Dear investors,

Something we like to evaluate are opportunities to invest in “cold elite athletes”: businesses with an excellent track record of financial results, but which are undervalued due to poor results in the recent past, caused by some temporary ailment. Especially in times of weaker economic conditions, the market tends to give exaggerated importance to short-term results and heavily penalize companies that have bad quarters. This creates opportunities to buy shares of companies at low prices that have a good chance of recovery by simply reverting their results to the historical average.

This type of investment requires a willingness to act against prevailing public opinion, something more difficult than one might imagine. Companies with poor recent results and falling shares are easy targets for criticism from market professionals. At a certain point, there are so many people speaking negatively about the stock that a stigma is created around the company and many investors start to disregard the thesis without properly investigating its merits, simply assuming that the majority must be correct and, in the case of professional managers , also due to the reputational risk implicit in investing in what the entire market believes is a bad idea and which would create an image of an avoidable error if the thesis had bad results in the future.

Note that this type of stigma has no impact on the real risk of a given business, but it can cause its share price to fall beyond what the fundamentals justify, creating risk and return asymmetries that can offer atypical investment opportunities. good. This is precisely the type of situation that investors should investigate.

In this letter, we will share a summary of our investment thesis in Multi (formerly Multilaser), which fits into what we have just described: it has an excellent track record of results over the last 10 years, poor results in recent quarters and is the target of disdain from the most professional investors. In this context, the price of its shares has fallen so much that a partial recovery of its historical results is enough for the investment to bring interesting returns.

Performance over the last decade

Multi began its activities in 1987, selling refilled printer cartridges. In 2003, the company was the leader in its market niche, with annual revenues of around R$ 30 million, and an unexpected event changed the course of the business: its founder, Israel Ostrowiecki, died in an accident while diving on a vacation trip. . Then, Alexandre Ostrowiecki, his son, took over the company at just 23 years old, bringing as a partner Renato Feder, his personal friend and son of the entrepreneurs at the head of the Elgin group, to help him with the challenge of maintaining and developing the business.

In the following years, Multi began to expand its lines of action, launching lines of computer accessories and electronic products imported from China under the Multilaser brand, with the aim of offering the Brazilian market technological products at very affordable prices and quality control. higher than that of goods imported indiscriminately from China, which competed in the same price category. To this day, Multi is closely associated with Multilaser computer accessories, which represent only a fraction of the company's total business. However, before delving into its current business model, let's look at the data that caught our attention and led us to study the investment thesis at Multi.

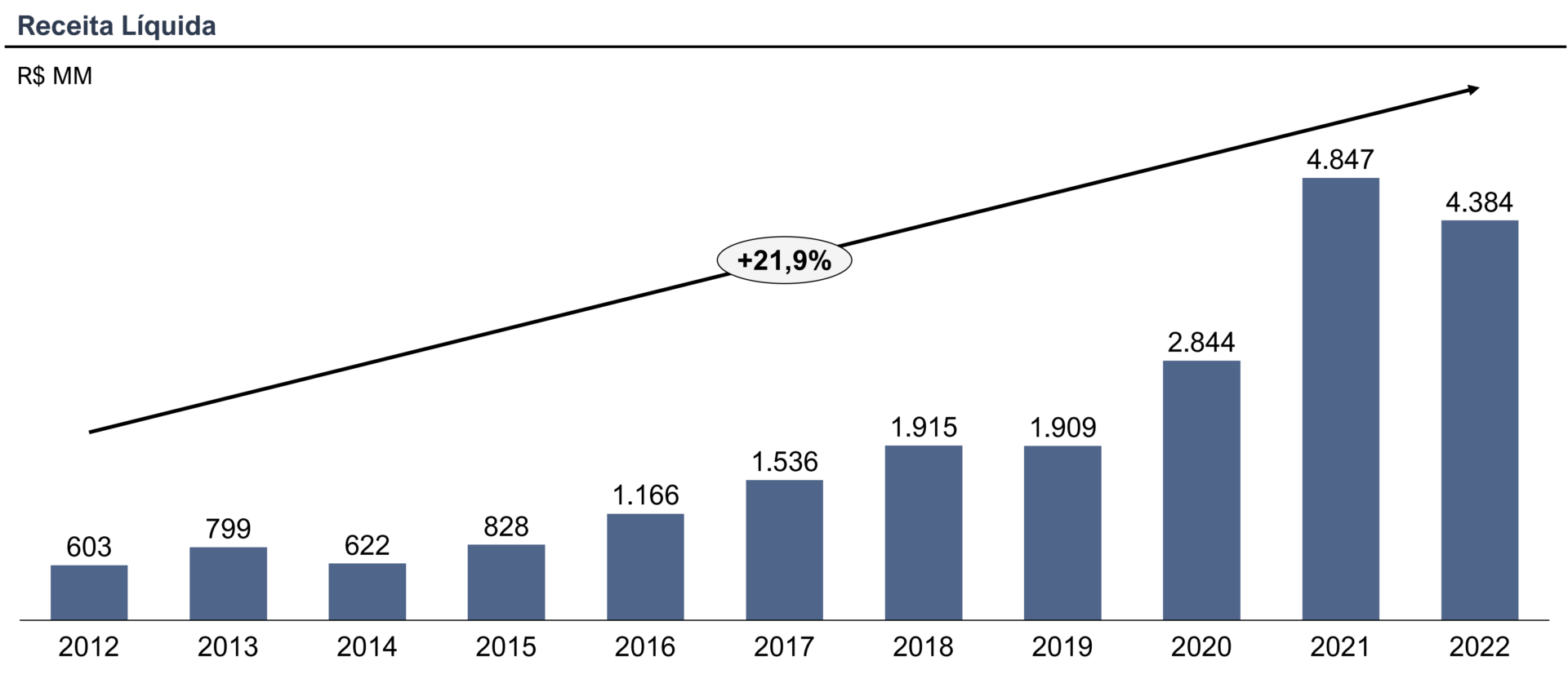

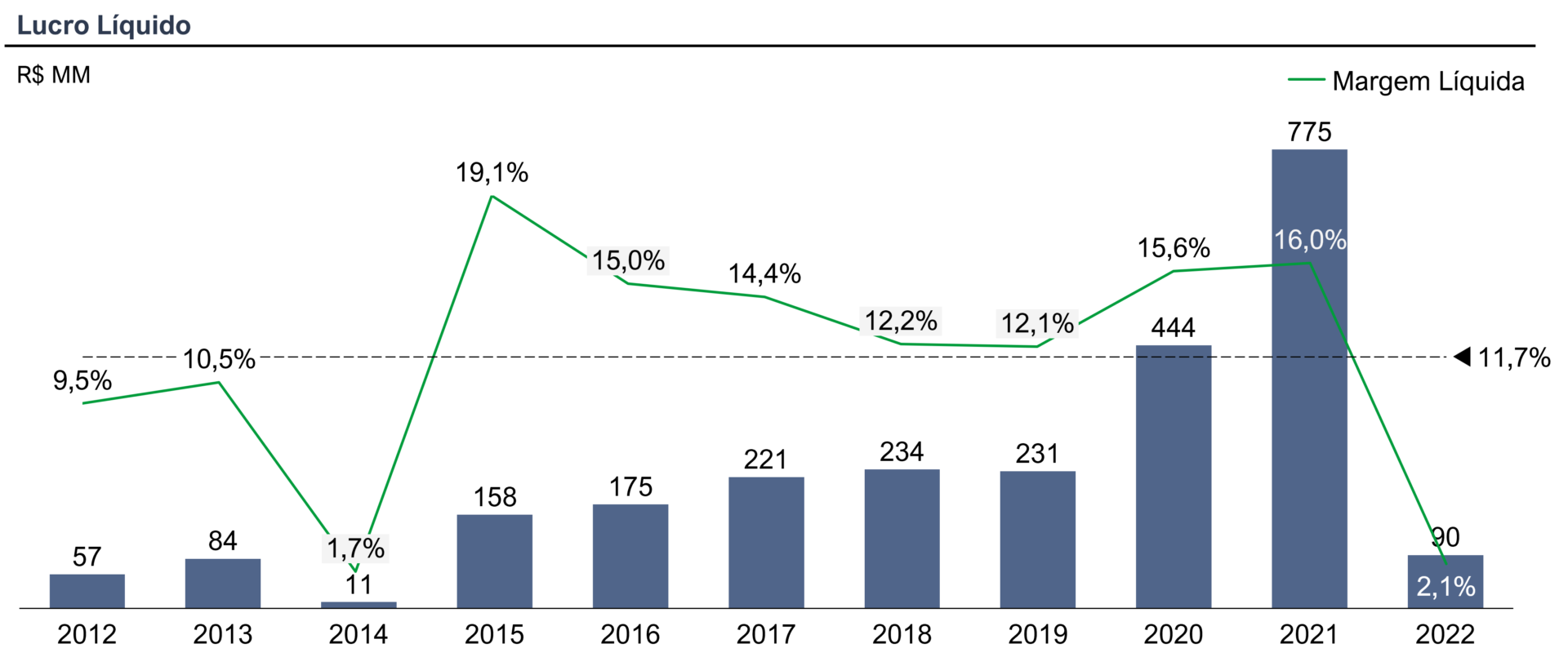

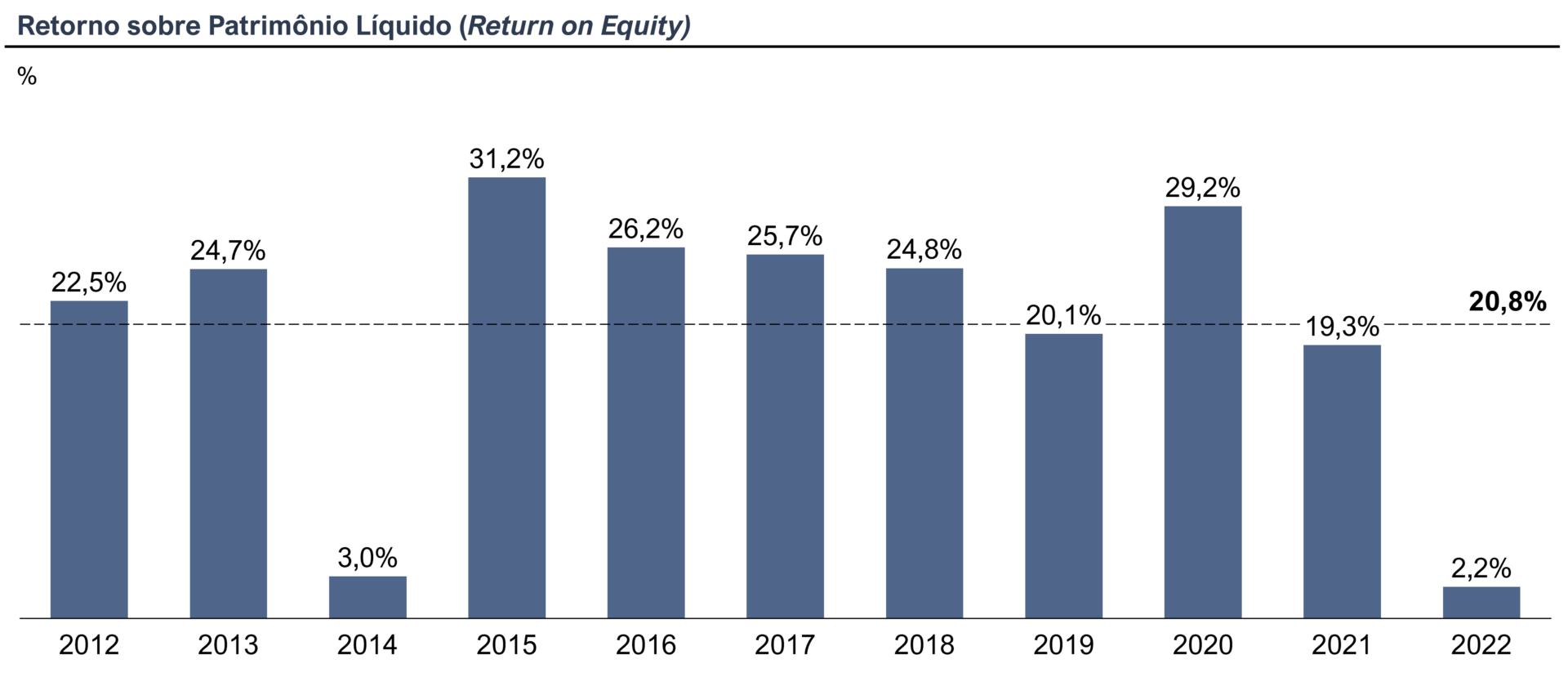

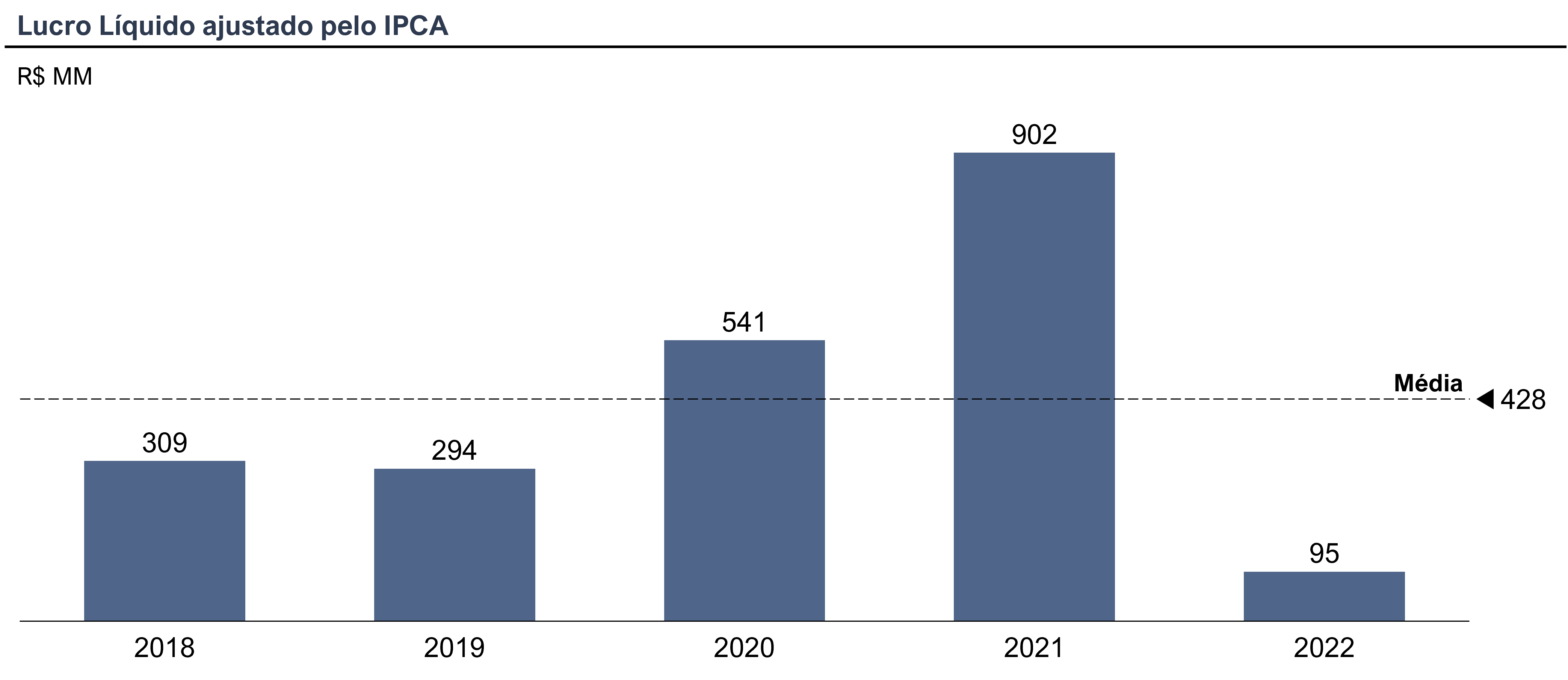

Over the last 10 years, the company has shown average growth of 21.9% per year, with an average net margin of 11.7% and average profitability on equity of 20.8% (already including the bad year of 2022). See the history of annual results over the last decade illustrated in the graphs below.

In addition to this excellent track record of results, we are pleased with the fact that, in contrast to the recent “unicorns” that grew rapidly while consuming hundreds of millions received from venture capital funds in loss-making operations, Multi followed a more traditional trajectory: it grew while maintaining good profitability over the years and reinvesting its own cash generation. If what we've presented so far has also caught your attention, let's explore what Multi's business is today.

What Multi does today

Multi is today a large importer, manufacturer and distributor of a wide range of consumer goods. Its portfolio includes more than 7 thousand products (SKUs) from 44 brands, 20 of which are its own and 24 partner brands, several of which are distributed by Multi exclusively in Brazil. In addition to the well-known computer accessories, the company sells smartphones, notebooks, small appliances, household items, tools, sports equipment, health and beauty products, equipment for telecommunications networks, automotive products, safety equipment, children's items, items for pets and others. various product categories. Really, Multi is a good name for the company.

Multi's customer base is also quite diverse. There are more than 30 thousand customers who sell Multi products in more than 44 thousand points of sale. Customers include retailers of all sizes, distributors, companies that directly purchase large quantities and public bodies, through contracts won in bidding processes. End consumers are also served directly, through e-commerce channels.

The company's business model is based on its sales force and its operational efficiency. It consists of identifying products linked to technology that are on the rise, developing relationships with manufacturers, most of them located in China, testing the products in their laboratories to guarantee the expected quality and importing them to Brazil at competitive costs. Part of the products are purchased ready-made and part of them are assembled or manufactured in Brazilian territory, sometimes to take advantage of tax benefits offered to companies that have local production. Maintaining high operational efficiency and cost control, Multi is able to offer products at extremely competitive prices when compared to products of similar quality.

Note that this business model depends little on the product categories in which the company operates. Multi has 12 business units that operate autonomously and deal with very different product classes. Each unit has its own resources, marketing and engineering and the remuneration of senior executives is linked to the return on capital employed in their unit. In addition to risk diversification, this decentralized operation also gives the company flexibility to adapt to changes in the market demand profile. In other words, if a certain product segment stops being profitable, the cost of abandoning it and replacing it with another segment is quite low. Even Multi's production and assembly lines are easily adaptable to produce a huge range of different products.

This versatility is not theoretical. The company has already made major changes to its product mix over time and maintained consistent financial results throughout the transformations in its portfolio. The discipline of continually monitoring the profitability of each item and replacing those that do not reach the target profitability with new products is ingrained in Multi's culture. We understand that this dynamic of continuous portfolio renewal, in search of profitability, is one of the main success factors for Multi.

However, the following question arises: if the business model is profitable, diversified and adaptable, why did the company have such poor recent results and its valuation was so penalized by the market?

Recent results

The year 2021, in which Multi had an IPO on the Brazilian stock exchange, was quite atypical. Amid the lockdown, while several service and entertainment businesses suffered, several product segments went through a period of increased demand: for example, people working from home started to buy more small appliances to facilitate their domestic routine, more computers and accessories information technology to equip your home offices. However, at the same time as this overheating in demand occurred, the process of importing goods was much slower than usual, due to logistical problems and product shortages caused by production stoppages. Multi reacted to this scenario in a way that, in principle, made sense: it increased its stock levels in the proportion necessary to sustain the sales volumes that were being made. This reaction is what later caused a strong hangover.

Multi has long followed the practice of maintaining robust inventories to be able to quickly fulfill its customers' orders, an especially important differentiator for small retailers who do not have enough working capital to keep a lot of merchandise in their stores. The practice has worked well for years and appears to be suitable for times of predictable demand, but it has proven to be a dangerous strategy during periods of demand shock.

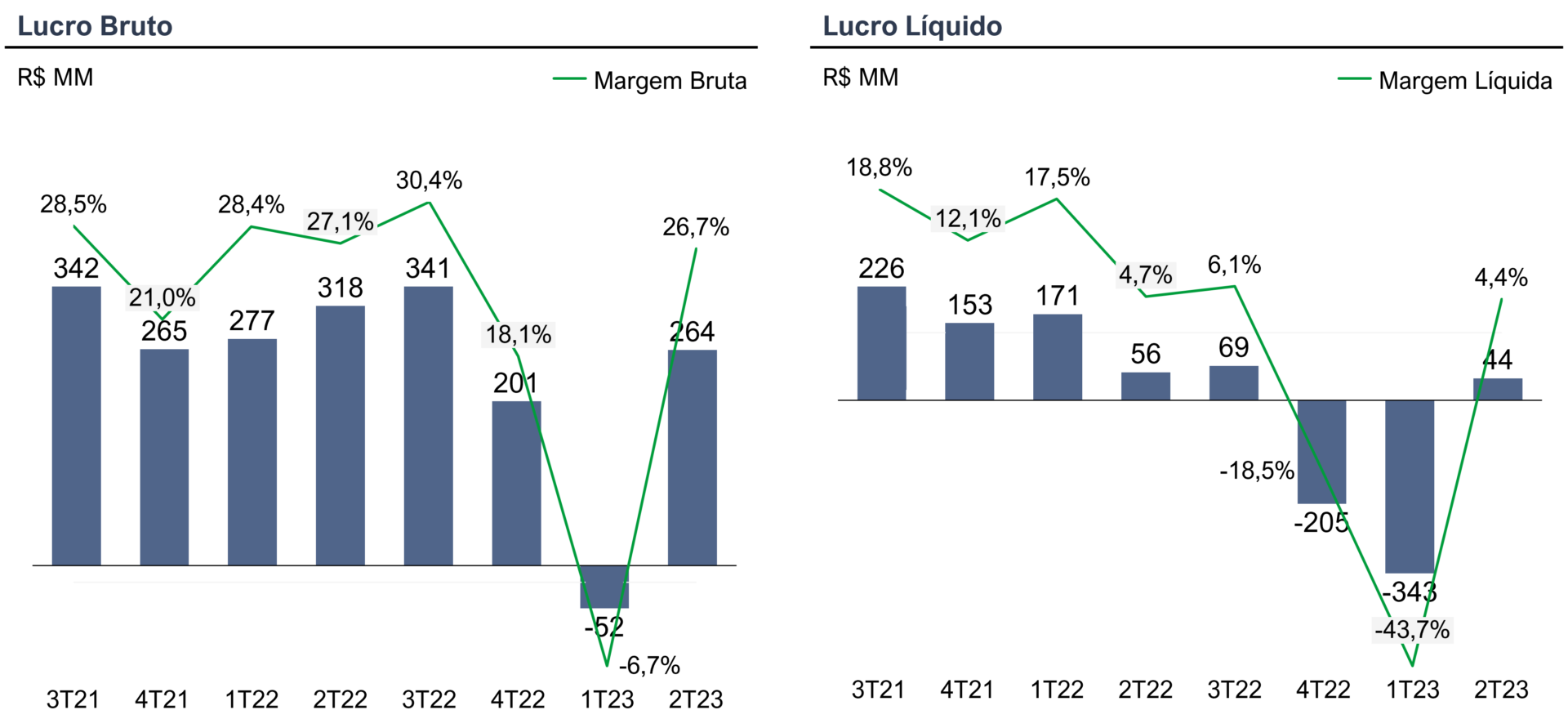

In 2022, after the suspension of the lock down and consequent return to normality, consumption of the product segments we mentioned returned to pre-pandemic levels, while Multi still maintained sufficient stocks to meet several months of overheated demand. With weak demand, the company was forced to carry out very aggressive inventory burns, which destroyed its profitability in the 4th quarter of 2022 and the 1st quarter of 2023.

In addition to this problem, in January 2023, the company migrated its ERP (from TOTVS to SAP) and had a severe operational problem in the new implementation, which was resolved in the following two months, but prevented the company from billing the volume of usual orders throughout the 1st quarter, strongly affecting its revenue in the period.

The burning of stock and the problem with the ERP migration, together, led Multi to a loss of R$ 548 million in these two quarters. Without a doubt, a significant destruction of value. However, before judging whether Multi's shares are worthy of investment, there are two important questions: i) will the harm suffered by the company have a temporary or lasting impact? and ii) does the current share price correctly reflect business results expectations?

Was the evil temporary?

The first question is the most important. If a business undergoes a structural transformation, its history of results becomes of little relevance when estimating its future. A well-known example is the story of Kodak, which was successful for more than 100 years, but quickly succumbed after the emergence of digital cameras. So, let's investigate the two problems that Multi suffered.

The biggest problem was the excessive purchase of stock of items that had overheated demand during the pandemic. After the purchases were made, the company only had two options left: continue selling at normal prices, until inventory returned to normal, or sacrifice margins to burn excess inventory faster. As a large part of Multi's stock was made up of technological products, which lose value over time and can “run aground” (as they become obsolete), the alternative chosen was to burn stock as a corrective measure. Despite the damage, we do not believe that this inventory sizing error will lead the company to new excessive purchases, inventory burns and negative margins. In addition to not being a systemic problem, since purchases of new products are not dependent on past purchasing decisions, the memory of the recent error is a certain antidote against repeating this error in the near future. So much so that Multi is already moving in the opposite direction: it has been taking severe measures to reduce purchases and take less risk on the products selected to keep in stock.

The second problem is easier to analyze. ERP migrations are non-recurring events and SAP, the system Multi migrated to, is usually the definitive ERP adopted by large companies, which means that decades can pass before a new migration is necessary. In this context, it matters little whether the problem that occurred was inevitable or whether it was a lack of skill on the part of the company, as future business results almost do not depend on the ability to repeat this process. One concern we had was the reputational damage caused by delays in deliveries to small retailers, but the vast majority of them had a long-term relationship with Multi, understood that the situation was temporary and did not stop being customers because of what happened.

From this perspective, the conclusion that Multi has not undergone any transformation that will have a lasting negative impact on its future seems correct. Despite the recent bad quarters, the company continues to operate with the same business model that generated very positive results in the last decade, under the command of the same CEO who created the company's history of success, maintaining to this day a ~40% stake in Multi and , during the share price drop following weak results, purchased a significant volume of shares, signaling his confidence in his own business. Furthermore, the last quarter's numbers already show a good recovery in profitability and strong cash generation, indicating that the worst is over.

Are Multi shares cheap?

Estimating the value of a company with a reasonable margin requires detailed work to project its financial results and estimate how much cash flow the business will generate for its shareholders in the future (discounted cash flow method). However, it is possible to get a sense of the minimum level that a business should be worth based on less precise, but faster and easier to understand, analyses. This is what we will do here, presenting a very simplified analysis.

Multi had R$ 4 billion in Net Revenue in the last 4 quarters. It is reasonable to assume that this level of revenue is sustainable, as Brazilian retail was not very booming during this period and there were a few months in which revenue was affected by the problem with the ERP migration. As a reference, the company has already reached Net Revenue of R$ 4.85 billion in 2021, a level 21% above the current level. Adopting the average net margin of 11.7% that the company has had over the last 10 years, Multi's normalized Net Profit would be R$ 468 million.

Today, Multi is valued at R$ 2.67 billion on the stock exchange (R$ 3.26/share as of 04/Sep), which would equate to a 5.7x Price/Earnings multiple. Compared to this value, the average Price/Earnings multiple for companies listed on B3 (ex-Petrobrás and Vale) is 12.4x, in the period between January 2005 and July 2023. Another reference is that listed companies that sell products similar to a part of Multi's portfolio (Intelbras, Positivo and Allied) were traded at average multiples of 11.6x Price/Earnings in the last 2 years. Given these references, Multi today would be valued at a discount of around 50%. It would still be arguable that its multiple should be higher than the average multiple of the Brazilian stock exchange, as it has higher growth rates than most other listed companies.

From another angle, Multi's Net Equity on balance today is R$ 3.75 billion. If it is able to monetize its assets at the historical average of 20.8%, the Net Profit generated would be R$ 781 million. If we are more conservative and assume that its future Return on Equity will be 15% (28% below the historical average), the company would still generate R$ 563 million in profit and the implied Price/Earnings multiple would be 4.7x.

A third check is to evaluate the profits already generated by Multi in the last 5 years, adjusted by the IPCA, to estimate the corresponding values in currency equivalent to the Real in 2023. This period includes three pre-IPO years, before Multi raised R$ 1.9 billions to invest in the growth of your business, and the year 2022 with your profitability affected by the burning of inventory. Even so, the average profit level for the period was R$ 428 million, which would lead to an implied Price/Earnings multiple of 6.2x.

Regardless of the angle of analysis, it is clear that Multi's shares are quite cheap. If the company grows half as much as it did in the past and recovers profitability that is minimally close to its history, there will already be a relevant appreciation in relation to the current share price. If Multi returns to historical performance, growing more than 20% per year with more than 20% return on invested capital, the potential return on investment is enormous. Although the analyzes presented here are quite simplified, the results of our detailed analyzes point in the same direction.

Final considerations

Like every thesis, this one has its risks. The main ones are the possibility that Brazilian retail will continue to be slow, which could harm both sales volume and margins, and the risk of some tax change, amid the various measures that the current government has been trying to implement to increase revenue, negatively impact the company. However, Multi's current share price seems so far below what would be reasonable that the investment could have an interesting return even if some negative events with a moderate impact occur.

Another consideration is that we tend to spend much more time analyzing risks than possible positive events, but Multi has invested in several initiatives that can bring results beyond what we estimate in our projections. For example, the company recently established several partnerships with internationally renowned brands, started producing small appliances and entered the electric motorcycle market. These initiatives are still in their embryonic phase and generate revenue that is not very representative for the business as a whole, but they can grow quickly and become relevant additions.

We give little weight to these positive factors because it is common for investors to be entertained by the possibilities of exceptional gains and attribute excessive value to the chance of optimistic scenarios materializing. We prefer to follow a more prudent approach: staying focused on the risks of each investment, estimating the value of the business considering normalized average results and demanding a reasonable margin of safety in the entry price of new theses. If unforeseen positive events occur over time, they are always welcome surprises.

On 13/09 we will do a live broadcast via YouTube commenting on this month's letter. sign up clicking here.