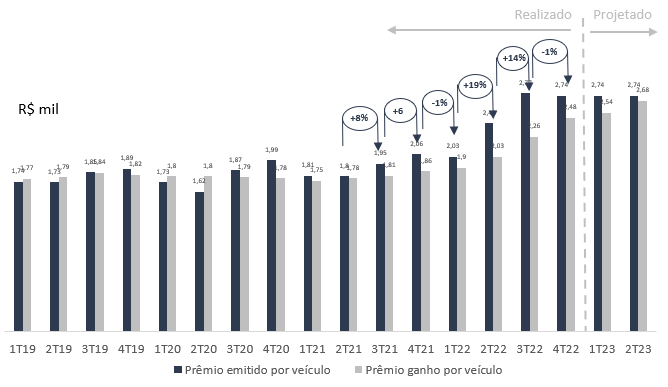

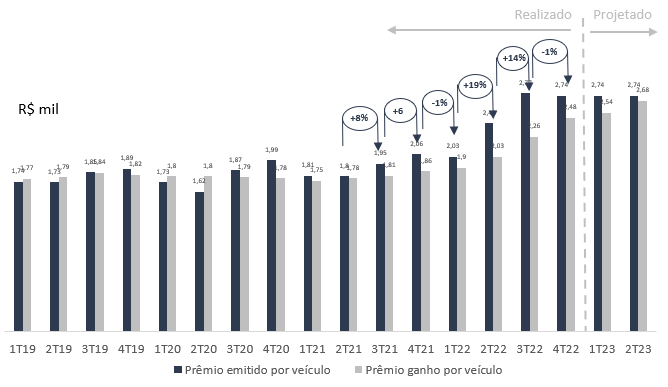

One of our main theses is about Porto Seguro. We started investing in Porto in 2021, and we significantly increased the position in 2022. This is due to the great growth potential. Furthermore, in the valuation done, we saw that the company was extremely discounted. In the analysis, we saw that the price of the premium issued per vehicle (how much the company effectively charged the policyholder) would only be effectively captured in the company's balance sheet, after 1 year.

The loss ratio (calculation of the loss ratio as: Loss ratio = Loss ratio / Premium won) after the pandemic period – where there was a large drop – increased due to repressed post-pandemic demand, to then enter a decreasing stage.

The decrease in this loss ratio is directly related to the high pricing that the market has now noticed and the consequent increase in share prices. Our team realized this early on, which enabled us to make significant gains on paper.