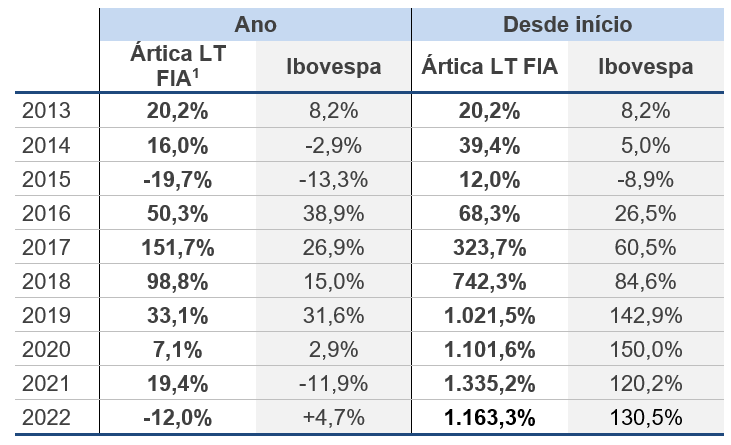

Dear investors, We ended 2022 with a return of -12.0% for the year, compared to +4.7% for the IBOV and -15.1% for the SMLL (small caps index). The accumulated return since the beginning of the fund, around 9 and a half years ago, is 1.163%, which represents an average return of 30.7% pa (vs. 9.2% pa for the IBOV):