Despite the major short-term challenges, the Brazilian stock market is enjoying a period of magnificent returns. Since the beginning of 2016, after having dropped to 38 thousand points, the Ibovespa has been consistently delivering good results (26% aa from 01/17/2016 to 03/01/2021, closing of this letter) – not even the pandemic, when the stock exchange it went from 118 thousand to 67 thousand and back to 118 thousand in less than 1 year, it was able to contain this trend that lasted more than 5 years.

What factors most contributed to this return? Faced with this question, we decided to measure the highest returns on the Brazilian stock exchange since 2005, and investigate which companies provided the best returns for investors. For this analysis, we used the concept of Total Shareholder Return (TSR).

The TSR breaks down the valuation of an asset into 4 components:

- Proceeds distribution;

- Increased net income;

- Expansion of the P/E multiple (Price / Earnings); and

- Combined effect of items 1, 2 and 3

In summary:

TSR = earnings + net income increase + P/E expansion + compounding effect

While items 1 and 2 are linked to the company's performance, item 3 represents a change in investors' expectations of profit growth.

To illustrate the growth expectation implicit in expanding the P/E multiple, suppose an investor buys a stock at a P/E of 50x. Let's also assume that the company goes through a period of high growth for 10 years, where it would pay only the mandatory minimum of 25% of net income in earnings and, after this period of strong growth, its net income stabilizes and it starts to distribute 100% of the result. For the investor to have a real return (above inflation) of 10% per year in the long term, the company's profit should grow 28% per year, above inflation, for 10 years! In other words, raise more than 1,000% in the period. If net income does not grow, the fair multiple to achieve the same rate of return would be 10x P/L. That is, the higher the P/E, the greater the expectation of growth in the company's net income for the coming years. After all, we imagine that nobody would buy an asset waiting 50 years to receive the investment back.

The table below shows the companies that performed the best since 2005:

Table 1 – Highest annual returns on the Brazilian stock exchange since 20051

| Company | annualized return | Earnings | net profit expansion | multiple expansion | It is made Combined |

| 1 whirlpool | 31% | 12% | 16% | 1% | 2% |

| 2 Locates | 25% | 2% | 16% | 6% | 1% |

| 3 Comgás | 25% | 10% | 8% | 5% | 2% |

| 4 Alpargatas | 24% | 3% | (1%) | 20% | 1% |

| 5 Renner | 22% | 2% | 17% | 2% | 1% |

| 6 Grazziotin | 22% | 5% | 18% | (2%) | 0% |

| 7 Ferbasa | 20% | 6% | (2%) | 16% | 0% |

| 8 sanitation | 20% | 7% | 10% | 2% | 1% |

| 9 Coelce | 17% | 8% | 2% | 6% | 1% |

| 10 Porto Seguro | 17% | 5% | 11% | 0% | 1% |

| 11 Sabesp | 16% | 3% | 2% | 10% | 1% |

| 12 Roma | 15% | 5% | 6% | 3% | 1% |

| 13 Engie | 15% | 6% | 8% | 1% | 1% |

| 14 CSN | 15% | 5% | 5% | 4% | 1% |

| 15 Bradespar | 14% | 4% | 1% | 8% | 1% |

Source: Economática, Capital IQ, Arctic Analysis

As we can see, Whirlpool (WHRL4) is the company with the highest annualized profitability in the period, delivering a return of 31% pa since 2005. This return was composed of 12% aa in earnings, 16% aa in net profit growth, 1% aa in expansion of multiple and 2% aa of the combined effect. It was consistent, high-quality feedback. Whirlpool is a company we know well, as it has been in our portfolio since 2013.

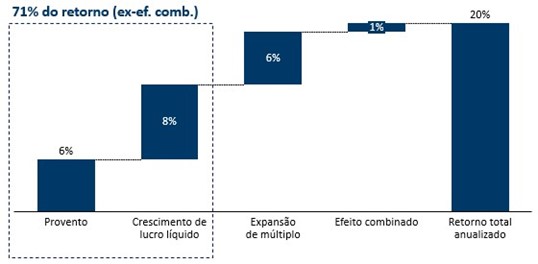

Another point worth mentioning is that most of the returns were composed mainly of growth in net income and earnings – the longer the analysis window, the more this tends to be true. The chart below shows the return composition of the 15 companies listed in the table above:

1 For the analysis, companies that had negative net income in 2005 or 2020 LTM were excluded, since it is not possible to measure their TSR components. In addition, a liquidity filter of >R$25mil/day was applied during all years of analysis. The analysis covers the period from 12/29/2005 to 02/26/2021, therefore, companies that made the IPO after this period are not included in the analysis. Some of the companies presented may have suffered non-recurring impacts that inflate or reduce net income for the years under analysis. Such effects were not considered in the table.

Graph 1 – Composition of return2

If we now look at the returns since 2018, the results have a different dynamic:

Table 2 – Highest annual returns on the Brazilian stock exchange since 20183| Company | annualized return | Earnings | net profit expansion | multiple expansion | It is made Combined |

| 1 Petro Rio | 167% | 0% | 48% | 81% | 39% |

| 2 Banco Inter | 162% | 1% | (62%) | 591% | (368%) |

| 3 Pan Bank | 153% | 2% | 57% | 58% | 36% |

| 4 unique | 111% | 0% | 3% | 105% | 3% |

| 5 Roma | 110% | 15% | 40% | 31% | 24% |

| 6 WEG | 101% | 1% | 29% | 54% | 17% |

| 7 Magazine Luiza | 96% | 0% | (25%) | 161% | (40%) |

| 8 Eneva | 94% | 0% | (11%) | 119% | (13%) |

| 9 CSN | 89% | 3% | (13%) | 110% | (11%) |

| 10 JHSF | 81% | 4% | 61% | 9% | 8% |

| 11 TOTVS | 79% | 1% | 95% | (9%) | (8%) |

| 12 Sinqia | 78% | 0% | (28%) | 147% | (41%) |

| 13 EMAE | 74% | 7% | 5% | 56% | 7% |

| 14 Comgás | 73% | 14% | (7%) | 64% | 3% |

| 15 Kepler Weber | 70% | 1% | 164% | (37%) | (59%) |

Source: Economática, Capital IQ, Arctic Analysis

- Composition of returns of a theoretical portfolio composed of the 15 assets in Table 1 above, considering equal weights for each asset.

- For the analysis, companies that had negative net income in 2018 or 2020 LTM were excluded, since it is not possible to measure the components of the TSR of these. In addition, a liquidity filter of >R$25mil/day was applied during all years of analysis. The analysis covers the period from 12/28/2018 to 02/26/2021, therefore, companies that made the IPO after this period are not included in the analysis. Some of the companies presented may have suffered non-recurring impacts that inflate or reduce net income for the years under analysis. Such effects were not considered in the table.

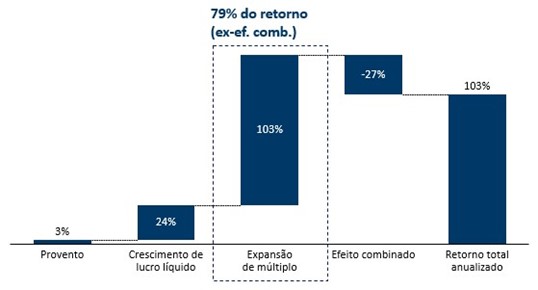

Companies with the highest level of return in recent years had the expansion component of the P/E multiple as the factor that most contributed to the annualized return – with some interesting cases, such as Banco Inter, where there was a retraction in net income, however the multiple expansion effect contributed to a return of 591% aa! Graph 2 below illustrates the relevance of the multiple expansion effect on the returns of these companies.

Graph 2 – Composition of return4

Source: Economática, Capital IQ, Arctic Analysis

It is important to point out that the multiple expansion effect does not necessarily indicate that the company became expensive. Other reasons can explain the expansion of this factor: (i) there is an expectation of profit growth or (ii) the company was cheap and went through a readjustment.

Despite 2020 not being a “typical” year due to the pandemic, the results obtained are similar to those mentioned by large investors in other periods of history:

“[…] in the short run, the market is like a voting machine –tallying up which firms are popular and unpopular. But in the long run, the market is like a weighing machine–assessing the substance of a company”

ben graham

The quote above from Benjamin Graham, considered the father of value investing and mentor of Warren Buffett, explains this concept. In the short term, variations in the stock market can be caused by psychological and emotional factors, which lead “Mr Mercado” to leave stocks that are too expensive or too cheap; while in the long term, eventually the company's fundamentals prevail, reflected in its share price.

The composition of returns of a theoretical portfolio composed of the 15 assets in table 2 above, considering equal weights for each asset. It should be noted that in the analysis the combined effect is negative, despite the growth in net income and the multiple expansion, because there is a strong presence of extreme results, distorting the consolidated view of the portfolio. Even so, it is possible to observe the relevance of multiple expansion as the main contribution to total return.

Besides him, John Maynard Keynes in his work “The General Theory of Employment, Interest and Money” compared the speculative activity of short-term investors to that of a beauty contest, where the important thing is not to judge who is the most beautiful, but to judge by imagining who the others will vote for:

“ […] professionals trade stock, not based on their own long-term forecast of companies' assets but on the anticipation of market valuation after a few months a company.”

John Maynard Keynes

Keynes, disregarding the merits of the preached monetary policies, was an above average manager, having delivered 16% per year of performance between 1922 and 1946 – not a bad result considering that it was a very troubled period for the stock market, with the crisis of 29 and World War II between 1939 and 1945.