Why do we invest in Porto?

Dear investors,

The ideal investment opportunity is to find a high-quality company trading at a low price on the market. This type of opportunity almost never arises when the economic climate is favorable and the company is performing well. So, if you want to buy truly cheap stocks on the stock exchange, be prepared to invest when the economic climate is very bad, or when the company is performing poorly, or when both occur simultaneously.

It was in this context that we purchased our shares in Porto (PSSA3). The thesis is interesting because it's practically a textbook case, without any major complications or twists and turns, and it illustrates some aspects of our investment philosophy well. So, we'll tell the story of our investment, which is still ongoing. Currently, Porto is the second-largest position in the Ártica Long Term FIA portfolio.

What Porto does

Porto is one of Brazil's leading insurance companies, with 13,000 employees and 37,000 independent brokers serving 16 million customers nationwide. The group is divided into four business verticals: Insurance, Health, Banking (financial services), and Services (general). The main business is the insurance unit, which currently accounts for approximately 65% of the company's total revenue. It was the group's initial business. The other verticals were created to sell additional products and services to customers already covered by Porto's insurance. The table below summarizes the company's current business areas.

In auto insurance, Porto is the clear leader in Brazil, maintaining a market share of ~27% for over a decade, while the second-largest company currently holds around ~18% (after acquiring competitors) and the third-largest company, ~13%. In the Southeast, where it has the largest presence, its market dominance is even greater. This segment is the most important for the company, not only because it represents ~50% of the group's revenue, but also because it is the best known and the gateway to new customers, to whom the rest of the product and service portfolio is also offered. Therefore, we will place greater emphasis on this business line.

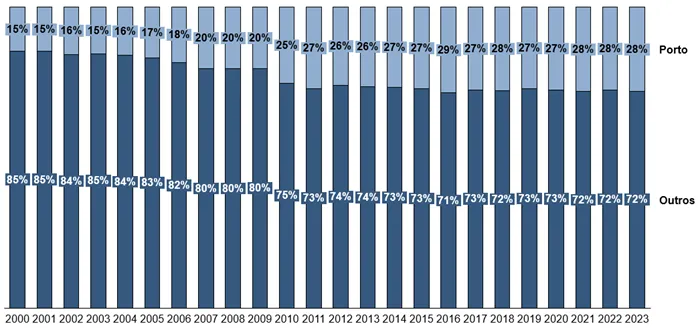

The crucial point is understanding how Porto has been able to maintain its leadership position for so long. Stable market share typically indicates the existence of entry barriers and competitive advantages, as these impediments alone prevent competitors from attracting large numbers of customers. Sectors with these characteristics tend to have orderly competitive dynamics, in which each company ends up dominating certain regions or product segments and does not launch major offensives to try to take market share from its competitors. This configuration is well applicable to the auto insurance sector in Brazil, where the market share of the main insurers remains stable or changes very gradually over time. Consider how Porto's market share has evolved since 2000.

Market Share Porto vs. other insurers

Source: Susep

In our view, there are three main competitive advantages that make Porto's leadership position quite sustainable: the scale of its operations, the strength of its brand with end customers, and the company's strong reputation and relationships with its network of independent brokers. Let's explore each of them.

The importance of scale for the auto insurance segment is related to traditional economies of scale (e.g., bargaining power in negotiating spare parts) and the need to maintain a service network ready to serve insured vehicles that, for example, are involved in traffic accidents.

This support structure must be sized according to peak demand in each region served—that is, the number of simultaneous calls each support unit must be able to handle to ensure a satisfactory level of service to customers. For a small insurer, both geographic coverage and optimizing the use of the support network are challenging requirements.

The issue of geographic coverage is simple. Imagine a small insurance company that only has clients in the state of São Paulo. It's natural to have a service structure in the region where its clients live, but how can it serve those involved in an accident while traveling to Minas Gerais? It's unpredictable where and when clients will travel, and maintaining coverage in all possible areas to address sporadic events is economically unfeasible. An insurer with clients in both São Paulo and Minas Gerais ultimately has an advantage. Ideally, it should operate nationwide, as is the case with Porto.

Understanding the advantage of scale in optimizing the use of the assistance network requires some understanding of statistics. A traffic accident is a random, low-probability event, and therefore, it is impossible to predict whether a given driver will be involved in an accident on a given day. However, it is easier to predict the number of accidents a large group of drivers will experience in a given day. The larger the group, the greater the predictability of the total number of accidents, as it will approximate the probability of each individual accident occurring multiplied by the number of drivers in the group. This statistical principle is known as the Law of Large Numbers. Thus, the greater the number of customers within the operating radius of a given service center, the more predictable and consistent the number of accidents that unit will have to handle each day, and the lower the total cost per service. In this regard, it is not only the total number of customers that matters, but also how concentrated they are in a given region. Therefore, the insurer with the largest market share in a given geography will likely have the lowest logistics costs for handling insured events. This is again the case for Porto in the main regions.

Interestingly, the average probability of a driver in Brazil being involved in an accident is once every 78.9 years, according to our estimates using 2023 data from the Ministry of Transportation (disregarding minor accidents that go unreported). Thus, an insurer with 100,000 customers within a service radius of a given unit could expect to handle approximately four accidents per day in that location. This illustrates how difficult it is for a small insurer to maintain a support network that offers a high level of service and is not idle most of the time.

As the market leader with nationwide coverage, Porto Seguro is in an excellent position to offer the highest level of service to its customers and reinforces this advantage with a culture highly focused on providing high-quality services. Over decades of excellent customer service, Porto Seguro has built an excellent reputation that is very difficult to replicate. Today, the Porto Seguro brand is one of the best-known and most highly regarded in the country.

An insurance company's reputation is especially important because of the dynamics of its business. Customers pay the insurance policy upfront and expect the insurer to honor its obligations, but they'll only put their hopes to the test on a bad day, when they're stranded on the street with their car wrecked. Therefore, it's natural for people to seek insurance from a reputable company and be willing to pay a premium for the confidence that the insurer will be honest and helpful if called upon.

Porto's average annual car insurance premium was R$2,600 in 2023, approximately R$220 per month. If a lesser-known insurer offered a lower premium, a significant discount, would it make sense to save R$22 per month and not have the peace of mind that you'll be well-cared for if you have a problem? Most people think otherwise and prefer to stick with Porto, especially since the premium isn't a significant difference in their lives. This price premium, compared to the industry average, directly contributes to the company's profitability.

The third competitive advantage is the strong relationship with the network of independent insurance brokers, which handles approximately 80% of new auto insurance policy sales. A number of factors maintain this relationship with brokers: attractive commissions compared to the market average; payments are always made promptly and quickly (up to 7 days), which makes a significant difference for brokers, who are not always financially stable; Porto's systems and internal team interact with brokers efficiently and conveniently; and incentive programs are available to motivate the network, such as travel or product awards for the year's best brokers. This set of initiatives, combined with the strength of the Porto Seguro brand with end customers, makes Porto's insurance preferred by brokers, which increases the likelihood of them being the most recommended to their end customers.

Working together, these three key competitive advantages form a virtuous cycle that increasingly strengthens Porto and makes it very difficult for a competitor to overtake its leadership position. Scale helps maintain broad coverage and a high level of service, which pleases customers and reinforces the brand's strength. This allows it to charge price premiums and have more room to compensate brokers well, which helps attract more clients, further expanding its scale.

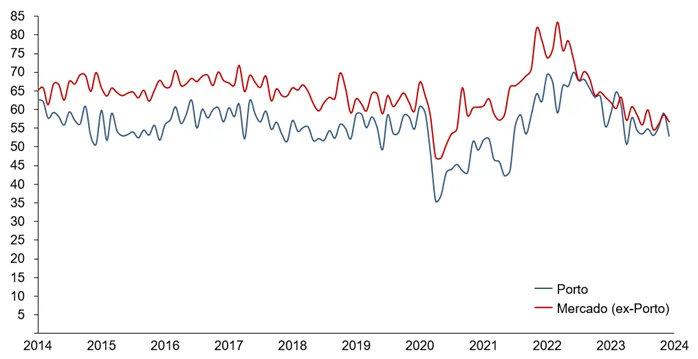

Porto's advantage becomes clear when comparing its loss ratio (cost of claims divided by the value of insurance premiums issued) with the rest of the market. Year after year, it remains ahead of the competition (the lower the loss ratio, the better).

Porto claims ratio vs. other insurers (%)

Source: Susep

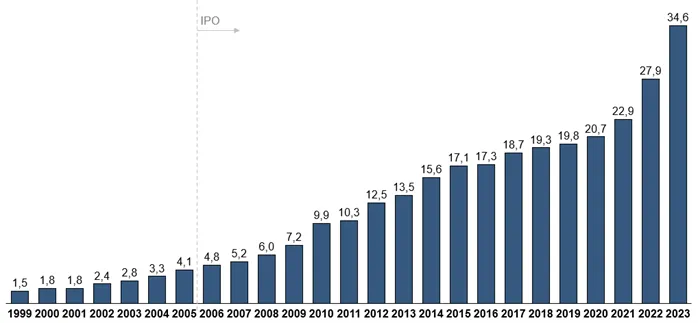

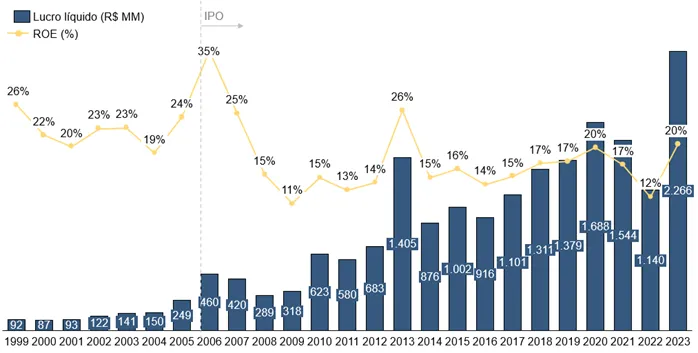

In this context, Porto has been growing and generating excellent financial results for decades. In 25 years, its revenue has grown and its margins have remained healthy every year, even through major crises, such as the subprime crisis in 2008, Dilma Rousseff's impeachment in 2015, and COVID-19 in 2020. Very few companies have such a stellar track record. In businesses with these characteristics, it's very difficult to lose money investing. Even without any major movements that rapidly increase the company's value, the compounding effect of a long period of results is significant. Since its IPO in December 2004, Porto's shares have generated an average annual return of 16.3%, multiplying their value by 18.3x.

Net Revenue (in R$1,040 Billion)

Net Profit and Return on Equity History

What generated the opportunity

Porto is a longtime market favorite. Nearly 20 years since its IPO and above-average profitability make it one of the greatest success stories on the Brazilian stock exchange. Historically, its shares outperform the Ibovespa index over any five-year period. Therefore, it's no secret that the group has high-quality businesses. A unique situation caused its share price to plummet.

During the pandemic, the auto insurance industry suffered several shocks. The first was that new car sales plummeted rapidly in 2020, also reducing the volume of insurance policies typically purchased when picking up a new car from the dealership. As a result, Porto's auto insurance revenue did not grow that year, and, more significantly, the market reduced expectations for its business growth in the coming years, sending its stock price tumbling.

We made our first purchases in early 2021, still with a modest capital allocation, to monitor the situation. Our interpretation was that the insurance sector has been quite resilient throughout history and would likely continue to be so, as private cars are unlikely to cease to be an important mode of transportation.

The first half of 2021 still saw modest growth, but Porto has already returned to growth in the second half. Even so, the company's shares fell amid the start of the interest rate hike announced as a measure to combat inflation. We took advantage of this decline to make our first significant purchases at the end of 2021. A bit early, in retrospect.

In 2022, another shock hit the industry. During the social isolation period, car traffic had significantly reduced, also reducing the number of accidents (claims) that insurers had to cover. Initially, this impact was positive, but the industry's competitive dynamics caused new policy prices to adjust to the expected lower claims ratio. Shortly thereafter, two unforeseen events negatively affected insurers' profitability: the return of urban traffic to post-pandemic normality was faster than expected, and, in parallel, there was a sharp rise in car and spare parts prices, increasing the unit cost of claims. As a result, some insurance policy seasons became much less profitable than usual, squeezing the sector's profits. The weaker results and the ongoing macroeconomic unease, due to high interest rates and discussions surrounding the presidential elections, kept Porto's share price low throughout the year.

We continued to buy. One factor that gave us considerable confidence in this is that we saw the company significantly adjust its auto insurance prices (a 43% increase in the price of policies issued in 2Q22 compared to 2Q21) without causing a reduction in its customer base, as all insurers followed suit. With the adjustment made, it was only a matter of time before profitability returned, as low-yielding policies would have to be renewed at the new prices within one year of issuance.

It's rare to have such visibility into the factors that will lead a company to return to its historical profitability and such clarity about the timeline for this to happen. To this day, we still wonder why this investment opportunity existed for so long in such a well-known and liquid stock. Our best guess is that many funds were experiencing redemptions, so several managers were unable to act on the opportunity or were looking for something that offered the hope of faster returns to try to assuage their investors' dissatisfaction. In any case, we spent 2022 buying Porto shares at attractive prices, until we tripled our capital allocation at the end of 2021, making this thesis the main one in our portfolio at the time.

Where are we today

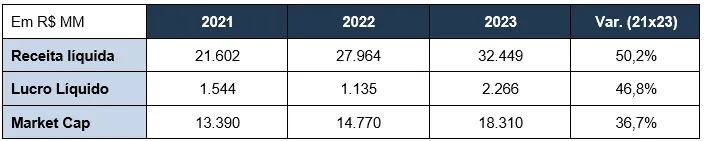

Fortunately, the auto insurance unit recovered its profitability and resumed growth throughout 2023, as we had predicted. Growth was even stronger than we initially expected. Over the past two years, auto insurance revenue increased by 44%. The company's other business segments, although not our focus here, also contributed significantly to growth, with non-auto revenue expanding by 57% over the past two years, resulting in a consolidated group revenue growth of 50% over the period. Note that we are talking about a large company, with net revenue of R$$ 21.3 billion in 2021, reaching R$$ 31.9 billion in 2023.

As a result of these excellent results, the share price rose again, but more modestly than expected. Today, Porto's value is 37% above the market cap calculated using the 2021 closing price. This may seem like a significant price adjustment, but the stock was already cheap at the time, and the business has evolved to a clearly different level over the past two years, which is easily observed by comparing recent financial results.

Another piece of data that points to the company still being undervalued is that Porto's current P/E multiple is 8.1x, compared to a historical average of 10.9x over the last 10 years.

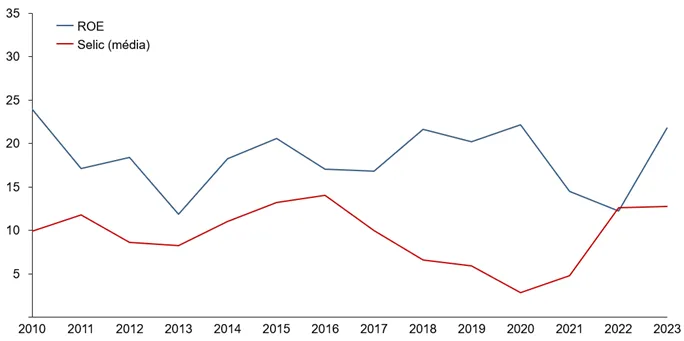

One argument that could explain the market's reluctance toward the stock is the expectation that insurers will experience weaker results in a lower interest rate environment, as part of their revenue comes from investing advance payments from customers in insurance policies. However, this hypothesis is not verifiable in Porto's historical results. The company has maintained a similar level of profitability across various economic scenarios with very different interest rate levels. In short, this occurs because the insurance industry in Brazil is highly professionalized and prices its policies based on the market's projected yield curve, meaning that the expected interest rate decline is already factored into current prices.

Porto's Return on Equity vs. SELIC Rate (% per year)

In the absence of a good explanation as to why the stock is undervalued, it seems to us that it simply remains cheap, amid the reluctance of many Brazilian investors toward the stock market. Therefore, we continue to hold Porto as one of the main theses in our portfolio and remain optimistic about the results it should bring us in the years to come.