Dear investors,

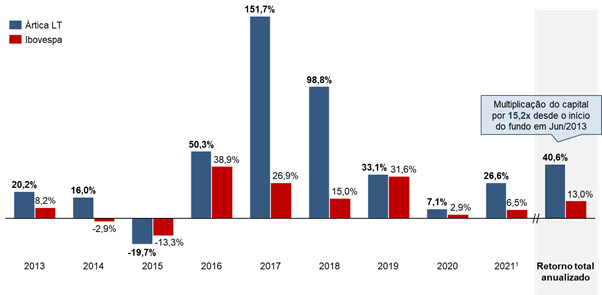

On 06/27, Ártica LT FIA turned 8 years old. Since our creation in 2013, the fund has returned 15.2x equity, equivalent to an annual return of 40.6% per year over the period! In the same period, the Ibovespa accumulated a rise of 1.7x, or 13.0% per year.

What makes us even more excited is that these levels of return were achieved without too much risk, in our opinion. The fund never used leverage and always invested in stocks that had a significant margin of safety (which we consider the best way to manage risk). A reflection of this is that, in the two crisis situations we went through (2015-16 crisis, and Covid-19 in 2020), the fund outperformed the Ibovespa.

The chart below shows the fund's annual return since inception:

Graph 1 – Ártica LT FIA annual profitability[1]

In this month's letter, we brought some factors that we consider important for our investors to know and that were crucial to achieve this performance since our foundation.

1. Alignment between managers and investors

As many know, Ártica LT FIA started as an investment club created to invest the equity of Ártica's members and team. To date, a significant portion of the personal assets of all partners and management team professionals is invested in the fund (percentage greater than 70% of assets for several of us).This level of personal exposure brings a great alignment of interests between our management team and the other investors of Ártica LT FIA. We remain fully focused on obtaining optimal returns and we think a lot about the risks before making any investment decision. It may seem obvious, but without significant equity invested in the fund, a manager could prefer to raise more investments for the fund even if this would bring lower profitability, as this would increase management fees, or take risks beyond what he should, as he would share more gains than losses. We manage Ártica LT thinking about how to preserve and monetize our personal equity invested in the fund. Exactly the same objective as our investors.

2. Focus on the best theses

An important point of our strategy is to always invest between 5 and 15 companies, with holdings varying between 5 and 25% of the fund's assets. This profile may seem concentrated to many investors, but it is what we believe is ideal to obtain a better risk-return ratio for the fund.

From the point of view of return, it is intuitive to think that the 10 best ideas will always have a potential return much higher than the next 40. That is, in a portfolio of 50 stocks, the 50th best stock has a much worse return expectation than the next 40. 1st best stock, so adding it to the portfolio should reduce the potential return on the portfolio as a whole.

Regarding the risk aspect, a portfolio with 10 stocks already reaps most of the risk reduction possible through diversification and, with a limited number of companies, we manage to have a greater level of depth and conviction in each thesis, which we believe to be the best way to control portfolio risk.

For more details on this topic, it is worth consulting the letter we wrote in Nov/20.

3. Unusual Opportunities

As part of our strategy, we seek to actively monitor unusual opportunities, which few investors analyze. Such opportunities can occur in different ways, but the most common are: (a) discount between classes of shares; (b) holding discounts; (c) subscription bonus; (d) M&A or delisting opportunities.

For example: an investment that we have already made and that fits into situation (a) above was the long short[2] with Itaú shares, which is traded on the stock exchange through two classes of shares: ON (ITUB3) and PN (ITUB4). Both stocks pay the same amount of dividends, however ITUB3 trades at a discount ranging from 10 to 15% to ITUB4.

At a certain point, the discount between ITUB3 and ITUB4 exceeded historical limits, so we set up a long position on ITUB3 (long) and sold in ITUB4 (shorts). The interesting thing about the investment is that, in this case, we would make money not only when the discount returned to historical levels, but also if it remained constant.

The reason is that, for identical financial exposure at the ends long and shorts, the number of purchased shares of ITUB3 was greater than the number sold of ITUB4, which allowed a positive exposure to Itaú shares without committing 1 real from the fund (for example, for an exposure of R$ 1.0 MM for each side, and assuming that ITUB3 trades at R$ 25.00 and ITUB4 trades at R$ 28.57; we would have to buy 40 thousand ITUB3 shares and sell 35 thousand ITUB4 shares, that is, positive exposure of 5 thousand shares). The result is that, whenever Itaú paid dividends, we would be remunerated for the positive exposure we have in the company, which would most likely be greater than the cost of renting the shares in the position shorts.

The advantage of this type of strategy is that it provides a differentiated return with a very low risk exposure. It works as an important return complement for the portfolio, especially in times of rising markets, when it is naturally more difficult to find good investment opportunities.

Another example of an operation of this type that we have already mentioned in a letter was the case of Bradespar and Vale. For more information, access our letter of Feb/20.

4. Technology to improve the quality of decisions

In recent years, we have been investing more and more in technology to help us with the fund's day-to-day activities. Both to speed up analysis processes and to improve our decision quality.

Some examples worth mentioning:

- monitoring of special situations: As mentioned in the previous item, we actively seek to find unusual arbitrage opportunities, which often go unnoticed by investors. To assist in this process, we have developed robots that monitor stock markets 24 hours a day and notify us whenever any opportunities are identified.

- Insider purchase analysis: Companies listed on the B3 publish the “CVM 358” report on a monthly basis, which presents the purchase and sale transactions carried out by “insiders” of the company (directors, directors and controllers). We have developed an algorithm that compiles all the published reports and presents us, in a completely automatic way, all the purchase and sale transactions of “insiders” of all companies listed on the stock exchange. purchase of “insiders” (management, board, controller) can be an important indicator of investment opportunity.

- Data intelligence: For monitoring the investees and companies themselves, we have the practice of massively collecting public data on the Internet through robots that scan websites and collect information in a structured way. Having this information allows for deeper analysis, or the ability to anticipate trends that benefit or harm certain companies.

5. Discipline and patience to invest

Finally, an important aspect of our management model, which has been in our DNA since the beginning of the fund: we are very disciplined to maintain rigor in the choice of assets that make up the Ártica LT portfolio, and we only invest when we find great opportunities for investment.

When investing, our objective is always to select companies that have a high chance of providing good returns and exclude those that have a significant risk of underperforming. The problem is that this distinction is never known a priori, and we are always subject to two types of error:

- Type 1 error: Rejecting a good investment

- Type 2 error: Approving a bad investment

As part of our philosophy, we believe that type 2 errors are more harmful to the fund's long-term results, and therefore, we seek to reduce them as much as possible, even at the cost of missing out on good opportunities.

Following this philosophy is more difficult than it seems, because great investment opportunities are rare and we can spend months (or years) analyzing several stocks, without pulling the trigger on any thesis, until a good opportunity is found. Over time, this can become frustrating and the temptation arises to relax the criteria to make investments more frequently. In order not to fall into this error, we are always careful to maintain the necessary discipline and patience to invest only when we have real conviction in the thesis.

[1] Ártica LT FIA started on 06/27/2013 as an “investment club” and, on 09/27/2019 was transformed into an “equity investment fund. Profitability presented from the beginning on 06/27/2013 to 05/31/2021

[2] long: Investing in a stock (earnings occur when the stock appreciates); Shorts: Betting against the stock (gains occur when the stock depreciates). Strategies long shorts are used for investments where the thesis is the relative change in asset value, not the absolute change.