Investment Case – Marcopolo

Dear investors,

In this letter, we would like to share our investment thesis on Marcopolo (POMO4), a stock we purchased between 2019 and 2021 and which today constitutes a relevant position in our portfolio.

It's not common for managers to share investment theses while they're still in their portfolios, largely due to the risk of making a public error if the future turns out to be contrary to our expectations. However, we believe this transparency will help our shareholders (and potential new shareholders) visualize what we consider a good investment thesis. Therefore, we decided put our mouth where our money is!

This thesis, like any other, has its risks. What we seek are investment opportunities where the probability of gain is substantially greater than the probability of loss. We will briefly explore here the main factors that led us to the conviction that this is the case with Marcopolo.

The idea of investing in Marcopolo

Marcopolo is a global leader in the bus body industry. With 12 manufacturing plants in 8 countries, it manufactures approximately 10% of the new bus bodies sold worldwide. In Brazil, Marcopolo serves approximately half of the domestic market.

At first glance, it doesn't seem like a particularly attractive sector. The product isn't highly technological, the market isn't booming, and bus bodies don't make headlines. However, what caught our attention was the fact that the company multiplied its shareholders' investment by 80x (32% per year) in the 16-year period between 1998 and 2013. After that, the entire sector entered a lean period, and Marcopolo returned 0.7x its shareholders' capital between January 2014 and August 2021 (-5% per year). A long time of poor results, right? But the 80x figure remained in our minds and the question of whether the company could experience a new era of glory. We decided to study the case further.

In this letter, we will present a summary of our analyses regarding Marcopolo's business in Brazil because, although export revenue is quite significant, it is spread across several countries and, therefore, Brazil is by far the most relevant market for the company.

Pre-pandemic History

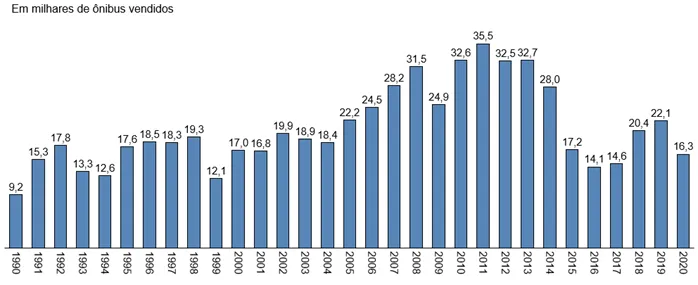

The bad season for Marcopolo, and the entire bus body industry, began during Dilma's second term. From 2015 onward, demand for new bus bodies in the country fell sharply. This decline was largely a side effect of sales above sustainable levels, especially between 2008 and 2014, stimulated by subsidized credit for bus purchases (FINAME).

In 2015, the supply of FINAME lines for bus purchases was reduced to R$ 6.5 billion (vs. R$ 20 billion in 2013 and 2014) and the volume of new bus purchases fell to the level of two decades ago.

Figure 1: Internal Bus Sales

This low demand continues to this day. However, while the era of subsidized credit led to a renewal of the bus fleet, this long period of low sales led to its aging. This tends to put pressure on demand for new buses because, after a certain age, maintenance to keep them in good condition becomes more expensive than replacing them with a new one. Thus, two questions arose: what is the condition of Brazil's current bus fleet? And what should be the normal level of annual bus sales to maintain an adequate fleet for the country?

Bus fleet today

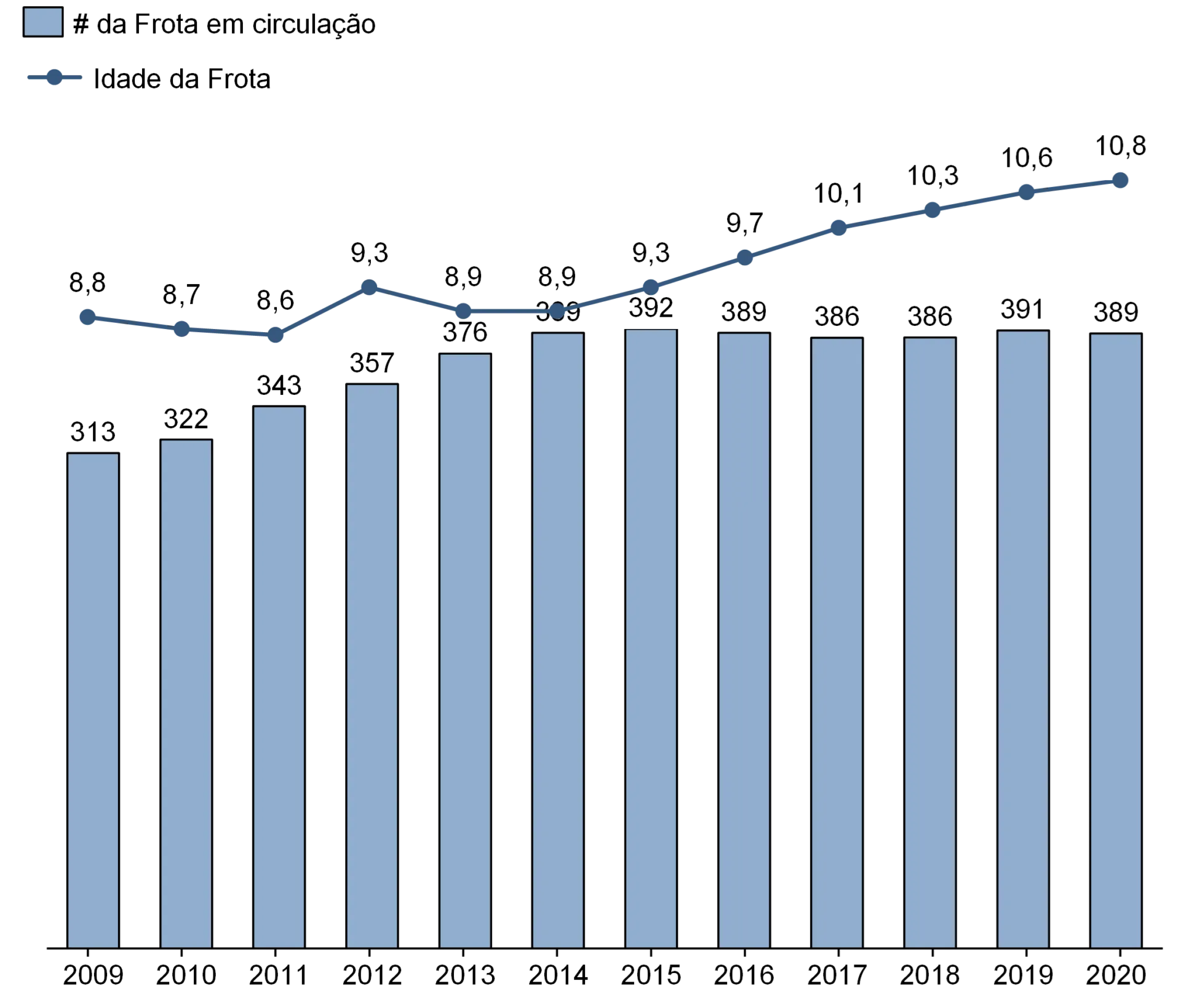

In 2020, Brazil had 389,000 buses in circulation, the same number of buses in circulation in 2014. However, the average age of the fleet in this period rose from 8.9 years in 2014 to 10.8 years in 2020. Today, the Brazilian bus fleet is older than it has been in the last 12 years.

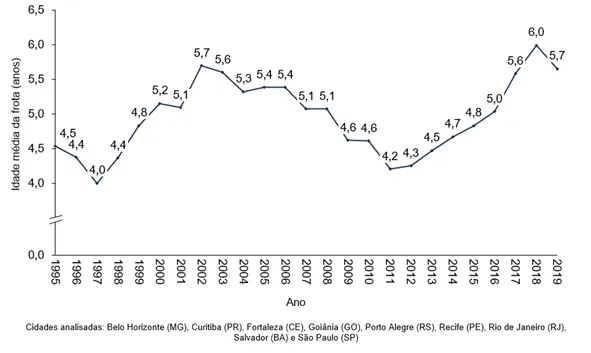

Another reference that also points in the direction that the current fleet is too old is data on the average age of the urban bus fleet in large capitals, published by NTU[1]According to this historical data, the current fleet is older than it has been in the last 25 years. Therefore, we have some confidence in stating that the fleet is indeed aging, and there should soon be an incentive to purchase new buses to renew it.

Figure 2: Bus fleet in circulation

Source: Sindipeças

Figure 3: Evolution of the average age of the urban bus system fleet (1995-2019)

Normal level of demand

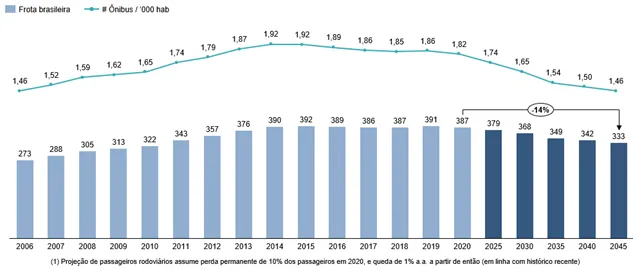

The question remains as to what volume of new bus sales should be needed to maintain the Brazilian fleet at an adequate age and size. For this estimate, we studied long-term trends in the passenger transportation sector and concluded that bus use is slowly declining. Thus, we project the bus fleet to decline from 387,000 units in 2020 to 333,000 in 25 years. This, while seemingly subtle, represents a 20% drop in the number of buses in circulation per thousand inhabitants in the country (from 1.82 buses per thousand inhabitants in 2019 to 1.46 in 2045).

Figure 4: Bus fleet in Brazil and # of buses / thousand inhabitants

Source: Sindipeças and BIGE; Arctic Projections

With this fleet size projection and considering statistics on the probability of a bus being retired according to its age[1], we estimate that, to maintain the fleet at its current average age (10.8 years), a volume of around 21,000 new buses per year is required. This volume could be higher, considering that the "normal" fleet age appears to be closer to 9 than 11 years, and in this case, sales volume could reach up to 30,000 new buses per year. However, the risk of being conservative in market projections is much less dangerous for an investor than the risk of being optimistic, so we maintained the volume of 21,000 new buses per year as a reference in our analyses.

First share purchases

In 2019, the scenario we envisioned was that the aging of the fleet would eventually force demand for new buses to return to the estimated equilibrium level of 21,000 new units sold per year. In addition, the bus manufacturing sector was consolidating, and Marcopolo was increasing its market share. In 2016, Marcopolo acquired Neobus and now holds about half of the bus market in Brazil. With one caveat: CAIO, the second-largest manufacturer, is controlled by the same shareholders as the company that operates urban bus lines in São Paulo, and much of its revenue comes from this captive demand. In the broader market, Marcopolo was the clear leader.

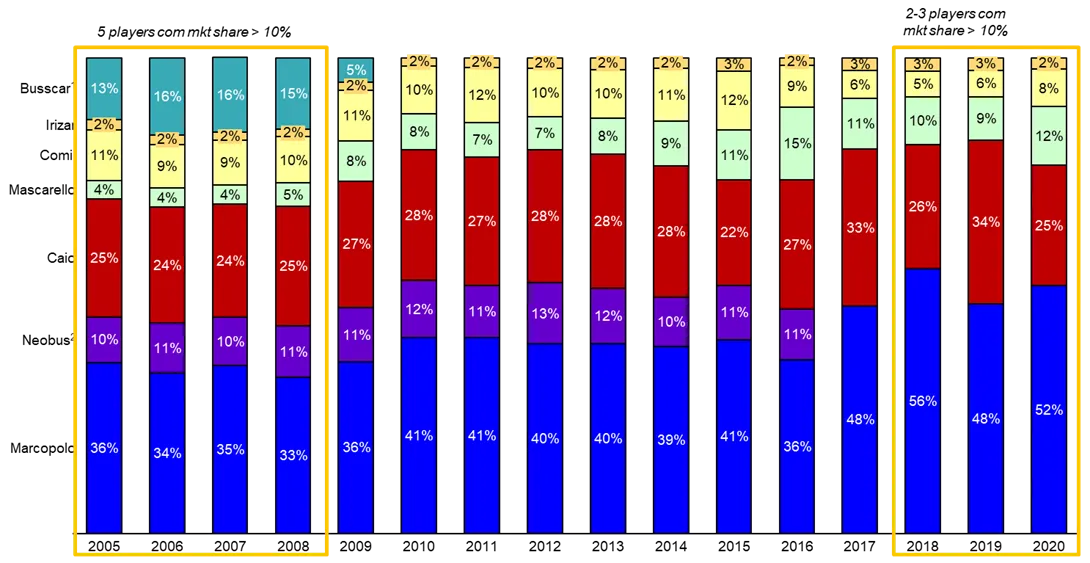

Figure 5: Market Share

Source: FABUS

In addition to being the leader in sales volume, Marcopolo is also able to sell its buses at a price 10-20% higher than its competitors. When a company offers the most expensive product and still has the highest market share In volume, this is generally a good sign, as it indicates that the market recognizes their products as having greater value. We spoke with industry insiders, particularly those responsible for purchasing new buses for urban and highway bus operators, and their reports corroborated our hypothesis: the general perception is that Marcopolo buses are of superior quality, with greater durability and greater acceptance in the used bus market.

Finally, based on the thesis of a rebound in sales volume due to the aging fleet, Marcopolo's sustainable leadership position, and the reasonably low share price, we began investing in August 2019. We certainly didn't anticipate the pandemic, which broke out in March 2020 and caused the stock to plummet, along with the rest of the stock market. Fortunately, our portfolio position wasn't that large, and we had purchased at a price much lower than the average price in February 2020, on the eve of the... lockdown. But yes, it was sad to see our precious profit accumulated until February evaporate in March. In any case, we made the decision to keep the shares in our portfolio, figuring that lockdown would not remain for many years (our base scenario predicted a recovery only in 2023).

Impact of the Pandemic

What happened isn't hard to imagine. With COVID-19 restrictions on movement, bus passenger flow plummeted, resulting in a reduction in the number of buses in service, and demand for new buses plummeted. To make matters worse, steel prices rose, and the company even suffered a shortage of chips for vehicle production, factors that put pressure on costs at a time of already low demand.

Even though Marcopolo's revenue was diversified across several countries, the pandemic impacted all of them simultaneously and in a similar way, and there was no escape. The company implemented a cost-cutting program, granted collective vacations, and took advantage of the low demand period to improve a number of internal processes, but its financial results suffered significantly.

While the impact was certainly negative, it wasn't catastrophic. Marcopolo continues to have a healthy capital structure and remains a market leader, a position that's even more sustainable given that smaller, less capitalized competitors suffered more from the crisis. But don't mistake us for optimists.

Our point is simply that the company won't die from COVID-19, and in this case, where there's life, there's future cash flow generation. Therefore, it could be a good investment at the right price, considering the negative impact of the crisis on Marcopolo. POMO4 reached a price level of R$ 5.00 before March 2020 and is now (September 21) close to R$ 2.75, a drop of 45%. In our view, the stock is cheap even considering the very unfavorable short-term outlook.

We ended up taking advantage of this price drop to buy more shares throughout 2020 and 2021. Not coincidentally, some shareholders in Marcopolo's controlling group, including the company's current CEO, also bought more shares amid the pandemic. On January 6, 2021, their purchase of 12 million shares was announced. The share price on that date was R$ 2.86 (purchase value around R$ 34 million). Coincidentally, their purchase price was very close to the current POMO4 price.

Prospects for the future

The big question in this thesis is what the future bus passenger flow (urban and intercity) will be like. If flow returns to normal, the number of buses in circulation will increase and drive demand for new buses to replace older ones, as maintenance costs begin to equalize with the installment plan for a new bus. We know that Marcopolo is the best positioned company to capture this market recovery, but there's no way to know when this will happen. This is the main risk of this thesis: bus passenger flow will take a long time to return to pre-pandemic levels. Here, we enter more arid territory, but let's explain our perspective.

We don't believe in a "new normal." We believe that, over time, news about the pandemic will cease, restrictions will be lifted, and the risk associated with COVID-19 will fade into oblivion, like so many other risks in our daily lives that have never prevented us from leaving home (traffic accidents, robberies, all other existing diseases, etc.). But let's look at our thoughts on passenger transportation.

In work-related transportation, a very small portion of existing professions can be performed from home. Even in these, the work regime home office is already starting to show that it is not as good as the enthusiasts of the beginning of the lock down preached, and some side effects emerge: communication between colleagues worsens, cultural dissemination is impaired, engagement slowly declines... Several companies are already calling their employees back to the offices, sometimes still on an optional basis, but vaccination will soon be completed and legal restrictions should be lifted. Perhaps some companies will maintain certain positions on a permanent basis. home office, but we believe that the number of people in these cases will not be large enough to interfere with the overall volume of bus passengers.

In leisure-related transportation, in countries where vaccination is more advanced, the tourism sector is already seeing a strong recovery in passenger numbers, in some cases even above pre-pandemic levels. This appears to be linked to pent-up demand and easily echoes our direct observations: how many people canceled a trip during the pandemic but still intend to take it as soon as conditions allow? It seems that restrictions are easing even more rapidly in urban leisure, and since any plan to meet friends requires traveling to their destination, and not everyone has their own car, many will travel by bus. More broadly, the desire to travel and seek social interaction are intrinsic to human nature, and whether quickly or slowly, we believe people will return to their normal ways of life. Living locked up at home is no one's ideal.

Ultimately, with passenger flow returning to normal, we should see Marcopolo's results recover to healthy levels. We will only suffer significant losses in a scenario where passenger flow remains low for a very long time, which seems unlikely to us. If the recovery is slow, the return will probably not be as encouraging, but it should still be positive.

Current Marcopolo price

At the close of trading on the last day of September, Marcopolo's market value was R$2.6 billion, with an implied P/E (Price/Earnings) multiple of 9.3x, taking into account 2019 net income (R$242 million), in the pre-pandemic scenario. However, of this R$0.7 billion corresponds to Marcopolo's stake in Newflyer.[1]. Without Newflyer, the value would be R$1.9 billion, with the P/E multiple (Price/Earnings) implicit of 9.0x taking into account the 2019 net profit (R$ 215 million, ex-Newflyer). Remembering that in 2019 the number of new buses produced in Brazil was 17.9 thousand, still below the 19 thousand new buses per year that we conservatively estimate to be the equilibrium volume for this market.

If the market converges to this level and Marcopolo is able to maintain its market share, we estimate its net profit to reach around R$1,000,000 million. The company already achieved a net profit of R$1,000,000 million in 2011, which, adjusted for inflation, would be equivalent to approximately R$1,000,000 million today. Since this was the era of subsidized credit for bus purchases, we don't believe the result will return to the same level, but R$1,000,000 million seems feasible. Considering that between 2010 and 2019 (the last 10 years excluding the pandemic period), Marcopolo's average P/E multiple was 20.2x, its market value could reach R$1,000,000 million. This is the earnings potential we see.

Furthermore, the series of adjustments made by Marcopolo to its internal processes, closing some plants that had low utilization and reducing its workforce by more than 1/3, may result in operating margins above their historical level, which could increase the company's net profit beyond the R$1.4T 300 million we estimate.

Our analysis of valuation are much deeper than this multiples rationale and are based on discounted cash flow models, but the results of both approaches point in the same direction. We always like to cross-check simplified approaches like this to ensure we don't lose reasonability amid the details and complexities of more technically sophisticated analyses.

Final considerations

In short, we believe that Marcopolo will remain the leader in the bus body manufacturing sector, with around 50% of the Brazilian market and market shares relevant in seven other countries. In Brazil, its main market, there are signs that demand for new buses should recover as soon as passenger flow returns to pre-pandemic levels, a recovery we believe is quite likely.

Despite this outlook, Marcopolo is currently in the midst of a perfect storm: low demand, pressured costs, and production interruptions. As a result, the share price has fallen to levels we consider quite affordable, and an asymmetry has emerged between risk and return for a long-term investment: the company maintains a solid capital structure even amidst these adversities, and we believe the likelihood of Marcopolo experiencing further negative surprises is low (given that almost everything bad has already happened); on the other hand, the company is well-positioned to reap the benefits of a market recovery, and the return potential in this scenario is quite significant.

So we decided to follow Baron de Rothschild's advice: Buy when there's blood in the streets, even if the blood is your own!

1 National Association of Urban Transport Companies

2 Published by Sindipeças

3 Marcopolo holds 9.3% in Newflyer, which is valued at CAD 1.7 billion on the Canadian stock exchange. At the current exchange rate of BRL/CAD = 4.29, Marcopolo's stake is worth R$ 675 million. (Values as of September 30, 2021)

Disclaimer

The information contained in this website/document does not constitute, nor should it be interpreted as, advice, recommendation, offer and/or solicitation for the purchase or sale of shares, bonds, securities and/or any other financial instruments.