Dear investors,

Continuing our initiative from last year, we reserved our last letter of the year to suggest five books related to the topic of investments. As a criterion, we seek to prioritize books that we like a lot, but perhaps are not as well known to the public.

“An investment in knowledge pays the best interest.” – Benjamin Franklin

First published in 2008, this book has won multiple awards and been recognized by Porchlight as one of the top 100 business books of all time.

In a way, it is a forerunner in the application of behavioral sciences in the investment business, something that became much more popular in the last decade, mainly after the publication of Thinking Fast and Slow in 2011. Rather than developing a theme or a thesis in a prescriptive way, the book is structured around a collection of 50 articles, which can be read independently, with some provocative ideas and insights of the most current theories at the time of publication, such as:

-

- Investors tend to assume linearity in their business projections, whereas, in fact, a company's growth tends to follow an S-curve. This means that people underestimate the growth potential of fast-growing companies, and overestimate growth. as the business matures.

-

- Financial models that imply an exact price for a stock are less useful than models that calculate business value under various scenarios, and assign probabilities to each scenario. One suggestion that the author makes is to have an analyst develop an economic-financial model for the company and then have a second analyst assign probabilities to each scenario, approaching a double-blind scientific method.

-

- Studies indicate that a group of people without any specific knowledge can solve problems as well as individuals who are specialists in the subject.

-

Being patient and diligent and following a sound investment process is more important than sporadically delivering great investment results. A good result does not justify a bad process. But even though a good process can sometimes produce a bad result, in the long run it will trump a bad process. While this seems obvious to some, the truth is that most fund investors pay very little attention to the robustness of the investment process.

From time to time it is interesting to revisit some of these ideas, not least because they are still true simply because they come out of 'the media'. An example is the Kelly Criterion, very well applied in investment management by Edward Thorpe (see last year's book suggestions) and which, although it is a theory developed in the 50's, is still little taught today.

The author of “More than you know”, Michael Mauboussin, brings to his curriculum an interesting mix of academia and investment practice. He currently leads research at Morgan Stanley's long-term equity fund Counterpoint Global, and is an adjunct professor of finance at Columbia Business School in New York.

It is a quick and highly provocative read on investment topics for beginners and professionals alike.

-

The Quest: Energy, Security, and the Remaking of the Modern World

Title in Portuguese: The Quest: energy, security and the rebuilding of the modern world.

In these times when a liter of gasoline is costing more than R$ 7.00 in many states, reading this book becomes mandatory to understand the economic and geopolitical dynamics of energy markets.

Written by one of the greatest authorities on the subject, Daniel Yergin, this book can be considered a continuation of the 1992 publication, “The Prize”, which narrates the history of oil between 1850 and 1990.

“The Quest” begins by telling how the oil industry evolved from the first Gulf War, describing its trajectory until the dissolution of the Soviet Union into more than a dozen republics. But the book goes beyond the oil industry, providing a comprehensive view of the global energy market and its geographic, political and technological interdependencies.

To give context to the political environment that permeates this industry, the book discusses issues related to energy security in countries and the challenge of having access to reliable and economically viable sources of energy to support its growth. In addition, it brings a lot of detail about China, which has been the tipping point in recent decades.

The importance of electricity for today's world gains a specific section in the book. The story of the development of this ubiquitous form of energy has been told many times, but Daniel does it succinctly and masterfully, also discussing the challenges of keeping such a comprehensive and complex system operating 24/7 without interruptions. An explanation is in order here about nuclear energy, which took a while to gain confidence as a source of electricity after the American bombings of Japan in World War II. During the 70's it had its glory days, but ended up falling out of favor due to accidents such as Chernobyl and Fukushima. With this context, for example, we were able to better understand the reason why the issue came up again and led China to announce, in early November, an investment of US$ 440 billion in new nuclear reactors by 2030.

Another very current topic for which “The Quest” gives us an excellent context is that of the carbon market. Celebrated during the last COP 26 in Glasgow, this global agreement aims to reduce the use of fossil fuels through the mechanism known as “cap and trade”.

In a specific session, the book covers the history of climate science, the evolution of debates about global warming and how the introduction of a market for cap-and-trade significantly reduced emissions of gases containing SO2, the main cause of acid rain.

Finally, it is worth mentioning the discussion about the future of the automobile market and the potential adoption of the electric car. At the time of publication of the book, Tesla had just made its IPO, the first company in the automotive sector to go public since Ford in 1946!

Yergin has a very fluid writing, making the reading of its more than 800 pages very pleasant.

-

The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness

Title in Portuguese: Financial Psychology: Timeless Lessons on Wealth, Greed, and Happiness.

This is one of the best personal finance books we've read recently. Very well written, it offers deep and high quality content in a simple and objective way.

Unlike many other books in its genre, “Psychology of Money” does not attempt to present specific tactics or formulas for building wealth quickly. Morgan Housel, its author, uses the example of 19 stories of how people handled their money to investigate the mental models and behaviors that shape much of our financial success.

The premise that runs through the book is that making money has little to do with how smart you are, but a lot to do with how you behave. A person who is a genius but who loses emotional control easily can be a financial disaster (see next review for a historical example!). On the other hand, the opposite is also true. Ordinary people with no financial education can become rich if they develop behavioral skills that have nothing to do with formal measures of intelligence.

-

- Less ego, more wealth: Our ability to save money is the difference between our ego and our income. Most of our spending on things and possessions (which feed our ego) gets in the way of our financial freedom and future options. “Spending money to show people how much money you have is the fastest way to have less money”

-

- Longer investment horizon means better returns: sounds simple, but in practice it is difficult to pursue. People admire Warren Buffet's investing skill, but his real secret is time and patience – his wealth is the result of over 75 years of invested equity, and 99.6% of his wealth (out of nearly US$ 100 billion) it was acquired after he turned 52!

-

- Good investments do not necessarily mean getting the highest returns., because the biggest returns tend to be one-off successes that cannot be repeated. It's about getting really good returns that you can keep and that can be repeated over a long period of time.

-

- The highest intrinsic value of money it's their ability to give you control over your time.

-

- A 'Reasonable Strategy' is better than a 'Rational Strategy': Reasonable is what works for you. Taking undue risk to optimize every penny of return may not be sustainable in the long run. This is a point that we elaborated on in our previous letter.

-

- Money for Nothing: The Scientists, Fraudsters, and Corrupt Politicians Who Reinvented Money, Panicked a Nation, and Made the World Rich

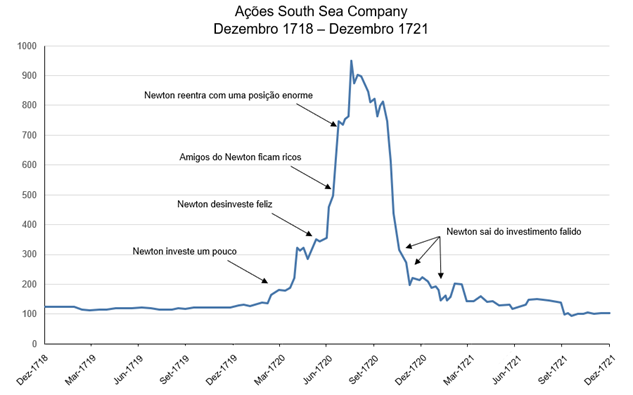

A "south sea bubble”, a financial boom that helped solidify nascent capitalism in the 1720s, is perhaps not as sexy and well-known as the Tulip Mania that occurred in 1637. It didn't capture the popular imagination in the same way. However, by helping to invent markets for bonds (debt securities) and consolidating the power of influence of the financial sector in modern politics, gave rise to the capital market as we know it today.

In the early 18th century, England was running out of money due to a protracted war with France. Parliament tried to raise additional funds by selling debts to its citizens, taking money now with the promise of interest later. It was the first permanent national debt, but still they needed more.

Parliament then turned to the stock market – a relatively new invention in itself – and where Isaac Newton's scientific discoveries (calculus, motion of the planets) were being tentatively applied.

A south sea company (Company of the South Seas), had been created to exploit the monopoly of trade between England and the Spanish colonies in the Caribbean. There was a small problem: Spain and England were at war (again), making any form of business between these countries unfeasible.

While waiting for the traditional enemies to settle their differences, the executives of the South Sea Company elaborated complex business plans, based on the actuarial tables of Newton and Halley (astronomer and discoverer of the comet that bears his name).

Soon, the south sea company began to see their shares rise in price, based not on anything they were making or selling, but on the putative value of their future plans. Stimulated by the “success” of the deal, the company's directors began taking out loans to buy more shares in South Sea, using their own shares as collateral.

Stock prices doubled, doubled again and then doubled again, getting everyone in London from Newton to the Prince of Wales caught up in the financial mania.

One thing that makes the book really enjoyable is the context provided by the author. The first third of the book shows what was happening in scientific thought and observation, in mathematical theory and in monetary practice between the mid and late seventeenth century. Without these changes, and the prevailing national debt, it is difficult to understand how the bubble could have happened when it did.

A second feature of the book is that it clearly explains many of the basic concepts needed to understand how the bubble started and how it was deliberately inflated.

As a curiosity, this was the (approximate) performance of Isaac Newton, perhaps one of the smartest people who ever lived, with this investment:

Source: Marc Faber, Jeremy Grantham, Sir Isaac Newton

-

- Invent and Wander: The Collected Writings of Jeff Bezos, With an Introduction by Walter Isaacson

The book is based on letters to Amazon shareholders written by Bezos and his speeches throughout his life. In a determined tone, Bezos comments on the values and culture he has developed within Amazon and that he carries with him in his life and his other businesses, such as the Washington Post and Blue Origin.

Letters to shareholders go far beyond commenting on the company's annual results, bringing an example of corporate strategy, long-term thinking and customer obsession. In our role as investors, we read many annual reports and letters from executives, but we rarely find such clarity and objectivity as Bezos.

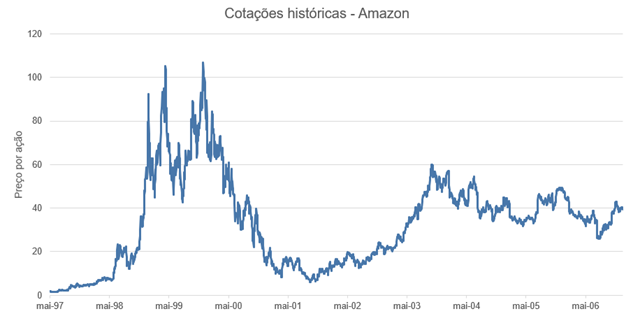

It's one thing for a successful entrepreneur to write about his career after the fact. The narrative becomes much more linear, and many challenges or even luck factors end up being forgotten or losing their due weight. It is another thing to read “history being written”. For example, this is a chart with Amazon stock prices around the year 2000:

Source: Capital IQ

And what did he write in the 2000 annual letter? “ouch. What a brutal year for the capital markets and especially for Amazon. As of the date of this letter, Amazon stock is down more than 80% since last publication. […] But if the company is better positioned today than it was a year ago, why then has the share price dropped so much? As the famous value investor Benjamin Graham put it, “In the short term, stocks are like urns, in which the most popular stocks stand out; in the long run, they are like scales, in which those with more substance prevail””. And the most fascinating thing is that from the time Bezos wrote the letter in 2000 until today, the stock has multiplied by more than 300x!

Among the points developed in the book, we highlight the following:

-

- Day 1 Mindset: since the beginning of Amazon, the mentality of working as if it were always the first day was maintained, that motivation to carry out a new project and with the energy and entrepreneurial spirit to participate in something great. We, as human beings, settle very quickly. The provocation of the book is to face every day with that typical excitement we have when starting a new personal project.

-

- It's all about the long term: the short term is very volatile, this is true both for the financial market and for the operational metrics of companies. Focusing solely on the result of this quarter or the next leaves us blind to structural and lasting changes in the coming years. We must plan ourselves and have a vision of where we want to be in the coming years and work accordingly to get there, knowing that the path to the goal may not be linear.

-

- Focus relentlessly and passionately on the customer: Amazon from the beginning intended to be the most consumer-focused company in the world. More important than focusing on competitors, as other companies tend to do, Amazon maintained its focus on customers (customer obsession as opposed to competitor obsession), because, in the words of Bezos, “customers are always beautifully, wonderfully dissatisfied, even when they report being happy and business is great”, exerting constant pressure for the company to improve.

-

- resist proxies: As companies get bigger and more complex, there is a tendency to be more concerned with formal processes than with the end goal they seek to achieve. A good process serves an employee so that he serves his end customer. However, if we are not careful, the process can become an end in itself. You stop looking at the end results and focus only on following the right process. In his own words, “It's not uncommon to hear a leader defend a poor outcome with something like, “Well, we followed the process.” A more experienced leader will use this as an opportunity to investigate and improve the process. The process is not the thing. It is always worth asking: “Do we own the process or does the process control us?”.

-

- decision making: some decisions have profound consequences and are irreversible. These decisions must be made very calmly, analytically and methodically, with great deliberation and consultation. However, most decisions are not irreversible, but revocable. The beauty of these decisions is that they can be made even without broad consensus and broad access to all information. 70% of the information should already be enough to take it by capable individuals. Above that, you're probably wasting your time.

In addition to several insights like these, the book features a light and humorous narrative, characteristic of Bezos, and tells a series of anecdotes about the history of Amazon, from the beginning, when they still dreamed of having money to buy a forklift, until the present day.

Whether you are a seasoned investor or just starting out, we believe the above books will provide valuable lessons with a healthy dose of fun. Special thanks to my friend Gustavo Baltar, who recommended one of the books in this review. Without further ado, happy reading!