Dear investors,

An analysis that we deem very relevant for investment decision-making is to evaluate the level of purchases made by people who know internally the operation and the numbers of the companies - the Insiders. This information is useful both because the insiders are the ones who know the company best and, in theory, would be able to more accurately estimate its fair value, as well as why it is always desirable to invest in companies where the main decision makers are aligned with their shareholders through the investment of their equity in the business.

In this month's letter, we explore the subject and provide some research based on historical data that supports our view.

| “Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise” – Peter Lynch |

1. What are purchases from insider

Insiders is the English expression to designate people with access to key company information, such as controllers, directors and directors. Because they have “insider” information, they are subject to specific trading rules – for example, they cannot buy or sell shares close to quarterly earnings announcements.

In Brazil, CVM Instruction 358 regulates such transactions and establishes that they cannot be carried out in the 15 days that precede the disclosure of financial information of companies and before the disclosure of material facts.

Conceptually, they would be better positioned than the market to assess the value of their company, so purchases made by them could indicate when they believe there are good opportunities.

Such information can be of different natures. Examples include temporary changes in business conditions (e.g., improvements in industry competitive dynamics; growth in orders for new merchandise; price increases; cost reduction programs) or better appreciation of the company's true value (e.g., turnaround successful in some subsidiary that operates at a loss; M&A operations; profit growth when new product development costs are over).

2. Research results on the topic

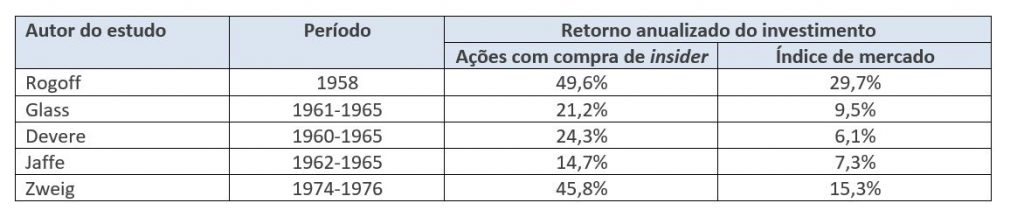

The table below presents the results of 5 studies carried out in the USA in the 1950s, 60s and 70s. In all cases, the companies selected for the study were those that presented volumes of purchases of insider which significantly exceeded the sales volume of Insiders. It was also considered an investment strategy in the stock shortly after the disclosure of information on the purchase of insider.

Table 1 – Returns on stocks purchased shortly after insider purchases[1]

Some of the best-known studies on the subject of Insiders were conducted in the 1970s, 80s and 90s by Nejat Seyhun, a professor at the University of Michigan. Based on his studies, Seyhun published a book on the subject: “Investment Intelligence from Insider Trading”.

In the book, the author presents some interesting conclusions from his studies:

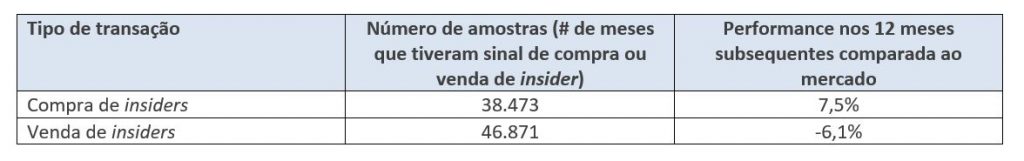

The table below presents the return of stocks against market indexes in the 12 months following the announcement of a purchase or sale event. insiders. In the study, the author selected only operations that had no conflicting transactions in the previous 3 months (i.e., a company with a purchase of insider that had sale of insider in the previous 3 months are excluded from the sample; ditto for companies selling insider).

Table 2 - Equity returns 12 months after the purchase or sale of insiders[2]

In addition to proving the results of studies carried out previously, the table also shows that purchases of insider has greater predictive value than sales of insiders. The reason is that a sale can be motivated by several factors that are independent of the fundamentals of the action (e.g. needs to redeem resources to buy an apartment, a car, make a new investment), while a purchase will only be carried out if the insider see an opportunity to earn money.

The author's studies covered the period from 1975 to 1994. In it, it was possible to observe that throughout the entire period of the sample, the transactions of insider proved to be good predictors of future returns, showing no downward trend.

Even more recent studies continue to point in the same direction. A landmark article written in 2011 by Kaspar Dardas of the European Business School analyzed insider in the period from Jan/2002 to Dec/2009. The study showed that purchases defined as “high conviction”[3] were associated with returns on average 20.9% higher than market indices in the 12 months following the publication of the purchase.

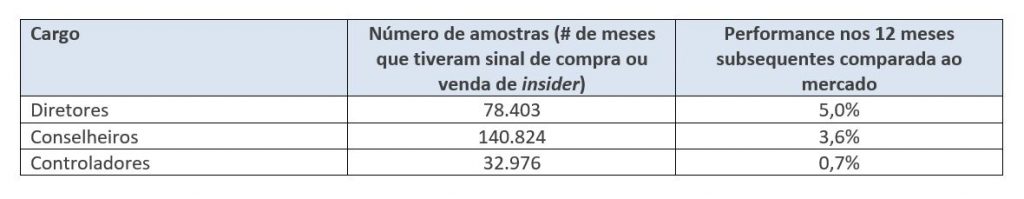

A very important point to consider in the analysis is the position of the Insiders. In reports released by companies listed on B3, there is a distinction between three positions: directors, members of the board of directors and controllers.

Evidence shows that directors are the best at trading their company's shares, followed by directors and controllers, as shown in the table below.

Table 3 - Returns according to the position of the insider[4]

The reason for this distinction is proximity to information. Directors are responsible for the main decision-making, and are involved with critical activities for the company on a day-to-day basis. Directors are a little further from the source of information, but actively participate in the company's main strategic decisions. Controllers, on the other hand, often have access to company information through directors or directors, which reduces their advantage when trading stocks.

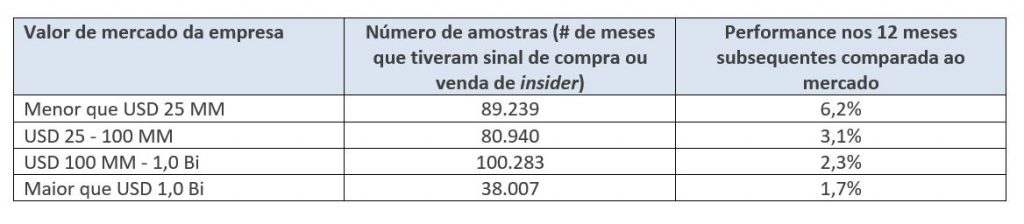

One finding interesting of the study is that purchases of insider in small companies it has greater predictive power than in large companies, as shown in the table below.

Table 4 - Returns according to company size[5]

As seen in the table above, insiders of small companies manage to obtain gains that exceed the gains of insiders from large companies by an impressive 4 times.

There are two hypotheses to explain this phenomenon. The first is that small companies are less covered by the market, so their market value tends to be farther from the intrinsic value more frequently, giving the insider greater opportunities to profit from such deviations. The second hypothesis is that new events tend to be more representative in small companies than in large ones. For example, a new product that is about to be launched and has an expected annual profit of R$ 100 MM will have a much greater impact on a company that has a market cap of R$ 1.0 Bi than on a company with a value of R$ 100.0 Bi.

3. Transactions of insider in practice

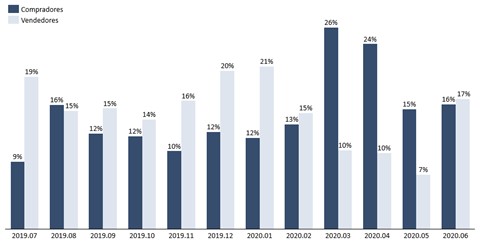

For illustrative purposes, we have compiled the transactions of insider of all companies on the stock exchange between Jul/19 and Jun/20 (we have a robot for that). The results are shown in the table below:

Graph 1 – % of companies listed on B3 that are net buyers or sellers of shares

What draws attention is that the number of companies with purchases of insider increased substantially in March and April. That is, the Insiders proved to be great investors in the initial period of the covid-19 pandemic, buying stocks exactly at the moments of the biggest drop in the stock market (probably realizing that the market reaction was exaggerated and the pandemic was not affecting business as much as initially feared).

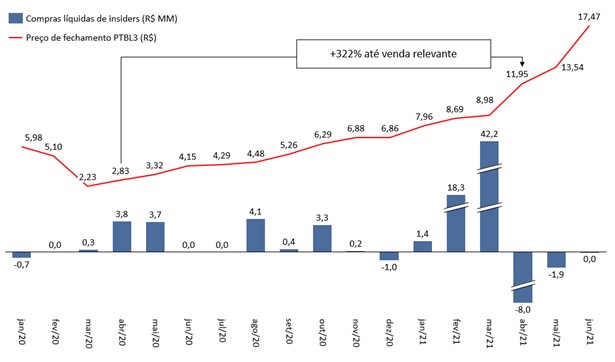

An interesting specific case that occurred in 2020 was that of the company Portobello (ticker PTBL3). As of Apr/2020, the Insiders of the company began to buy shares in significant volumes. What drew attention was that the company had no history of purchasing insider, and all of a sudden, there were purchases from directors, board members, and the controlling shareholder. Even more significant was that purchases were repeated for several months until Mar/21. The result: the stock rose from a level of R$ 2.83 at the beginning of the purchases and reached a value of R$ 12.00 when sales started in Apr/21 – appreciation greater than 4x in 1 year.

Graph 2 – Purchases of insider vs share appreciation (PTBL4)

As demonstrated above, transactions of insider can bring good insights about potential investment opportunities. Therefore, we seek to actively monitor such transactions in order to choose the best stocks for our portfolio. Obviously, an investment decision is never based solely on this criterion, but knowing that the insiders are buying shares in their companies is a great reinforcement for our theses.

[1] Studies referred to in the table are listed below and have been compiled into an article by Tweedy, Browne Company LLC:

(1) Donald T. Rogoff, “The Forecasting Properties of Insider Transactions,” Michigan State University, 1964;

(2) Gary S. Glass, “Extensive Insider Accumulation as an Indicator of Near Term Stock Price Performance,” Ohio State University, 1966;

(3) Charles W. Devere, Jr., “Relationship Between Insider Trading and Future Performance of NYSE Common Stocks 1960 – 1965”, Portland State College, 1968;

(4) Jeffrey F. Jaffe, “Special Information and Insider

Trading,” Journal of Business, July 1974;

(5) Martin E. Zweig, “Canny Insiders: Their Transactions Give a Clue to Market Performance,” Barron's, July 21, 1976.[2] Source: Nejat Seyhun, “Investment Intelligence from Insider Trading”

[3] The author defines “high conviction” purchases based on a series of parameters that include the position of the insider, the financial volume and the recurrence of the purchase

[4] Number of samples differs from table 2 because the study of table 3 does not exclude operations that had contrary transactions in the previous 3 months. Source: Nejat Seyhun, “Investment Intelligence from Insider Trading”

[5] Number of samples differs from table 2 because the study of table 3 does not exclude operations that had contrary transactions in the previous 3 months. Source: Nejat Seyhun, “Investment Intelligence from Insider Trading”