Dear investors,

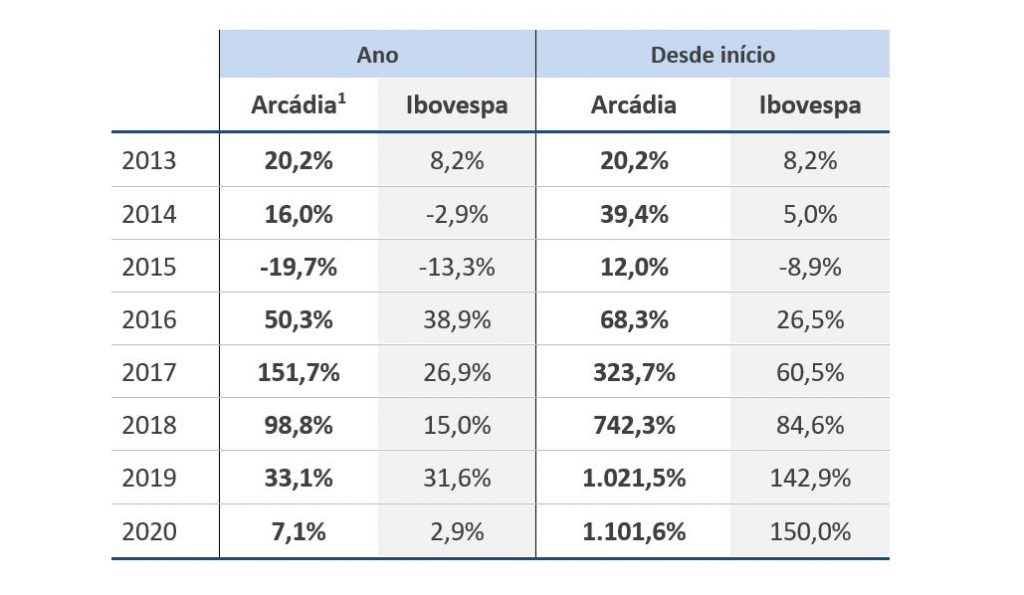

We ended 2020 with an annual return of 7.1%, higher than the Ibovespa and the CDI which totaled, respectively, 2.9% and 2.8% in the period. The accumulated return since the inception of the Fund, around 7 and a half years ago, is 1.102%, which represents an annualized return of 39.2%:

2020 Retrospective:

The year 2020 was quite challenging for everyone. It was a year marked by the Covid-19 crisis which, in addition to the terrible humanitarian consequences, brought enormous volatility to the financial markets.

With the Ibovespa surprisingly ending 2020 in the positive field and close to its historic highs, the days of extreme uncertainty we experienced at the beginning of the year seem distant. It is worth remembering that the circuit breaker[1] of Ibovespa was triggered 6 times in the year (record along with 2008) and, in March 2020 alone, the index accumulated losses of 30%, the worst month since August 1998 and the fourth worst in history. Between January and March 2020, the Ibovespa had an accumulated drop of 47%, losing almost half of its value in just 2 months.

This enormous volatility brought important lessons for investors:

-

- The first and most important is portfolio risk management. As we published in our October 2020 monthly letter, we believe that the best way to manage portfolio risk is not through diversifying investments into dozens of theses, but rather through in-depth analysis of each investment opportunity, carefully choosing companies with great return potential, resilience to face diverse economic scenarios and robust capital structure. We have always kept our portfolio focused on our best theses, which for many is synonymous with greater risk, and we managed to weather not only this Covid-19 crisis well, but all the others that have occurred since our foundation in 2013.

-

- Another important lesson was the importance of focusing on the long term. During the crisis, investors with a long-term perspective had the serenity to analyze and understand that the crisis was temporary and that, with time, the economy and good companies would recover. A fall in the stock price would be a short-term phenomenon, and could present an excellent buying opportunity.

That's exactly what we told our investors on 03/20/2020:

“We believe that this could be one of those opportunities that occur few times in a lifetime to make a good investment in the stock market. This is a severe but transient crisis. Some companies may fall by the wayside, especially the most leveraged and exposed to the most affected sectors, but those that survive should not have their results affected in the long term. We are very convinced that all the companies in which we invest and would like to invest belong to the second group. In a few weeks since the beginning of the crisis, the new contributions in our fund already represent 110% all the capital contributed in 2019. And, of these contributions, 75% was money from our team (or from family members, under our indication). Many investors ask us to tell them when is a good time to invest. We believe this is a good time.”

Case CEB:

In this letter, we are going to share a marry recent and little known of the fund: the investment in Companhia Energética de Brasília (CEB).

CEB gained notoriety at the end of 2020 with the successful privatization of CEB-D (its energy distribution subsidiary), which was sold to Neoenergia for R$ 2.515 billion, and had its share valued at 180% in 2020, higher than to any share of the Ibovespa index.

Privatization took place in December 2020, but our investment in the company started in 2019. Below, we detail our investment process in CEB and comment on the current outlook, given that it still represents an important position for the fund.

Graph 1 - Price per share of CEB (CEBR6) and main milestones

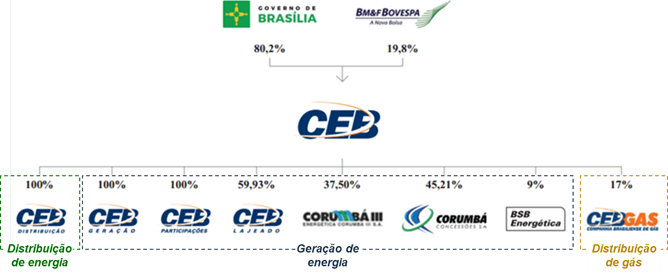

CEB is a state-owned company controlled by the Federal District government, with a stake of 80%. The remaining 20% are traded on B3. Its most liquid asset classes (ON: CEBR3 and PNB: CEBR6) are little traded on the stock exchange (daily liquidity of around R$ 500 thousand / day) and, therefore, the company was (and still is) left out by many investors. This lack of coverage generated a huge investment opportunity for us in 2020.

The company operates in the areas of distribution, generation and sale of energy through 8 subsidiary companies. The figure below shows the corporate organization of CEB:

Graph 2 – CEB's corporate organization

CEB's main asset is CEB Distribuição SA (CEB-D), which holds the concession to operate energy distribution in the Federal District.

CEB-D is a loss-making company in a difficult financial situation, as a result of high personnel costs and an inflexible cost structure (state company). Due to the regulation of the electricity sector, which requires companies to maintain minimum levels of financial health, CEB-D ran the risk of losing its concession.

To deal with this problem, the solution found by the company was to privatize CEB-D, a plan that gained momentum with the election of a district government with a more liberal bias. In June 2019, the company's privatization was approved by its shareholders and BNDES was hired to advise on the transaction.

CEB-D also had some characteristics that caught our attention and could make it a much desired target for private companies in the sector:

- Operation in one of the richest regions of the country, with low default rates;

- High density of consumers per km of energy distribution line, which reduces the need for investment per consumer and increases the profitability of the operation; It is);

- Low rates of failures and interruptions in the network when compared to other state-owned companies, which indicates a good quality infrastructure, without the need for large investments in adaptations after the eventual acquisition.

Due to the sector's successful track record in privatizing state-owned companies (companies such as Equatorial and Energisa have managed to generate enormous value for their shareholders by acquiring state-owned companies and making them more efficient), the news of CEB-D's privatization immediately caught our attention and led to study the case.

In addition to energy distribution, the company also plays an important role in the generation area, where it has good assets and a very stable cash generation. Among them, 4 hydroelectric plants stand out (UHE Lajeado, UHE Corumbá III, UHE Corumbá IV, UHE Corumbá Queimado) which, together, have an installed capacity of 200 MW[2] and concessions that expire between 2032 and 2037.

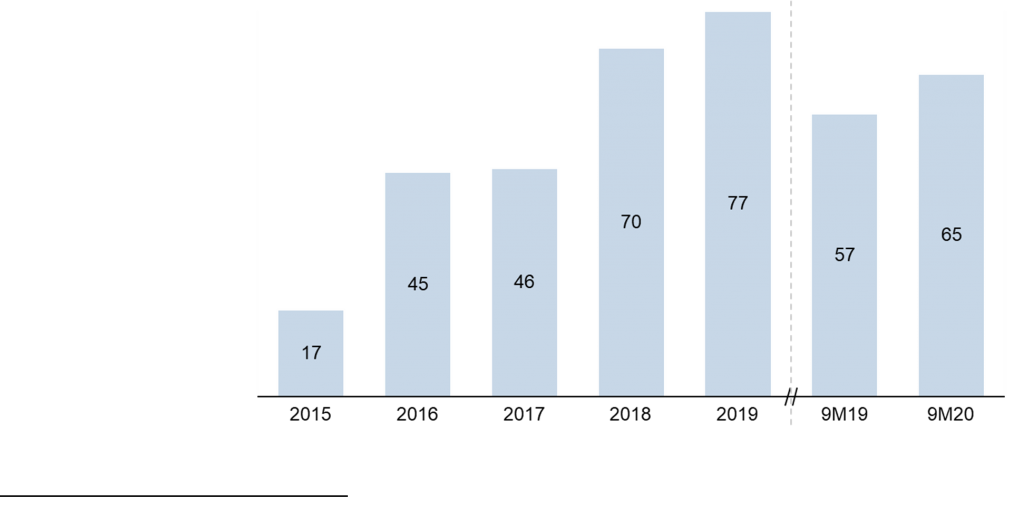

The results of these generators called our attention due to the profit growth observed in the last 5 years, as shown in the chart below.

Graph 3 – Net income from CEB's generation operations (in R$ million)

The main reason behind this growth is related to the reduction in the leverage of one of the concessions (Corumbá IV), which still had a high debt, as a result of the investments needed to build the plant. With the cash generation in recent years, the company managed to pay off a large part of this debt and considerably reduced its financial expenses. With a reduced debt level, our expectation is that the results will be even better in the coming years.

Despite these good results, the cash generated by the generators was largely used to cover CEB-D's losses. Thus, after privatization, the positive and consistent result of these companies should become more evident in the company's financial statements.

Estimate of valuation and portfolio risk management:

Having explained the context, let's move on to our analysis of the company's potential value. Considering that CEB was a holding company with several subsidiaries operating in different activities, it makes sense to calculate the value of the company considering a “sum of the parts” methodology.

For this, the first step was to estimate the value of the generators. Considering their cash generation profile and the duration of their concessions, we conservatively estimate that these companies had a joint value of R$ 600700 million, which represented multiples of EV/EBITDA of 6.0x and EV/Installed capacity of 4.0-4.5 R$ million/MW, both below industry averages.

The next step was to estimate the CEB-D value. In this case, given the privatization context, we work with two scenarios:

- Scenario 1 considered a successful privatization process. In this case, based on the privatization history of the sector, we estimate that the company could be valued above R$ 1.0 billion and, given the particular characteristics of CEB-D (mentioned above), there was room for positive surprises if several applicants participated in the auction.

- Scenario 2 considered a scenario without privatization. In this case, considering that the company was incapable of achieving Aneel's financial targets, it was likely that the concession would be declared forfeit and the CEBD would cease to exist. Considering the company's liabilities and closing costs, we estimate that, in this scenario, CEB-D would have a negative value of R$ 300 million.

There was still the possibility of the company continuing to operate the concession, which would be more advantageous (despite CEB-D being loss-making), but we consider this unlikely scenario and discard it for purposes of estimating the company's value.

Considering that the holding costs and the value of CEB-Gás (a small subsidiary) were negligible, the value of the company resided mostly in the sum of CEB-D and the power generation companies which we estimate at R$ 1.7 – 1, 8 Billion in Scenario 1 and R$ 300-400 Million in Scenario 2.

These amounts compared to a market value of R$ 700 million at the time, i.e. in scenario 1 (privatization) there was a potential gain of 140-160%, and in scenario 2 (continuing state-owned) there was a potential loss of 40-60% . Clearly, the successful privatization of the company was essential for the investment to be successful. We then set out to analyze the probability of privatization of CEB-D.

Estimates of this nature are always uncertain in Brazil, considering the different participants and political inclinations involved in such processes, but some factors gave us confidence that the chances of privatizing CEB-D were high:

- There was a successful history of 7 recent privatizations of regional distributors such as CEB, that is, we were not treading an unknown path.

- The government of the Federal District and CEB itself were very interested in privatization, both because CEB-D was at risk of losing the concession, and because of the more liberal bias of the company's board, which is working to make it more efficient. Proof of this were the steps that the company had already taken towards privatization.

- Aneel, the sector's regulatory agency, also welcomed the process, as it was a way to improve the quality of energy distribution in the region.

- The main opponents of the process were the company's own employees, organized in the form of unions, and politicians who supported such unions. Thus, we searched the history of other privatizations to understand what types of threats such oppositions could generate, but none of these processes had been stopped by union opposition.

- Furthermore, at the time of the analysis, the STF had recently decided that the privatization of subsidiaries of state-owned companies did not require approvals from legislative bodies. The decision had been taken within the scope of the privatization of Petrobras and Eletrobras subsidiaries, but it was also applicable to CEB.

- Finally, the interest of private companies in the asset was high. There were at least 6 private companies in Brazil with an appetite for acquiring state-owned energy distributors and, considering the quality of the asset, there was no reason why most of these companies would not be interested in CEB-D.

In our estimates, the probability of privatization should be greater than 25% for the investment to have a positive expected value and, considering the points above, it seems to us that the chances are much higher than these 25%. So we decided to make the investment.

Given that the position had a significant potential loss (40-60%), we sought to control the risk by sizing the position. We started with a small investment and, as the privatization process progressed and the chance of success increased, we increased the initial position until reaching a level of 10% of the fund invested in CEB.

In summary: with a position of 10% and considering our scenarios, we could lose 6% or gain 16% from the total value of the fund, with the positive scenario being more likely than the negative one. This asymmetry in the risk-return ratio is what led us to the decision to make this investment.

Current scenario:

Even after the privatization of CEB-D (which should be completed by March 2021), we still believe that CEB remains an excellent investment opportunity and we keep it in Arcádia's portfolio.

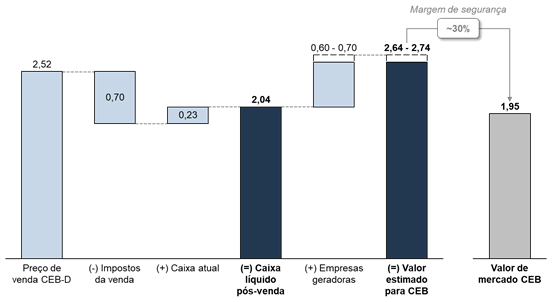

With CEB-D privatized for the amount of R$ 2.515 billion, we estimate that the company will pay around R$ 700 million in taxes and, added to the existing cash of R$ 225 million, the company will have a net cash position of R$ 2 .04 billion while its market cap is R$ 1.95 billion[3] – that is, the company's cash alone is worth more than its current value on the stock market!

In this account, we are not even taking into account the generators that, as we have seen, have an excellent cash generation profile. As valuation from the aforementioned R$ 600-700 million, we arrive at a fair value for the company of around R$ 2.7 billion. Compared to the market price, there is a safety margin close to 30% in the investment, quite high given that a large part of the valuation it is made up of cash on hand and, by all indications, a good part will be distributed as dividends. It seems to us that the company is still cheap.

Graph 4 - Estimate of the composition of the CEB value (in R$ billion)

CEB is an atypical company in the portfolio. Normally, we like to invest in companies of excellent quality, leaders in their sectors and with high levels of profitability. CEB, due to the very fact that it is a state-owned company, does not fulfill all the qualitative characteristics that we envision.

That doesn't mean it stopped being a great investment. In the stock market, it is possible to have excellent returns on average companies and large losses on excellent companies. It all depends on the price that is paid for the asset. For us, buying cheap is a great risk management method.

“ Investment success doesn't come from buying good things, but rather from buying things well.”

Howard Marks

Ártica Asset News

We have some news for 2021. The first is that Ivan Barboza, one of the founding partners of Ártica, left the M&A practice to dedicate himself exclusively to managing the company. In addition to his arrival, we reinforced our analysis team, and now we have a team of 5 people in the investment team. Another change is that, to facilitate our communication, we decided to unify our company's identity around a single brand: Ártica. As a result, our Arcádia FIA fund will be renamed Ártica Long Term FIA, unifying our Ártica brand with our investment philosophy

[1] Circuit breaker is a mechanism used to stop trading when the market goes down sharply

[2] The concessions for these plants are formed by companies with different stakes in CEB. The value of 200 MW presented represents only CEB's proportional participation in each of these plants

[3] On 12/31/2020