Dear investors,

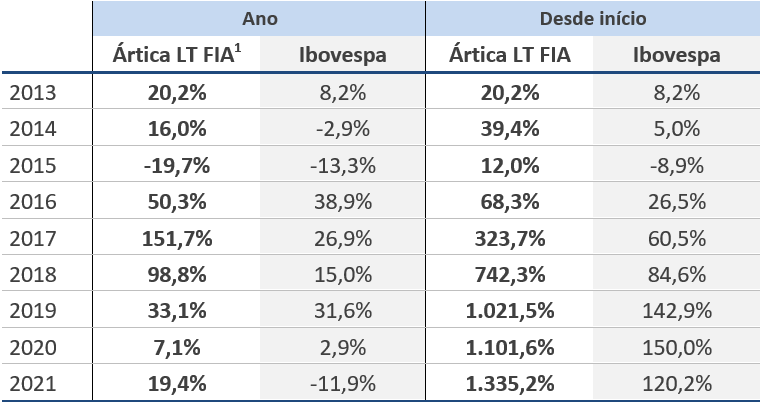

We ended 2021 with a return of 19.4%, higher than the Ibovespa and the CDI which totaled -11.9% and 4.3% respectively in the period. The accumulated return since the inception of the Fund, around 8 and a half years ago, is 1.335%, which represents an annualized return of 36.8%:

Retrospective 2021:

Ártica Asset reached several important achievements in 2021. In addition to being able to deliver good returns to investors (we had a performance 31.4% higher than the Ibovespa), the fund reached a PL of R$ 155 million, and we more than doubled the number of investors (we went from 60 to 125 quota holders).

The most important thing is that we have managed to bring investors in line with our long-term philosophy. As a reflection of this, 107 of these 125 investors never made any redemptions and 77 of them have already contributed to Ártica LT FIA more than once.

Having investors aligned is essential for us, as managers, to continue making decisions thinking about the long term. Let me explain: Imagine that the share of a good company is traded at R$ 5.00, and that our conservative assessment points to a fair value of R$ 10.00 (100% upside!). The problem is that, as a matter of market mood, this action just falls. What to do in a situation like this?

If you have a long-term mindset, the answer is obvious, buying a good company stock at 50% discount is a great opportunity. This stock may not make money in 1 month (or 1 year), but over a 3-5 year period, this investment is likely to be quite profitable. However, if the investor has a short-term bias, thinking about making money in the following month, he will probably let this opportunity pass and, if he invests, he will not have the stomach to stay invested if the market continues to punish the stock and it goes out from R$ 5.00 to R$ 4.00.

Our investment in Unipar exemplifies exactly this dynamic. We started the investment in Aug/14 and, in just over 6 months, the shares had fallen by around 25% (compared to a drop of 12% on the Ibovespa in the period)! It took almost 2 years for the share price to return to the level of our initial purchase price. Undoubtedly, a less than encouraging start for the position. Even with the fall, we maintained conviction in the thesis and took the opportunity to buy more Unipar shares at a good price. The result: In 5 years, the stock provided a 20x return on invested capital!

If a manager does not have his investor base aligned, he cannot “afford” to make this type of investment. At the limit, his impatient investors could decide to withdraw their money if the yields for the next few months disappoint them (for example, not beating the CDI), so he needs to focus on hitting the ball at once and choosing the stock that he believes the market will appreciate In the next months. This is a type of bet that is difficult to hit consistently.

For this aligned vision, our thanks to the investors of Ártica Long Term FIA! (The name is not by chance)

Cash allocation dynamics:

2021 was also a good example of our vision of cash allocation. The chart below shows the performance of the fund and the Ibovespa, as well as the evolution of our cash position (as % of the Fund's Equity) throughout the year.

Graph 1 - Evolution of Ártica LT FIA and IBOV (base 100 left axis) compared with cash evolution (right axis) throughout 2021

We started the year with a cash position of 7% of the fund's PL and gradually increased it throughout the first half, almost in line with the appreciation of Ártica LT FIA and Ibovespa shares. During this period when the stock market is on the rise, it becomes more difficult to find new good investment opportunities, and therefore it is natural for our cash position to increase (both through the sale of shares which, due to their appreciation, are left with a reduced margin of safety, and for receiving dividends from investees).

With the stock market crash in the second half, shares became cheaper and we were able to find some good investment opportunities, which reduced the fund's cash position to the current level of 6%. (On this topic, we are very excited! With the fall of the stock market in recent months, we managed to build positions in great companies at very attractive prices!)

To be clear, at no time do we attempt market timing (that is, trying to predict the best times to enter and exit the stock market). We don't know how to do this (and we believe no one does). We only buy when stocks are cheap and sell when they are expensive.

Dilemma between investing in the stock market or fixed income:

2021 also marked a period of sharp rise in the Selic rate. Basic interest rates in the Brazilian economy rose from 2.0% at the beginning of the year to 9.25% at the end of the year, and the trend is for the rate to continue rising at the next Central Bank meetings. This interest increase of 7,25% over a single year is the largest in history since the Real plan.

Given this scenario of higher interest rates, fixed income is once again attractive to investors, which has led many to ask us: “Why invest in stocks now, given that I can already get a very attractive return on fixed income, without risk?”

Our view is that it is precisely in higher interest rates that investors should increase investments in variable income.

To make this point, let's first focus on the historical evidence. 6 years ago, in Jul/15, the Selic rate reached 14.25% per year, remaining at this level for more than 1 year, until Oct/16. This rate of 14.25% is undoubtedly very attractive and has led many investors to focus their investments on fixed income. The result: The investor who had kept the money invested in CDI from July 2015 until December 2021 would have achieved a return of 60%, that is, an annual return of 7.7% pa. Keeping this money in the stock exchange, the investor would have obtained a return of 109% (12.2%a.a.). Much higher profitability, even considering that we had an impeachment, a truck drivers' strike and a pandemic in that period.

Graph 2 – Return on CDI vs. Ibovespa (Jul/15 – Dec/21)

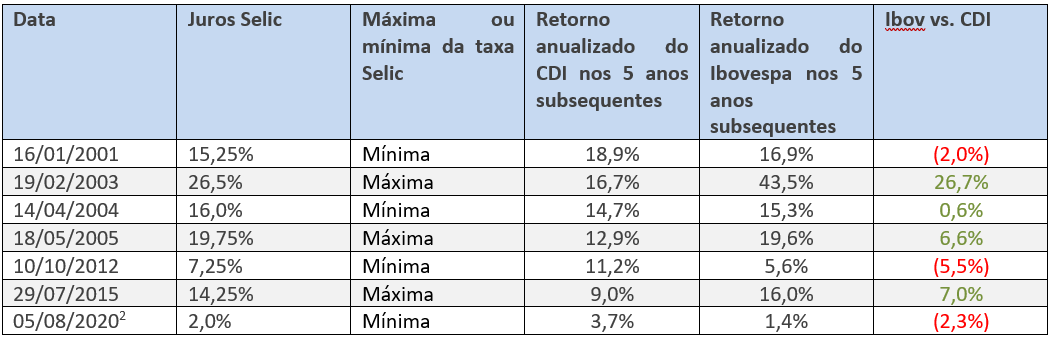

The superior performance of the stock market in this period is not an isolated event. We compare fixed income and equity returns over several time windows, and consider the interest rate scenario in each of these periods. The data in the table below, which show the return obtained by an investment in fixed income (CDI) or variable income (Ibovespa) in the 5 years subsequent to the historical maximum or minimum of the Selic rate, make the conclusion very clear: the best moments to invest on the stock market are precisely when the Selic rate is higher (gray lines in the table)!

Table 1 – CDI returns vs. Ibovespa in different interest rate scenarios

and why this happens?

The main reason is simply a matter of price. In periods of high interest rates, stocks tend to become cheaper and, as a result, it is natural for the stock market's profitability to be higher in subsequent years. The opposite happens in lower interest rates.

Does this mean, then, that in times of low interest rates, we should avoid the stock market? No, avoid it, but be careful to maintain the discipline of buying stocks only when prices are really good. With this discipline, investing in stocks can outperform fixed income both in times of low and high interest rates. As shown in the chart below, since our founding, Ártica LT FIA has always shown returns superior to those of the CDI and Ibovespa in 3-year windows.

Graph 3 – Annualized returns in 3-year windows (Ártica LT FIA vs. Ibovespa vs. CDI)

To our investors

As we have several new investors this year, it is worth remembering that our team is always available to answer questions about profitability, explain details about our investments, or even to receive suggestions and ideas that they would like to share. Please feel free to send us an email at [email protected] or call 11 3707-1890 that we will respond quickly and with the greatest pleasure.

We take the opportunity to wish everyone an excellent 2022!

A hug,

Ártica Asset Management Team